What is Usual?

Usual is a decentralized platform for issuing fiat-backed stablecoins that prioritize security, transparency, and the distribution of ownership and governance through the USUAL token. The platform aims to provide a secure stablecoin that not only preserves value but also offers users opportunities to generate additional returns through its suite of financial products.

Usual stands out for its integration of real-world assets (RWA) with decentralized financial (DeFi) governance models, addressing key challenges in the current stablecoin market. Operating as a multi-chain infrastructure, Usual aggregates tokenized RWAs from reputable institutions like BlackRock, Ondo, Mountain Protocol, M^0, and Hashnote, transforming them into permissionless, transparent, and easily integrable stablecoins.

As of November 19, 2024, just four months post-launch, Usual’s total value locked (TVL) has reached $380 million.

Notably, on November 15, 2024, Binance Launchpool officially announced the listing of the USUAL token, marking a significant milestone for the project in reaching a global audience.

Related: Binance Announces Listing of USUAL on Launchpool and Pre-market

How Usual Works

Usual operates through a closed-loop process that tightly integrates governance, stablecoin issuance, and value generation to create a decentralized, transparent, and secure system.

1. Issuing the USD0 stablecoin

- Users can deposit collateral assets such as USDC or real-world assets (RWA) into the Usual protocol.

- Based on these collateral assets, users receive USD0, a stablecoin backed by guaranteed assets.

2. Generating value with USD0++

- Users can lock USD0 to create USD0++, an enhanced version of USD0.

- Holding USD0++ rewards users with USUAL tokens and allows them to benefit from the protocol’s growth.

3. Ensuring liquidity

- Collateral Providers (CP) play a crucial role in ensuring system liquidity by supplying the required RWAs.

Products of Usual

1. USD0

USD0 is a stablecoin pegged 1:1 to real-world assets, specifically U.S. Treasury Bills (T-Bills), via overnight repo contracts. This structure ensures exceptional stability and mitigates risks compared to other stablecoins like Tether (USDT) or USDC, which rely on traditional banking systems with inherent insolvency risks.

USD0 addresses stablecoin market limitations through:

- Security: Backed by carefully selected collateral assets with robust risk management to ensure user value.

- Transparency: Real-time disclosure of collateral assets, eliminating risks associated with fractional reserves in commercial banks.

- Efficiency: Connecting liquidity from real-world assets (RWA) to DeFi, enabling RWA market access and growth.

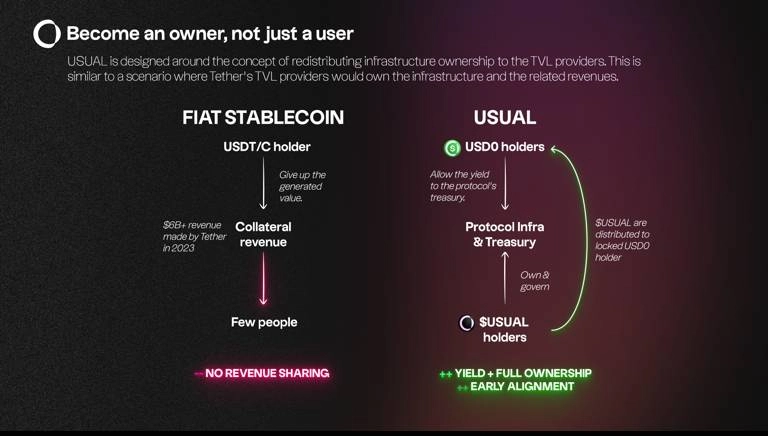

- Fairness: Redistributing profits from USD0 fairly among the community rather than concentrating them among a few large shareholders.

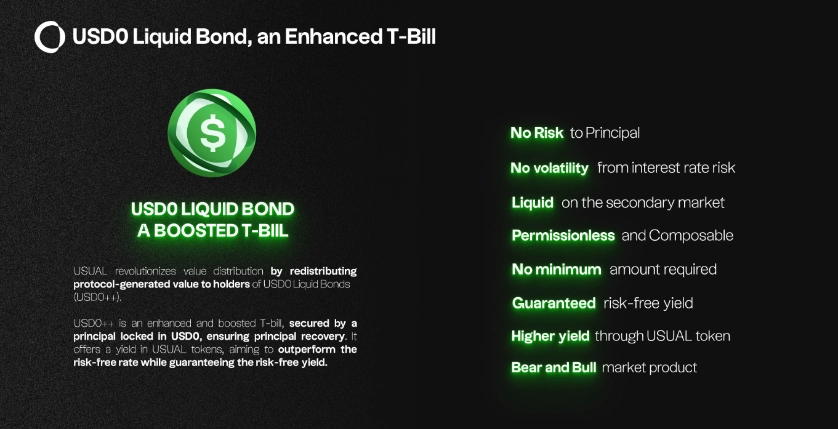

2. USD0++

USD0++ is a Liquid Bond Token (LBT) representing USD0 locked for four years, offering financial benefits to its holders through:

- Alpha Yield (α-yield): Daily distribution of USUAL tokens, reflecting the protocol’s growth.

- Baseline Interest Guarantee (BIG): Providing minimum returns based on collateral interest rates, paid in USD0 every six months.

- Liquidity: USD0++ is tradable on secondary markets, offering flexible liquidity.

- Protocol Ownership: Holding USD0++ grants participation in governance and ecosystem growth benefits.

3. USUAL

USUAL is the utility and governance token of Usual, playing several critical roles within the ecosystem:

- Governance: Enables holders to participate in protocol management and make strategic financial decisions.

- Deflationary issuance: The amount of USUAL tokens issued depends on the TVL of USD0++ in the system, controlling supply and increasing value as the ecosystem expands.

- Revenue model: Token issuance is tied to future cash flow, ensuring inflation remains lower than revenue growth and reserve funds.

- Staking rewards: Staking USUAL activates governance rights and earns holders 10% of newly issued USUAL tokens, encouraging long-term holding.

- Gauge mechanism: Optimizes and directs liquidity distribution within the protocol.

- Collateral management: Determines collateral types and weights in the system to ensure flexibility and stability.

- Reserve fund management: Grants governance over reserve funds to maximize returns and capital efficiency.

Team

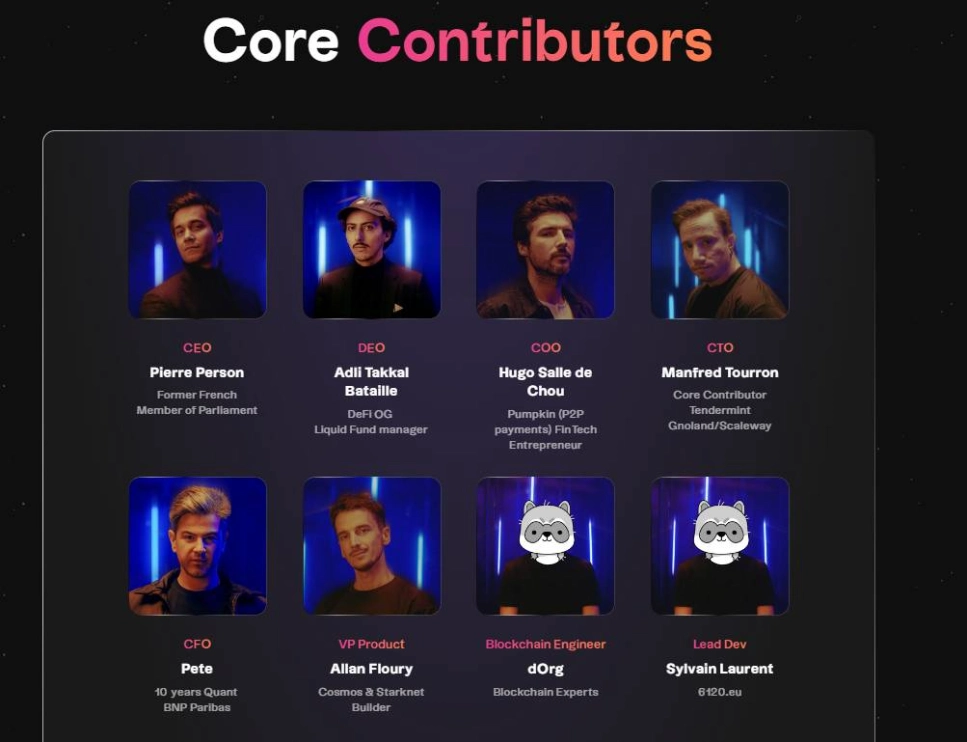

Usual is led by an experienced team of professionals in finance, technology, and policymaking, ensuring a strategic vision backed by deep expertise:

- Pierre Person (CEO): Former member of the French Parliament, bringing policy insights and high-level management experience.

- Adli Takkal Bataille (DEO): Manager of DeFi OG Liquid fund with extensive decentralized finance expertise.

- Hugo Sallé de Chou (COO): FinTech entrepreneur and co-founder of Pumpkin, a peer-to-peer payment platform.

- Manfred Tourron (CTO): Core contributor to Tendermint, Gnoland, and Scaleway, and a leading blockchain technology expert.

- Pete (CFO): A quantitative finance expert with 10 years of experience at BNP Paribas.

- Allan Floury (VP Product): Leading developer in the Cosmos and StarkNet ecosystems, driving strategic product development.

Investors and Partners

Investors

- April 17, 2024: Successfully raised $7 million in a Strategic round led by IOSG Ventures and Kraken Ventures.

- November 6, 2024: Secured an additional $1.5 million through a community fundraising initiative, receiving strong support from users.

Partners

- Bail Security: Ensures the safety and security of collateralized assets.

- Balancer and Curve Finance: Integrates liquidity and develops decentralized financial strategies.

Similar Projects

USUAL provides Ethereum-based stablecoins, comparable to projects like Ethena (ENA) offering USDe.

Overview of USUAL Token

Basic Information about USUAL Token

- Token Name: Usual

- Token Symbol: USUAL

- Blockchain: Ethereum

- Smart Contract Address: 0xC4441c2BE5d8fA8126822B9929CA0b81Ea0DE38E

- Listing Date: November 19, 2024 (Pre-Market on Binance)

- Total Supply: 4,000,000,000

- Max Supply: 4,000,000,000

- Circulating Supply: 494,600,000 (12.37% of the total supply)

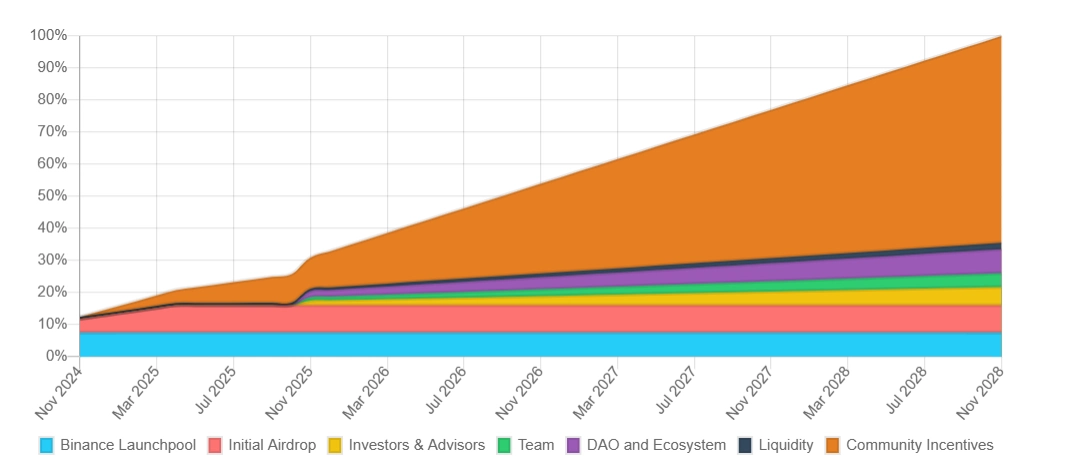

Token Allocation

The allocation of USUAL Token is designed to ensure long-term development and incentivize community participation:

- Binance Launchpool: 7.50%

- Initial Airdrop: 8.50%

- Investors & Advisors: 5.68%

- Team: 4.32%

- DAO & Ecosystem: 7.50%

- Liquidity: 2.00%

- Community Incentives: 64.50%

Token Release Schedule

A total of 494,600,000 tokens (12.37% of the total supply) will be released at launch, distributed as follows:

- Launchpool: 7.5%

- Airdrop: 4.25%

- Liquidity: 0.6%

- DAO: 0.02%

The full supply of USUAL tokens is expected to unlock within four years.

Where to Buy USUAL Token

Investors can trade USUAL Token on major exchanges, including Binance and Gate.io.

Potential of the Usual Project

Strengths of Usual

- Innovative Products and Groundbreaking Solutions:

- USD0: Backed by real-world assets (RWA), particularly U.S. Treasury Bills (T-Bills), providing greater stability and reduced risk compared to traditional stablecoins.

- USD0++: Creates earning opportunities by locking USD0 and encourages user engagement in the ecosystem through governance rights.

- Diverse and Sustainable Ecosystem:

- Combining real-world assets with DeFi to develop the RWA market, unlocking long-term growth potential in decentralized finance.

- Value distribution within the protocol benefits the community, attracting new users.

- Strong and Reputable Team:

- Key members like Pierre Person (former member of the French Parliament) and Pete (Quant at BNP Paribas) bring a combination of expertise in technology, finance, and governance.

- Support from Strategic Investors and Partners:

- Backed by major funds like IOSG Ventures, Kraken Ventures, and partners such as Balancer and Curve Finance, laying a solid foundation for long-term growth.

- Transparency and High Security:

- Real-time disclosure of collateral assets and commitment to eliminating fractional reserve risks, strengthening trust within the community.

Challenges and Risks

- Intense Competition:

- The stablecoin market is fiercely competitive, with major players like USDT, USDC, DAI, and other decentralized stablecoin projects such as Frax and Liquity.

- Usual needs to demonstrate its superiority in security, liquidity, and profitability to attract users.

- Regulatory Pressures:

- As a DeFi project, Usual may face scrutiny from global regulators, especially as stablecoin regulations tighten.

- RWA Market Risks:

- While real-world assets like U.S. Treasury Bills are generally safe, significant fluctuations (e.g., rapid interest rate hikes) could impact the value of collateral assets.

- Token Inflation Risks:

- With a four-year unlocking schedule, poor management of supply increases could result in selling pressure and reduce the value of USUAL tokens.

Growth Potential

- Emerging RWA Market:

- Usual is among the few protocols successfully tapping into the potential of RWAs, a market projected to reach $16 trillion by 2030.

- Bridging real-world assets with DeFi creates strong growth opportunities.

- Expanding DeFi Ecosystem:

- As more users adopt DeFi, the demand for safe, transparent, and decentralized stablecoins like USD0 is likely to increase significantly.

- Support from Binance and the Community:

- Listing on Binance and other major exchanges enhances liquidity and accessibility for investors.

- Community incentive policies (64.5% of total token supply) encourage participation and user loyalty.

Conclusion

Usual is a promising project thanks to its innovative products, strong team, and sustainable ecosystem. However, to achieve long-term success, Usual must effectively address challenges such as competition, regulatory risks, and token inflation management.

With a clear development strategy and robust investor support, Usual has the potential to become one of the leading stablecoin protocols, particularly in connecting real-world assets with DeFi. If successful, the project could deliver significant value to both users and investors.

This comprehensive guide introduces the key aspects of Usual. If you have any questions, feel free to leave a comment, and we’ll get back to you promptly!