October is approaching, and this could be the right time for you to consider investing in Bitcoin. Based on historical data and current trends, Bitcoin is predicted to continue its strong growth this October. Analyst Raymond has pointed out three important reasons why October is a golden opportunity to buy Bitcoin.

Promising History of October

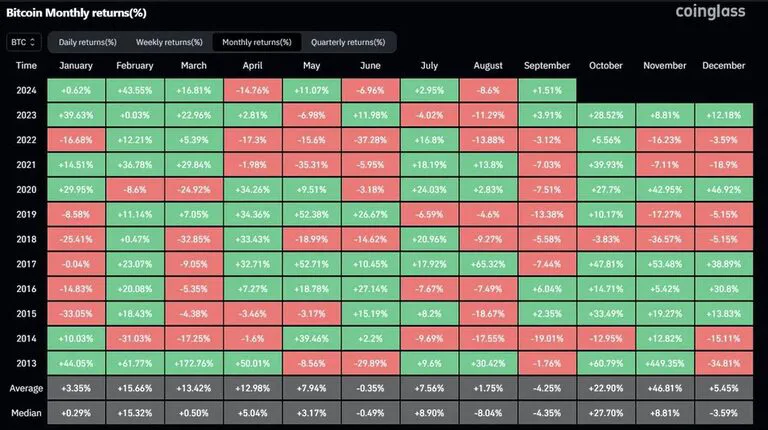

Bitcoin tends to experience significant growth in October, which is why it is often referred to as “Uptober” – a combination of “Uptrend” and “October.” According to statistics from the past 10 years, Bitcoin has increased by an average of 22% in October. This suggests that October is typically a positive period for Bitcoin prices. This can also be seen as an indicator of market for the Uptober.

October 2020 is a prime example, where Bitcoin’s price surged by more than 25%, marking the beginning of a massive bull run that extended into 2021. Most recently, in October 2023, Bitcoin also saw impressive growth, climbing from $26,000 and continuing up to over $72,000 USDT/BTC by March 2024. If you are looking for a good time to enter the market, October might be the right time to act.

Technical Analysis: Price Breaks Through Corrective Trend

After a strong rally from October 2023 to March 2024, the market entered a sideways and corrective phase. Bitcoin has respected the EMA50 line on the weekly chart, bouncing twice from this key level. Bitcoin is now ready to break through and prepare for a new bullish run.

In smaller timeframes like the daily or 4-hour charts, signals and indicators are even clearer, supporting the upward movement of Bitcoin.

The Increase of New Users in the Market

The “tap to earn” trend on Telegram has attracted a large number of new users to the cryptocurrency market. The strong influx of new users into the crypto space has brought significant capital, creating a strong momentum for Bitcoin and the overall market. With new users joining, market makers often tend to build trust to retain them, driving up the price of Bitcoin and the broader market, creating a positive price cycle.

Conclusion

October is predicted to be a highly potential period for Bitcoin, with historical trends, price momentum. If you are seeking an investment opportunity, this might be the perfect time to buy Bitcoin and capitalize on these positive signals.

Follow AZC.News to stay updated with the latest information, in-depth market analysis, and potential daily airdrop programs.

OMN

OMN  BTC

BTC  ETH

ETH  USDT

USDT  XRP

XRP  BNB

BNB  SOL

SOL  USDC

USDC  DOGE

DOGE  TRX

TRX