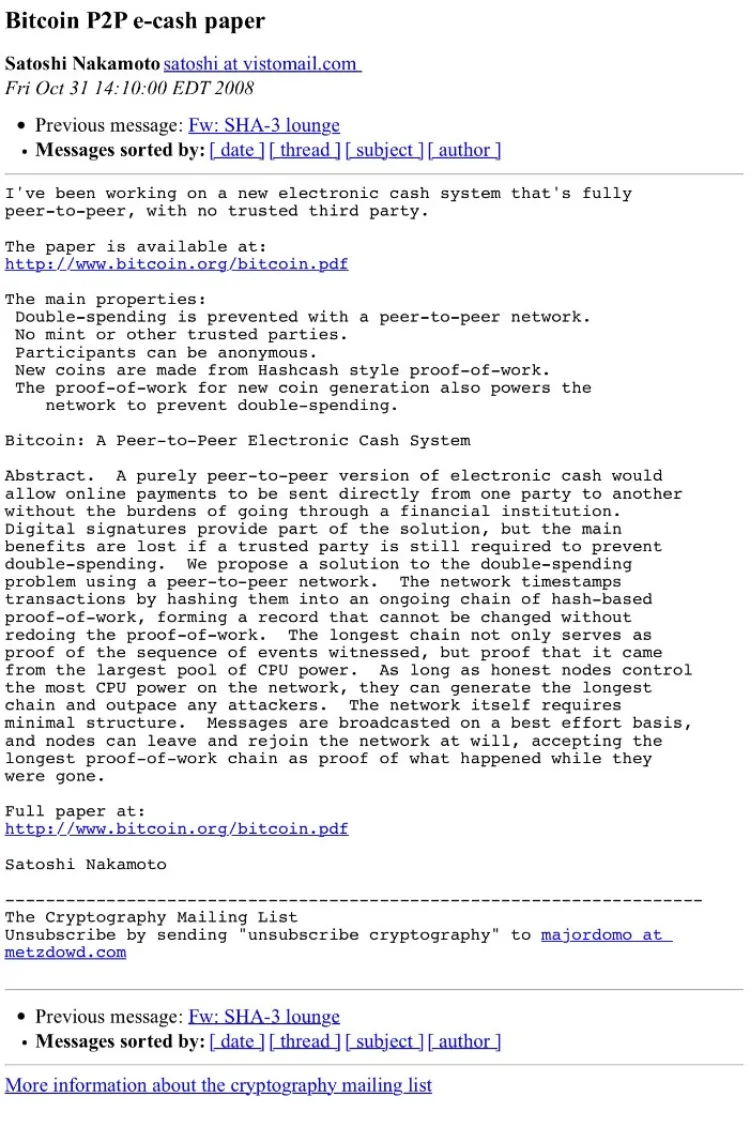

Back in 2008, Satoshi’s opening words in an email read, “I’ve been working on a new electronic cash system that’s fully peer-to-peer, with no trusted third party,” and he proceeded to introduce the document titled “Bitcoin: A Peer-to-Peer Electronic Cash System.”

The white paper introduced a groundbreaking concept—a decentralized system for peer-to-peer transactions designed to address the prevalent issue of “double spending” in digital currencies. This innovative solution proposed a network of nodes to validate and record transactions using a proof-of-work consensus mechanism. Just two months after this unveiling, Bitcoin was officially launched on January 3, 2009.

Satoshi Nakamoto’s remarkable achievement didn’t emerge in isolation; it was built upon the foundations of earlier developments in cryptography and electronic money. Notably, the white paper’s first reference is to Wei Dai’s concept of b-money, an electronic peer-to-peer cash system that, although never implemented, played a pivotal role in shaping Satoshi’s vision for Bitcoin.

Much like Bitcoin, b-money envisioned a system where participants maintained a database of account balances, tracking the ownership of money. Transactions would be initiated and completed through broadcast messages to all participants, updating the account balances of the involved parties. This concept foreshadowed the role of nodes in the Bitcoin protocol, which maintain an ever-expanding blockchain.

To ensure the security and integrity of the system, proof-of-work was incorporated. This cryptographic method required one party to prove to others that a specific amount of computational effort had been expended. Satoshi adopted this innovation, giving credit to Adam Back’s creation of Hashcash in 1997, which employed proof-of-work to combat email spam and denial-of-service attacks.

The Cypherpunks and Fathers of #Bitcoin:

• Hal Finney: Reusable PoW

• Adam Back: Hashcash

• Wei Dai: B-money

• David Chaum: DigiCash

• Nick Szabo: BitGold

• Phil Zimmermann: PGP

• Bram Cohen: BitTorrent

• Tim May: Crypto Anarchist ManifestoAnd Satoshi Nakamoto: Bitcoin

— Crypto Leroy (@TheBitLeroy) June 27, 2020

Satoshi Nakamoto’s Bitcoin white paper not only introduced a pioneering electronic cash system but also stood on the shoulders of earlier pioneers in the field of cryptography and digital currency. Today, we commemorate the 15th anniversary of this momentous document, celebrating the legacy and impact it has had on the world of finance and technology.

Another fundamental feature of Bitcoin, successfully implemented by Satoshi Nakamoto, is timestamps. The Bitcoin timestamp server operates by generating a unique hash, akin to a serial number, for a block of transactions and then associating it with the time when that block is added to Bitcoin’s blockchain.

These cryptographic hashes link one block to the next, ensuring the integrity of Bitcoin’s data. Timestamps play a critical role in preventing double spending, rendering the network tamper-proof and immutable. Satoshi acknowledged the work of Henri Massias, Scott Stornetta, Stuart Haber, and Dave Bayer in integrating timestamping into Bitcoin’s protocol.

Furthermore, Bitcoin incorporates Merkle trees to verify transaction data using digital signatures. Satoshi attributed this concept to Ralph Merkle’s work on developing public key cryptosystems.

David Chaum – “DigiCash” 1995

R.C Merkle – “Protocols for public key cryptosystems” 1980

Adam Back – Hashcash – “A Deniel of Service Counter-Measure” 2002

Nick Szabo – “Bit Gold” 2005

Wei Dai – “b-money” 1998

Satoshi Nakamoto – “Bitcoin: A Peer-to-Peer Electronic Cash System 2008 pic.twitter.com/EjfVsE4pDc— Crypto Shaman (@CryptoShaman256) September 10, 2022

It’s essential to credit the preliminary projects that paved the way for Bitcoin, as noted by Bitcoin advocate and cypherpunk Jameson Lopp. However, Satoshi’s brilliance lies in how he ingeniously pieced together these components to create a fully functional system.

As Lopp put it, “There’s no single piece of the puzzle that I think is more important than the others. Nakamoto’s genius was not any of the individual components of Bitcoin, but rather the intricate way in which they fit together to breathe life into the system.”

>>> Bitcoin Sentiment Soars and Mining Difficulty Reaches New ATH

What Bitcoin achieved was revolutionary at the time, as it effectively separated money from the control of governments and financial institutions, enabling users to transact globally without intermediaries. The first real-world Bitcoin transaction took place in May 2010 when Laszlo Hanyecz purchased two pizzas for 10,000 Bitcoins.

Early on, mainstream media often highlighted Bitcoin’s use by criminals for activities like money laundering, but this narrative has since evolved. Bitcoin has gained increasing adoption worldwide and was even declared legal tender in El Salvador in September 2021.

President Bukele just announced that a new #Bitcoin City will be built in El Salvador.

Bitcoin will be legal tender. There will be 0% income, capital gains and property tax.

A 10% VAT will serve as a key source of city revenue.

The city will be financed by a “bitcoin bond”. pic.twitter.com/CvCPvXvPIq

— Peter Young (@petermiyoung) November 21, 2021

Financial institutions have also sought to offer Bitcoin exchange-traded funds (ETFs) in the United States, and some have already launched their Bitcoin ETFs in Europe.

Numerous technological advancements have been introduced to enhance Bitcoin’s scalability and expand its use cases. The Lightning Network, launched in 2018, aims to boost Bitcoin’s transaction speed by conducting certain computations off-chain. In January, Bitcoin saw the introduction of non-fungible token-like Ordinals, made possible by the Taproot soft fork implemented in November 2021.

Bitcoin’s price has experienced substantial fluctuations. Starting at a meager penny in 2009, BTC has weathered numerous boom and bust cycles, with price volatility occasionally reaching as high as 88%. As of now, BTC is trading at $34,350, down 50% from its all-time high of $69,000 on November 10, 2021.