What is Pre-Market?

In the crypto market, pre-market trading (also known as pre-launch) refers to exchanges allowing users to trade coins/tokens that have not yet been officially launched or listed on major exchanges.

Due to the 24/7 nature of the crypto market, there is no pre-market hours like in traditional markets. Instead, pre-market refers to projects that have not officially launched but are confirmed to have tokens, and users can trade these tokens months before their official launch.

There are two main types of pre-market trading:

- Pre-market Perpetual

- Pre-market Trading (OTC)

Related: What is P2P Trading? Can You Make Money P2P Trading During a Bear Market?

How Pre-Market Works in Crypto

Pre-market Perpetual

Pre-launch perpetual is a derivative product, specifically a perpetual futures contract for tokens that have not yet been launched. Like other futures contracts, this contract does not give users ownership of the asset but provides long/short positions based on the asset’s price.

Key components of pre-launch perpetual contracts include:

- Index Price: The average price of the asset on major exchanges, used as a standard price for the futures contract.

- Funding Rate: The fee paid between long and short positions based on the price discrepancy between the spot and futures markets.

- Mark Price: The marked price of the contract, typically calculated based on the actual bid/ask volume on the exchange.

Since the tokens have not officially launched, there is very little information available about these tokens. Therefore, Index Price and Funding Rate components are often not used immediately due to the lack of spot prices on exchanges.

Pre-market Trading (OTC)

Pre-market trading refers to Over-the-counter (OTC) trading of tokens that have not yet been officially launched. For investors who want to actually own the asset rather than speculate on its price, pre-market trading is a more suitable option.

To participate in this market, investors must create buy/sell orders or agree to existing buy/sell orders with predetermined prices and quantities of tokens. There are two main models:

- Whales Market: Conducts OTC trading via smart contracts, representing decentralized exchanges.

- Bybit Pre-market: Conducts OTC trading on the exchange, representing centralized exchanges.

Besides Bybit, which was the first to pioneer Pre-market trading on exchanges, there are also platforms like OKX, Bitget, and Gate involved in this innovative approach.

Pros and Cons of Pre-Market Trading

Pros

For Token Issuers:

- Helps in price discovery by determining the current market demand and supply.

- Increases token visibility.

For Users:

- Allows finding favorable positions.

- Provides early token ownership.

For Exchanges:

- Increases trading volume and fee revenue.

- Attracts new users.

- Increases incentives for exchange tokens (if applicable).

Cons

For Users:

- Lower liquidity.

- Higher price volatility.

- Lack of clear information about the token, leading to possible mispricing.

- Limited order types.

- Potential for price discrepancies between exchanges.

How to Start Pre-Market Trading on Bybit

Open a Bybit Account to Trade Pre-market Here!!!

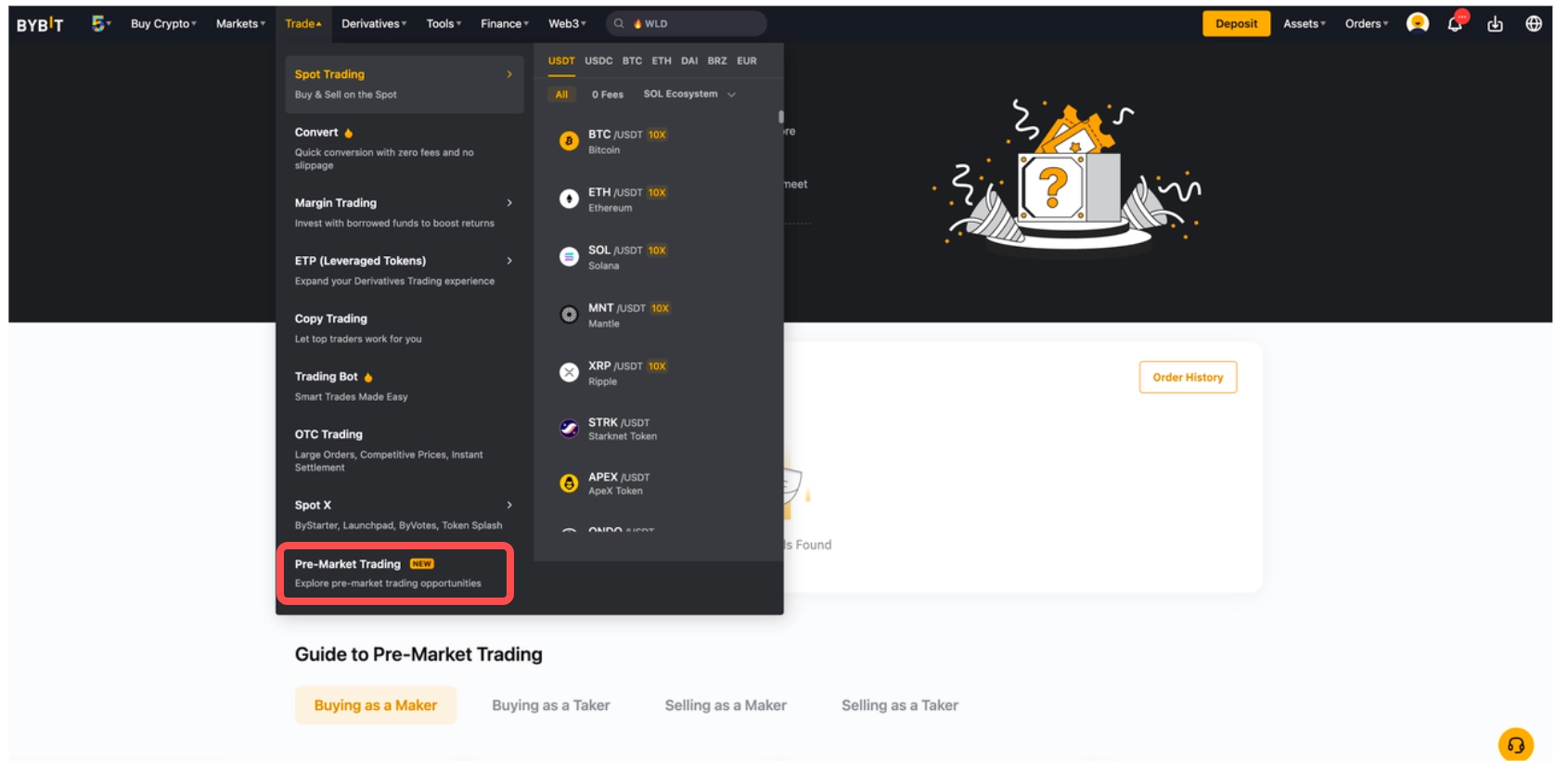

Step1: Access Bybit: On the navigation bar, select Trade → Pre-Market Trading.

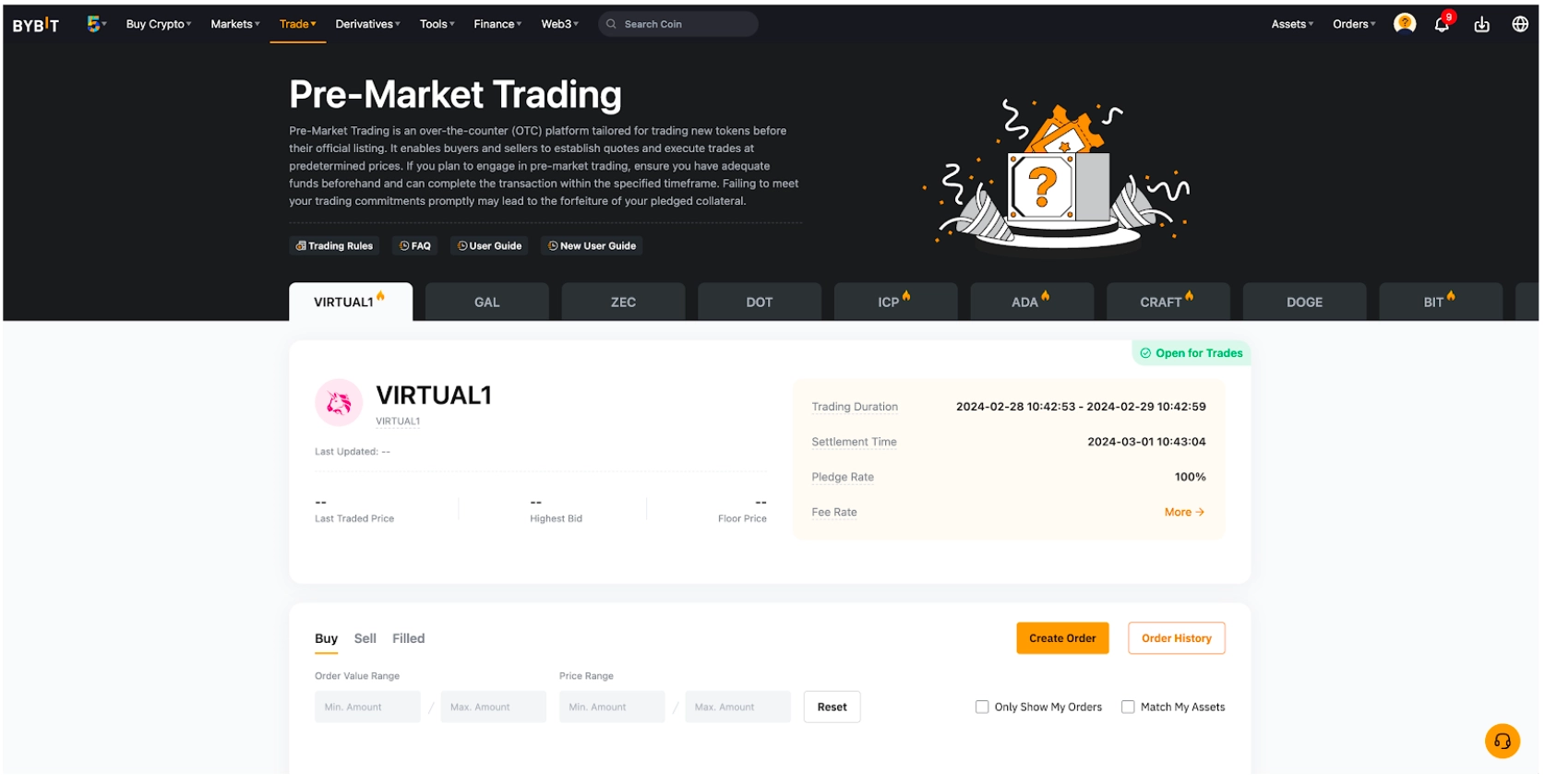

Step 2:

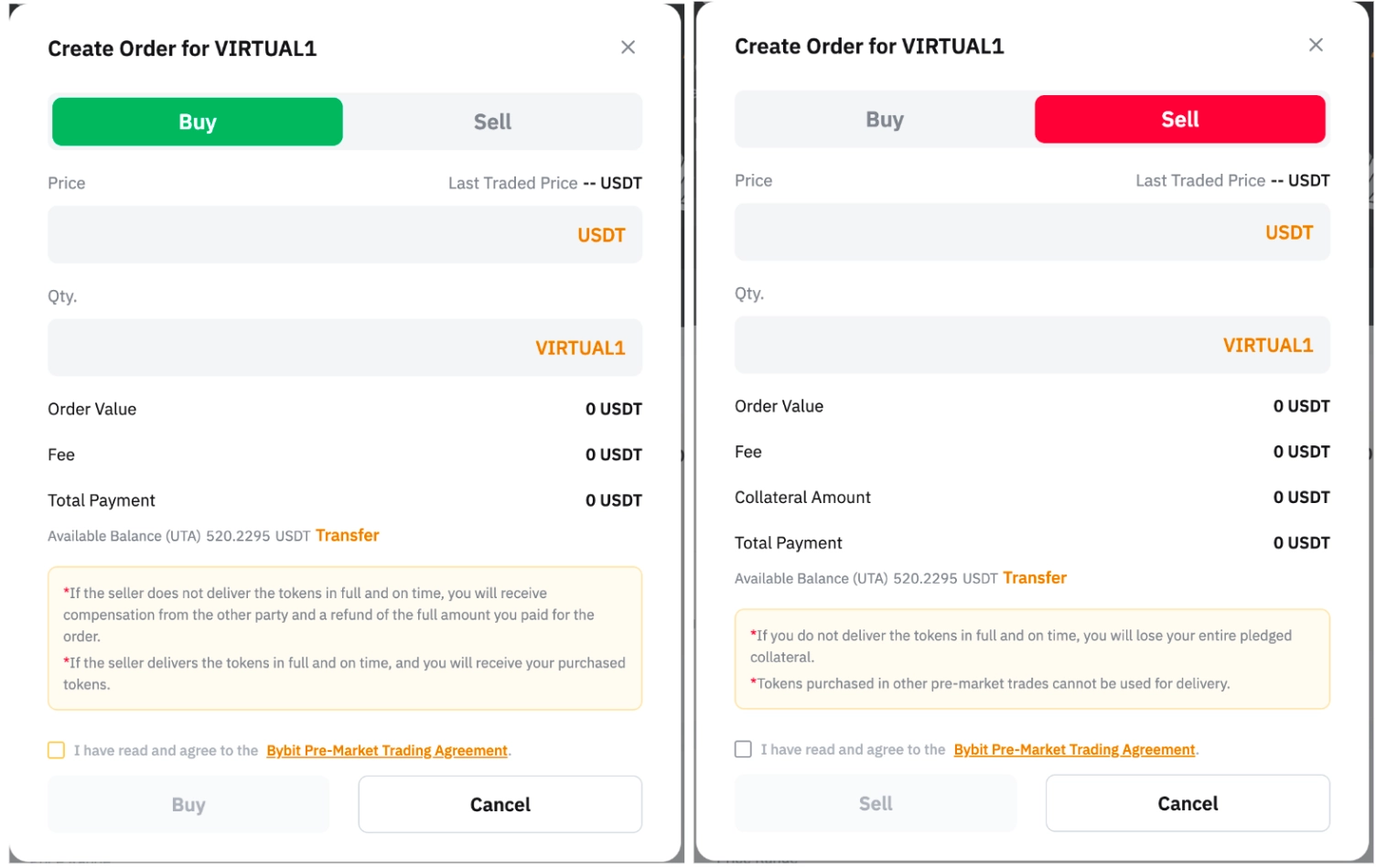

For Makers:

- Select the coin you want to trade, click Create Order, and choose Buy or Sell.

- Enter the Price and Order Quantity, then click Confirm. Confirm again by clicking Buy or Sell to place the pre-market order.

For Takers:

- Browse through the pending orders in the Buy or Sell tab. Select a matching order and click Sell or Buy to confirm the order.

- Orders must be fulfilled entirely, with no partial completions allowed.

Conclusion

The advent of pre-market trading introduces new perspectives and experiences for investors. Although this trading method is still new in the crypto market, it offers considerable benefits for all participants.

Note: AZC.News does not encourage users to utilize this feature due to the high risks for investors.

Do own the token immediately you buy or you wait for launch?

wait for launch