Bitcoin has dropped below $98,000 several times since early November 2024, but it has managed to reclaim that level and often leads to new all-time highs (ATH). Currently, several technical and on-chain metrics point to a potential short-term price increase for BTC.

1. Decreasing Bitcoin Supply on Exchanges

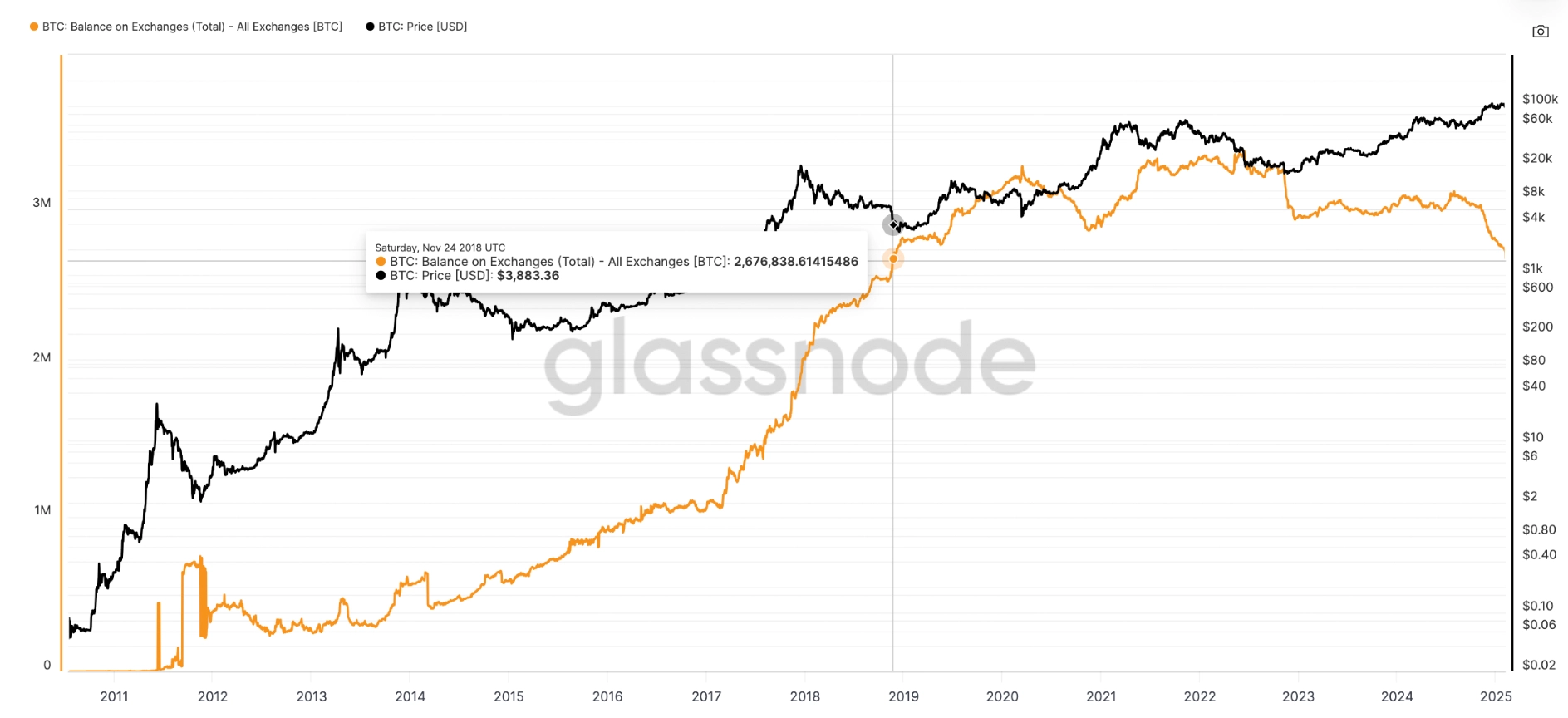

One factor supporting Bitcoin’s upward momentum is the declining supply on exchanges. The BTC balance on exchanges has fallen by 13% over the past six months, from 3.1 million BTC on August 9, 2024, to a six-year low of 2.67 million BTC on February 5. This decrease coincided with a 62% increase in BTC’s price during the same period. When BTC investors transfer funds from centralized exchange (CEX) wallets to self-custody wallets, it indicates that they do not intend to sell, but rather are holding in anticipation of future price increases. Over 17,000 BTC were withdrawn on February 5, including 15,000 BTC withdrawn from the U.S.-based Coinbase exchange. This was the largest BTC withdrawal from an exchange since April 2024.

According to André Dragosch, Head of Research at Bitwise in Europe,

Whales are buying the dip.

Market research firm Santiment has made similar observations, noting that whales are accumulating after the latest Bitcoin decline.

This is an ideal environment for crypto market capitalization to increase, even if it takes a few more weeks (or even months) to see the overall price impact of the coins absorbed by whales.

2. Weakening U.S. Dollar

The U.S. Dollar Index (DXY), which tracks the performance of the greenback against major world currencies, fell by 1.7% from its high of 109.51 on February 3 to 107.673 after President Donald Trump threatened to impose tariffs on Canada and Mexico. The subsequent suspension of these tariffs brought some relief to the market, with DXY rebounding from a low of 106.91 on February 5.

A weakening dollar is considered a “massive tailwind for risk assets, including Bitcoin,” according to crypto KOL Lark Davis, who added,

If DXY continues to decline and with all the upward catalysts like US SBR & national Bitcoin FOMO, this could be the next step for the crypto bull market.

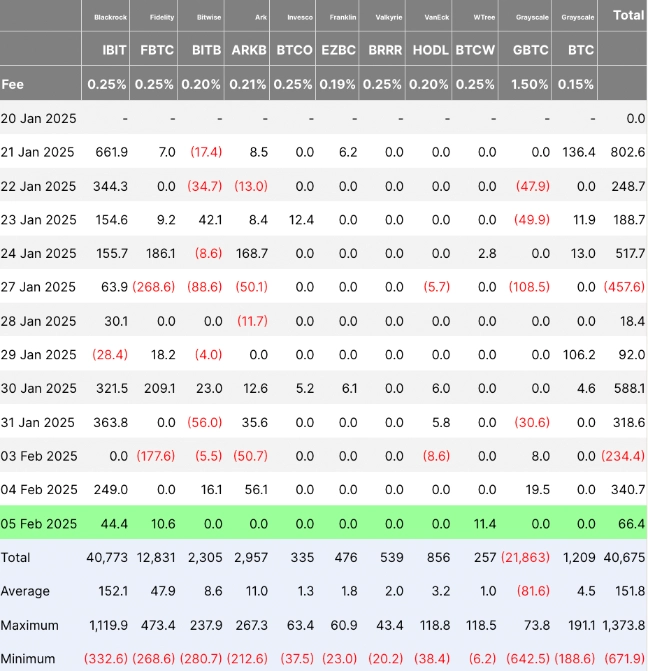

3. Strong Inflows from Spot Bitcoin ETFs

BTC’s price is further supported by robust inflows into U.S.-based spot Bitcoin ETFs, which have seen approximately $2.5 billion in capital flow over the past two weeks. In fact, these investment products have attracted $40 billion in capital since their market debut in the U.S. on January 11, 2024. The increased institutional demand is encouraging, as it was considered a key factor in Bitcoin’s appeal last year when its price surged more than 133% in 2024. This trend is also reflected across other Bitcoin products; the latest weekly report on digital asset fund flows from CoinShares revealed that net inflows into BTC investment funds reached a total of $486 million for the week ending January 31.

Related: MicroStrategy Rebrands to Strategy, Unveils New Bitcoin Strategy

4. Bullish Flag Pattern Indicates Further Upside

Although BTC’s price fell at the beginning of the week, a bullish flag pattern on the weekly chart suggests that the upward trend may continue. Bitcoin bulls are focusing on turning the upper boundary of the flag at $101,800 into a support level. A weekly candle closing above this level would signal a breakout, with a projected target of $167,000—a 70% increase from the current price. Additionally, the Relative Strength Index (RSI) at 63 indicates that market conditions remain favorable for further price gains.