Aptos vs Sui: Introduction

Both Aptos and Sui are new generation L1 blockchains. Built with the ultimate goal of creating a comprehensive, decentralized blockchain with high transaction speed and low latency. To bring a closer Web3 experience to regular users.

Aptos and Sui are two projects developed from Facebook’s Diem blockchain (called Meta today). After co-founder of Diem blockchain, David Marcus, left Facebook. This project was later cancelled. The team working on the Diem project then gradually separated to develop other projects. Among them, Aptos and Sui receive the most attention.

Both of these projects also use the Move programming language. A programming language researched and developed to serve Diem.

Aptos vs Sui: Technology

Programming language

Both Aptos and Sui use the Move programming language developed from the Diem project. Move is a programming language based on Solana’s Rust that focuses on memory safety. Capable of providing transparency for immutable values and preventing memory data leaks.

Move was developed by the Diem team between 2019 and 2020. At that time, NFTs had not yet become popular, and the programming language was not optimized for NFTs or GameFi genres. In late 2021 and early 2022, Sui continued to improve and expand, creating its own version of Sui Move.

This mechanism is called Object-centric model. Sui Move divides asset types into objects, of which there are 3 main types:

-

Owned object: Owned by a specific owner and can only be modified by that owner.

-

Shared object: Can be changed, does not have a specific owner. Can be included in the transactions of different parties without any permission.

-

Read-only object: Does not have an exclusive owner. Cannot be altered by anyone once published and can be used in transactions by all users.

Consensus mechanism

Both Aptos and Sui use the Proof of Stake consensus mechanism. With validators stake native tokens and operate the network. However, these two projects have differences in consensus algorithms.

Aptos uses BlockSTM technology and the Byzantine Fault Tolerance (BFT) consensus protocol.

Sui uses the Narwhal & Tusk consensus algorithm. Use DAG-based (directed acyclic graph) mempool to separate the data transmission process from the transaction consensus process and parallel transaction processing. The asynchronous protocol means it can withstand denial of service (DoS) attacks.

Parallel naming shows 2 different tasks:

Narwhal: Ensures availability of data when submitted leading to consensus.

Tusk: Determines the specific order of the data.

This is done in a layered 2-module model. Therefore, Narwhal can also be used with other external consensus algorithms such as HotStuff, BFT or Tendermint… Narwhal has also been used by other blockchains such as Celo, Sommelier.

In terms of technology, the community considers Sui to be slightly better due to its more optimized programming language and more secure consensus mechanism. Both projects scale in a way that processes transactions in parallel, maximizing network capacity.

Both projects are capable of performing 120,000 – 130,000 TPS under test conditions. However, to accurately evaluate it is necessary to wait until the stage of actual use.

Aptos vs Sui: Tokenomics

Aptos

Aptos has not yet officially announced the token, nor has there been information about the token and the ecosystem’s economic model. However, it is safe to assume that there will likely be APTOS tokens used as gas fees and to secure the network.

Related: What Is Aptos? Complete Information About APT Token

Sui

On the Sui side, information about the SUI token is revealed in more detail. Accordingly, SUI – the network’s native coin will have the following main uses:

-

Gas fees: all network activities on the platform require gas fees. Gas fees are rewarded to those who participate in the Proof of Stake mechanism. It can also be used to prevent spam and denial of service attacks.

-

Storage Fund: To compensate future validators for bearing the storage costs of on-chain data, Sui’s storage fund is used to distribute stake rewards to validators over time.

-

Proof-of-stake mechanism: Used to select, incentivize and reward platform operators, also known as validators and delegators.

-

On-chain voting: To vote on governance and protocol upgrades.

In addition, Sui also has a gas pricing mechanism to keep gas fees low and predictable.

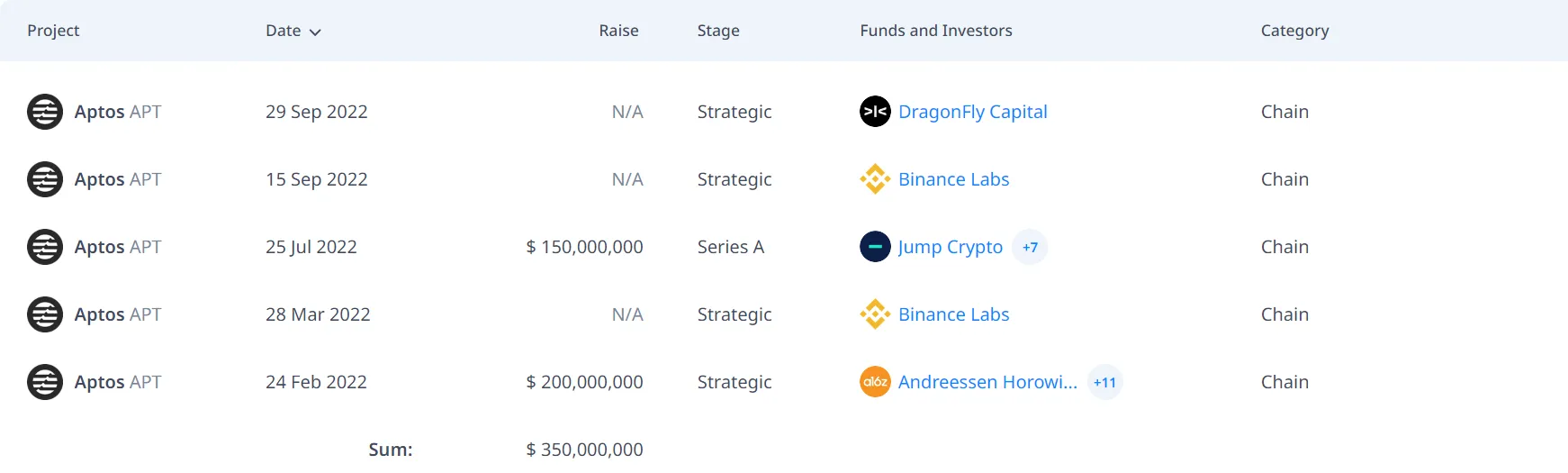

Aptos vs Sui: Fundraising

Aptos

Recently, Aptos has made a big splash when calling for capital from large investors right in a period of gloomy market. Up to now, Aptos has completed two rounds of funding, Seed Round and Series A, with a total amount of 350 million USD.

Seed Round:

-

Announcement date: March 15, 2022

-

Amount raised: 200 million USD

-

Main investor: Andreessen Horowitz (a16z)

-

Other investors: Multicoin Capital, Three Arrows Capital (still not collapsed at this time), Hashed, Tiger Global, FTX Ventures, Coinbase Ventures, Parafi Capital…

-

Valuation: More than 1 billion USD

Series A:

-

Announcement date: July 25, 2022

-

Amount raised: 150 million USD

-

Main investors: FTX Ventures and Jump Crypto

-

Other investors: Apollo, Griffin Gaming Partners, Franklin Templeton, Circle Ventures, Superscrypt, and continued support from a16z, Multicoin Capital…

-

Valuation: 2 billion USD

Strategy:

-

Announcement date: September 15, 2022

-

Amount raised: Not announced yet

-

Main investor: Binance Labs

-

Other investors: Dragonfly Capital

-

Valuation: 4 billion USD

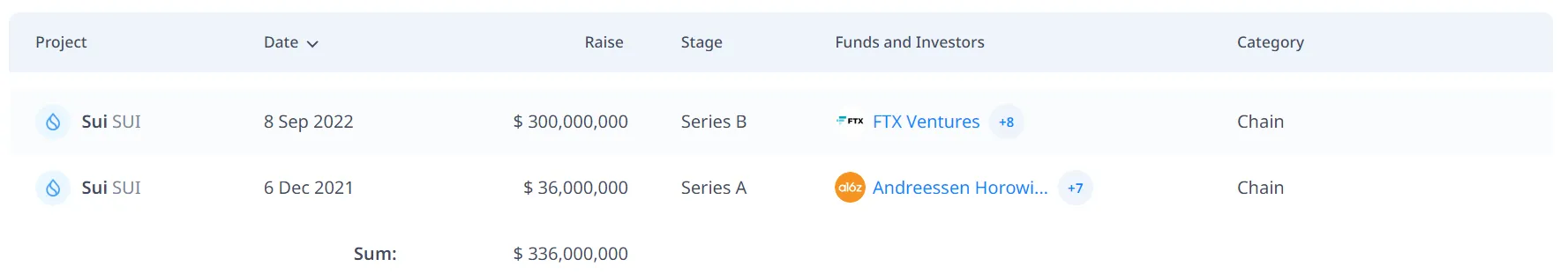

Sui

As for Sui, this project is also receiving the attention of many large investment funds in the market. Sui has completed a Series A funding round and is said to be working on a Series B funding round. Specifically:

Series A:

-

Announcement date: December 6, 2021

-

Amount raised: 36 million USD

-

Main investor: a16z

-

Other investors: NFX, Scribble Ventures, Redpoint, Lightspeed Venture Partners, Electric Capital, Samsung NEXT, Slow Ventures, Standard Crypto, Coinbase Ventures…

Series B:

-

Announcement date: December 8, 2023

-

Amount raised: 300 million USD (estimated)

-

Investor (known): FTX Ventures with at least 140 million USD

-

In this funding round, Mysten Labs is said to be raising capital at a valuation of 2-3 billion USD. A total of 336 million USD is expected to be raised.

→ Both projects have the biggest backers on the market, showing the potential of the two projects. Aptos is somewhat more prominent in terms of capital raised as well as valuation when valued at up to 4 billion USD.

This also means that Aptos Labs has stronger financial potential than Mysten Labs, this money will be used to develop the ecosystem in the future. However, retail investors will have to pay more attention to this valuation.

Summary

In general, aptos and sui both attract the attention of the community due to bringing new technological features and having a significant amount of capital raised. However, determining which project has greater potential at this stage is difficult because it is still too early. At the present time, it can be seen that Aptos has a slight advantage over Sui because it was formed and developed first, at the same time has support from the community and has strong finances after successful capital calls. labour.