What is Holding Coins?

Both “Hodl” and “Hold” mean “to hold.” In the cryptocurrency market, Holding coin refers to keeping a coin without selling it, even when the market is volatile or the price drops. Essentially, Holding coin is a form of long-term investment, unlike short-term trading (trade coin).

For example, if you choose a promising Altcoin and believe it has significant growth potential, you might buy some of this coin and decide to hold it for at least 1-2 years, selling only when it reaches your expected price. During this period, even if the price drops, you won’t sell. At this point, you are referred to as a “Holder” and your action of holding the coin is known as Holding coin.

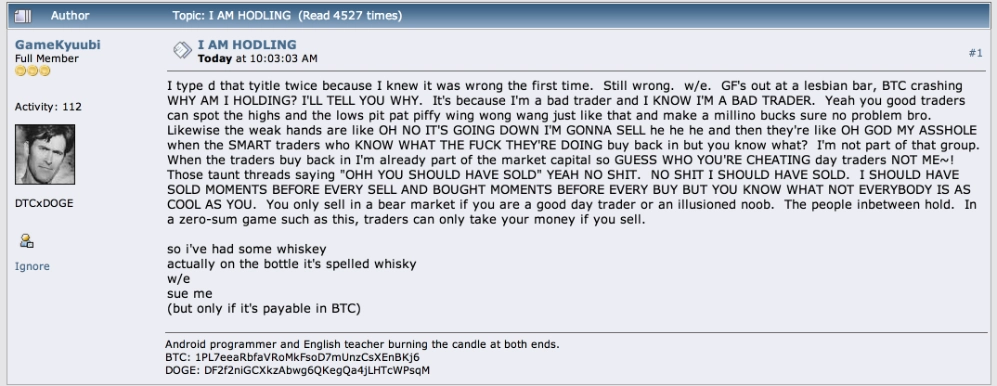

The term first appeared in 2013 on the Bitcoin Talk forum from a member with the nickname GameKyuubi in a topic titled “I AM HODLING.” Since then, this misspelled phrase has become very popular in the cryptocurrency world. Whenever someone says they are hodling or want to hodl, it means they believe the coin they hold will increase in value in the future, not immediately.

Why Should You Hold Coin?

- High returns: If you choose the right project to hold, the potential returns from your investment can be substantial in the future.

- Sustainable income: With some types of coins, while holding, you can stake or farm them, providing sustainable passive income, even compounding interest.

- Safety: Holding is considered the safest investment strategy in the cryptocurrency market. This approach helps you avoid many trading risks.

- Less need for in-depth analysis: Holders do not need to spend as much time and effort analyzing the market daily as Traders do.

How are Holders and Traders Different?

Profit Goals

Unlike Traders, who seek short-term profits, Holders aim for significant returns, often 100% or more. Because of their different goals, they use different tools: Holders typically buy on the spot market, while Traders often trade with leverage.

Market Perspective

Traders usually view the market in the short term and use many H1 and H4 charts, with D charts being the highest. In contrast, Holders typically use H4 and D charts, and some famous investors even use W and M charts.

Analysis Methods

In Crypto, the term “Investor” usually refers to Holders. Holders use fundamental analysis to assess a project’s potential, though they may also use technical analysis but not daily. Traders treat technical analysis as a daily necessity, constantly monitoring charts to earn short-term profits.

When Should You HODL?

Deciding when to hold or sell cryptocurrency is a personal choice, and you should conduct thorough research before making a decision. Some investors adopt a broad HODL strategy, meaning they buy cryptocurrency and do not plan to sell it for months or years.

When the Market is Volatile

The cryptocurrency market is known for its unpredictability and frequent volatility. During periods when the market trend is unclear, trading can be dangerous as it might lead to “buying high and selling low.” Thus, the HODL strategy is particularly suitable for protecting your investment. You can sell when the market confirms an uptrend or continue holding if the market enters a downtrend.

When the Economy Shows Signs of Recession

Economic recessions will affect all markets, not just crypto. If you sell off coins to convert to cash during a recession, you might face double losses. This is when you should apply the HODL strategy.

When You Are New or Not a Full-time Investor

Anyone, especially newcomers, can HODL. HODL is also suitable for investors who do not have time to read charts or perform technical analysis. Traditional investors new to this market will also find it easier to adapt to HODL coin practices.

Criteria for Choosing Coins to HODL

Not all coins you HODL will bring potential profits. Look back at the crypto market since 2013, and see which coins have survived. Or consider the top coins from 2-3 years ago; which ones have maintained their positions?

Focus on bluechip coins. Like the stock market, the cryptocurrency market also has bluechip, mid-cap, and penny coins. Bitcoin and Ethereum are the bluechips of the cryptocurrency space. Though more expensive than other coins, you can buy small amounts and accumulate over time.

This doesn’t mean altcoins aren’t worth investing in. Pay attention to coins that have been released or ICO projects with promising technology, experienced development teams, good backers, and clear, feasible roadmaps. These might be the coins that will make significant advancements in the future.

How to Optimize Profits When Holding

DCA (Dollar-Cost Averaging)

To optimize future profits, you need to buy coins at the lowest possible price. The simplest method to do this is the DCA strategy. DCA means averaging the purchase price. With this strategy, you divide your capital and buy coins at different times, helping you buy coins at a low average price.

Staking – Farming

Some cryptocurrency wallets like Kelp allow users to stake or farm certain cryptocurrencies. If you hold these types of coins, you can stake or farm them to earn passive income.

Related: What is Staking Crypto? Tips to Maximize Profit When Holding Coins

Launchpool – Launchpad

When holding certain exchange coins like BNB, MX, BIT, etc., you can participate in the exchange’s launchpad, bringing compound interest.

Conclusion

The above profit optimization methods are primarily for holders who believe in the project for the long term. For some tokens, not participating in DeFi would be a significant oversight for a holder’s benefits. However, investors should not focus solely on the interest earned but should diversify their methods to minimize risks.

Through the article “What is Holding Coins? How to Optimize Profits When Holding Coins,” do you understand Holding coin now? If not, leave a comment below for us to answer your questions right away!

When holding a coin as investor, how do I know when to sell since I’m not always on the chat

Very good explanation. I understand better

I really enjoy this

Very impressive 👏 thanks 😊

Which coins are good for holding right now

A very educative and entertaining article, nice one team!👍🤝