Astra Nova plunges 65% overnight

Right after being listed on Binance Alpha, Astra Nova [RVV] soared to a new all-time high of $0.03. However, the rally was short-lived. Within just 24 hours, RVV plummeted to $0.0105 — a staggering 65.5% drop. Its market cap also collapsed by 65%, down to only $10 million, signaling a massive capital outflow.

18 hacker-linked wallets dumped tokens en masse

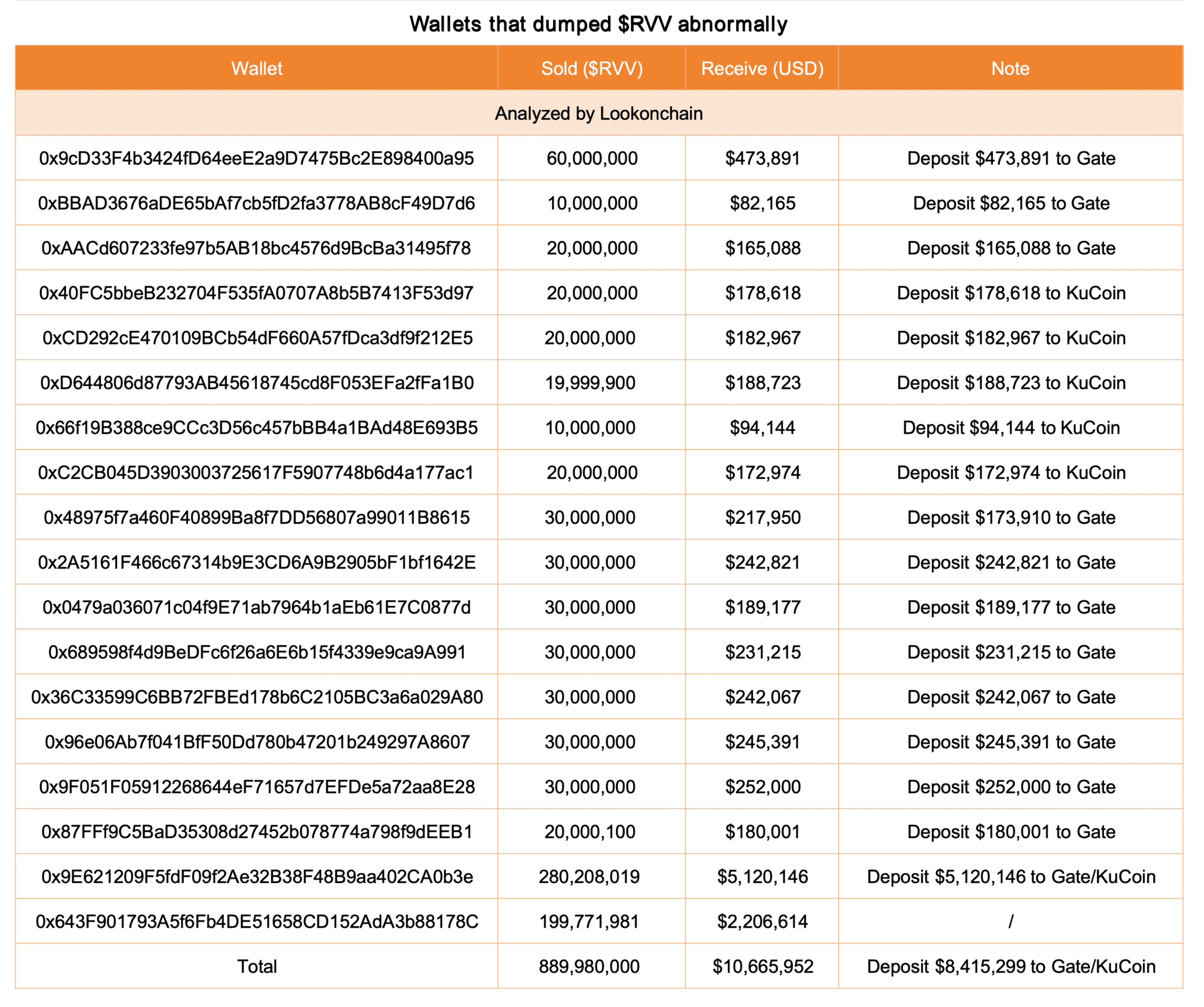

According to data from Lookonchain, soon after RVV’s listing, 18 wallets simultaneously dumped 890 million RVV tokens worth $10.66 million. Around $8.4 million of these tokens were sent to Gate and KuCoin, suggesting a coordinated market exit.

The Astra Nova team later revealed that these wallets were tied to a malicious cyberattack, not insider trading, as initially suspected.

Market maker account hacked

Astra Nova confirmed that after launch, its third-party market maker account was compromised, giving hackers control over 18 linked wallets.

These wallets then began aggressively selling RVV on the market. Despite the hack, Astra Nova emphasized that its blockchain, smart contracts, and infrastructure remain secure.

The team has since engaged on-chain forensic experts and law enforcement agencies to trace and recover the stolen funds.

Emergency token buyback program

Facing heavy backlash from the community, Astra Nova quickly launched a token buyback program to support affected investors. Under this plan, the team will repurchase from the open market an amount equal to the tokens dumped by hackers.

Additionally, investigative teams that successfully help recover the stolen assets will receive a 10% bounty of the retrieved funds.

Astra Nova reaffirmed its commitment, stating:

“We’re here for the community — transparent, accountable, and stronger than ever.”

Investor panic drives extreme volatility

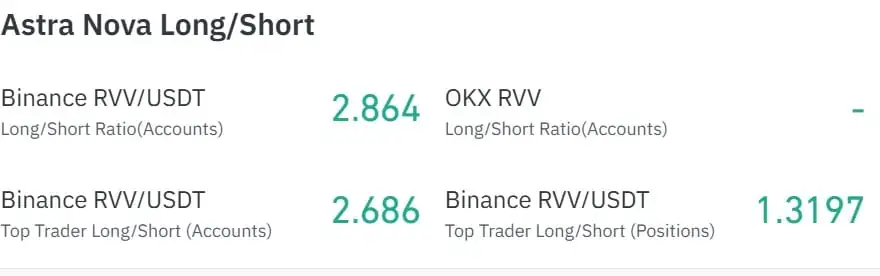

The hack triggered widespread panic selling across both spot and derivatives markets. Over the past 24 hours, total liquidations reached $4.28 million — including $2.28 million in long positions and $2 million in shorts.

Despite the steep decline, data from CoinGlass shows that the Long/Short Ratio on Binance and OKX remains elevated, at 2.8 and 2.6 respectively, suggesting traders are still betting on a rebound.

Can RVV recover?

In the short term, continued uncertainty could push RVV below the $0.01 threshold toward $0.0093.

However, if Astra Nova successfully resolves the security issues and the buyback program restores investor confidence, RVV could rebound toward the $0.012 mark in the near future.