21Shares Files to Launch Hyperliquid ETF

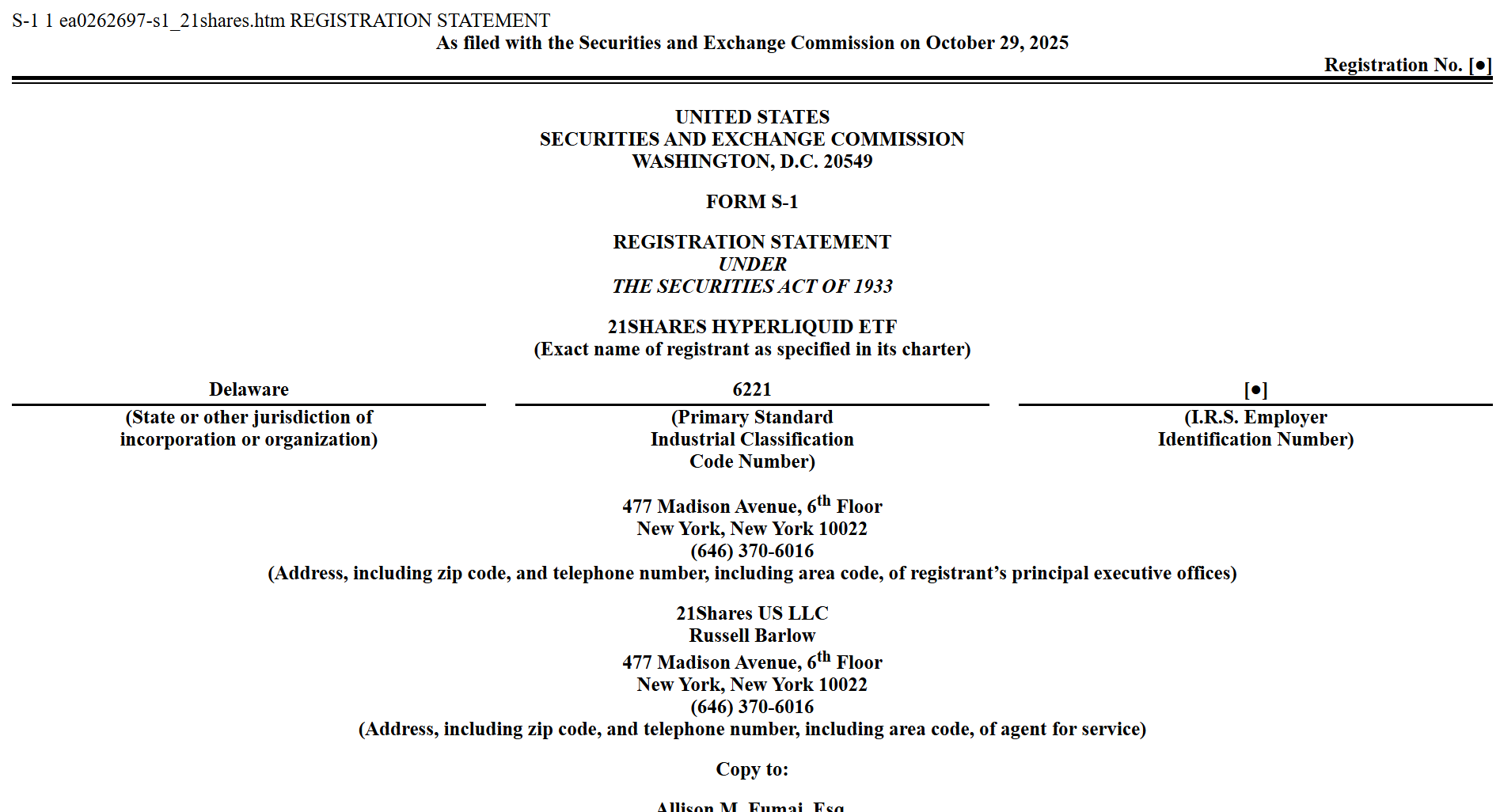

Asset manager 21Shares has filed with the U.S. Securities and Exchange Commission (SEC) to create an exchange-traded fund (ETF) tracking the Hyperliquid (HYPE) token — the native asset of the perpetual futures protocol and blockchain of the same name.

-

The filing, submitted on Wednesday, did not disclose a ticker symbol or management fee.

-

Coinbase Custody and BitGo Trust were listed as custodians.

-

The move follows a similar filing from Bitwise last month for a Hyperliquid ETF.

The HYPE token is used to pay transaction fees and receive discounts on the Hyperliquid decentralized exchange (DEX). Its value has climbed significantly over the past year, in line with the platform’s rapid growth.

Bitwise’s Solana ETF Sees Explosive Trading Volume

Meanwhile, Bitwise’s Solana Staking ETF (BSOL) continued to attract investor attention, posting over $72 million in trading volume on its second trading day.

-

According to Eric Balchunas, a Bloomberg ETF analyst, the figure is “a huge number” and a “good sign,” noting that most ETFs typically experience a sharp drop in volume after day one hype fades.

-

BSOL began trading on Tuesday, alongside Canary Capital’s Litecoin and Hedera ETFs.

-

On its debut, Bitwise’s ETF recorded $55.4 million in trading volume, the largest among all crypto ETFs launched in 2025, according to Balchunas.

Not to be outdone, Grayscale has also entered the competition with its Grayscale Solana Trust ETF (GSOL) — a staking-enabled fund designed to rival Bitwise’s BSOL.

However, Balchunas noted that GSOL’s first-day trading volume reached around $4 million, which he described as “healthy but clearly short of BSOL.”

“Being just one day behind makes catching up extremely difficult,” he added.

The latest wave of ETF filings from 21Shares, Bitwise, and Grayscale highlights Wall Street’s growing appetite for altcoins like Solana and Hyperliquid. While the crypto ETF sector remains relatively young, the impressive trading activity suggests that U.S. investors are becoming more willing to embrace higher-risk digital assets in pursuit of returns.