- Price Breakout and Analyst Forecast

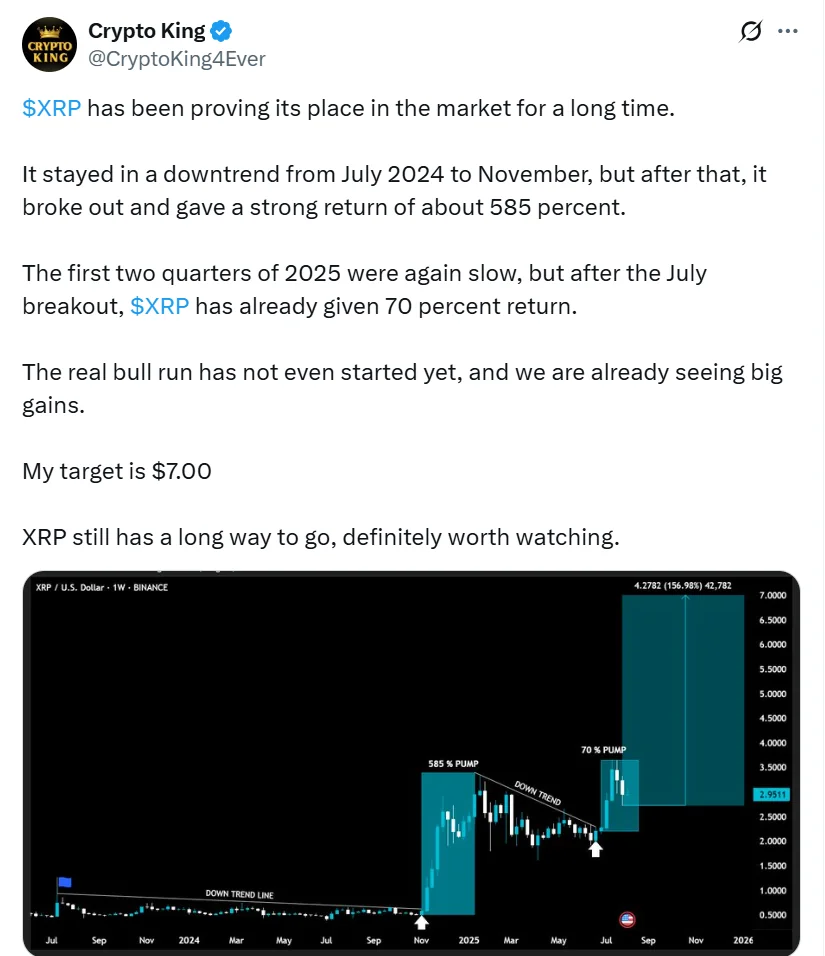

After a long period of stagnation, XRP surged 70% in July, continuing the momentum from a major breakout in November 2024, when the token skyrocketed by 585%.

At the time of writing, XRP is trading around $3, up 2% in the past 24 hours, though still slightly down by over 4% from the previous week. According to analyst Crypto King, XRP has officially broken out of a downtrend that lasted from July 2023 to late 2024. He has set a price target of $7 — representing more than a 150% increase from current levels.

- Exchange Supply Drops Significantly

Data from CryptoQuant shows that XRP reserves on exchanges fell sharply — from around 3.02 billion to 2.3 billion tokens between July 24 and August 7. This suggests a growing number of investors are withdrawing their tokens to private wallets, signaling long-term holding behavior and reduced selling pressure.

- NVT Ratio Surges

At the same time, XRP’s Network Value to Transactions (NVT) ratio jumped 44% within 24 hours to reach 225. This metric compares a token’s market cap to the volume of on-chain transactions. A high NVT ratio indicates that market value is rising faster than network activity — meaning price may be outpacing real usage. Caution is advised.

- Legal Developments in Ripple vs. SEC Case

The long-standing legal battle between Ripple and the U.S. Securities and Exchange Commission (SEC) may soon reach a turning point. The SEC is expected to respond to Ripple’s request to withdraw its appeal at 03:00 UTC on August 7. If the appeal is dropped, XRP could finally gain full legal clarity in the U.S. — a key milestone that could spark major institutional inflows.

A favorable ruling could also unlock $125 million currently held in escrow and release over 1,700 pending Ripple contracts for public use.

- XRP ETF and Institutional Buying Plans

Financial giant SBI Holdings has filed to launch an XRP exchange-traded fund (ETF) — a move that could open up XRP investments to broader audiences through regulated channels. Meanwhile, reports suggest some companies are planning up to $1 billion in XRP purchases for treasury purposes.

In Summary: With strong price momentum, bullish on-chain trends, potential legal clarity, and growing institutional interest, XRP is approaching a critical inflection point. However, investors should closely monitor ongoing developments before making major moves.