What is Renzo?

Renzo is a groundbreaking platform that offers an advanced Liquid Restaking Token (LRT) solution, built on EigenLayer’s restaking platform, aimed at providing abundant profits for users. This protocol enables users to conveniently access and enjoy the EigenLayer ecosystem while ensuring absolute safety for verified operational services and delivering superior yields compared to directly staking ETH.

With its simple yet highly innovative design, Renzo Protocol eliminates complex user difficulties while facilitating effective collaboration with EigenLayer’s node operators.

Backed by strong support from EigenLayer, Renzo Protocol aims to facilitate continuous innovation on the Ethereum platform without permission and to promote widespread use of EigenLayer solutions.

Renzo has also been listed on the Binance exchange as the 53rd project on Binance Launchpool, marking a significant milestone in the protocol’s development journey.

Related: Binance Lists Renzo (REZ) on Binance Launchpool

How Does Renzo Work?

Renzo Protocol utilizes a groundbreaking and efficient operating model, including the following steps:

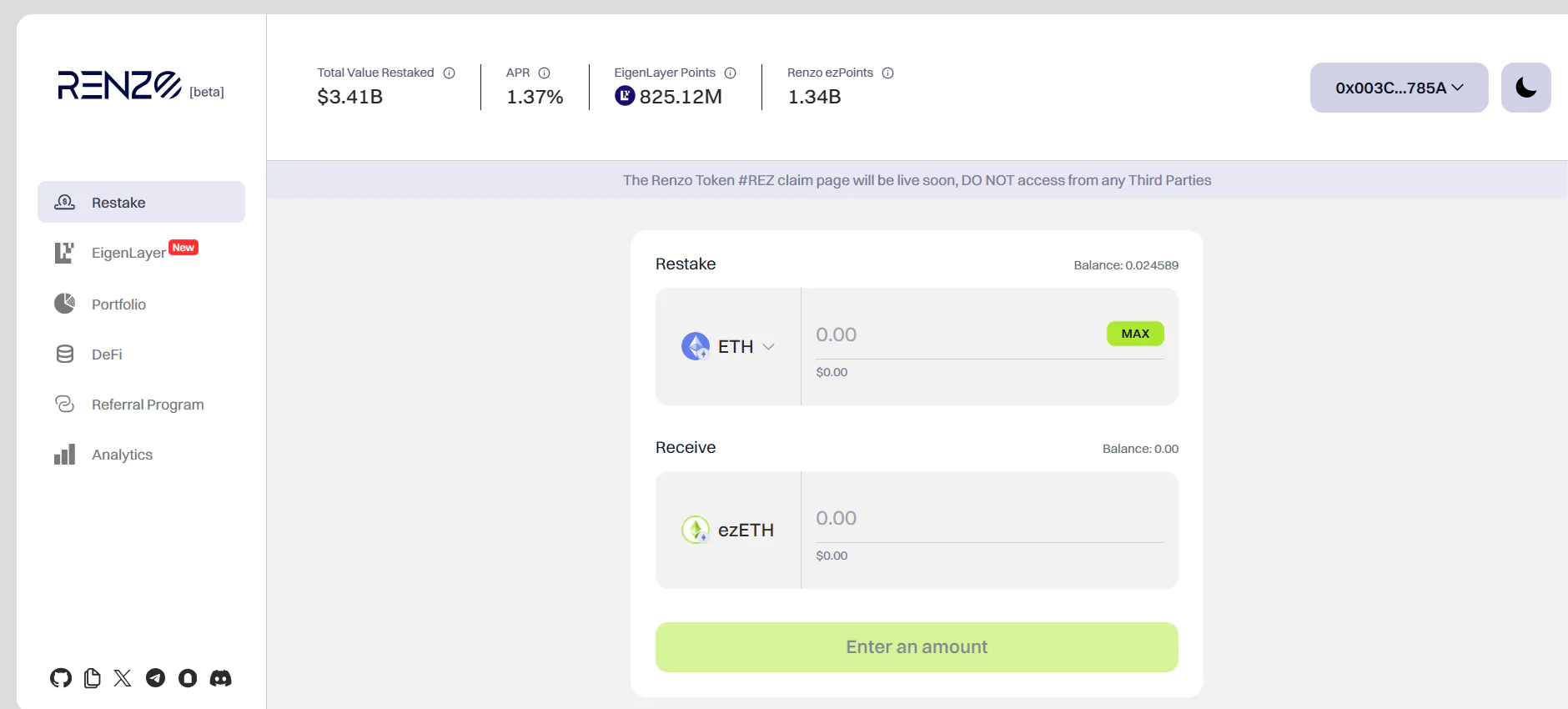

- Users stake ETH into Renzo Protocol and receive ezETH (representative token) at a 1:1 ratio.

- The staked ETH is forwarded to EigenLayer by Renzo Protocol and restaked into the Native Restaking Pool through a smart contract called the Strategy Manager, ensuring a safe and transparent process.

- Next, the restaked ETH is delegated to Node Operators to operate Actively Validated Services (AVS) – Ethereum security leasing services. Each AVS will have different reward and risk levels, so the more AVS, the more diversified the strategy is optimized. Renzo Protocol assists users in selecting AVS that provide maximum profit with the highest level of security.

- AVSs incur security fees, and these fees are distributed back to users, creating sustainable income.

Key Features of Renzo

In the rapidly evolving landscape of Liquid Restaking protocols aimed at optimizing user experience, Renzo has emerged as a shining star with the following outstanding advantages:

- Cross-chain Restaking on Layer 2: Through a partnership with Connext Network, Renzo enables restaking of wETH tokens on Layer 2 ecosystems such as Arbitrum. In the future, the project will continue to expand to new L2s, providing seamless and simplified experiences for users.

- Integrated Protocol Diversity: With the ability to combine leading DeFi protocols such as Pendle, Balancer, Gearbox, Curve, Renzo allows users to use the ezETH representative token to participate in activities such as liquidity provision, token swapping, and more.

- User-Friendly Interface: Renzo stands out with its intuitive interface, minimalist design, yet full-featured, allowing users to easily experience and perform operations with just a few simple steps.

Development Team

The team behind Renzo Protocol remains somewhat of a mystery, with very little information disclosed publicly. However, two individuals believed to be key members driving the project frequently participate in Renzo Protocol’s online question-and-answer sessions (AMAs) on Twitter:

- Lucas Kozinski: He has previously worked with several DeFi protocols such as Moonwell, TokenSoft, and blockchain Layer 1 Tezos.

- Kratik Lodha: He gained experience at Woodstock Fund for 3 years before officially joining Renzo Protocol in 2023. He has previously worked as a Quantitative Research Consultant at WorldQuant and in Equity Research at Alchemy Capital Management Pvt Ltd.

Investors

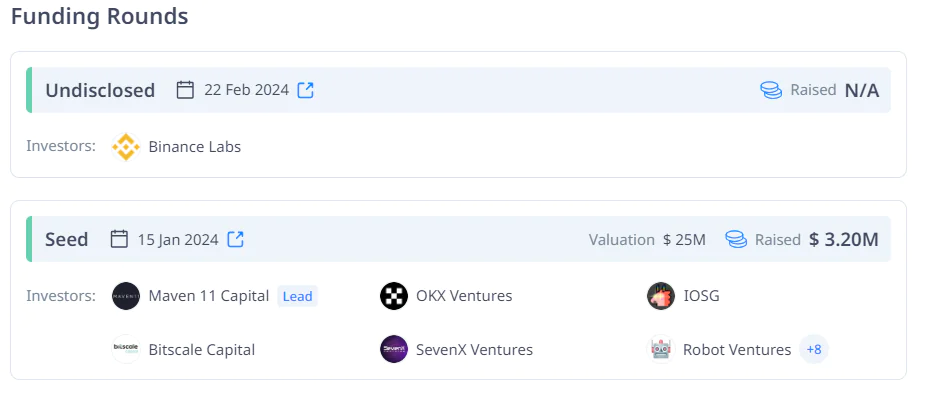

The project raised funds in the seed round with an amount of $3.2 million USD, and investors participating in this round are also well-known in the crypto market, such as OKX Ventures, Figment Capital, …

Subsequently, Binance also invested in Renzo with an undisclosed amount and announced the listing of this project on their platform as a Launchpool.

What is REZ Token?

After learning about Renzo, let’s explore the project’s token – REZ.

Token Key Metrics

- Token Name: Renzo

- Ticker: REZ

- Blockchain: Ethereum

- Total Supply: 10,000,000,000 REZ

- Initial Circulating Supply: 1,050,000,000 REZ

Token Allocation

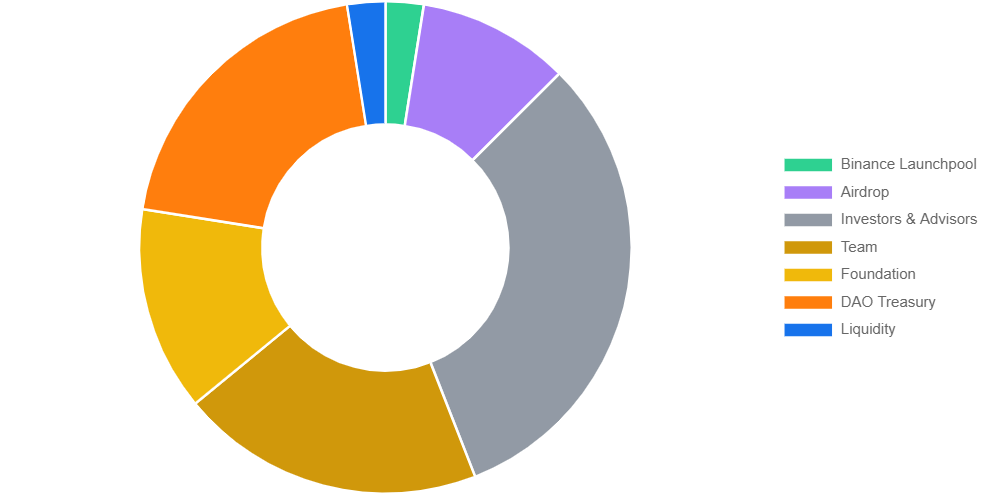

- Binance Launchpool: 2.50%

- Airdrop: 10.00%

- Investors & Advisors: 31.56%

- Team: 20.00%

- Foundation: 13.44%

- DAO Treasury: 20.00%

- Liquidity: 2.50%

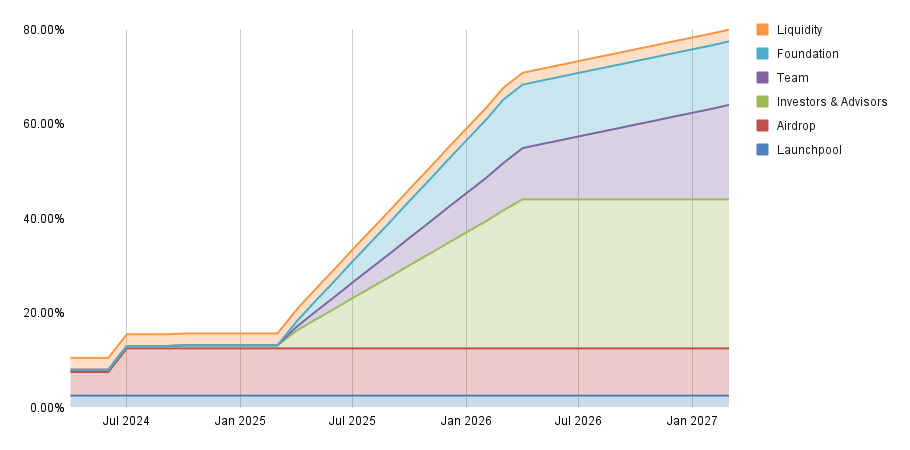

Token Release Schedule

- Until March 2025, the token unlock is not significant (not exceeding 20%), and most of it is airdrop. After that, it will be gradually released to the remaining groups until 2027, when the entire REZ Token will be fully unlocked.

Development Roadmap

- Renzo beta mainnet was deployed on December 18, 2023.

- Transfers – ezETH transfers will be launched in January 2024.

- Withdraw – can be used in the first quarter of 2024.

- In April 2024, the TGE Token REZ was announced on Binance.

After being listed on Binance, Renzo currently has not announced its upcoming plans.

Project Information

- Website : https://www.renzoprotocol.com/

- Twitter : https://twitter.com/RenzoProtocol

- Discord : https://discord.gg/FMwGPDXXtf

Conclusion

Liquid Restaking is becoming a hot investment trend, attracting capital inflows and special attention from the market thanks to the new frenzy surrounding the Restaking mechanism and the emergence of the pioneering project EigenLayer. In this context, Renzo quickly asserted its pioneering position as one of the first LRT projects, rising to hold a top 3 position in the Liquid Restaking field full of potential.

Renzo’s success is further affirmed as the third project related to restaking by the world’s leading exchange Binance to be officially listed, following the names Ether.fi and AltLayer.

Through the article “What is Renzo? Information about REZ Token,” have you understood Renzo or not? If not, please leave a comment below to get answers right away!

field route buzz vacant empower bounce local inflict advance erosion service turkey