The trading activity of Bitcoin “whales” (individuals or entities holding large amounts of Bitcoin) has slowed down significantly over the past two days, coinciding with Bitcoin’s price drop below $63,000.

According to data from Santiment, on June 23, the total number of Bitcoin whale transactions (holding over $100,000) over the previous two days was 9,923, marking a 42% decrease from the 17,091 transactions recorded in the preceding two days.

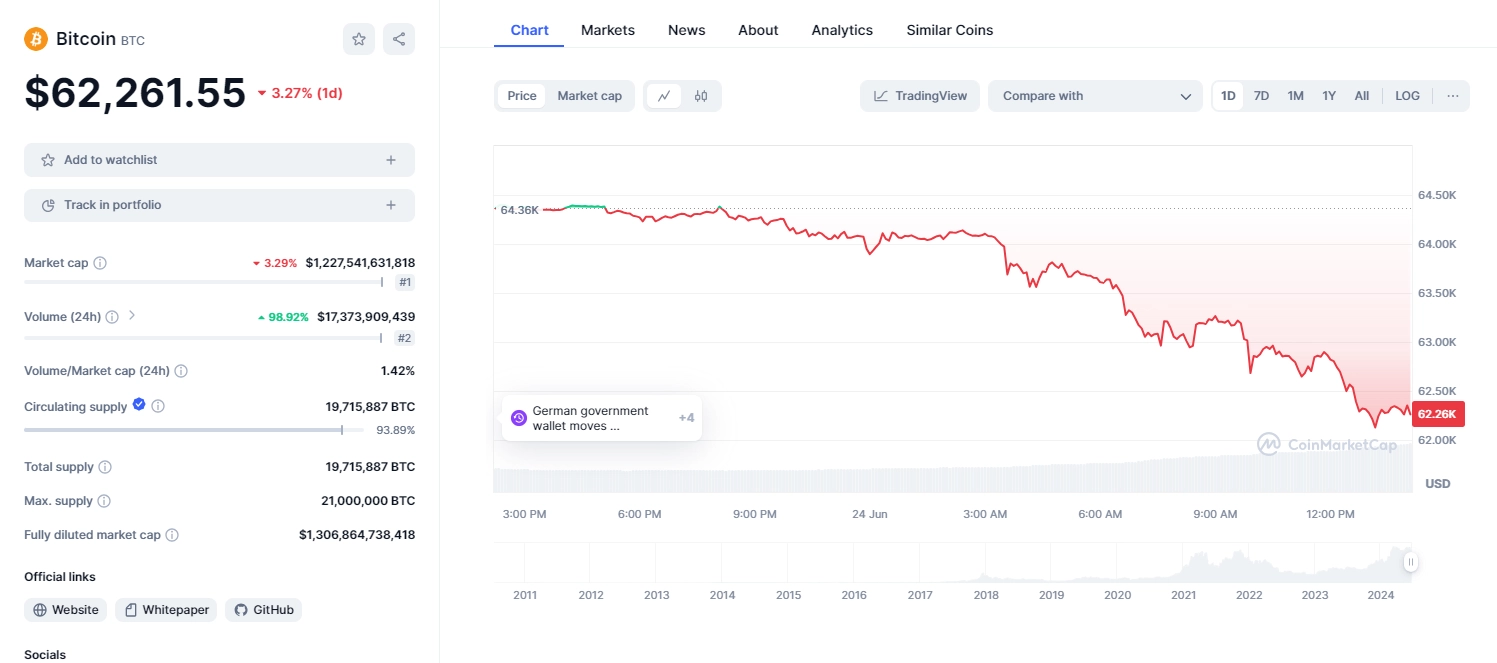

This slowdown occurred as Bitcoin’s price fell from $64,685 to $63,422 and continued to drop to $62,231 at the time of writing, based on data from CoinMarketCap.

Ki Young Ju, the CEO of CryptoQuant, observed that major traders on derivative exchanges are in “risk-off” mode—a term used to describe a negative shift in market sentiment.

#Bitcoin IFP indicator turned red. Whale traders on derivatives exchanges are in risk-off mode. pic.twitter.com/wv1XK78FoN

— Ki Young Ju (@ki_young_ju) June 22, 2024

Ki pointed out that the Inter-exchange Flow Pulse (IFP) index turning “red” is behind this decline. The IFP tracks Bitcoin movements between spot and derivative exchanges, reflecting market sentiment. When the IFP turns red, it indicates an increase in traders withdrawing Bitcoin from derivative exchanges, suggesting a more cautious or defensive trading stance.

Related: Willy Woo Explains Why Bitcoin Cannot Recover

Market Sentiment Shift from “Greed” to “Neutral”

The Fear and Greed Index for the cryptocurrency market, which gauges market sentiment, has fallen to a “Neutral” reading of 51. This is the lowest level in 51 days since Bitcoin fell below the crucial $60,000 mark.

Furthermore, spot Bitcoin ETFs have recorded outflows for six consecutive trading days, with the largest single-day withdrawal being $226.2 million on June 13.

Despite these bearish indicators, some analysts remain optimistic about Bitcoin’s prospects. James Check, the lead analyst at Glassnode, highlights other metrics suggesting potential upward momentum for Bitcoin. He notes that Bitcoin’s risk-to-reward ratio has reached levels indicating that the market might be poised for a shift, and that Bitcoin needs to find a new price range to reignite market interest and sentiment.

Cool

ancorepay

Lu”cky