What is Omni Network?

Omni Network is a rollup layer integrated into the Ethereum platform, enabling developers to build unified applications across all Ethereum’s scaling solutions. It operates on a new blockchain architecture, supporting sub-second transaction finality, with security ensured through restaking on Ethereum.

Omni’s mission is to bring Ethereum back to its role as a unified operating system for decentralized applications.

The rollup-oriented architecture of Ethereum has forced the network to scale through isolated execution environments. This fragmentation has fragmented liquidity, users, and developers, and diminished the network effects of Ethereum. Using Omni, developers can program across multiple Ethereum rollups as if they were working in a single state machine. Applications built with Omni’s EVM can automatically exist across all Ethereum rollups, allowing developers to integrate Ethereum’s entire liquidity and user base into their applications.

Recently, Binance announced Omni Network as their 52nd Launchpool project.

Related: Binance Lists Omni Network (OMNI) on Binance Launchpool

Components of Omni Network

Omni Network consists of the following key components:

- External rollups: These are source and destination networks for inter-rollup messages.

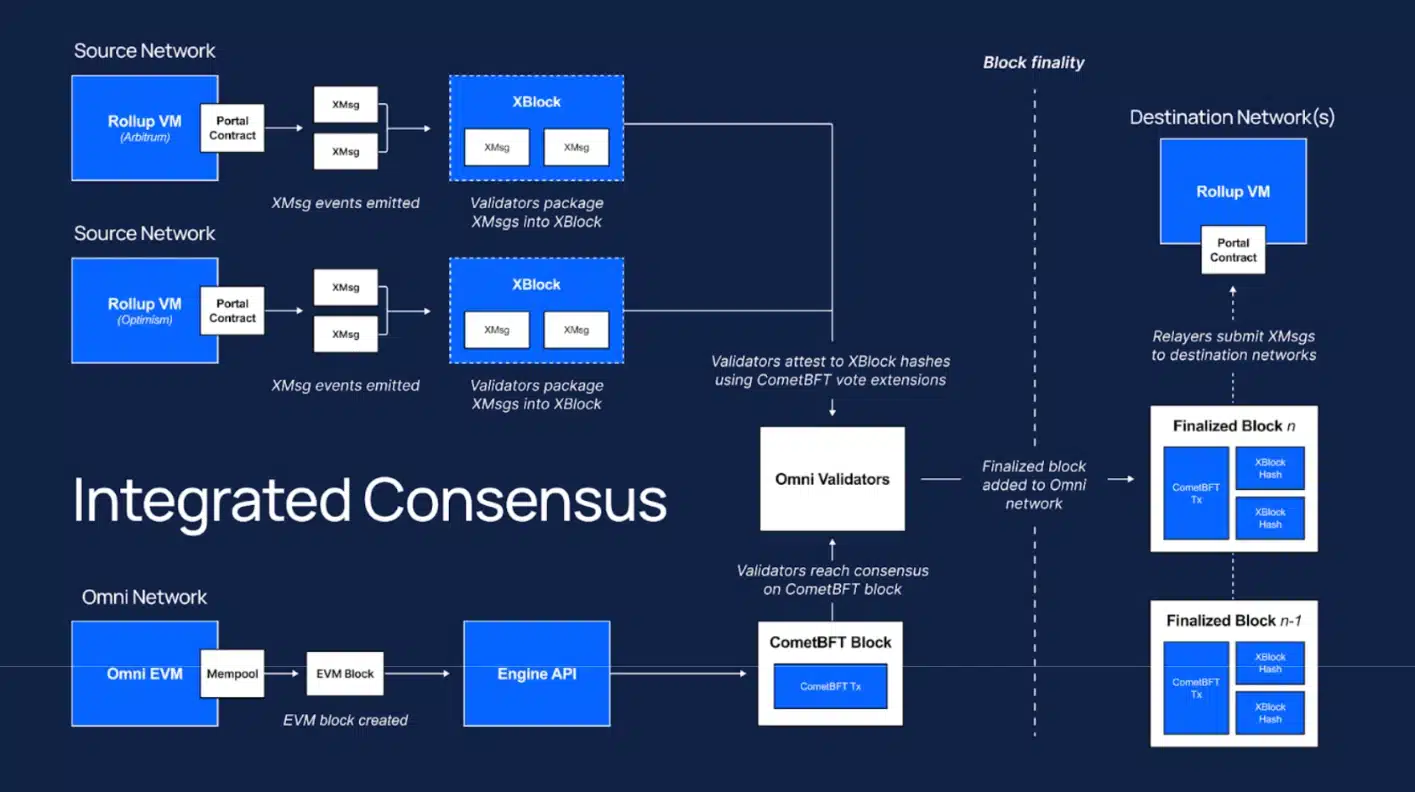

- Omni validator nodes: These are a permissionless network of nodes using CometBFT consensus to validate inter-rollup messages and transactions on Omni EVM. These nodes are secured by staking a total value of OMNI tokens and restaked ETH.

- The Omni blockchain: This is the sole source of truth for all inter-rollup messages and Omni EVM transactions processed by Omni validator nodes.

- Relayers: These are permissionless entities that relay confirmed inter-rollup messages from the Omni network to target rollups.

These components work together to provide a unified platform for Ethereum applications to operate across multiple scaling solutions (rollups).

Technology of Omni Network

- Modular Node Architecture: Omni introduces a new node architecture (Octane) designed around the Ethereum Engine API. This creates a clear separation between the consensus and execution environments of each node, while allowing nodes to use existing Ethereum execution clients.

- Integrated Consensus: Omni validator nodes use CometBFT consensus and ABCI++ voting utilities to simultaneously verify inter-rollup messages and transactions on Omni EVM.

- Natively Global Applications: Omni EVM simplifies the development of inter-rollup applications by propagating smart contract state and interfaces to any rollup. This method of building inter-rollup applications allows developers to program in a single environment and minimize potential smart contract vulnerabilities due to the complexity of working with distributed state.

Highlights of Omni Network

- Dual Staking Model: Omni is a Proof-of-Stake network secured by the combined value of restaked ETH and staked OMNI tokens. This dual staking mechanism not only aligns the incentives of validator nodes but also provides a robust security foundation for the Omni blockchain.

- Sub-Second Verification: Omni uses the CometBFT consensus protocol to process inter-rollup messages and Omni EVM transactions in less than a second. Additionally, by using other confirmation mechanisms such as pre-confirmations and transaction insurance, Omni can provide sub-second transaction finality for inter-rollup messages, delivering a seamless user experience across Ethereum’s scalable ecosystem.

- Diverse Rollup Support: Omni is designed with minimal integration requirements, ensuring compatibility with any rollup virtual machine, programming language, and available data architecture. This allows developers to build unified applications that can operate on multiple Ethereum scaling solutions.

- Backwards Compatibility: The architecture of Omni is designed to be backward compatible, allowing applications to integrate with the protocol without modifying existing smart contracts. Instead, applications can use modified frontend guides to send inter-rollup messages through the Omni network, simplifying the integration process and reducing barriers to entry for developers.

Development Team

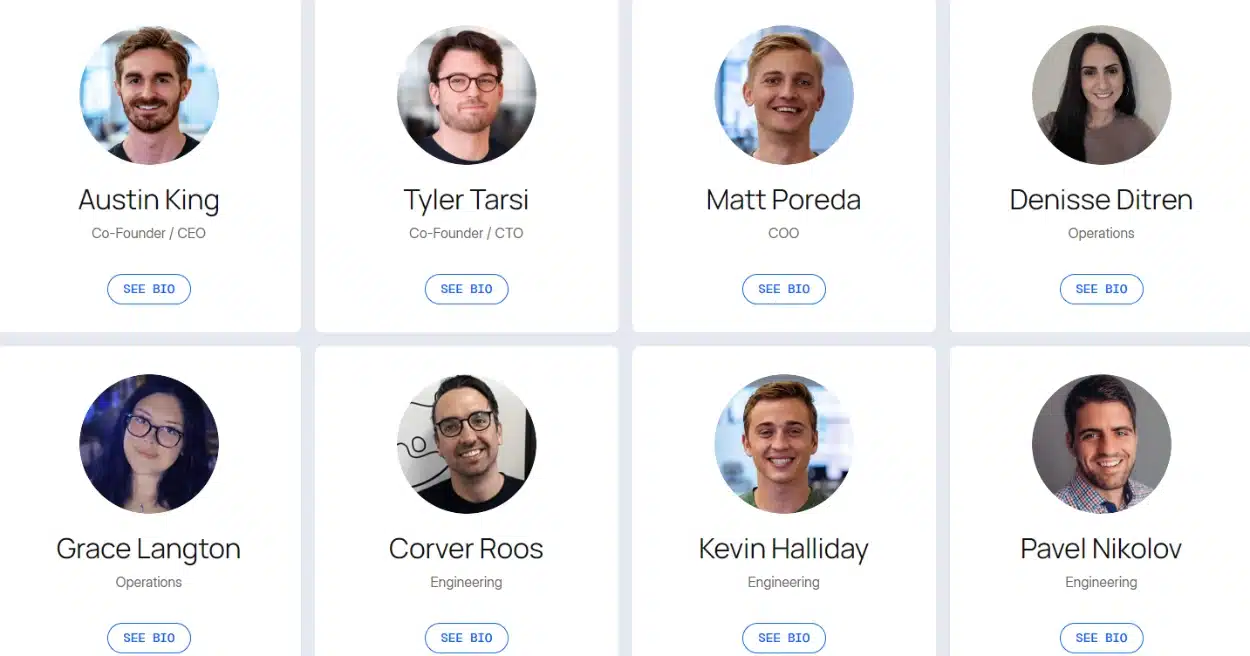

Austin King – Co-Founder & CEO:

Holds a Bachelor’s degree in Computer Science from Harvard, with studies at Stanford and Carlos III in Madrid. Worked as a manager at Microsoft for 1 year in 2017. Later became CEO of Strata Labs – a blockchain infrastructure company, later acquired by Ripple. Worked as a software engineer at Ripple for 2 years. Co-founded Omni Network with colleagues from early 2021.

Tyler Tarsi – Co-Founder & CTO:

Holds a Bachelor’s degree in Computer Science and Economics from Harvard. Previously worked at Squarelink and DataProphet. Co-founded Omni Network with Austin in 2021.

Matt Poreda – COO:

Holds a Master’s degree in International Economics, International Management, Data, and an MBA. Has experience at major companies like Spotify, BCG, Amazon, and IBM. Joined Omni Network as COO, his first venture into the crypto space.

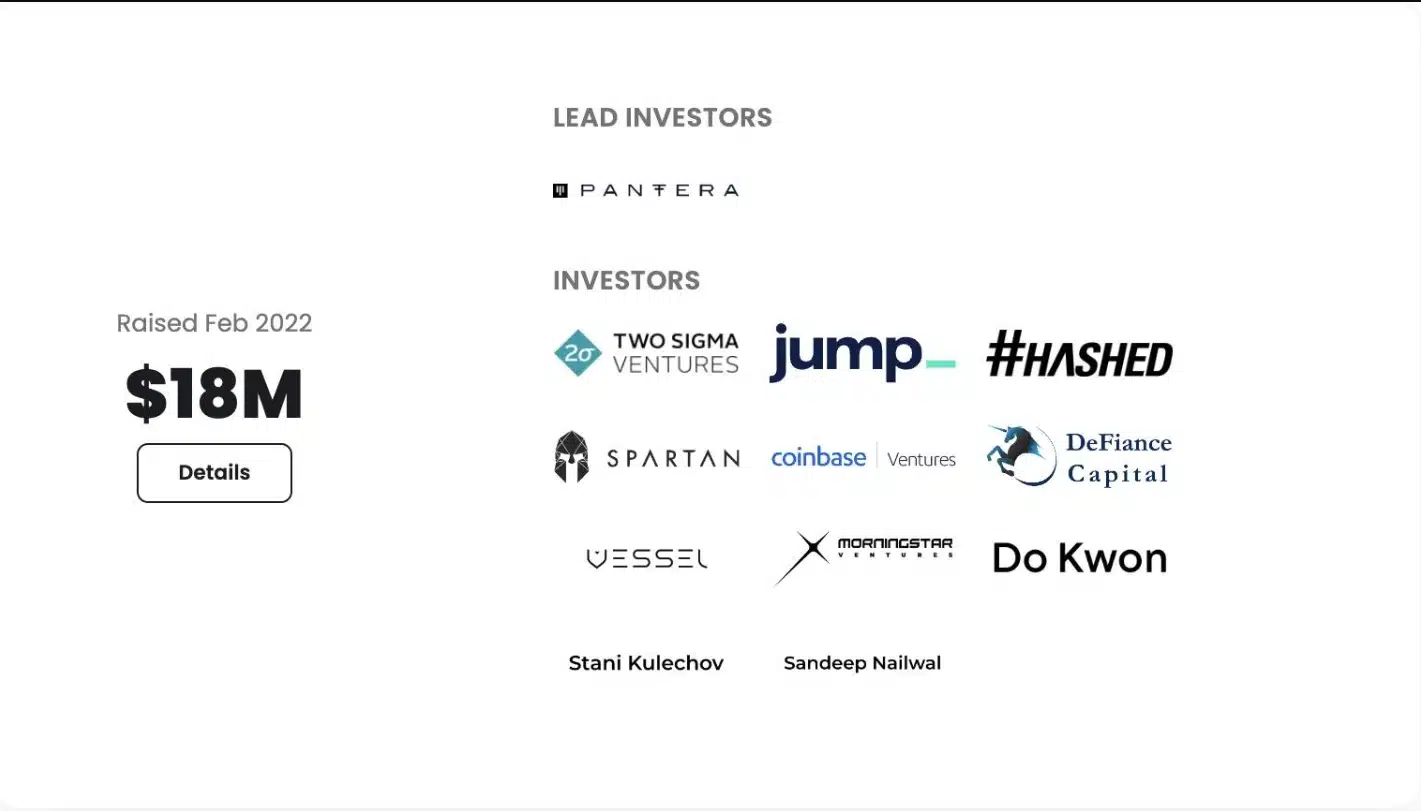

Investors

Omni Network has raised $18 million from leading investment funds in the crypto market such as Pantera, Jump, Coinbase Ventures, …

What is OMNI coin

OMNI Coin Basics

- Token Name: Omni Network

- Ticker: OMNI

- Smart Contract Details: Ethereum

- Total Supply: 100,000,000 OMNI

- Initial Circulating Supply: 10,391,492 OMNI (10.39% of total supply)

OMNI Coin Utilities

- Universal Gas Resource: OMNI is used as a payment method to compensate relayers for sending transactions to target rollups.

- Gas for Omni EVM: OMNI is the native currency for processing transactions on Omni EVM.

- Network Governance: OMNI stakers are responsible for various governance decisions such as protocol upgrades and additional development features.

- Staking: The Omni protocol implements a dual staking model to ensure economic security. Security is a function of the aggregate value of staked OMNI and restaked ETH.

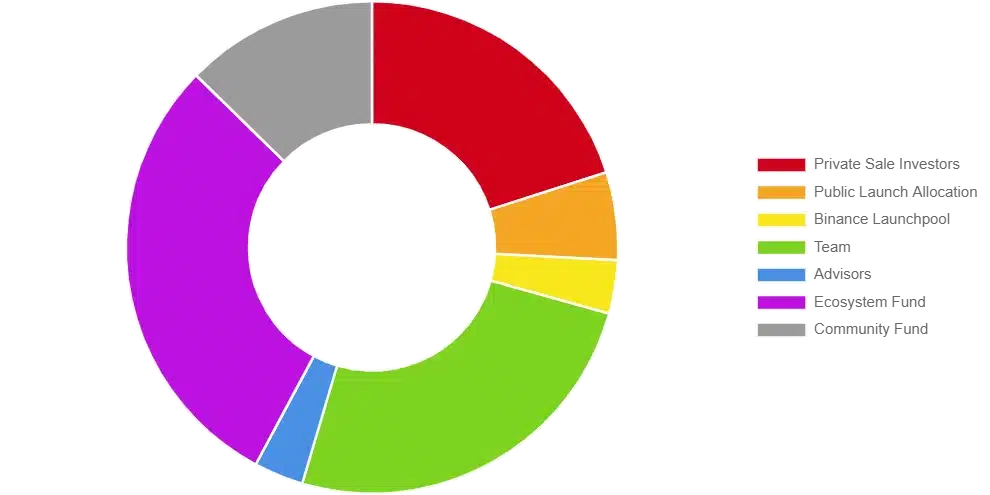

OMNI Coin Allocation

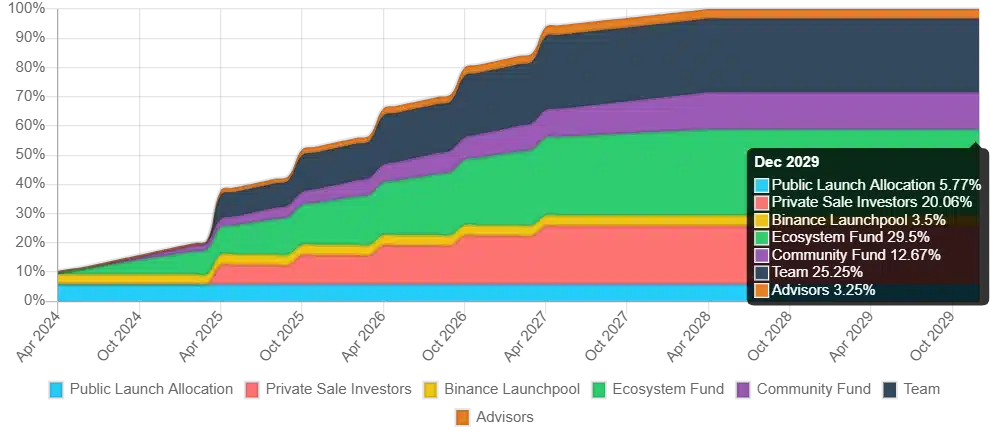

OMNI Coin Vesting

Roadmap

I have outlined the development roadmap of Omni Network for the quarters of 2024. Let me summarize each phase:

Q2 2024:

- Mainnet launch

- Deployment of Liquid Restaking

- Protocol and onboarding of EigenLayer operators

- Token Generation Event organization

- Onboard committed deployments of xERC20 worth over $11 billion secured by Omni

Q3 2024:

- Launch of Natively Global Applications (NGAs) deployed on Omni EVM

- Deployment of multi-rollup smart contracts declaratively, enabling a Kubernetes-like experience for applications across all rollups

- Launch of a Typescript frontend library to deploy natively multi-rollup applications, seamlessly operating across all rollups

Q4 2024:

- Expand Omni Network to include alternative

- Data Availability systems such as EigenDA and Celestia Deployment of attestation fragmentation to increase network rollup capacity by an order of magnitude

- Onboard MPC providers to provide organizational access to all Ethereum rollups

Project Information

- Website : https://omni.network/

- Twitter : https://twitter.com/OmniFDN

- Discord : https://discord.gg/omninetwork

Conclusion

Through the article “What is Omni Network? Learn about the latest OMNI Coin“, have readers understood Omni Network or not? If not, leave a comment below to discuss!

Good news

Incredible

ok

I’m still not very clear about this.

Good One

Where’s the referral link?

I mined the coin for over 8 months, without kyc,all the 8downlines , gave up because they sow as a wastage of time, including me,on the nine months without kyc,I gave up

Just hearing about this, cool.

i wanan to know it whether free ?when has show out an application ?

Ok