What is Wormhole?

Wormhole is a Cross-chain Messaging Protocol (W), enabling asset and information transfer between different blockchains.

Initially, Wormhole served as a pioneering Cross-chain Bridge in the Solana ecosystem, quickly becoming the largest bridge in the ecosystem by contributing significantly to liquidity and facilitating the easy flow of capital from Ethereum to Solana.

In February 2022, Wormhole was hacked, resulting in losses of up to 120K WETH (equivalent to over $300M at the time), which severely damaged the project’s reputation and TVL.

Thanks to the support of Jump Trading, Wormhole is currently recovering quickly and regaining its position in the Cross-chain sector.

What is Wormhole’s solution?

Moving tokens between blockchains has always been a significant barrier for users. Before Wormhole’s introduction, the workaround for this limitation was to transfer assets through centralized exchanges to relay them to the desired destination. However, this method was suboptimal as users were hesitant to entrust their assets to others, and passing through multiple intermediaries posed a risk of asset loss. Smart Contracts and dApps couldn’t interact with each other.

With the significant advancements in DeFi, Smart Contracts, and Layer 2 solutions, the limited interoperability of blockchains became a crucial issue that Wormhole was founded to address.

With these two major limitations in mind, Wormhole was established to optimize blockchain interoperability, providing the best possible user experience.

On April 3, 2024, Binance announced the listing of Wormhole on its platform.

Related: Binance Announces Listing of Wormhole (W)

What are Wormhole’s operations?

There are four main components in Wormhole’s operational model:

- Wormhole Core Contract: Smart contracts deployed on blockchains connected to Wormhole.

- Guardian: A network consisting of 19 validators responsible for verifying and approving messages.

- Replayer: Responsible for relaying messages (transaction data requested by users) to the target blockchain.

- VAA (Validator Action Approval): Stores messages that need to be relayed, approved by Guardians.

The sequence of Wormhole’s operations is as follows:

- Messaging is sent through the Wormhole Core Contract, then forwarded to Guardians. These Guardians verify and approve the message’s authenticity.

- Messages must have approval from at least 2/3 of Guardian signatures to be passed, after which they are transferred to the VAA.

- Finally, the Replayer is responsible for relaying VAA to the target chain for execution.

What are Wormhole’s products?

Wormhole offers a diverse range of products, including Messaging, Queries, Connect, and Gateway.

- Messaging: A decentralized messaging protocol for blockchain developers to exchange information and value with other blockchains safely and easily.

- Queries: A new tool for developers, allowing faster and cheaper cross-chain data access exponentially.

- Connect: A toolkit provided to developers to integrate Wormhole’s cross-chain solution easily, enabling developers to incorporate Wormhole’s cross-chain capability into their applications with just a few lines of code.

- Gateway: An L1 Appchain developed based on Cosmos SDK. Gateway leverages the flexibility of Cosmos SDK and CosmWasm, allowing seamless integration between Wormhole and the Cosmos ecosystem.

With its suite of products, Wormhole seems to aspire to become the leading cross-chain infrastructure provider for crypto projects.

What are the applications built on Wormhole?

Additionally, several applications are built on the Wormhole platform, including:

- Portal Bridge: A Cross-chain Bridge developed by the xLabs team, currently supporting asset transfers on over 30 different blockchains.

- Carrier: Token and NFT bridge developed by the Automata Network team, providing advanced bridge features such as simultaneous transactions, wallet management, etc.

- Wormholescan: Developed by the same team as Portal Bridge, xLabs, Wormholescan is a Blockchain Explorer, allowing users to easily query and track transactions processed by Wormhole.

What are the highlights of Wormhole?

- Wormhole supports non-EVM chains: Wormhole is one of the few cross-chain messaging protocols that can support various blockchain types, from Cosmos appchains to EVM and non-EVM chains like Solana, Aptos, Sui, etc. It can be said that supporting a diverse range of chains has helped Wormhole build a broad network of interactions. As of now, Wormhole has supported over 30 blockchains.

- Strong and decentralized network: Wormhole’s trust layer is built on the PoA (Proof of Authority) mechanism with a group called “Guardians.” This ensures the authenticity and security of cross-chain messages. There are 19 Guardians managed by prominent companies like Certus One, Everstake, Staked, etc.

- Seamless user experience: Currently, Wormhole allows users to use the bridge service at very low fees. Additionally, with the Connect product, Wormhole will help projects easily integrate with Wormhole without having to pay any fees, significantly simplifying the interaction process.

What is the W Token?

After learning what Wormhole is, let’s delve into the project’s token – W.

Basic information about the W Token:

- Token Name: Wormhole

- Symbol: W

- Total Supply: 10,000,000,000 W

- Initial Circulating Supply: 1,800,000,000 (18%)

- Price: To be updated…

- Market Cap: To be updated…

- TGE (Token Generation Event): 04/03/2024

Utility of the W Token

The W Token is currently used as the governance token of Wormhole.

Holders of W can participate in voting on Wormhole to make decisions regarding token utility and design, smart contract upgrades on Wormhole, adjusting Wormhole’s product fees, and other platform-related decisions.

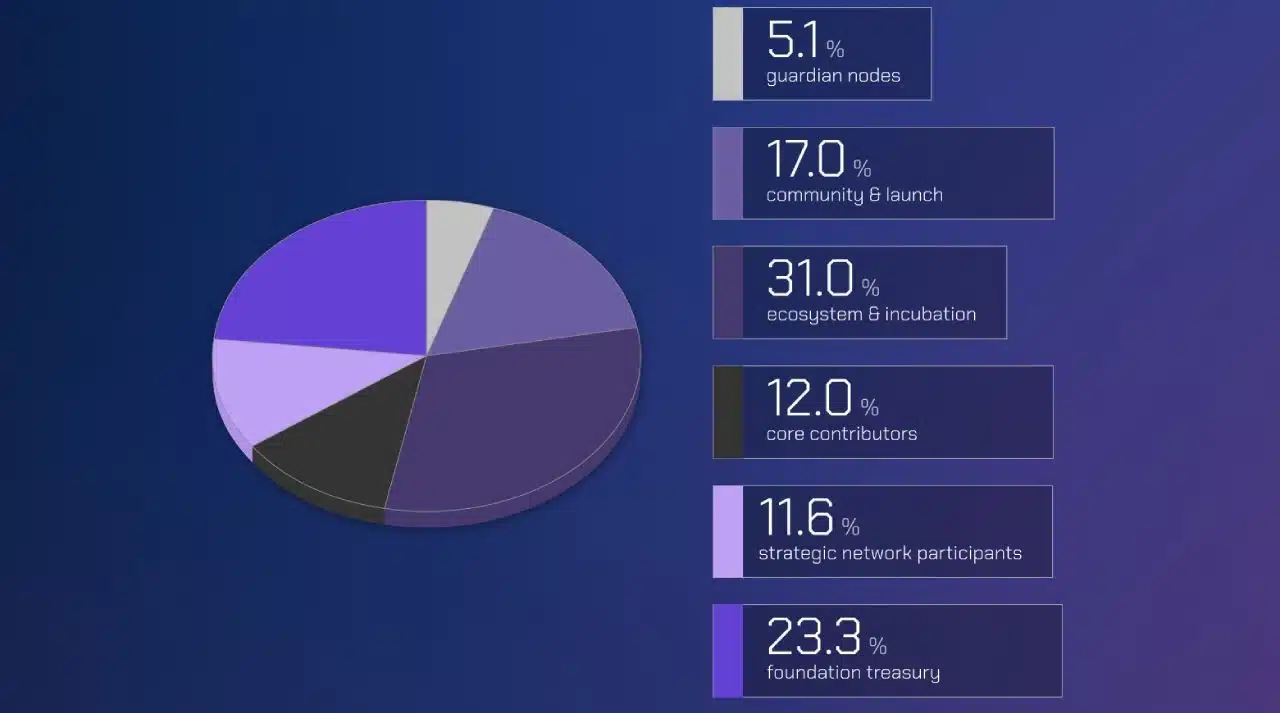

W Token Allocation

Here’s how Wormhole’s 10 billion W token allocation is distributed:

- Guardian Nodes – 5.1% (510,000,000 tokens): Tokens allocated to Wormhole’s Guardian Node network.

- Community & Launch – 17% (1,700,000,000 tokens): Tokens allocated for the community. Of these, 11% will be airdropped to users and projects that were snapshot before the tokenomics announcement.

- Core contributors – 12% (1,200,000,000 tokens): Tokens allocated for the project’s core development team.

- Ecosystem & Incubation – 31% (3,100,000,000 tokens): Tokens allocated for community organizations, ecosystem development initiatives, strategic contributors, etc.

- Strategic Network Participants – 11.6% (1,160,000,000 tokens): Tokens allocated for investment funds, partners, etc.

- Foundation Treasury – 23.3% (2,330,000,000 tokens): Tokens allocated for the Wormhole Foundation’s reserve fund.

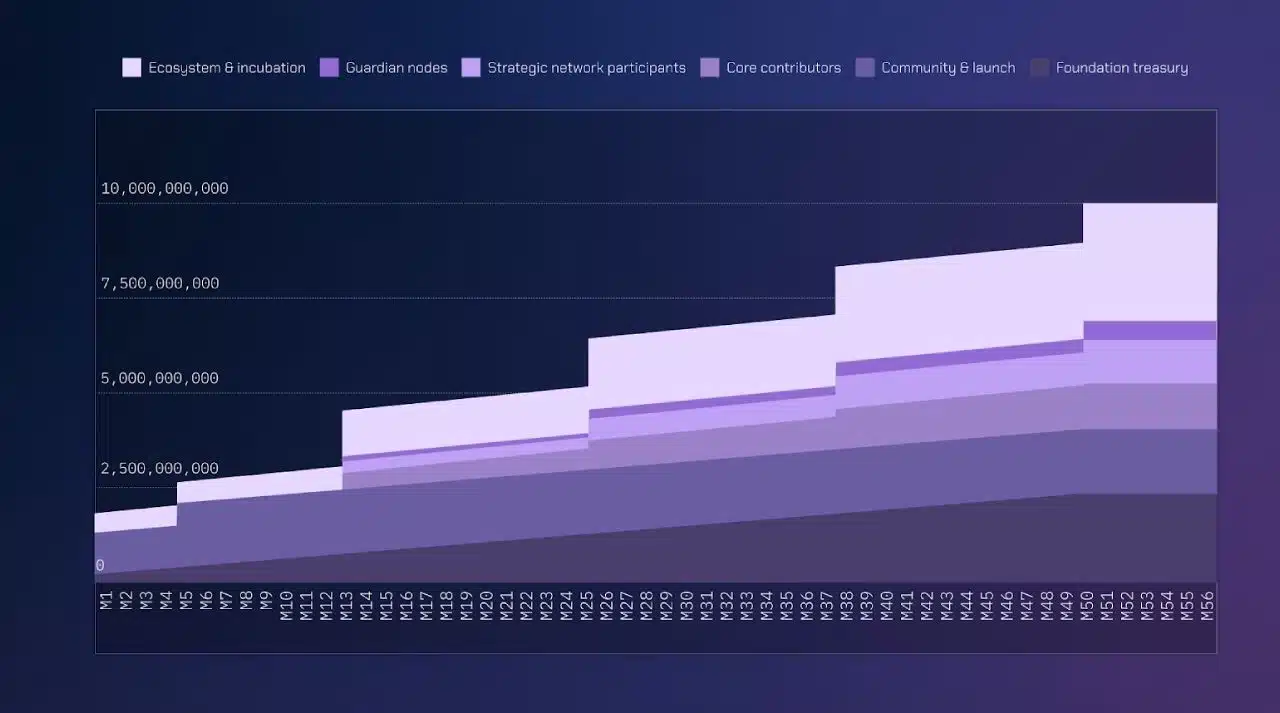

W Token Vesting Schedule

Here’s the specific token vesting schedule for each portion of Wormhole (W):

- Guardian Nodes – 5.1%: No token unlock at TGE, tokens will begin vesting after 12 months.

- Community & Launch – 17%: 11% equivalent to 1,100,000,000 W will be circulating at TGE, the remaining 6% will continue to unlock 4 months after TGE.

- Core contributors – 12%: No token unlock at TGE, tokens will begin vesting after 12 months.

- Ecosystem & Incubation – 31%: 5% equivalent to 500,000,000 W will be circulating at TGE, the remaining 21.6% will continue to unlock 4 months after TGE.

- Strategic Network Participants – 11.6%: No token unlock at TGE, tokens will begin vesting after 12 months.

- Foundation Treasury – 23.3%: 2% will be unlocked at TGE, the remaining 21.3% will vest after 12 months.

Buying and storing W Token

People can buy and sell W Tokens on Binance from April 4, 2024.

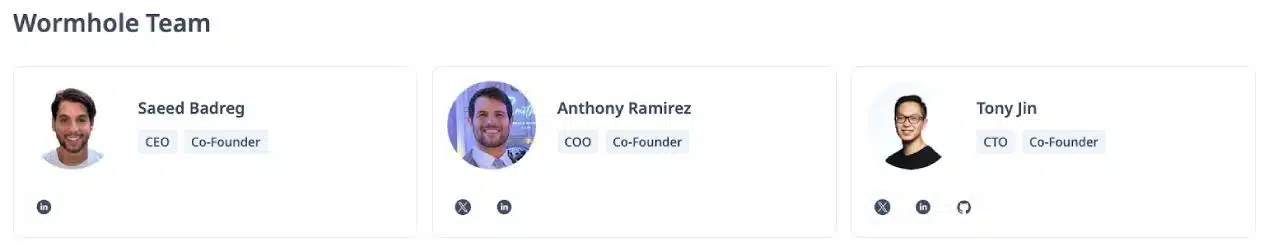

Development team

Currently, the Wormhole team has a scale of over 50 members. Among them, there are three key members in the leadership team:

- Saeed Bardreg (Co-founder & CEO)

- Anthony Ramirez (Co-founder & COO)

- Tony Jin (Co-Founder & CTO)

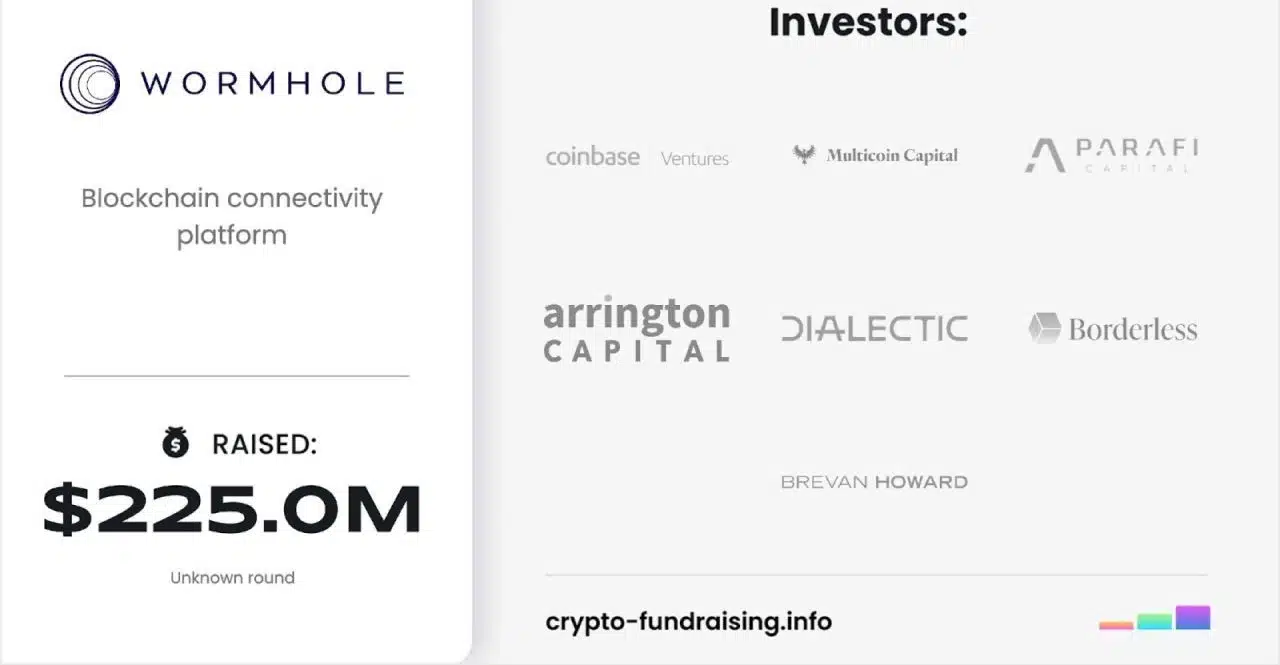

Investors

Wormhole has successfully completed two funding rounds, with specific information as follows:

- Seed Round (5/2022): No information about participating funds or investment amounts was disclosed.

- Funding Round (11/2023): Raised $225 million at a valuation of up to $2.5 billion. Participated by top investment funds such as Multicoin Capital, Coinbase Ventures, Jump Trading, etc.

In terms of partners, Wormhole currently has a large network of partners with over 30 blockchains and 200 protocols using Wormhole’s products.

Roadmap

Recently, Wormhole has announced the Wormhole ZK roadmap. The Wormhole ecosystem will introduce a portfolio of software solutions to achieve the common vision of ZK support. The forward path of Wormhole ZK aims to enable extremely fast, low-cost, and trustless message verification. The ZK roadmap focuses on:

- Enhancing Wormhole’s flexibility by allowing the protocol to support multiple verification mechanisms beyond Wormhole Guardians.

- Promoting the minimization of protocol trust through accelerated ZK proofs and integrating lightweight client applications, thereby enabling trustless communication between blockchains.

- Enabling more scalable integration to meet the rapid, permissionless integration needs of new blockchains.

- Enabling a more robust multichain combining capability for users to easily build richer applications.

Information project

- Website : https://wormhole.com/

- Twitter : https://twitter.com/wormhole

- Discord : https://discord.com/invite/wormholecrypto

Conclusion

It can be seen that the emergence of Wormhole is a positive signal for the future of cross-chain. Wormhole is an advanced messaging protocol capable of connecting to every blockchain through a reliable and verifiable network. Furthermore, the project is built synchronously, allowing for low-latency consensus. This capability ensures that information sources are used freely.

Hopefully, the insights shared in the article have helped you understand what Wormhole is and have provided an overview of the project. However, investing in crypto remains a risky field with many pitfalls alongside attractive profit opportunities. Traders should conduct thorough research and only invest when they have a clear understanding of the project.

How does it work