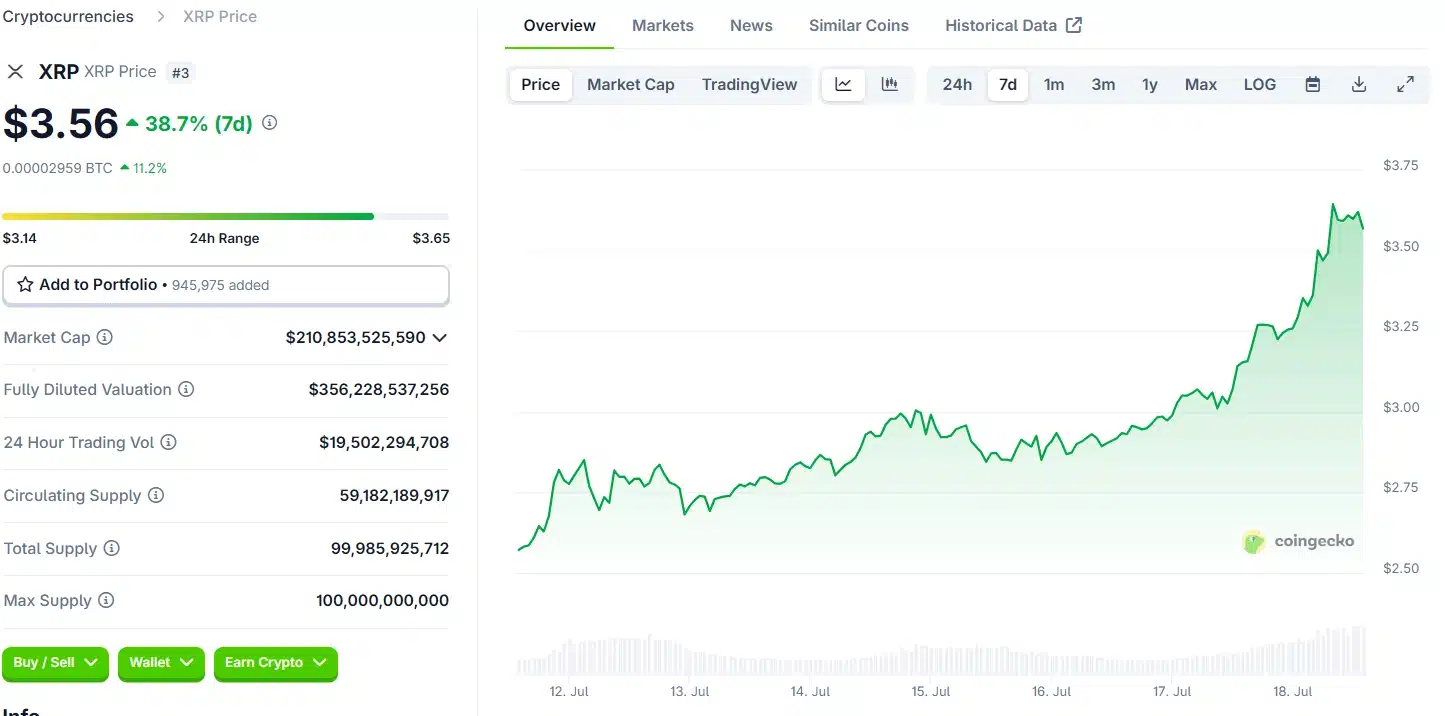

On the morning of July 18, 2025, the price of XRP officially surpassed its historical peak of $3.4 set in January 2018, reaching a new all-time high (ATH) of around $3.6. This impressive increase of over 20% in a single day and 38% over the week marked a strong breakout for XRP, allowing it to surpass USDT, the largest stablecoin by market capitalization, to become the third-largest cryptocurrency, with a market cap exceeding $212.1 billion compared to Tether’s $160.3 billion.

This is the second time in seven years that XRP has set a new price record, affirming the remarkable comeback of one of the oldest cryptocurrencies in the market. XRP’s price surge occurred against a backdrop of a broadly bullish crypto market, with Bitcoin reaching $120,000 last week. Other leading cryptocurrencies also saw significant gains, with ETH rising over 21.6% and SOL increasing by more than 8%.

However, analysts suggest that XRP’s extraordinary recovery is not only due to the overall market uptrend but also positive legal signals, policy developments, and the growth of Ripple’s ecosystem. Two years ago, Ripple achieved a significant victory in its lawsuit against the SEC when the court ruled that the sale of XRP does not always violate securities laws. By March 2025, Ripple completely ended its four-year legal battle with the SEC by withdrawing its appeal and reaching a settlement with a reduced fine of $50 million.

Related: Could Donald Trump Soon Launch a Game Featuring His Brand?

Following the legal victory, Ripple quickly expanded its operations, becoming a nationally chartered banking organization in the U.S. and the first cryptocurrency company to acquire a licensed brokerage firm. Currently, Ripple operates the XRP Ledger, a high-speed, low-cost cross-border payment processing platform widely adopted by over 100 major financial institutions, including Bank of America.

Additionally, Ripple launched its own stablecoin, Ripple USD (RLUSD), at the end of 2024. Just eight months later, RLUSD achieved a market capitalization of over $517 million, making it one of the fastest-growing stablecoins in the market. RLUSD is expected to benefit significantly from the recently passed GENIUS Stablecoin Act, which is awaiting House approval. Notably, Ripple has also formed a strategic partnership with BNY Mellon, one of the largest custodial banks in the U.S., to issue RLUSD, further solidifying its position in the global financial market.