The social media platform X, owned by billionaire Elon Musk, is preparing to expand into the financial sector with plans to integrate a range of payment and investment services, allowing users to manage their personal finances directly within the app.

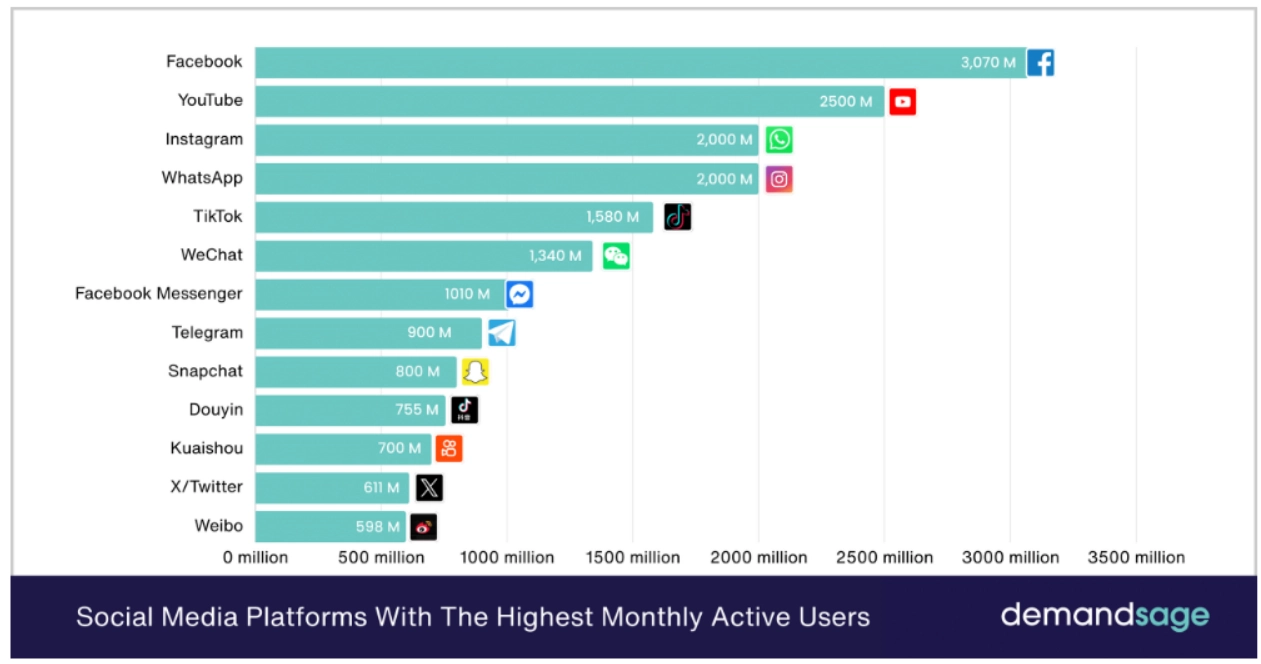

In an interview with the Financial Times, Linda Yaccarino, CEO of X, revealed that over 600 million users will soon be able to conduct transactions ranging from money transfers to asset investments on the platform. Notably, X is considering launching a branded credit or debit card, expected to debut by the end of 2025. “This will be a comprehensive financial and commerce ecosystem,” Yaccarino emphasized.

Previously, Elon Musk hinted at the payment and banking app X Money, which is currently in beta testing. In a post on X on May 25, Musk stated that this process is being carried out with utmost caution to protect user assets. According to X Money’s official account, the app is set to officially launch in 2025, with the United States as its first market.

Although Elon Musk is known as a strong supporter of cryptocurrency, particularly Dogecoin, both he and Yaccarino have not confirmed plans to integrate crypto payments into X Money. Back in March 2024, Musk hinted at the possibility of using DOGE to purchase Tesla vehicles in the future, but did not provide a specific timeline. This has raised hopes that X may soon implement cryptocurrency payment solutions.

Related: Elon Musk’s xAI Faces Lawsuit Over Air Pollution

While X remains tight-lipped, many other financial giants are actively entering this space. Visa is increasing the acceptance of stablecoins in Africa through a partnership with Yellow Card Financial, which has processed over $6 billion in transactions since 2019. In the U.S., JPMorgan Chase is also in the game, having filed a trademark application for JPMD—a collateral token supporting crypto-related services, with plans for testing on Coinbase’s Base network in the near future.

With these bold moves, X is gradually positioning itself not just as a social media platform but also as a financial super app, promising to create a significant shift in how users manage their assets in the future.