Background on the Bitcoin Ecosystem and the Emergence of Runes Protocol

When the Bitcoin Halving L4 event occurred, it became a powerful catalyst within the Bitcoin Ecosystem and the explosion of the Proof-of-Work (PoW) system in Q2/2024.

Previously, Bitcoin (BTC) was the sole known token on the Bitcoin network, with a simple programming language that did not allow for the issuance of other types of tokens. However, with the emergence of Ordinals, the door for the development of alternative token types was opened, leading to the birth of many new protocols in 2023, including BRC-20, ARC-20, ORC-20, ORC-CASH, SRC-20, along with older solutions such as RGB, Counterparty, Omni Layer, and Taproot Assets.

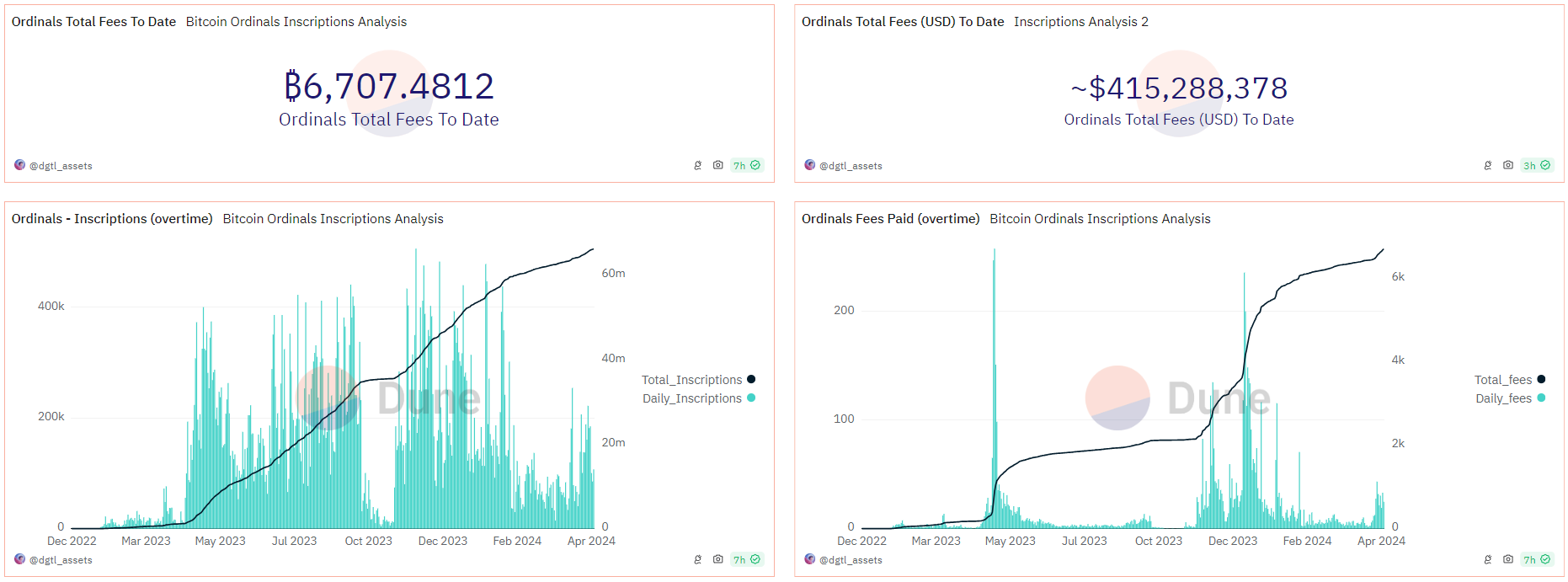

Data from Dune shows that the demand for activity on Ordinals is increasing and showing signs of a resurgence based on the drastic change in Daily Inscriptions during the last week of March 2024.

Developers within the Bitcoin ecosystem agree that transitioning to a Rollup solution is the most optimal choice compared to the current Unspent Transaction Output (UTXO) mechanism on the Bitcoin network, which is causing excessive bloat from the BRC-20 trend.

BRC-20 operates based on the Ordinals protocol, where each transaction creates new UTXOs to record its balances. As the number of BRC-20 tokens and transactions increases, the number of UTXOs also increases, leading to spam on the Bitcoin network. Furthermore, BRC-20 token data is stored in the Witness Data instead of in UTXOs, causing expensive network costs when participating in rewards on the Bitcoin network.

Recognizing these limitations, the founder of Ordinals sought to address them by developing an entirely new protocol for alternative tokens, aiming to optimize fragmentation within the system, leading to the birth of the Runes Protocol.

What is Runes Protocol?

Runes Protocol is a new protocol developed by Casey Rodarmor – the renowned founder of the Ordinals protocol, for issuing fungible tokens on the Bitcoin network.

Introduced in September 2023, Runes is currently in the testing phase and is expected to launch its mainnet during the Bitcoin Halving event at block 840,000 in the upcoming April 2024.

The most significant difference between Runes Protocol and other fungible token issuance protocols lies in its use of the UTXO (Unspent Transaction Output) model, which we will explore in detail regarding its operational mechanism.

The adoption of the UTXO model allows Runes Protocol to address the fragmentation and congestion issues on the Bitcoin network caused by the BRC-20 token development trend. This optimizes system performance and scalability while reducing transaction costs for users.

With its groundbreaking vision and ability to resolve the limitations of previous protocols, Runes Protocol is expected to become the new standard for token issuance on the Bitcoin network, marking an important step forward in the development of the cryptocurrency ecosystem.

How Does Runes Work?

The purpose of the Runes Protocol is to create and monitor fungible tokens on the Bitcoin network more easily. Fungible tokens mean that they can be interchanged with each other, similar to paper bills of the same denomination in your wallet.

Similar to BRC-20, Runes will use Bitcoin and pay fees in Bitcoin to create new tokens. However, the main difference between Runes and BRC-20 is that Runes, like Bitcoin, uses the UTXO (Unspent Transaction Output) model – in contrast to the account model used by some Layer 1 blockchains like Ethereum.

The UTXO model represents the amount of cryptocurrency that a person has available to spend. This model is crucial for tracking ownership and decentralized transactions on the Bitcoin network, ensuring transparency and security within the system.

Many in the Bitcoin community believe that the UTXO model is superior, and one of the reasons Ethereum has faced scalability issues is due to its use of the account model. Casey Rodarmor, the founder of the Runes Protocol, also believes that the UTXO model is superior because while other token standards tend to rely on off-chain data, Runes resides entirely on Bitcoin’s on-chain ledger.

With Runes, the issuer will create tokens and set a limit on the number of tokens that one person can issue in a single transaction. This way, both the token creator and the future community of buyers have an equal opportunity to access and purchase the tokens simultaneously, ensuring fairness and transparency in the distribution process.

Related: What is Merlin Chain? Information about MERL Token?

How Does Runes Differ from Other Token Standards on the Bitcoin Network?

Runes vs BRC-20

- Runes: Uses a UTXO-based model, helping to minimize fragmentation and congestion due to “junk” UTXOs, while making the tokenization process simpler and more efficient.

- BRC-20: More complex in nature, requiring the issuance of an NFT before creating tokens, leading to network congestion due to the creation of unnecessary “junk” UTXOs.

Runes vs ORC-20

- Runes: Provides a simpler and more efficient way to create fungible tokens, designed to be fully compatible with the Bitcoin ecosystem.

- ORC-20: Created to address the inefficiencies of BRC-20, hoping to resolve issues such as the 4-character token name limit and the lack of a reliable double-spending prevention system.

Runes vs Other Protocols (Taproot Assets, Counterparty)

- Runes: Does not require off-chain data or native tokens – while Counterparty does not rely on the UTXO model, which offers high security and transparency.

- Other Protocols: Often rely on complex technical frameworks or require additional elements like native tokens or off-chain data management, leading to complexity and difficulty in deployment and usage.

What are the Technical Features of Runes?

Runes Protocol brings many groundbreaking technical features, promising to improve the user experience and change the way assets are issued on the Bitcoin network.

- UTXO-based Structure: Runes originates from the UTXO (Unspent Transaction Output) model, which is the foundation of Bitcoin. This approach helps minimize fragmentation and congestion due to unnecessary “junk” UTXOs, thereby reducing the footprint on the chain and optimizing performance.

- Simplified Token Management: The key difference between Runes and other protocols is that it does not add additional data to each transaction (like Ordinals and Stamps) – which creates performance and chain scalability issues. This makes the process of issuing and managing tokens simpler and more efficient.

- User-Friendly Protocol Design: Runes’ structure is designed to be simple, potentially attracting a large developer base and driving innovation within the Bitcoin community. This could also help the Bitcoin network gain wider adoption by eliminating the need for native token processing or complex issues related to off-chain data.

- Flexible Balance Distribution and Movement: OP_RETURN transactions and the ability to push additional data allow for flexible movement of Runes balances. Invalid messages from protocols will lead to Runes tokens being burned, helping to protect the integrity of the protocol and facilitating future upgrades.

With these advanced technical features, Runes Protocol is expected to become the new standard for token issuance on the Bitcoin network, providing an optimal user experience and superior scalability compared to existing protocols.

Runes’ Impact on Bitcoin Scalability

Mitigating Blockchain Bloat

- The Runes protocol takes a UTXO (Unspent Transaction Output) approach to manage token balances, unlike the address-based BRC-20 standard. This helps mitigate blockchain bloat, optimizing storage space and operational efficiency.

Technical Approach

- Token Issuance: The initial transaction for creating a new token on Runes requires specifying the symbol, supply, and decimal places of the token. The supply is tied to a specific UTXO, and subsequent token transfers will split this UTXO into new UTXOs, optimizing storage space.

- Data Storage: Runes uses the OP_RETURN function to store data efficiently, while Ordinals utilizes the transaction witness, a part of the SegWit transaction that is not included when the transaction is hashed and signed.

Integration with Bitfinity EVM

- Expanding Smart Contracts: The combination of Runes and Bitfinity EVM, a Layer 2 technology for Bitcoin, can enhance the efficiency and scalability of smart contracts on the Bitcoin network.

- Benefits for Developers and Users: This integration provides a scalable, Ethereum-compatible environment for Solidity programming, while leveraging Bitcoin’s liquidity and security.

What Projects Are Being Built on Runes?

Rodarmor has planned to launch Runes at the Bitcoin halving event. This means that the Runes Protocol and the various “runes” tokens being built on the protocol will go live when Bitcoin reaches block 840,000, which is expected to occur in mid-April 2024. This event will mark a significant milestone for both Bitcoin and the Runes Protocol.

Projects Being Developed on the Runes Protocol:

RSIC (Rune Satoshian Inscription Collection)

- Consists of 21,000 Ordinals and plans to launch a token named RUNE.

- RSIC Ordinals have been airdropped to wallets holding certain Ordinal inscriptions, such as Ordinal Maxi Biz.

- The name RSIC is a play on the term ASIC, the Bitcoin mining equipment.

- Owners of RSIC Ordinals can use them to start “mining” the project’s token.

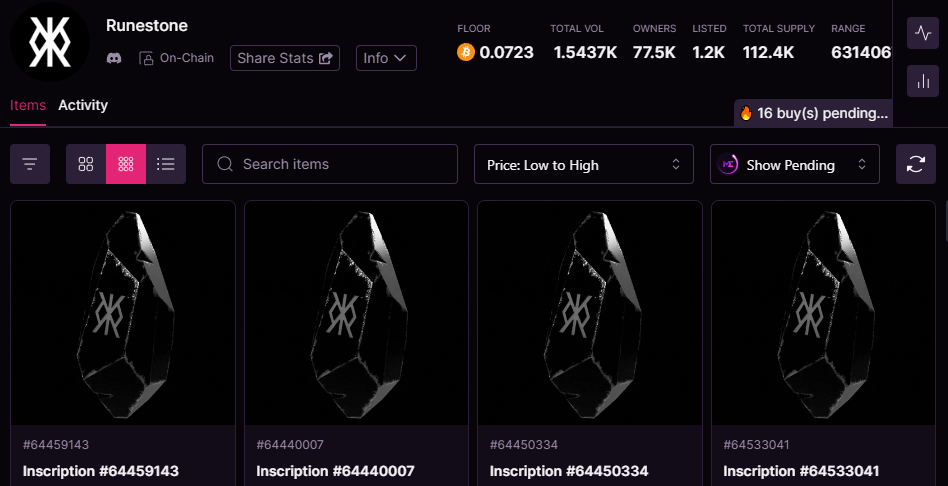

Runestone

- 112,383 Runestone Ordinals have been airdropped to the community.

- An Ordinals project created by an NFT and Ordinals veteran going by the pseudonym Leonidas.

- Each Runestone will be “converted” into a runes token once the protocol goes live.

Node Apes

- Combines profile picture (PFP) art inspired by NodeMonkes with a “Runic Miner” Ordinal.

- The Node Ape and Runic Miner Ordinal allow users to “mine” runes tokens by holding them in the same wallet.

Other Projects

- RuneX is building a decentralized exchange for Runes on Bitcoin and has its own Ordinals collection.

- The Xverse Bitcoin wallet has added testnet support for Runes, with plans to support this fungible token standard on mainnet.

- Many other projects are deploying plans with Runes in the Ordinals space.

It’s important to distinguish between Runes, as a protocol, and “runes” – the tokens being built on top of this protocol that anyone can create.

Conclusion

The emergence of the Runes protocol has opened up many new investment opportunities within the Bitcoin ecosystem. Among these, the most promising projects are expected to fall into two main categories: Infrastructure and Memecoins.

Infrastructure is the most crucial foundational element of any ecosystem, providing the necessary tools, services, and solutions for building and developing other applications. Meanwhile, Memecoins are the primary driving force behind community growth, creating virality and attracting the attention of a broad user base.

However, numerous projects are participating in the race for market share through Runes airdrop campaigns. Therefore, investors need to decide whether to participate in these airdrops and thoroughly research before selecting a project.

Regarding the prospects of Runes, many are optimistic about the potential of this new token standard to replace BRC-20 and become the next craze in the Bitcoin ecosystem. However, this will depend on the support and adoption from the community, as well as Runes’ ability to address the issues of BRC-20 and provide superior features.

After reading “What is Runes Protocol? The Protocol Creating Hype After the Halving Event,” do you understand Runes Protocol? If not, feel free to leave a comment below for further clarification!

💚💚💚 digital revolution it mean all to me in my life

Wow! Informative. I enjoyed the reading.