What is Restaking?

Since Ethereum transitioned from Proof-of-Work to Proof-of-Stake, the amount of staked ETH has surged, reflecting the strong confidence of the community and enhancing the decentralization and security of the Ethereum network.

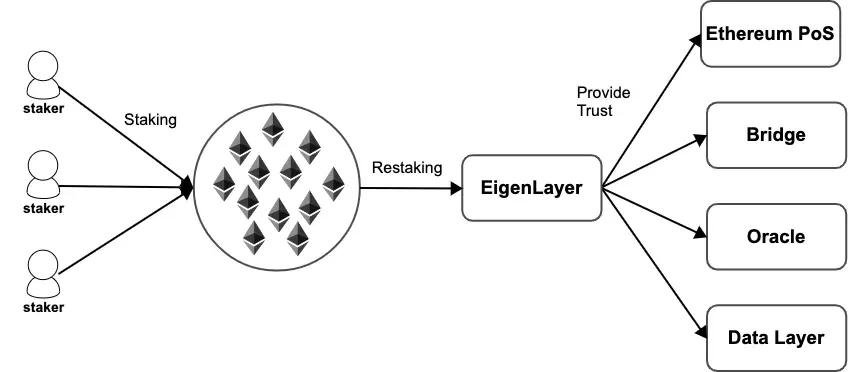

Recognizing this, EigenLayer introduced the concept of Restaking—a method that leverages Ethereum’s security strength to support smaller networks.

EigenLayer allows users to continue staking ETH or Liquid Staking Tokens (LST) to earn additional rewards. For example, users who have staked their ETH on Liquid Staking protocols like Lido can restake their stETH on EigenLayer. This enables Restakers to contribute to the security of smaller networks built on EigenLayer.

These smaller networks are called Actively Validated Services (AVSs). When users restake ETH, they protect AVSs and help these AVSs inherit Ethereum’s security. In return, Restakers receive rewards from the fees that AVSs must pay.

This model offers specific benefits:

- Capital Optimization: Stakers have a stronger incentive to stake ETH, enjoying higher returns.

- Security: It enhances the security of multiple networks while significantly reducing operational costs.

What are Liquid Staking Tokens?

Liquid Staking Tokens (LST) are DeFi products that allow users to trade, convert, and utilize staked assets. LSTs offer high returns; however, the cryptocurrency remains locked for a certain period. LSTs increase capital efficiency and liquidity on blockchains through the Proof of Stake (PoS) consensus mechanism. Users can simultaneously benefit from staking and DeFi opportunities.

Related: What is Staking Crypto? Tips to Maximize Profit When Holding Coins

The Emergence of Restaking

To understand why restaking emerged, it’s essential to review its background.

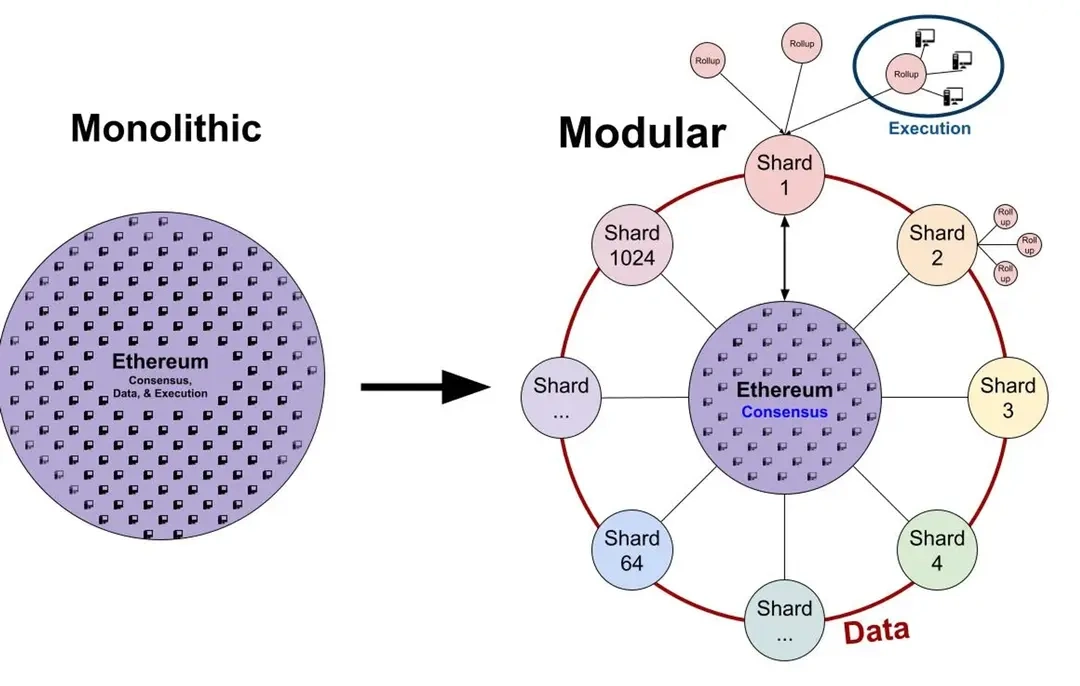

In 2009, Bitcoin introduced the vision of decentralized trust, but it only facilitated BTC transactions. Therefore, Ethereum was created, providing an EVM execution layer based on Ethereum’s trust module. This enabled developers to build applications without starting a new network. However, Ethereum still had issues:

- Security Utilization: New blockchains cannot leverage the security of existing blockchains. Modular blockchains address this issue partially.

- Dependence on Middleware: Ethereum relies on middleware projects like Oracle and Bridge, which need their trust networks. Often, their security is weak, making them the weakest link in the modular stack.

- Ethereum’s Value: Ethereum (ETH) does not capture all its value since users need to use tokens from other Dapps.

- Cost of Usage: The cost model is not optimal, as the cost of using services can exceed the value they provide.

Restaking solves the problem of enhancing the security of these intermediary applications.

How Restaking Works

Another approach is liquid restaking using Liquid Staking Tokens (LST). Users stake their assets and receive tokens representing their stake with a validator, then restake these LSTs on the restaking protocol. Currently, liquid restaking deposits on EigenLayer are paused.

Once tokens are submitted through the restaking protocol, users can use dApps to restake their tokens. These dApps, called Actively Validated Services (AVS) on EigenLayer, provide security infrastructure through restaking.

Validators and stakers receive additional rewards based on the number of supplementary protocols being validated. EigenLayer suggests systems can use services like data availability layers, new virtual machines, watchtower networks, oracle networks, bridges, threshold cryptography schemes, and trusted execution environments. However, these services are currently unavailable for restaking.

Advantages and Disadvantages of Restaking

Advantages

- Increased Returns: Staked assets are not locked and can be restaked on multiple platforms, optimizing returns while investors maintain their staked assets. This allows for additional stablecoin collateral, rapidly increasing capital.

- Enhanced Security: Continuously staking crypto assets increases their value, attracting new market participants. This creates higher security requirements, compelling projects to enhance their system security.

- Flexible Asset Use: Participants can stake tokens into validators, boosting the staking power of native tokens and providing diverse liquidity in the DeFi market.

Disadvantages

- Asset Loss Risk: If nodes malfunction or behave maliciously, investors’ assets risk partial or total seizure.

- Time and Gas Fees: LSTs locked in the protocol can take considerable time to liquidate. Various rewards types mean gas fees significantly impact returns, especially for individual investors.

- Hacking Risk: Despite advanced encryption, the security systems of projects with LSTs and restaking features can still be compromised, causing asset loss.

- Asset Bubble: Continuous restaking can inflate asset values. Using staked tokens as collateral to create new stablecoins on platforms can lead to asset liquidation during market volatility.

Notable Restaking Projects

EigenLayer

EigenLayer designs middleware that turns staked ETH into a commodity rentable by other protocols for security. Stakers can send native Ethereum tokens or LSTs to EigenLayer, providing additional security services for AVS on the Ethereum blockchain and earning extra rewards from restaked assets.

LSTs from protocols like Ankr (ankrETH), Binance (wbETH), Origin (oETH), Lido (stETH), and Coinbase (cbETH) can be restaked on EigenLayer in the Liquid Restaking section.

Puffer Finance

Puffer Finance is a decentralized, permissionless native liquid restaking (nLRP) protocol using secure signer technology to protect validator private keys. It combines Ethereum staking with native restaking on EigenLayer to optimize Ethereum’s potential and increase investor returns.

The project enhances security, mitigating slashing risks for validator nodes through the combination of Secure Signer and Remote Attestation Verification (RAVe) technologies.

Ether.Fi

Ether.Fi provides a mechanism to stake ETH in exchange for LST eETH. This fuels DeFi and Ethereum’s decentralization process. The platform has a total staked value of $5.55 billion, equivalent to 486,000 ETH tokens.

Ether.Fi has three main phases:

- Delegated Staking: Allows stakers to choose node operators to run validator nodes and control keys during staking.

- Liquidity Pool: For those with less than 32 ETH or who don’t want to monitor validator nodes. Investors can stake by holding eETH in the liquidity pool and trading it with ETH.

- Node Services: Where node operators and stakers provide and use additional node services.

Renzo Protocol

Renzo is an LRT and strategy manager of EigenLayer. It serves as an interface for the EigenLayer ecosystem, protecting Actively Validated Services (AVS) and offering higher yields than traditional ETH staking.

The platform simplifies the user process, facilitating collaboration between end users and node operators on EigenLayer. Renzo aims to promote innovation without permission on Ethereum, enhancing community trust and adoption of the ecosystem.

Conclusion

The Restaking mechanism is truly a potential mechanism in the future that projects should consider building due to its ability to stimulate rapid asset growth.

As mentioned, understanding the mechanism of any restaking protocol is important, and being aware of how it affects you as a staker. It should be noted that this concept is still in the development stage and needs time to adjust. At the same time, this article is not financial advice. Before investing in any protocol, it is always important to research thoroughly and ensure you understand the associated risks.

Through the article “What is Restaking? Projects Benefiting After Ethereum ETF“, have you understood Restaking or not? If not, please leave a comment below to get your questions answered right away!

হগফ