What is ZeroLend?

ZeroLend is a pioneering protocol in the field of cryptocurrency borrowing and lending, operating on advanced networks such as zkSync, Manta, Blast, and Linea. The platform provides an efficient solution for users to lend their digital assets to generate profit with attractive APY interest rates or borrow assets to participate in DeFi activities, thus optimizing capital utilization and maximizing efficiency.

Developed based on the renowned AAVE V3 protocol, ZeroLend has been creatively customized with breakthrough features related to Real World Assets (RWA), Account Abstraction (AA), among others, to enhance the borrowing and lending experience, providing superior convenience and safety for users.

What are ZeroLend’s Products?

Lending

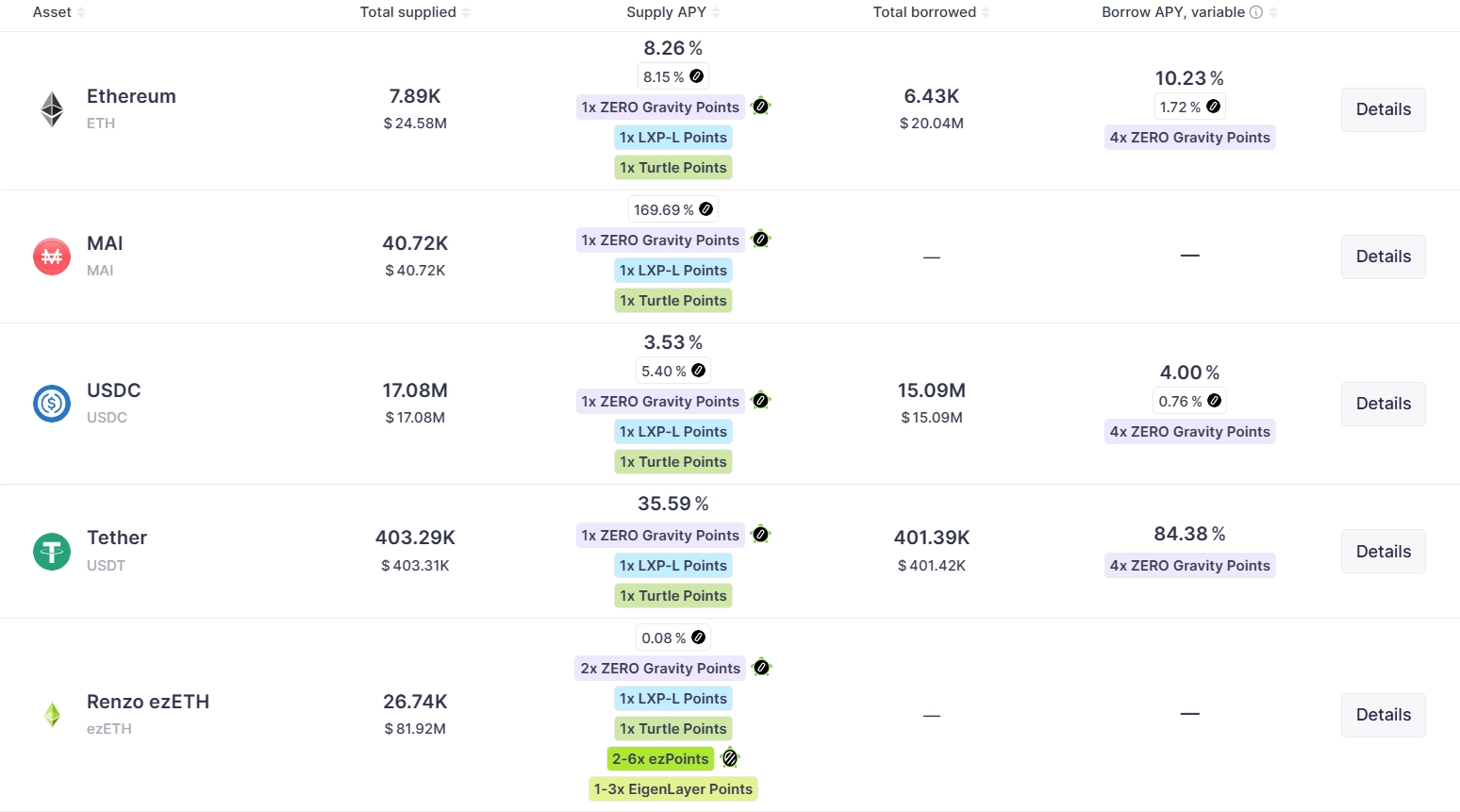

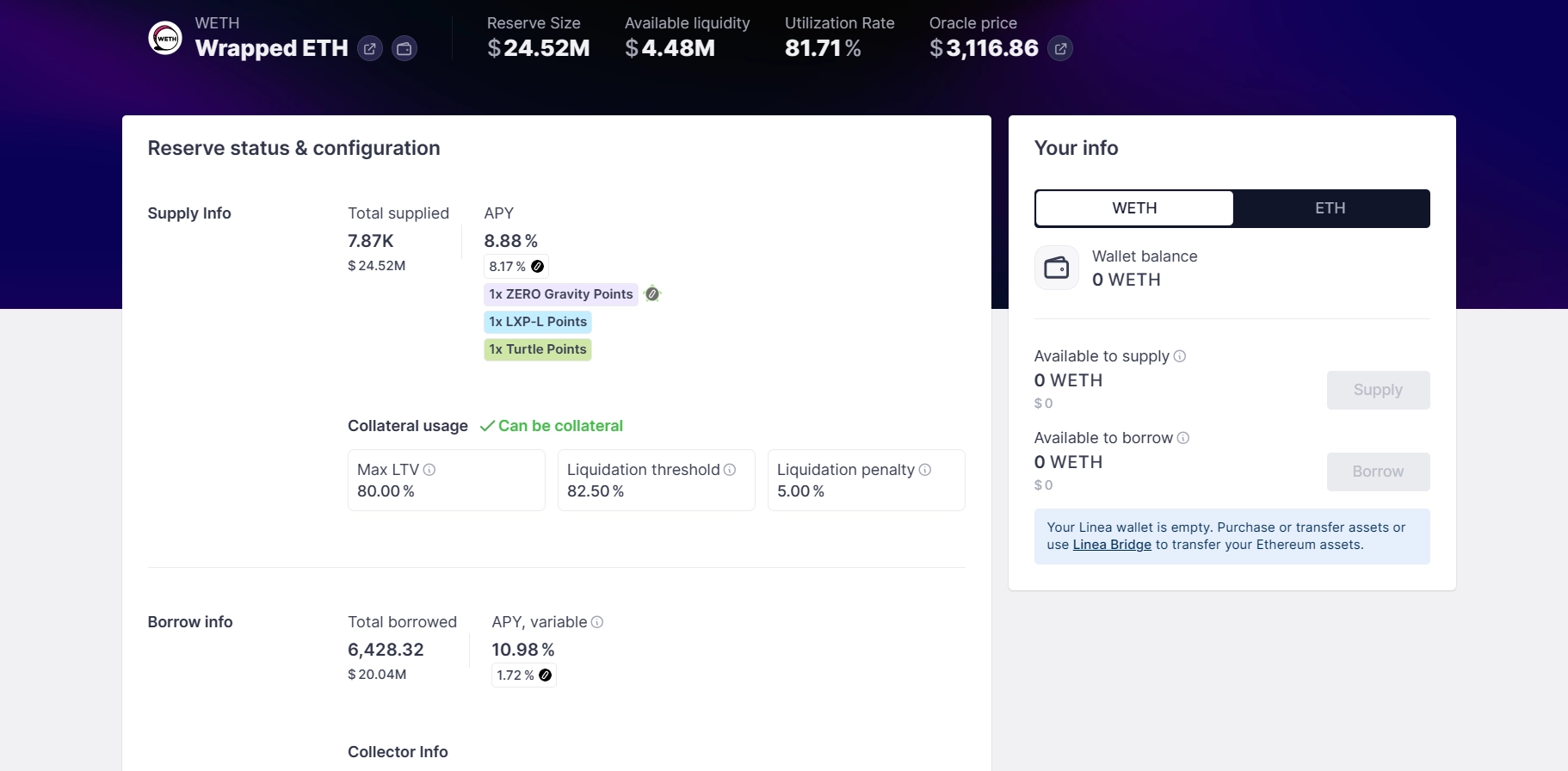

ZeroLend allows lenders to deposit assets into pools supported by the protocol and earn flexible APY interest rates through the Lend feature. The APY rate is not fixed but depends on the assets in each pool.

In addition to APY interest, lenders also receive representation points for the assets they deposit into the protocol, distributed through two types: Gravity points and Turtle points. These points can be converted to receive airdrops from the platform, with larger airdrops for higher point levels.

Note: Each pool in ZeroLend has a specified maximum deposit amount, and lenders need to pay attention to ensure a smooth lending process.

In addition to conventional lending, ZeroLend also develops a credit delegation model, allowing lenders to delegate credit for assets to borrowers. This model provides higher benefits for lenders with better APY rates than the standard, while also helping borrowers access capital more conveniently.

Borrowing

The borrowing feature allows borrowers to collateralize assets into the protocol and borrow cryptocurrency. Borrowers need to avoid liquidation by avoiding paying an additional 5% – 10% penalty fee.

The maximum borrowing limit for borrowers is determined by factors such as the deposit value, asset type, and liquidity of the collateral assets. Additionally, the borrowing limit also depends on the Health Factor.

The Health Factor is an index assessing the safety of the loan and the borrower’s repayment ability, calculated based on the ratio of the collateral asset value to the total loan value. The higher the Health Factor, the greater the borrower’s repayment ability, and vice versa.

Additionally, the protocol provides the Isolation Mode feature to limit the risk of newly supported collateral assets on ZeroLend. During evaluation, if an asset is determined to have high risk, ZeroLend will activate Isolation Mode when listing the asset to protect borrowers.

Liquidation

Liquidation is the process of liquidating assets, triggered when the borrower’s Health Factor is below 1.

The roles in the liquidation process on ZeroLend are as follows:

- Liquidated Person: Represents debt positions with a Health Factor lower than 1.

- Liquidator: Monitors debt positions and seeks eligible loans for liquidation. Liquidators receive a 50% allocation of the liquidation penalty fee.

Stake

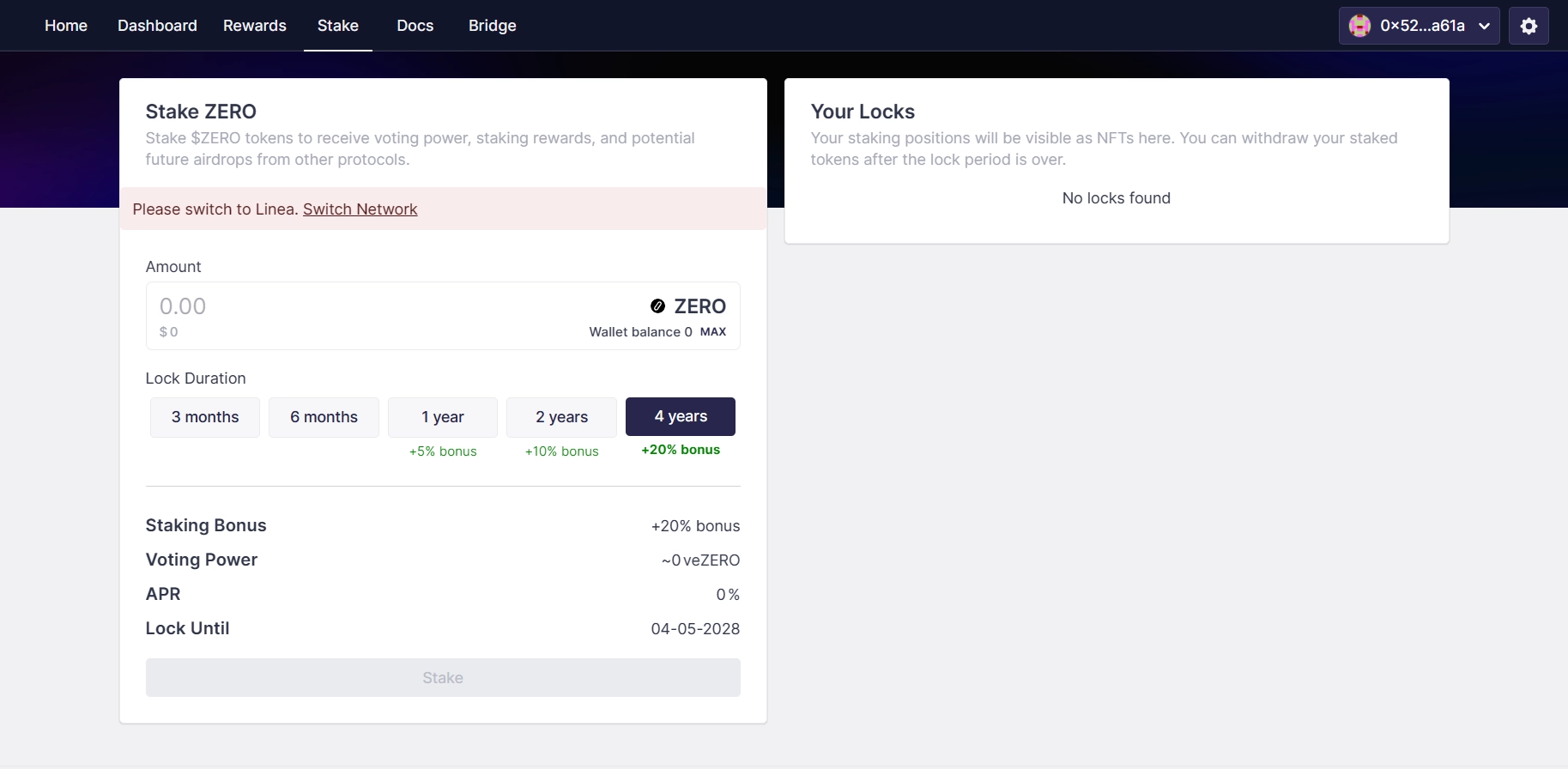

Users can stake ZERO tokens to receive voting rights, rewards from staking, and the ability to receive airdrops from other protocols in the future. Staking periods can be 3 months, 6 months, 1 year, 2 years, or 4 years.

Account Abstraction (AA)

In addition to the core features of borrowing and lending, ZeroLend also integrates zkSync’s AA tool to enhance the user experience through 3 features:

- Social Login: Allows users to authenticate their crypto wallets linked to social media platforms, Gmail, phone numbers, etc.

- Biometric: Biometric authentication mechanisms such as fingerprint recognition ensure account security and enhance convenience when using the platform.

- Delegate Transaction: Allows users to delegate some transaction tasks to ZeroLend through smart contracts. For example, lenders can delegate ZeroLend to automatically close a borrower’s position as required.

However, the 3 features: social login, biometric, and delegate transaction have not been released yet (scheduled for launch in 2024).

Moreover, in 2024, the platform also introduced borrowing and lending features based on RWA assets such as stocks, bonds, real estate, etc., to enhance the user experience.

Key Highlights of ZeroLend

ZeroLend possesses several key highlights compared to other lending protocols such as:

- Account Abstraction: Leveraging Layer 2 zkSync makes it easy for ZeroLend to integrate Account Abstraction, bringing breakthrough features to the protocol.

- Support for Real World Assets (RWA): ZeroLend plans to integrate Real World Assets into the protocol in Q2/2024. Besides expanding collateral asset choices and loans, RWAs also allow for under-collateralized loans, opening up opportunities to access new capital for a diverse customer base.

- Hyperchain and Security Layer: ZeroLend plans to integrate a Security Layer using Hyperchain technology (Layer 3) from zkStack in early 2025, enhancing transaction security for all users.

- Multi-Oracle Approach: Instead of using a single Oracle, ZeroLend combines Price Feeds from two leading Oracle providers in the industry, Chainlink and Pyth Network, ensuring the most accurate price data and minimizing price errors in the loan liquidation process.

Team

Currently, there is no information available about the development team of the project. Stay tuned for cryptocurrency updates to get the latest information on the project!

Investors

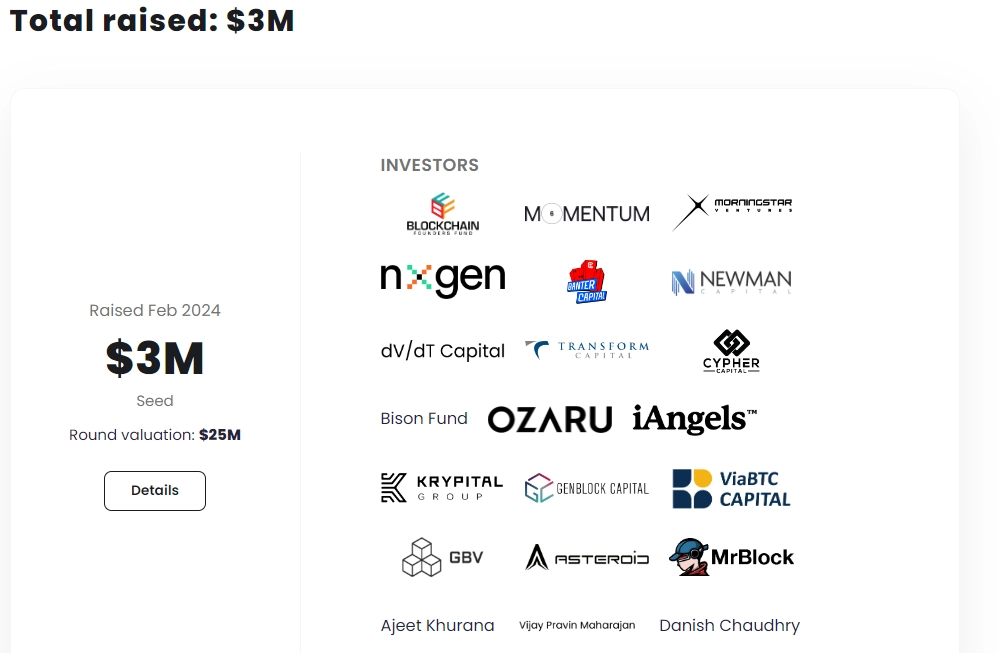

On February 20, 2024, ZeroLend announced the successful raising of $3 million in Seed funding, with a valuation of $25 million. Some investment funds participating in the fundraising round include: Momentum 6, Blockchain Founders Fund, Morning Star Ventures, Banter Capital…

Partners

ZeroLend has built strong partnership relationships with many partners such as: LayerZero, Manta Network, Pyth, AAVE…

What is ZERO Token?

After learning about what ZeroLend is, let’s delve into the project’s token – ZERO.

Basic Information about ZERO Token

- Token Name: ZeroLend

- Ticker: ZERO

- Blockchain: zkSync, Linea, Blast, Manta

- Contract: 0x78354f8DcCB269a615A7e0a24f9B0718FDC3C7A7 (Linea)

- Token Type: Utility & Governance

- Total Supply: 100,000,000,000 ZERO

- Circulating Supply: Updating

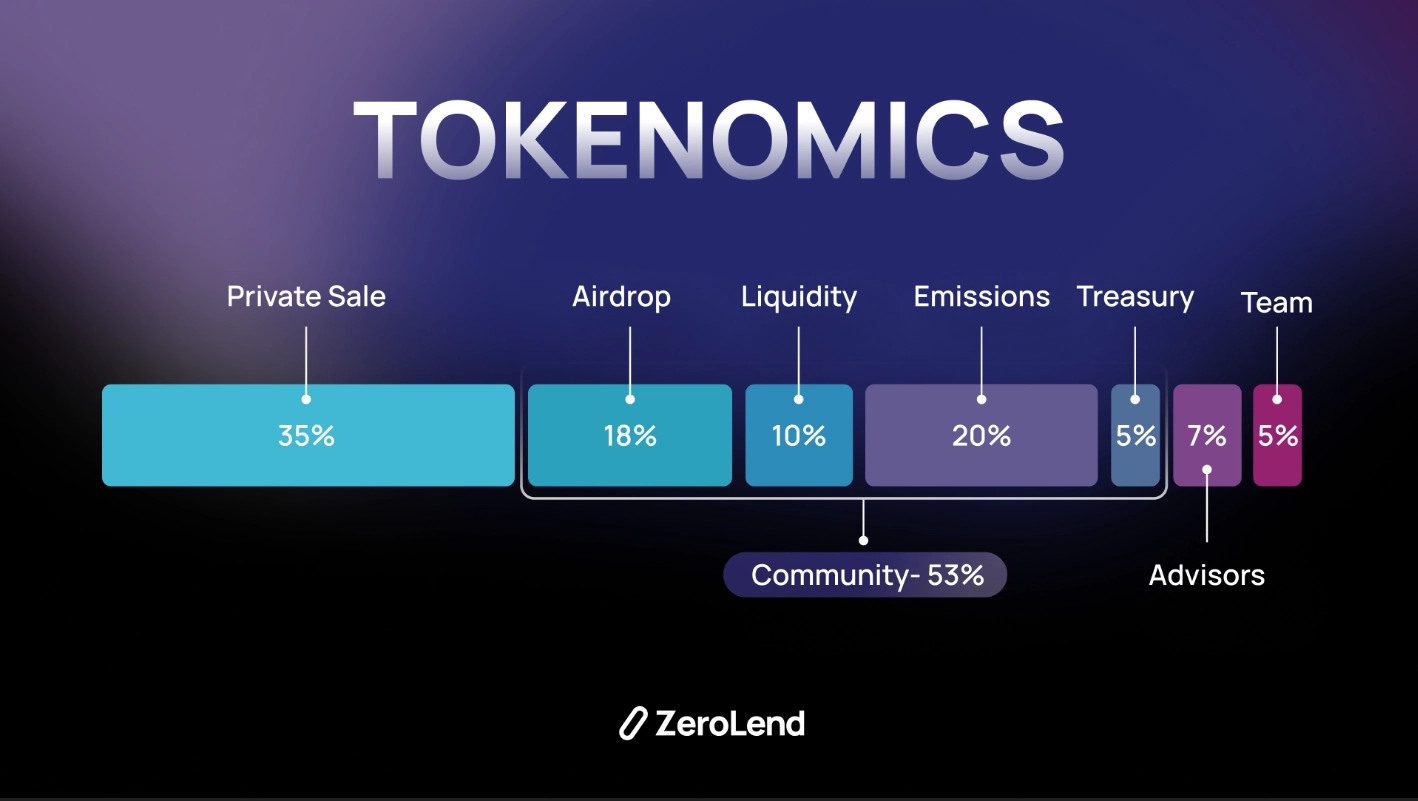

Allocation of ZERO Token

- Emission: 35%

- Private Sale: 30%

- Liquidity: 10%

- Treasury: 10%

- Advisor: 7%

- Team: 5%

- Airdrop: 3%

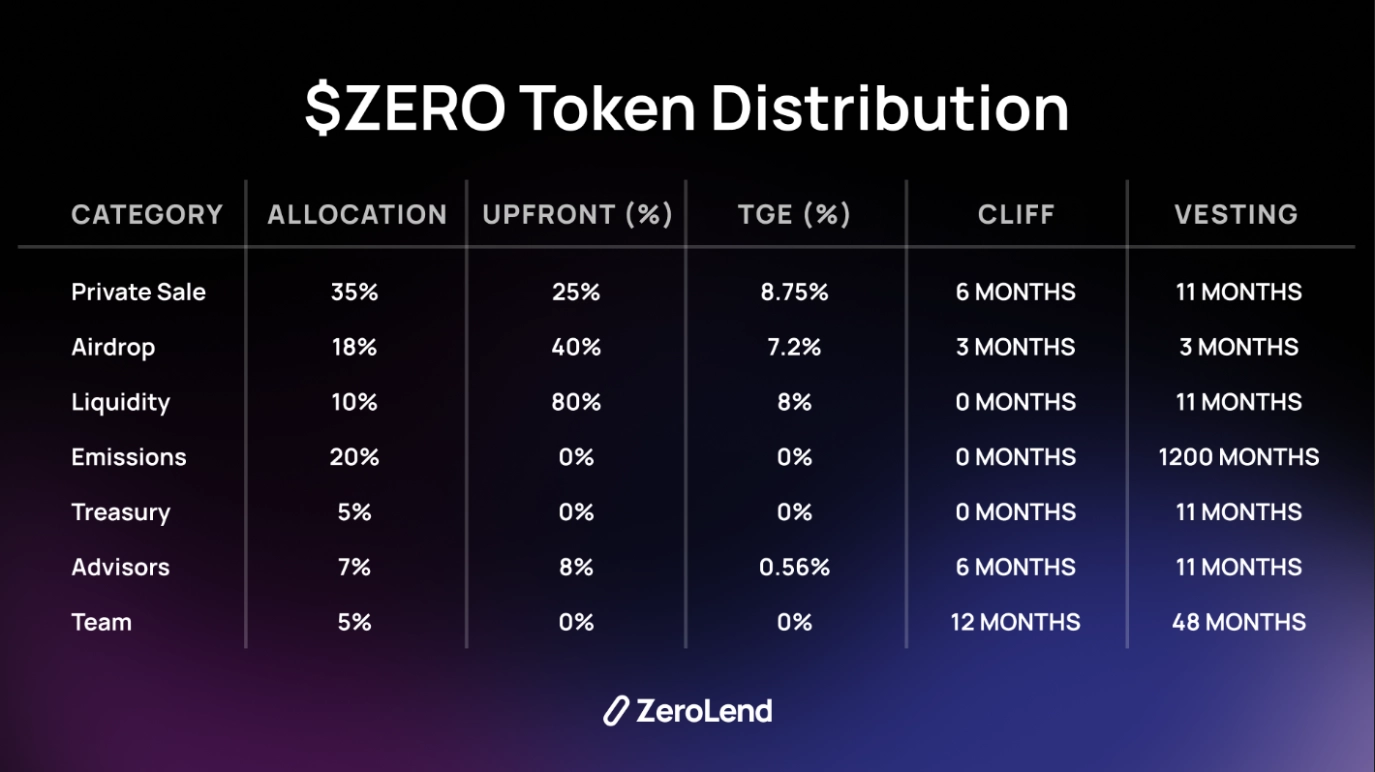

ZERO Token Release Schedule

According to the project, the ZERO token release schedule is as follows:

- Private Sale (30%): Allocate 25% at TGE and unlock gradually over 1 year.

- Liquidity (10%): Allocate 8% at TGE and unlock gradually over 1 year.

- Team (5%): Allocate 0.8% at TGE and unlock gradually over 10 years.

- Treasury (10%): Allocate 8% at TGE and unlock gradually over 1 year.

- Advisors (7%): Allocate 25% at TGE and unlock gradually over 1 year.

- Airdrops (3%): Allocate 33% at TGE and unlock gradually over 6 months.

- Emissions (35%): Allocate 19% at TGE. Decrease over time.

ZERO Token Use Case

Users holding ZERO tokens can use them for the following purposes:

- Allow users to stake ZERO tokens into the protocol and receive rewards.

- Pay transaction fees and rewards for verifiers.

- Incentivize user participation in the platform.

- Buy and sell ZERO tokens.

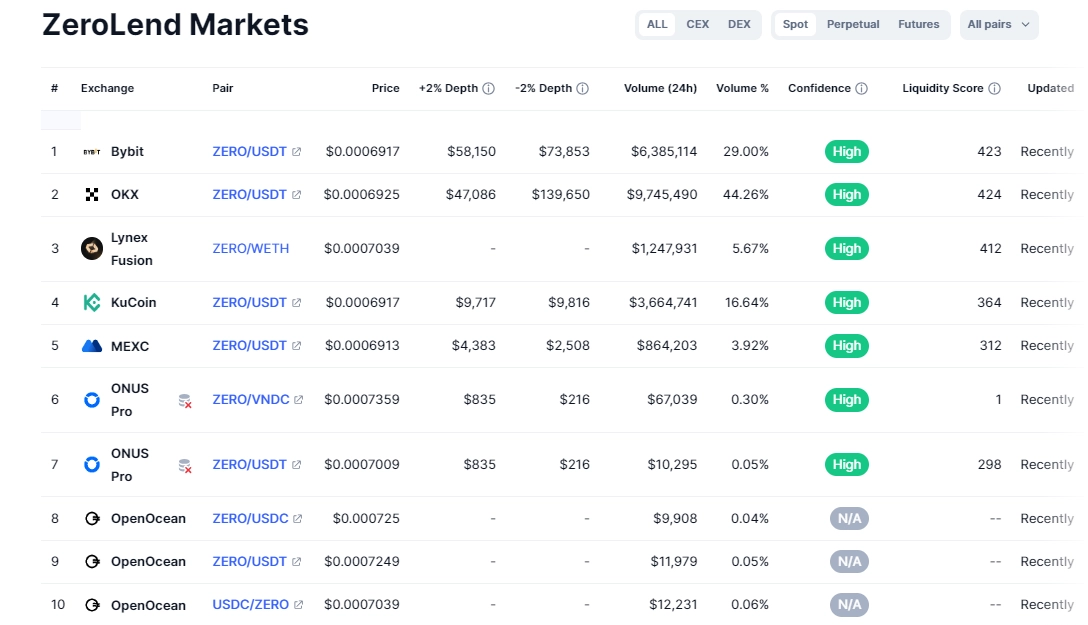

Buying and Selling ZERO Token

ZERO Token has been listed on many major exchanges such as OKX, Bybit, Mexc, Kucoin, etc.

Related: OKX Announces Listing of ZeroLend (ZERO)

Roadmap

ZeroLend has divided its development process into 5 stages as follows:

Stage 1: (current)

- Official launch of ZeroLend mainnet.

- Launch of stablecoin ONEZ.

- Implementation of airdrop program and marketing campaigns.

- Listing of ZERO token on major exchanges.

Stage 2: Expected in 2024

- Integration of RWA Lending.

- Integration and improvement of Account Abstraction & Hyperchain.

Stage 3: Expected in 2025

- Global expansion.

- Similar projects

Some similar projects

- Pike: A cross-chain lending and borrowing platform on Base, using technologies such as cross-chain messaging from Wormhole, Circle’s cross-chain transfer protocol (CCTP), and Pyth’s Data Feed.

- Liquidium: A lending and borrowing protocol on Bitcoin aiming to expand the utility of BTC tokens for holders.

Project information

- Website: http://zerolend.xyz/

- Twitter: http://twitter.com/zerolendxyz

- Discord: http://discord.gg/zerolend

Conclusion

With its development on the zkSync ecosystem and the potential for an airdrop when zkSync launches, ZeroLend promises to be a potential project in the future.

Through the article “What is ZeroLend? Information about ZERO Token,” readers have understood what ZeroLend is. If not, please leave a comment to get your questions answered!

Note: The article aims to provide knowledge and is not investment advice.