What is SatoshiVM?

SatoshiVM (Satoshi Virtual Machine) is a Layer 2 (L2) scaling solution for Bitcoin that is compatible with the Ethereum Virtual Machine (EVM). It utilizes Zk Rollup technology to address scalability and transaction speed issues, enabling faster transactions with lower costs.

On March 15th, the SatoshiVM Alpha Mainnet was publicly launched, introducing a full suite of new features including:

- SAVM staking

- Token bridging

- Coin deployment in under 30 seconds

- Airdrops for SAVM stakers

- Low-fee BRC20 token transactions

Despite facing numerous criticisms and challenges, the project remains steadfast in its commitment to innovation, progress, enhancing user experience, and expanding the ecosystem’s capabilities.

In January, several users accused SAVM of being a scam after a wallet associated with the project sold 420,000 SAVM tokens, worth approximately $4.7 million at that time. The community suspected that the transaction was executed by the development team itself. Prior to this, multiple accounts on X had also accused SAVM of scamming and warned the community to be cautious when investing.

Related: What is Bitcoin Layer 2? The Top 5 Most Notable Bitcoin Layer2 Projects Right Now

Network Structure

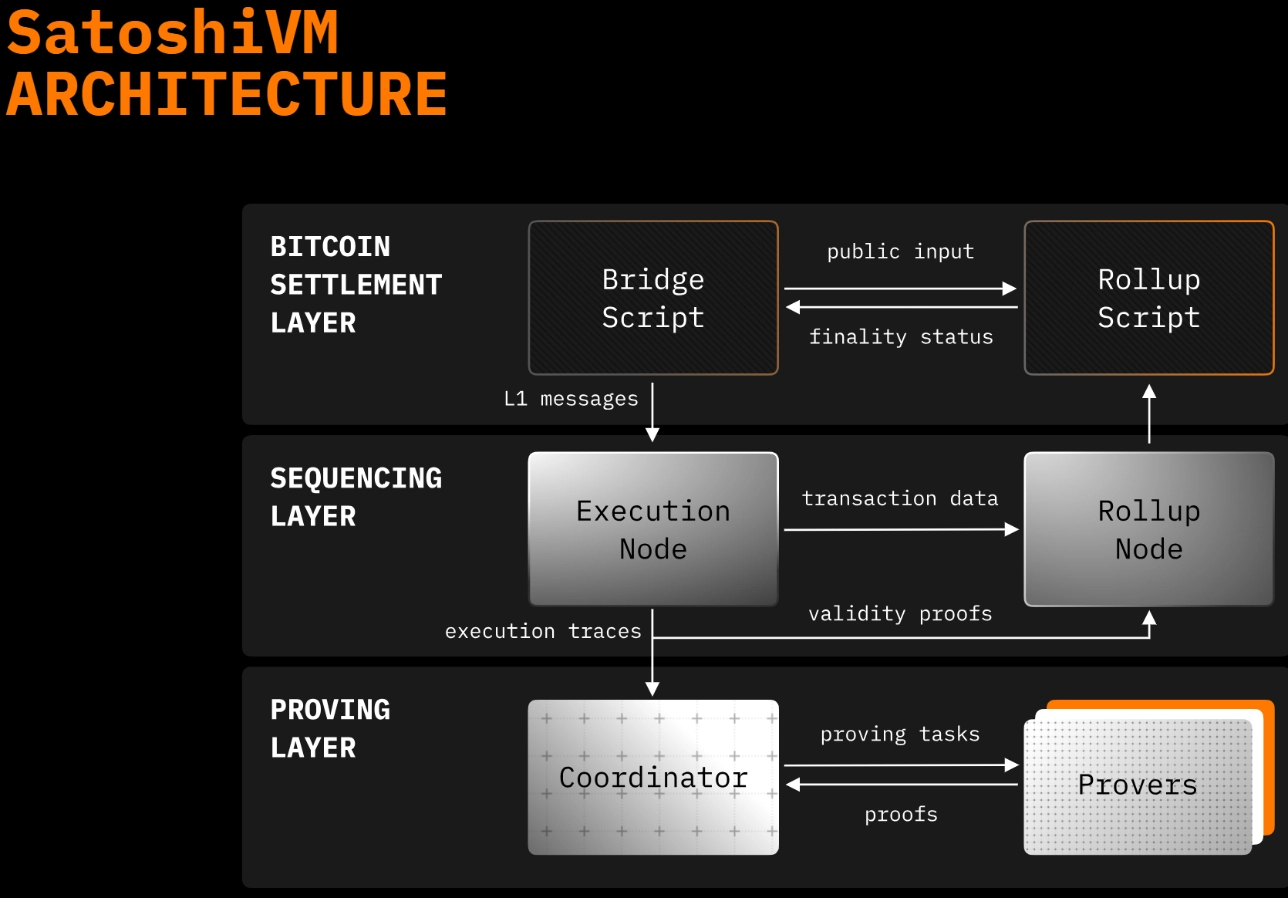

SatoshiVM is structured into three layers: Bitcoin Settlement Layer, Sequencing Layer, and Proving Layer. The specific functions of each layer are as follows:

- Settlement Layer: Provides data availability, sequencing, and proof verification for the SatoshiVM chain. It allows users and applications to broadcast messages and assets between Bitcoin and SatoshiVM. Bitcoin acts as the settlement layer, with bridges and rollup scripts deployed on the Bitcoin network.

- Sequencing Layer: Comprises an execution node responsible for processing transactions submitted to the SatoshiVM queue and transactions sent to L1 bridge scripts, creating L2 blocks. It also includes a Rollup node that processes transactions batched into bundles, publishes transaction data and block information to Bitcoin for data availability, and sends validity proofs to Bitcoin for final verification.

- Proving Layer: Consists of a coordinator that assigns proof tasks to proving programs and transmits the generated proofs to the Rollup node for final verification on Bitcoin. It also includes a pool of provers responsible for generating valid proofs to verify the correctness of L2 transactions.

Operational Mechanism

Similar to other Rollup solutions, SatoshiVM executes numerous transactions on Layer 2, packages them, and then sends them to the base layer for verification. Transactions on Layer 2 are sent to a private mempool to avoid MEV Bot attacks. Each Layer 2 block is created every 3-60 seconds, regardless of whether there are transactions.

Initially, the SatoshiVM Foundation was the sole entity capable of creating blocks on the network, but this will later transition to a decentralized model. Using Bitcoin as the verification layer for Layer 2 transactions is complex because Bitcoin’s network does not support smart contracts.

Development Team

Updating

Investors

Updating

What is SAVM Token?

- Token Name: SatoshiVM

- Token Symbol: SAVM

- Blockchain: Bitcoin

- Smart Contract:

1ebca700d02609c7454c827d7fd0a0d988d7b62c3600f72c1bec54768980381ci0 - Total Supply: 21,000,000 SAVM

- Max Supply: 21,000,000 SAVM

- Circulating Supply: 7,000,000 SAVM

SAVM Token Allocation

- Ecosystem: 36.5%

- Liquidity: 30%

- Contributors: 15%

- Bootstrapping and Advisors: 15%

- Bounce Finance IDO: 2%

- APE Terminal IDO: 1%

- $MUBI Farming Pool: 0.4%

- $BSSB Farming Pool: 0.1%

SAVM Token Release Schedule

- Ecosystem: Linear vesting, unlocking 5% of the total each month.

- Liquidity: 20% unlocked at TGE (Token Generation Event), allocated to Uniswap liquidity. The rest will be announced later.

- Contributors: 6-month cliff followed by a 2-year vesting schedule.

- Bootstrapping and Advisors:

- Bootstrapping partners: 50% initially unlocked, 3-month cliff, then 4% per month for a total of 15 months vesting.

- Advisors: 3-month cliff followed by a 2-year vesting schedule.

- Bounce Finance IDO: 100% at TGE.

- APE Terminal IDO: 100% at TGE.

- $MUBI Farming Protocol: To be confirmed (TBC).

- $BSSB Farming Protocol: To be confirmed (TBC).

Use Cases for SAVM Token

- Governance and voting

- Staking and rewards

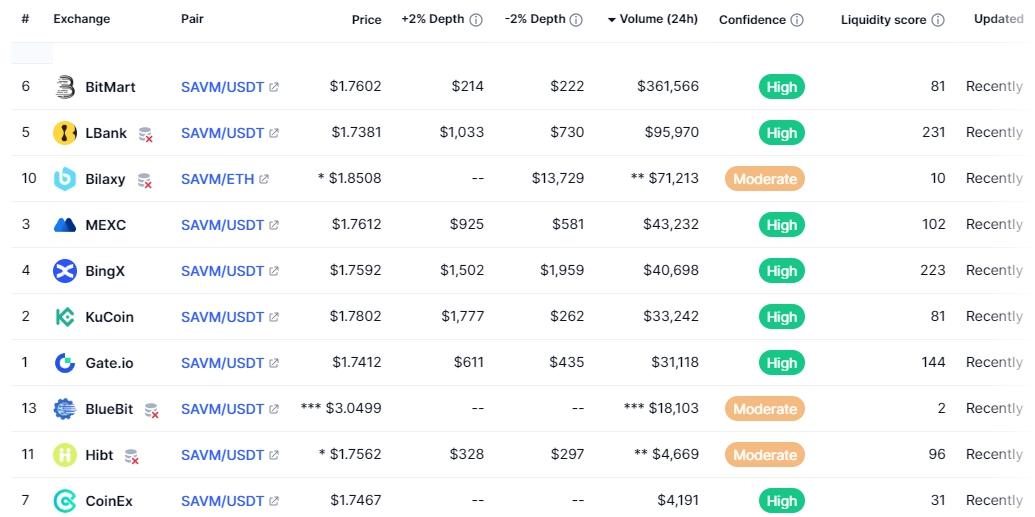

Where to Trade SAVM Tokens?

SAVM tokens are currently available on major exchanges such as Bitmart, MEXC, BingX, etc.

Roadmap

Q3 2024

- Develop the Rollup module to publish SatoshiVM’s states to the Data Availability layer.

- Implement Rollup contracts for verifying the legitimacy of transaction proofs and states.

- Advance the SatoshiVM Prover System (Phase 2).

- Begin circuit conversion for the verification module (Phase 1).

- Release non-interactive verification for prover and verifier on Bitcoin, excluding circuit conversions.

- Introduce the Anti-Transaction Reordering module based on SVMZK.

Q4 2024

- Start integrating ZK Rollup modules for SatoshiVM.

- Begin developing circuit conversion for the verification module (Phase 2).

Q1 2025 and Beyond

- Conduct system integration testing.

- Empirical verification of the security model.

- Optimize system performance.

Similar Projects

SatoshiVM is a Layer 2 solution on Bitcoin similar to Merlinchain and Stacks.

Project Information Channels

- Website: https://www.satoshivm.io/

- Twitter: https://x.com/SatoshiVM

- Discord: :https://discord.com/invite/satoshivm

Conclusion

SatoshiVM is a Layer 2 Bitcoin ZK Rollup solution that bridges the Bitcoin ecosystem with Ethereum, offering asset issuance and application development capabilities. With features such as ZK EVM, ZK Rollup, ZK Fraud Proofs, data availability, and BTC Native Gas, SatoshiVM creates a secure, flexible environment that maximizes the potential of both the Bitcoin and Ethereum networks.

Through this article, we have introduced you to SatoshiVM and the SAVM Token. If you have any questions, please leave them in the comments section to get your queries answered promptly!

When will satoshiVM airdrop start?

We will update when it start