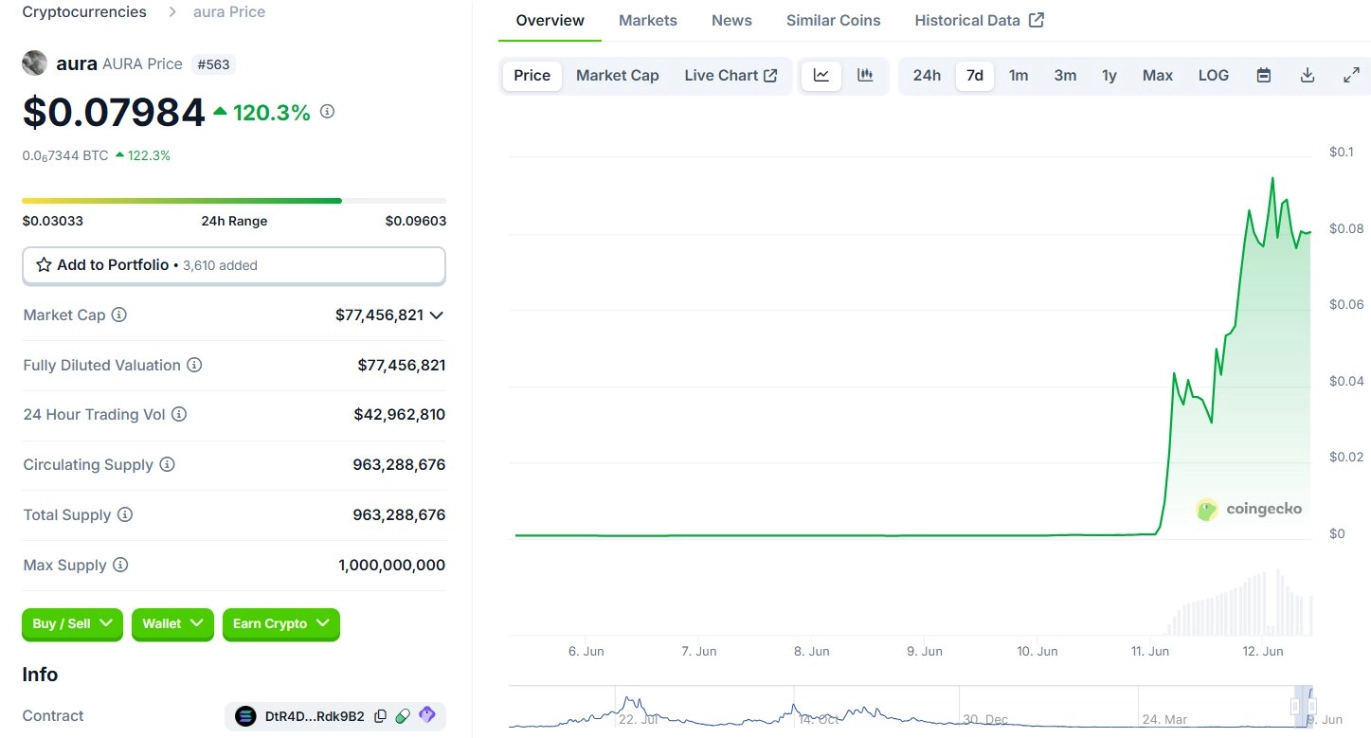

Aura (AURA), a memecoin on the Solana platform, has shocked the cryptocurrency market with a spectacular breakout, rising nearly 10,000% in just a few days. From a modest price of $0.001, the token surged to nearly $0.1, pushing its market capitalization from $1 million to almost $100 million. Trading volume also exploded, exceeding $40 million, creating a frenzy among retail investors.

The significant rise of $AURA is attributed to 215 wallets using $4 million to purchase 30% of the total supply of $AURA, driving the price up sharply.

Blockchain data from Lookonchain reveals enormous profits achieved by some investors. For instance, one wallet turned an initial investment of $24,000 into $128,000, pocketing a profit of $104,000. Another trader even claimed to have an unrealized profit of nearly $700,000.

Despite the attractive price surge of AURA, cryptocurrency experts continue to urge caution. David, a tool specializing in detecting blockchain scams, has sounded the alarm by categorizing AURA as “Level 3 – Professional Scam.” He points out several suspicious signs: the token’s utility is unclear, the distribution of the tokens lacks transparency, and the timing of the price increase is unusual.

Related: SEC Rejects DeFi Development’s Plan to Purchase $1 Billion in Solana

David emphasizes that AURA was only launched in May 2024 but quickly reached a market capitalization of $70 million before collapsing and then bouncing back. Notably, wallets holding large amounts of the token did not purchase them but received them through transfers, raising suspicions of manipulation or a pump-and-dump scheme.

In this heated market environment, investors are advised to exercise caution and carefully consider participating in the AURA frenzy, as the potential risks may outweigh the tempting profits.