What is Sanctum?

Sanctum is a DeFi project focused on Liquid Staking, built on the Solana blockchain. Sanctum allows users to provide liquidity for SOL with LST (Liquid Staking Tokens), earning rewards while also providing liquidity for the trading pairs and participating in network security.

Sanctum addresses two main issues in Liquid Staking Derivatives:

- Liquid Staking platforms create their own xSOL, causing liquidity fragmentation due to the limited SOL.

- The number of Validators on Solana increases, reducing the supply of SOL and the depth of the xSOL-SOL pools.

Sanctum’s solution is to build a protocol that allows users to quickly convert xSOL back to SOL without trading on AMM. This increases the liquidity of xSOL and supports sustainable DeFi on Solana. When liquidating LSTs, they can be instantly converted back to SOL, minimizing the impact on the ecosystem.

Sanctum creates a Sanctum SOL Reserve Pool to convert xSOL back to SOL instantly and allows conversion between different xSOL tokens. The transaction fees range from 0.01% to 3%, depending on the ratio of SOL withdrawn from the Reserve Pool, and 0.01% when trading LSTs with each other.

What are the products of Sanctum?

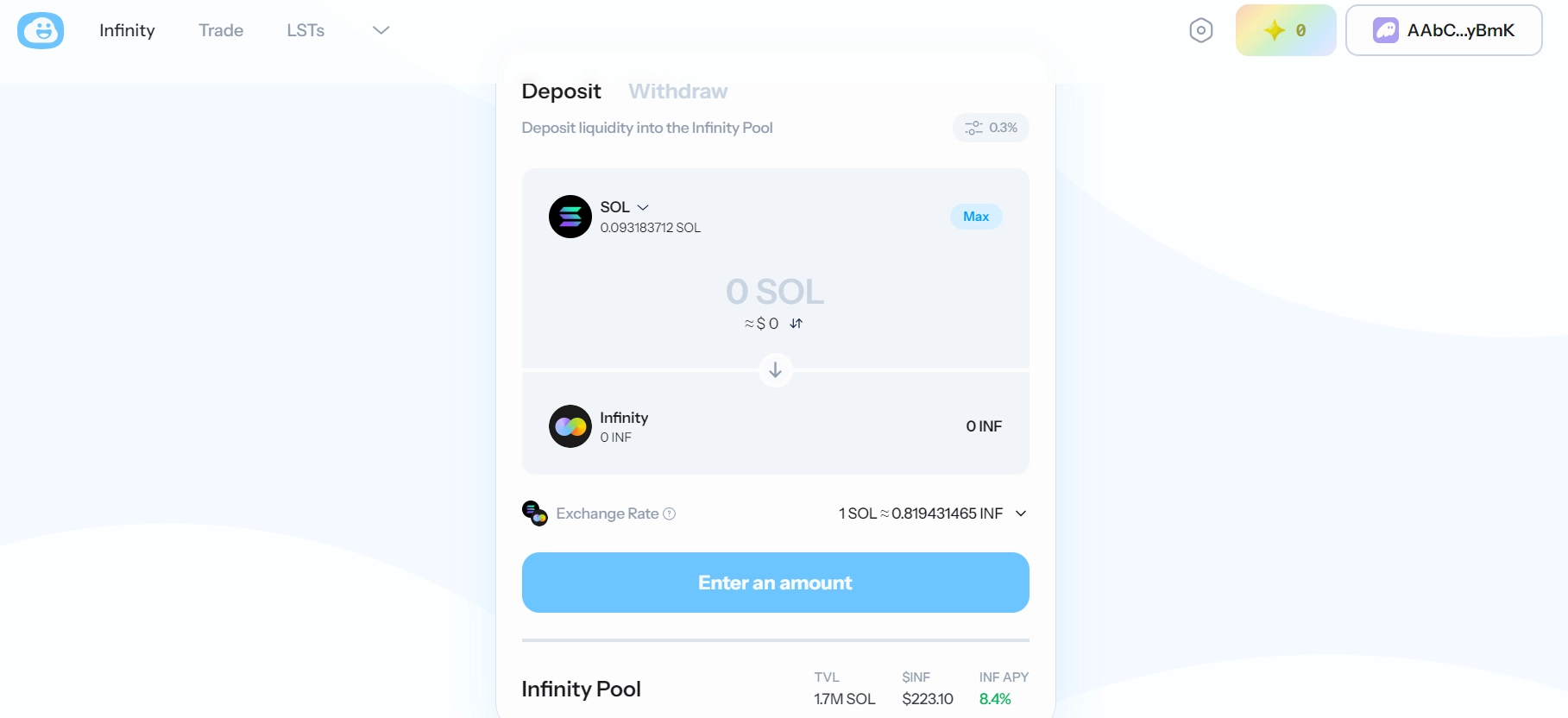

Infinity

Infinity is a multi-LST liquidity pool (LP) that supports almost all existing Liquid Staked Tokens (LSTs), such as bonkSOL, bSOL, cgntSOL, JitoSOL, mSOL, and many others.

Unlike other LPs that only support 2 to 4 assets, Infinity can support millions of different LSTs. LSTs can be converted into stake accounts and valued based on the amount of SOL in those accounts, allowing any pair of LSTs to be converted without a third party.

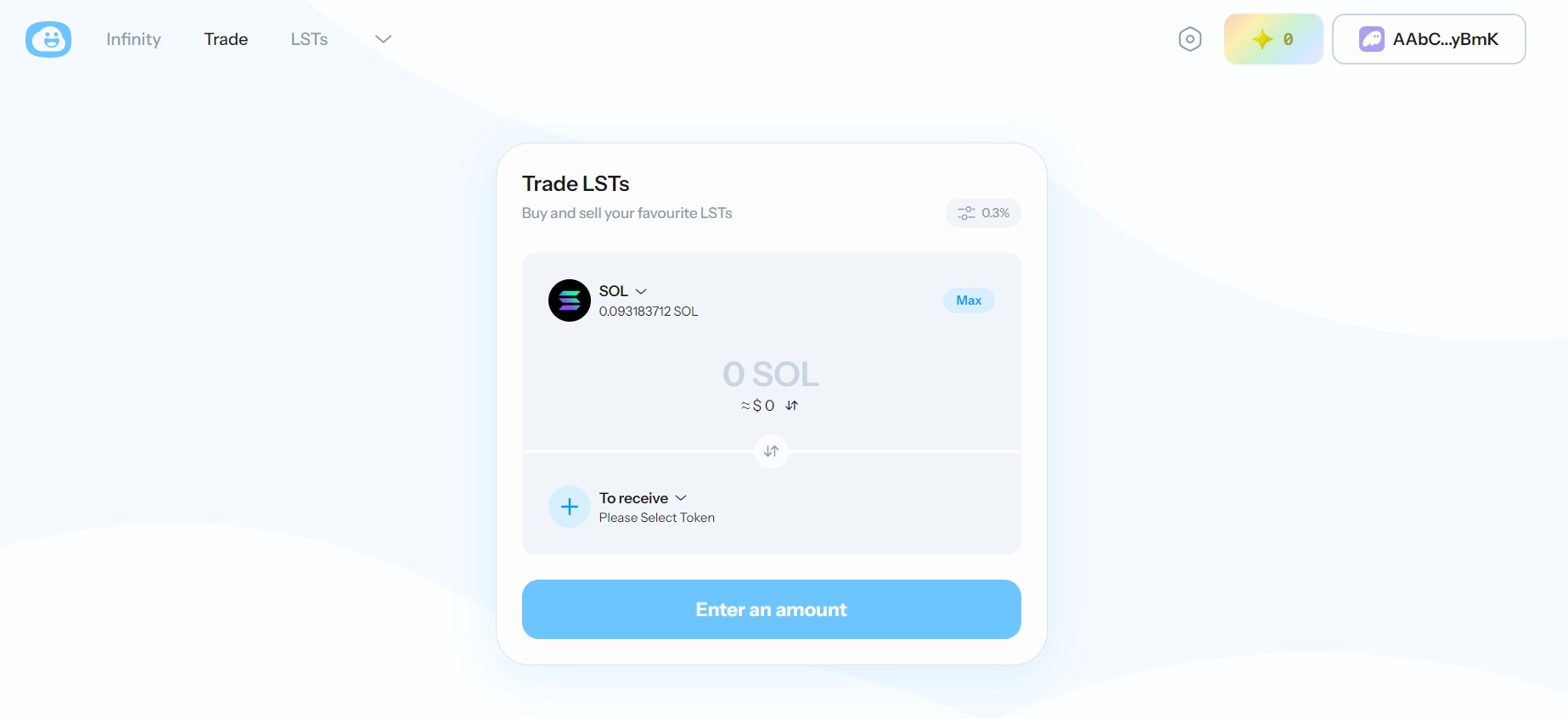

Trade

Sanctum enables users to buy and sell LSTs using SOL or other LSTs. When users buy LSTs with SOL, they are effectively staking those LSTs and earning additional rewards.

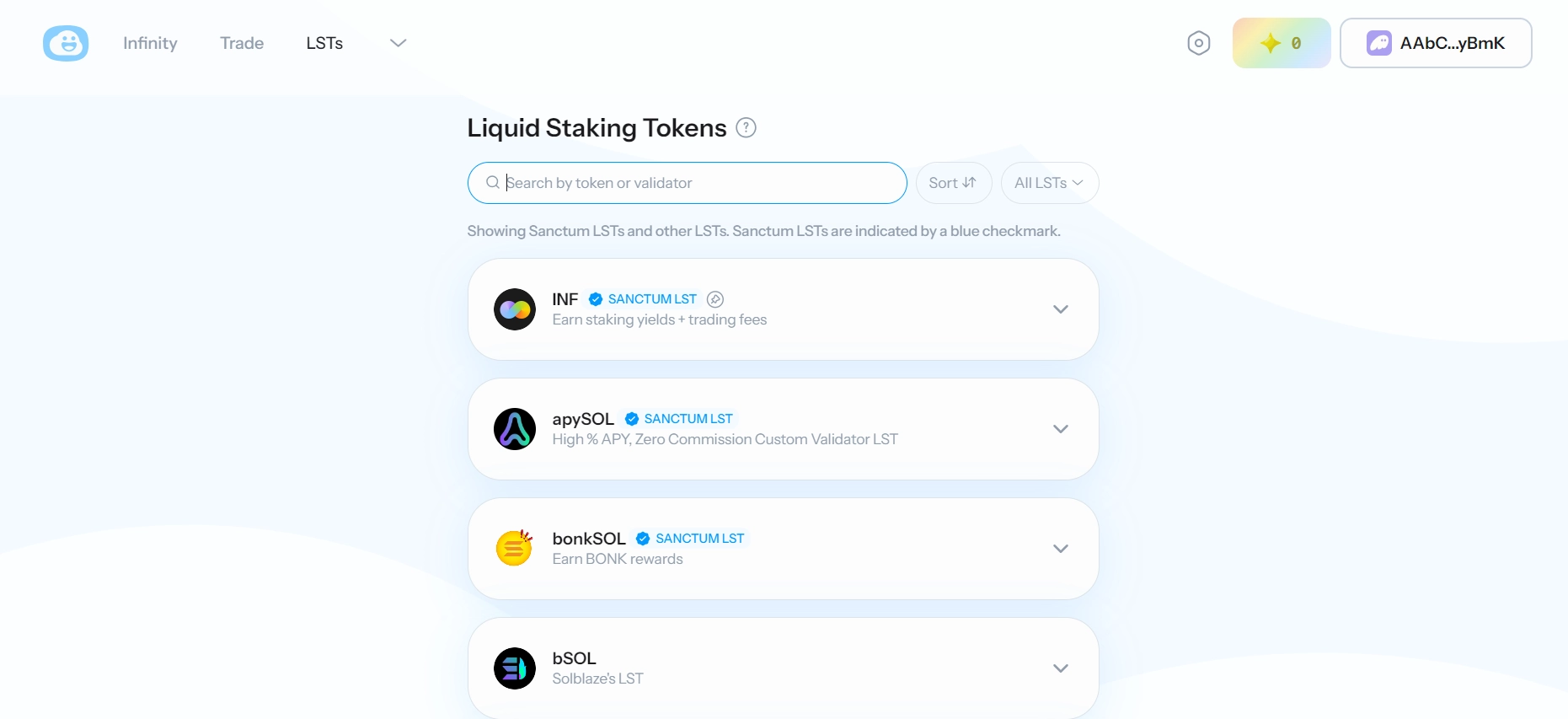

Validator LST

Validator LST is a token representing the amount of money users have staked with a specific validator, growing based on the project’s APY. When staking SOL, a stake account is created and delegated to the validator. When unstaking, this account is deactivated after a predetermined period (epoch).

Stake Account

When users stake SOL with a chosen validator (e.g., picoSOL), a Stake Account is created. The Stake Account can be understood as a locked SOL account of the user, and the validator cannot access their SOL.

Wonderland

After staking, users will own a Pet (at least 0.1 LST equivalent). Users can raise this Pet to gain experience for rewards and participate in voting.

Team

The Sanctum team are pioneers on Solana, having started building the liquid staking system since February 2021. They helped Solana Labs develop the SPL stake pool program, which most LSTs use today. Sanctum also launched the first SPL stake pool, called Socean. Over the years, they have continuously improved the liquid staking system. A significant contribution is unstake.it (now Sanctum Reserve), providing instant unstake liquidity for all LSTs on Solana. Currently, they are developing Sanctum, a system to unify liquidity for all LSTs and usher in a new era for liquid staking on Solana.

The Sanctum team consists of 7 members and is actively expanding.

Key members:

- FP (Founder): Twitter

- HY (Founder): Twitter

- 0xf812 (Founder): Twitter

- J (Founder): Twitter

- Patron (Engineer): Twitter

- CW (Product & Design): Twitter

- Alkine (BD): Twitter

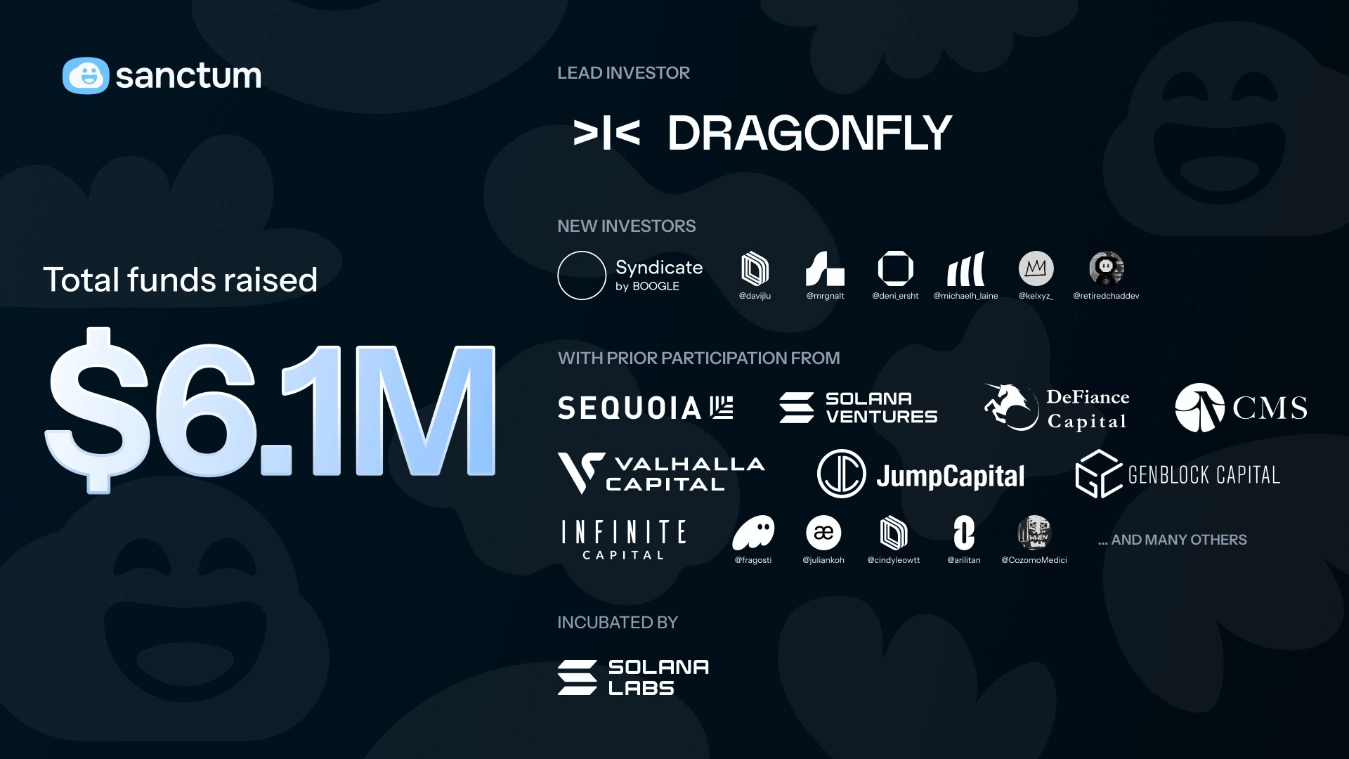

Investors

On March 3, 2024, Sanctum successfully raised $6.1 million, led by Dragonfly Capital, with participation from Solana Ventures, CMS Holdings, DeFiance Capital, Genblock Capital, Jump Capital, and Marin Digital Ventures.

What is the CLOUD Token?

After understanding what Sanctum is, let’s explore the project’s token – CLOUD.

Basic information about CLOUD Token

- Token Name: Sanctum

- Token Symbol: CLOUD

- Blockchain: Solana

- Smart Contract: CLoUDKc4Ane7HeQcPpE3YHnznRxhMimJ4MyaUqyHFzAu

- Total Supply: 1,000,000,000

- Circulating Supply: 180,000,000

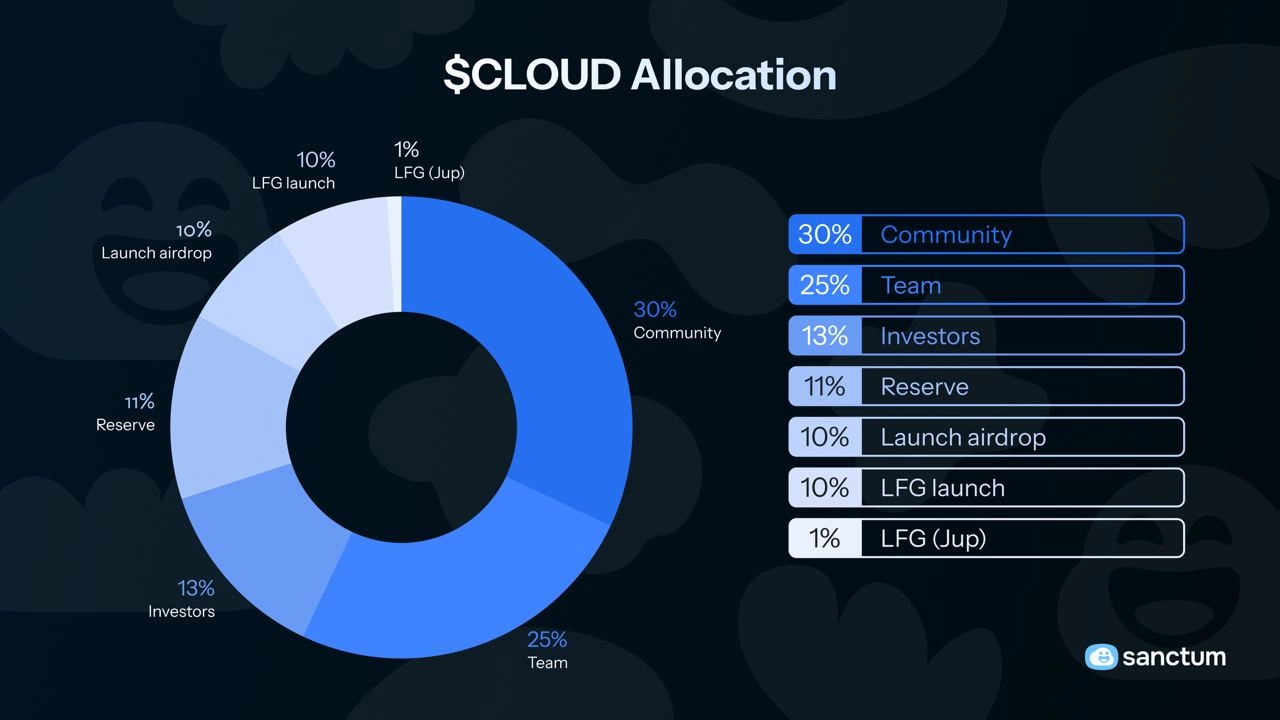

CLOUD Token Allocation

- Launch Liquidity (20%): 20% of the total supply will be unlocked at launch. 10% will be released in the initial airdrop, and 10% will be used to provide liquidity in the LFG launch pool. The proceeds and any unsold tokens will go to the Strategic Reserve.

- Community Reserve (30%): 30% of the total supply will be governed by the community. The community reserve will be used strategically to grow the pie (via future airdrops, active staking rewards, grants, etc.), although the community decides its ultimate use.

- Strategic Reserve (11%): 11% of the total supply is allocated to the Strategic Reserve, which the team will use to grow the Sanctum ecosystem. This fund is earmarked for future acquisitions, strategic investors, LST partners, grant recipients, loans to market makers, on-chain liquidity, and more.

- Team (25%): 25% of the total supply is allocated to the founders and core contributors, who have been building Sanctum for more than three years.

- Investors (13%): 13% of the total supply has been sold to investors. Most tokens were sold back in 2021.

- Jup LFG (1%): 1% will be given to Jupiter LFG.

CLOUD Token Release Schedule

All team and investor tokens will unlock over 3 years with a 1-year cliff. This means that 33% of the tokens will unlock 1 year after TGE, while the remaining 66% will vest linearly over 24 months after the cliff. All team and investor tokens will be fully vested 36 months after TGE.

What is CLOUD Token used for?

CLOUD is used for governance (validator voting on SIMDs) and rewards.

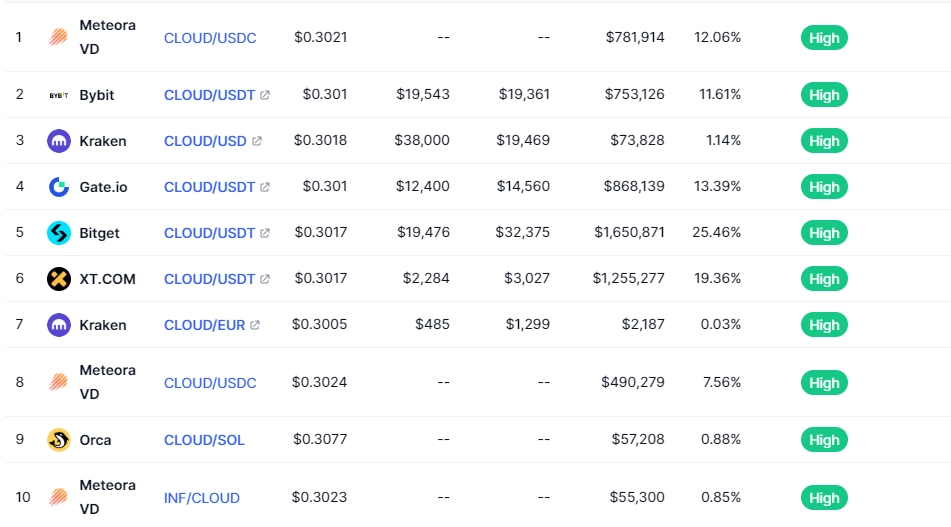

Where to trade CLOUD Token?

Currently, CLOUD Token is traded on major exchanges such as Bybit and Bitget.

Open Bybit Account Receive USDT Here!!!

Roadmap

Updating

Similar Projects

Sanctum is a Liquid Staking project similar to Lido, Socean, etc.

Project Information Channels

- https://www.sanctum.so/

- https://x.com/sanctumso

Conclusion

Through this article, AZC.News has introduced readers to information about Sanctum and the CLOUD Token. If you have any questions, please leave them in the comments section for immediate answers!

How can I buy this cloud token from bybit

How do we participate in on going project you talk about like airdrop? Do provide links