Why Is ASTER Falling?

At the time of writing, ASTER was trading around $1.87, down 8% on the day and more than 20% below its short-term peak of $2.43 recorded on September 24. Analysts point to three key reasons behind the decline:

1. Profit-taking and user doubts

Investor Mike Ess revealed on X (Twitter) that he sold 60% of his ASTER holdings and rotated into Bitcoin (BTC) and Plasma (XPL). While still profitable, Ess said the move was driven by “gut instinct” following CZ’s recent remarks and disappointment with Aster’s product.

“If you’ve used HYPE and then switched to Aster, you’ll know what I mean. It feels slower, less polished, like a copy-paste… The more capital I put in, the riskier it feels,” Ess wrote.

Other traders echoed the same concern. Analyst Clemente disclosed that he completely exited his ASTER position in favor of Hyperliquid’s HYPE token, arguing the project is superior across nearly every metric.

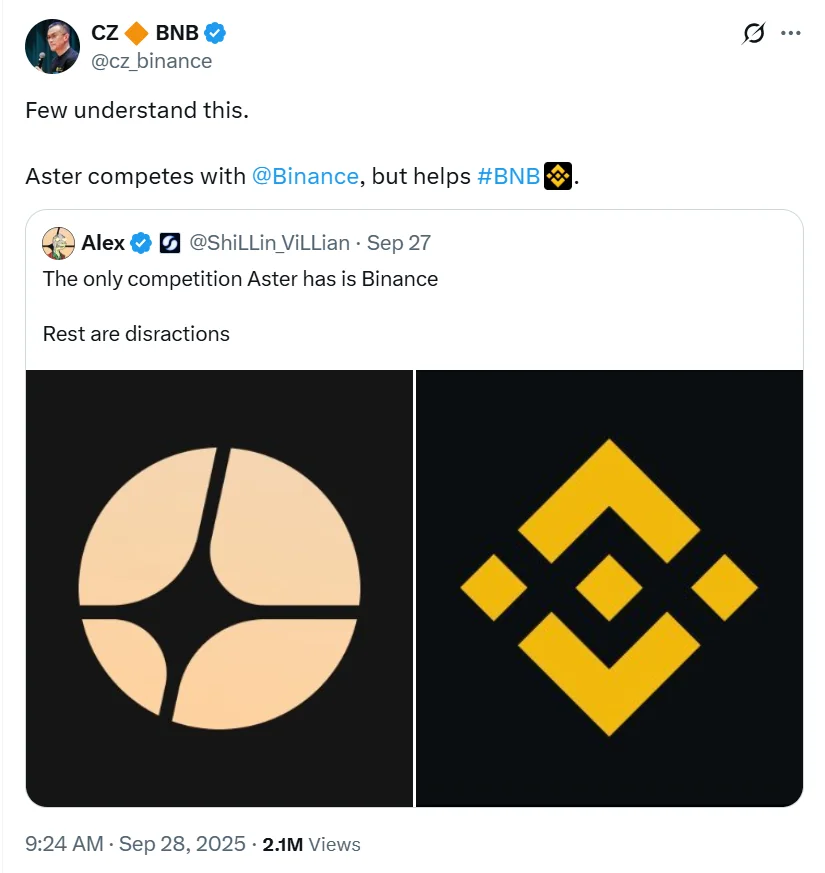

2. Mixed signals from CZ

Although CZ publicly described Aster as a “complementary piece” of the BNB Chain ecosystem, many traders sensed a degree of distance in his recent discussion. The lack of a strong commitment from CZ has fueled worries, prompting some investors to de-risk.

“If CZ stops talking about it, HYPE wins hands down,” Ess warned.

3. Strong fundamentals but trust deficit

In reality, Aster still shows impressive figures: over $82 million in fees generated and $701 million in TVL on BNB Chain within just weeks of launch. This represents significant growth for such a young project.

However, the sharp price pullback highlights the challenge of balancing early expansion with user trust and product reliability, especially as competition from Hyperliquid intensifies.

Future Still Contested

Some optimistic investors believe Aster will soon carve out a strong position in the perp DEX market, potentially even outperforming Solana or Ethereum in percentage terms during the next cycle. On the other hand, skeptics argue the project remains immature, its product unfinished, and overly hyped.

Thus, even with CZ’s backing, ASTER’s journey remains uncertain — and its token price may continue to see significant volatility in the near term.