What is Puffer Finance?

Puffer Finance is a Native Liquid Restaking Protocol (nLRP) developed on the Ethereum platform, part of the EigenLayer ecosystem. The protocol uses an “anti-slashing” mechanism (protection against penalties for validators) and Secure Signer technology, a remote signing tool that helps prevent validators from misbehaving.

The main goal of Puffer Finance is to diversify the validator network, reduce centralization in Ethereum’s Proof of Stake consensus mechanism, and address challenges faced by independent validators.

With Native Liquid Restaking, Puffer Finance accepts only ETH from users, directly staking it into validators on the Ethereum chain. At the same time, these validators also operate on EigenLayer’s AVS. This way, users who stake ETH can receive rewards from both Ethereum staking and EigenLayer through restaking.

Unlike other Liquid Restaking projects like Ether.Fi, Renzo, or KelpDAO that allow users to restake Liquid Staking Tokens (LSTs such as stETH, rETH, cbETH) to receive LRT tokens (like rsETH, ezETH), Puffer uses directly staked ETH.

Related: What is Restaking? Projects Benefiting After Ethereum ETF

Puffer Finance Products

Liquid Restaking

Users stake ETH into Puffer to receive Native Liquid Restaking Token (nLRT), pufETH, alongside staking and restaking rewards. The pufETH token automatically accumulates profit from both Staking Rewards (Ethereum PoS) and Restaking Rewards (EigenLayer), increasing in value over time. Additionally, pufETH can be used in DeFi applications like liquidity provision, trading, or collateral.

UniFi Based Rollup

UniFi is a Layer 2 solution on Ethereum, providing a platform for building dApps. Ethereum validators serve as Sequencers, and Puffer’s UniFi AVS acts as the block validator on this Layer 2. This architecture ensures high security and decentralization for UniFi. The native yield token for UniFi Layer 2 is unifiETH, used to pay network gas fees. Users earn unifiETH when transferring ETH, WETH, or pufETH from Ethereum to UniFi, enhancing their returns.

UniFi Preconf AVS

This is an AVS developed by Puffer Finance on EigenLayer to verify blocks on UniFi Layer 2, ensuring high decentralization and security for the chain.

Key Features of Puffer Finance

- Secure Signer Technology: Protects validators’ private keys from unauthorized access, reducing slashing risks and enhancing security.

- RAVe Technology (Remote Attestation Verification): Allows validators to validate transactions honestly by using a remote validation network to ensure accuracy.

- Capital Efficiency Optimization: Puffer Finance reduces the ETH required to run a node, increasing the number of nodes in the network and optimizing capital utilization.

Team

- Amir Forouzani (Co-Founder & CEO)

Amir Forouzani is the Co-Founder and CEO of Puffer Finance. He holds a degree in Applied Science from Monash University and a Master’s in Science from the University of Southern California. - Jason Vranek (Co-Founder & CTO)

Jason Vranek is the Co-Founder and CTO of Puffer Finance, holding both a Bachelor’s and Master’s degree in Computer Science from the University of California.

Investors

Puffer Finance successfully raised $24.27 million through five major funding rounds:

- 01/06/2022 (Pre-Seed): Raised $650,000, led by Jump Crypto, with participation from Arcanum Capital and IoTeX.

- 01/11/2022: Received $120,000 in funding from the Ethereum Foundation.

- 08/08/2023 (Seed): Raised $5.5 million, led by Lemniscap and Faction, with support from Animoca Brands, SNZ Holding, Brevan Howard Digital, Canonical Crypto, and others.

- 30/01/2024: Secured investment from Binance Labs, though details were not disclosed.

- 16/04/2024 (Series A): Raised $18 million, led by Electric Capital and Brevan Howard, with participation from Coinbase Ventures, ConsenSys, Animoca Brands, Mechanism Capital, Lemniscap, GSR, LongHash Ventures, and Franklin Templeton.

Additionally, Puffer Finance is a Launchpool product on four exchanges: Bybit, Bitget, Gate.io, and KuCoin.

Puffer Airdrop

Puffer Finance announced its first airdrop before the Token Generation Event (TGE). ETH stakers on the platform will earn Points, which can later be converted into tokens. However, like many restaking projects, Puffer faced criticism as the rewards from the airdrop were not proportional to the effort and cost involved in “farming” the airdrop.

Overview of PUFFER Token

PUFFER is the native token of the Puffer Finance platform, playing a critical role in governance and reward distribution.

Basic information

- Token Name: Puffer Finance

- Token Symbol: PUFFER

- Blockchain: Ethereum

- Smart Contract: 0x4d1C297d39C5c1277964D0E3f8Aa901493664530

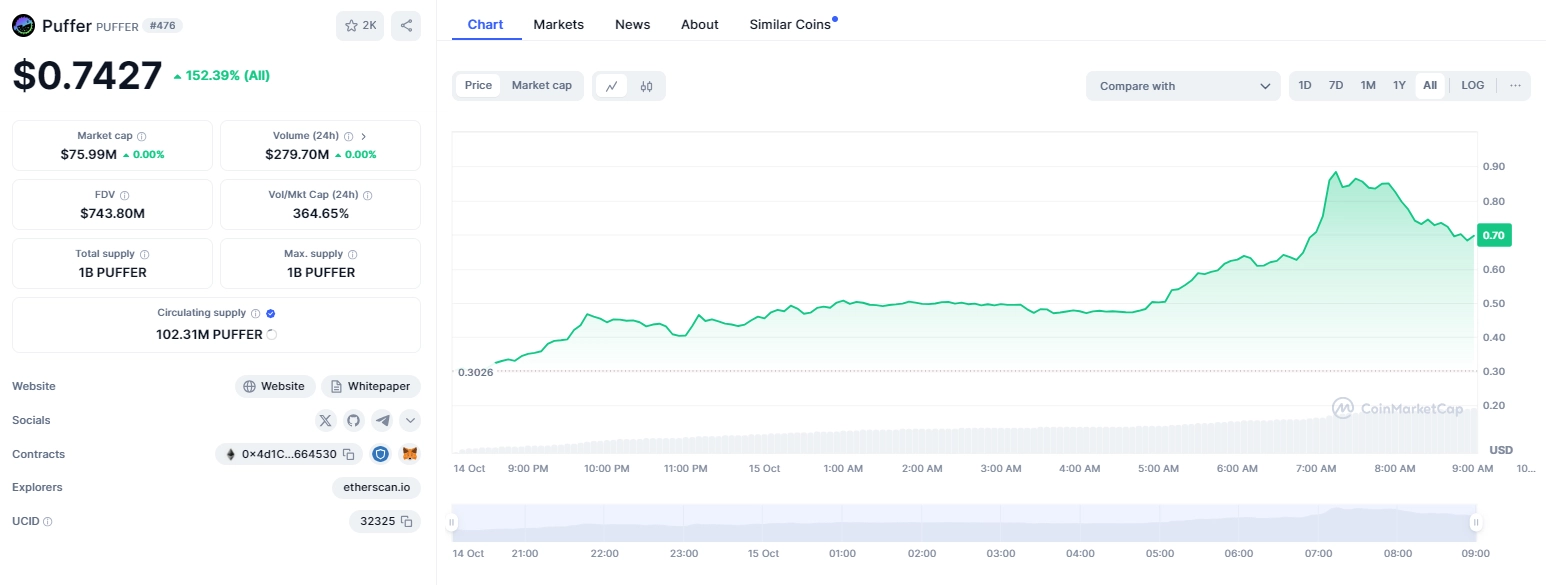

- Listing Date: 14/10/2024

- Price (as of 15/10/2024): $0.75

- Market Cap: $75 million

- Fully Diluted Market Cap: $750 million

- Total Supply: 1,000,000,000 PUFFER

- Max Supply: 1,000,000,000 PUFFER

- Circulating Supply: 102,306,717 PUFFER

Token Allocation and Release Schedule

- Ecosystem and Community (40%): Allocated for ecosystem and community programs, future airdrops, community incentives, and liquidity on exchanges.

- Airdrop Season 1 (7.5%): Fully unlocked at TGE.

- Airdrop Season 2 (5.5%): Allocated to participants of Crunchy Carrot Quest Season 2.

- Investors (26%): Allocated to investors with a 1-year lock and vesting over 2 years.

- Early Contributors & Advisors (20%): Reserved for the core team and advisors with a 1-year lock and vesting over 2 years.

- Protocol Guild (1%): Set aside to support Ethereum development, unlocked over 4 years.

By the end of 3 years, nearly all PUFFER tokens are expected to be fully unlocked.

Use Cases for PUFFER Token

PUFFER is used for governance in Puffer Finance and serves as a reward for users participating in staking or utilizing platform services.

Where to Buy PUFFER Token?

Investors can buy or sell PUFFER on exchanges such as Bybit, Gate.io, Bitget, and KuCoin.

Personal Evaluation

Here are a few of my personal insights on Puffer Finance:

This is a cutting-edge project developed on EigenLayer, featuring advanced restaking functionalities that attract ETH stakers with its appealing rewards mechanism and robust security. It’s already proven successful, with $1.4 billion locked in the protocol.

The development team consists of highly educated individuals trained in professional environments in the U.S. Additionally, the project is backed by reputable investors such as Binance Labs, Coinbase, and the Ethereum Foundation, building strong trust within the community.

However, despite its potential and quality, the tokenomics present inflation risks. Within 3 years, nearly all tokens will be unlocked, with the highest inflation expected one year after the TGE. While the initial year sees limited supply (only 10% at TGE), allowing for easier price growth, inflationary pressure will increase significantly in the following two years, posing challenges for maintaining long-term token value.

Conclusion

Above, AZC.News has provided comprehensive information about Puffer Finance and the PUFFER token. If you have any questions, feel free to leave them in the comments for further clarification!