According to the well-known analyst Willy Woo, Bitcoin miners will need to go through a tough phase before BTC can experience significant growth again.

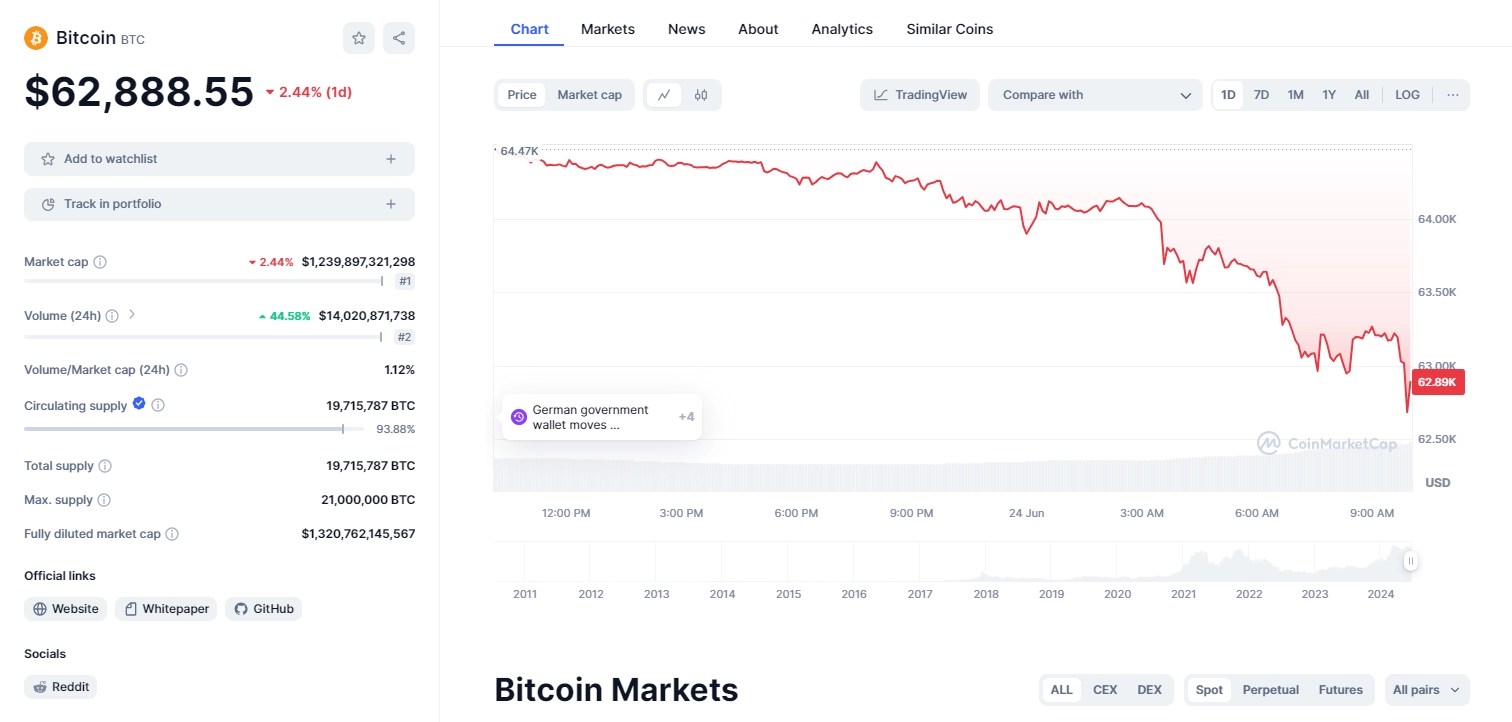

On the social media platform X (formerly Twitter), Woo shared with his 1.1 million followers the importance of observing the compression of Bitcoin’s hash ribbons when deciding when to buy and hold.

This may be uncomfortable for many, but BTC won’t break new all-time highs until we endure more periods of pain and boredom. The good news is that miners are gradually capitulating, and once this process is complete, it almost always leads to a major rally.

Bitcoin’s “hash ribbons” are an indicator designed to identify periods when Bitcoin miners are under stress and might be capitulating. Woo notes that Bitcoin’s price will remain under pressure until the hash market starts to recover in volume.

According to the analytics firm LookIntoBitcoin, Bitcoin’s hash ribbons attempt to pinpoint the moments when miners are struggling and possibly giving up. When this happens, it often signals short-term declines but sets the stage for a strong recovery afterward.

Woo believes that BTC’s price will continue to face selling pressure until miners start exiting the market, at which point, the market can enter a strong growth phase.

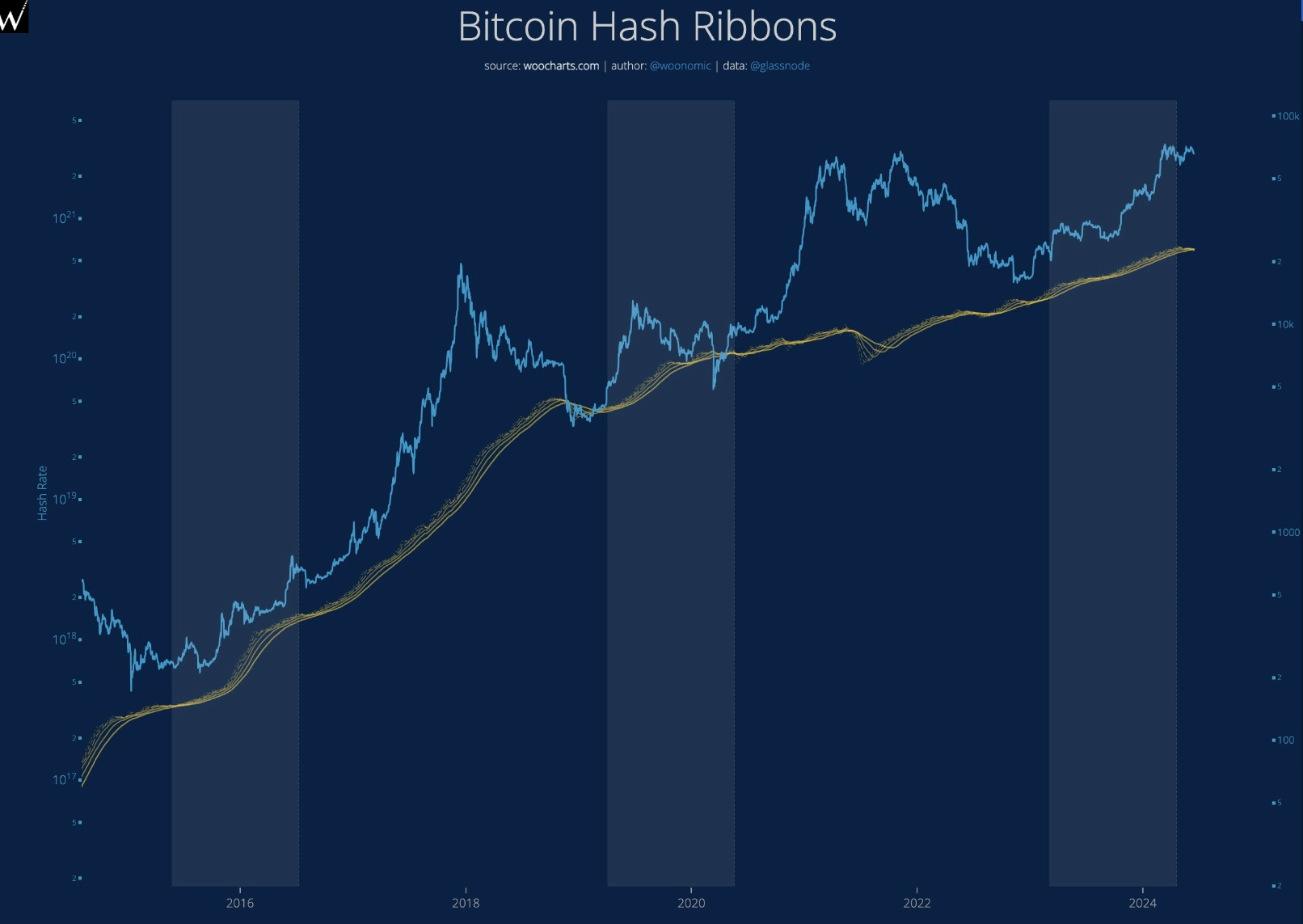

The on-chain analyst also discussed the current level of bets on Bitcoin derivatives.

The solid yellow chart is a z-score oscillator, indicating its significance in the short term. We need a significant number of liquidations to clearly signal that BTC is ready for further bullish activity.

Related: The First Bitcoin ETF Spot Officially Launched in Australia

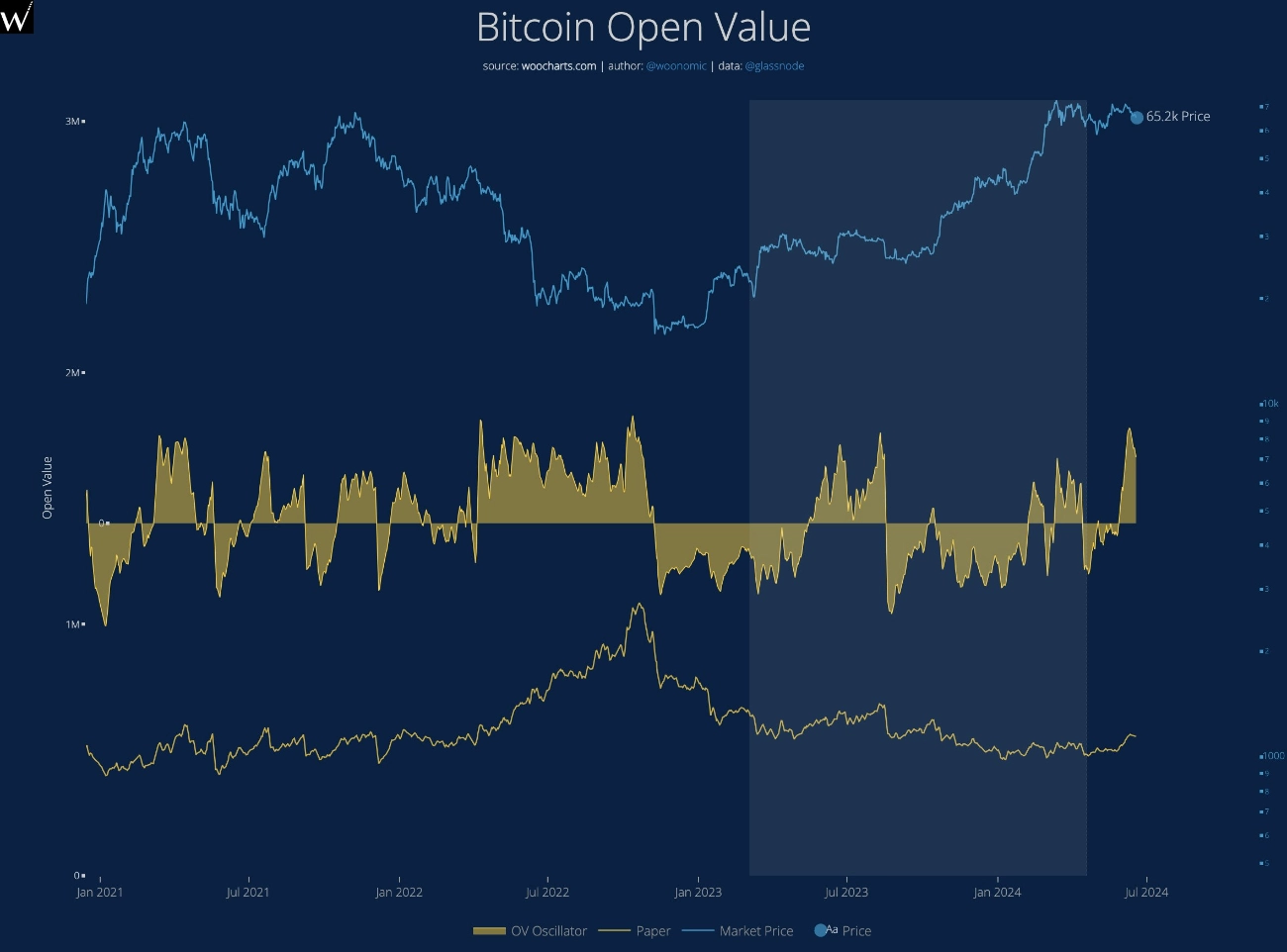

Bitcoin Price Movement

Currently, BTC is trading at $62,888. The leading cryptocurrency by market capitalization has declined nearly 5% in the past week.