Despite surging over 43% between May 7 and May 14, Ethereum (ETH) is still trading around $2,600 — well below its all-time high of nearly $4,900 in 2021. However, many analysts believe this is just the beginning of a stronger uptrend, with the potential for ETH to reach $5,000 in 2025, driven by three key factors: AI adoption, inflows into spot ETFs, and the Pectra technical upgrade.

1. ETF Flows and Institutional Interest

ETH remains the only real alternative to spot Bitcoin ETFs currently approved in the U.S. Although Ether ETFs recently saw modest outflows — with $4 million pulled out over two days in May — ETH has a competitive edge as other altcoins like XRP, SOL, and ADA have been excluded from state-level asset reserve discussions following recent U.S. government decisions.

If the SEC continues to reject ETF proposals for other altcoins, Ethereum may maintain its privileged position alongside Bitcoin. Additionally, improvements such as in-kind ETF creation and staking approvals could attract institutional capital, especially once clearer regulations are implemented.

2. The Pectra Upgrade and Scaling Potential

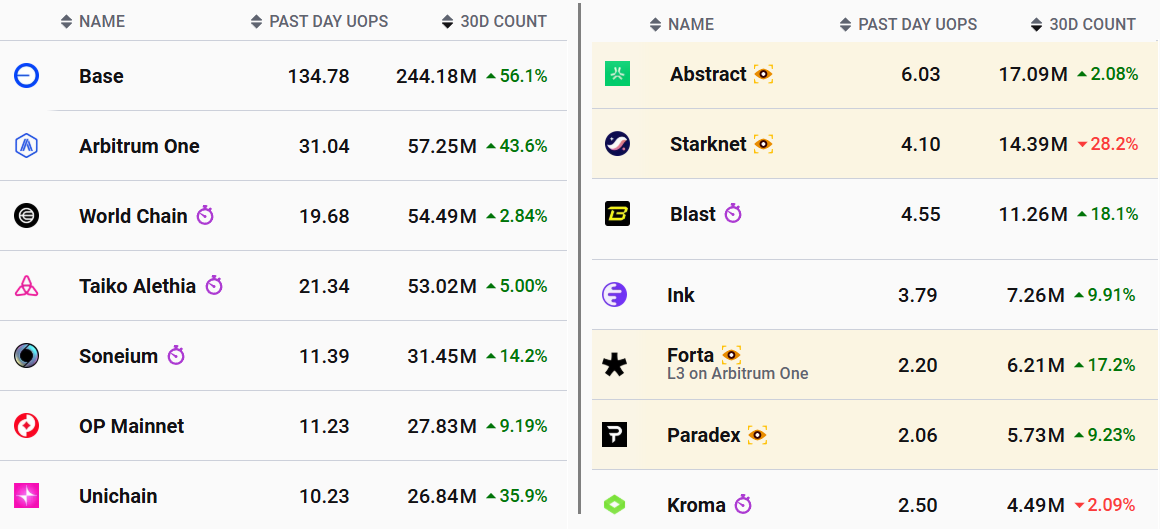

Ethereum’s latest Pectra upgrade has significantly improved data transmission efficiency, enabling better performance for layer-2 scaling solutions. In the past month, activity on the Base layer-2 network exceeded 244 million transactions — a 23% increase over the previous month — reflecting growing demand for Ethereum-based applications.

Previously, Ethereum’s burn mechanism was designed to make ETH deflationary, but the shift in focus toward scalability has reduced its impact. Still, with a significant uptick in on-chain activity, ETH could once again become deflationary — a long-term bullish signal.

3. Artificial Intelligence Could Boost ETH Demand

Artificial intelligence is emerging as a powerful catalyst for Ethereum adoption. Developer Eric Conner noted that AI agents could prefer Ethereum’s layer-2 infrastructure due to its support for multisignature smart contracts, automated payments, and integration with decentralized finance (DeFi) tools.

If this trend continues, smart contract activity could increase tenfold, pushing Ethereum’s usage and demand to new highs. Combined with institutional interest and ongoing technical improvements, ETH reaching $5,000 in 2025 is an increasingly realistic scenario.