What is Hifi Finance?

Hifi Finance (formerly known as Mainframe) is a lending and borrowing protocol built on the Ethereum network. This protocol provides lending services with fixed interest rates and terms, allowing users to know the repayment time and amount before deciding to borrow.

Hifi issues a type of synthetic asset called hToken (e.g., hUSDC). Borrowers create hTokens with a specific maturity by depositing collateral assets into the protocol, which can be any asset (e.g., ETH). Lenders buy back the borrowers’ hTokens at a discounted price and can exchange them for the underlying tokens upon maturity, profiting from the price difference.

What are Hifi Finance’s main products?

Hifi Finance has three main products:

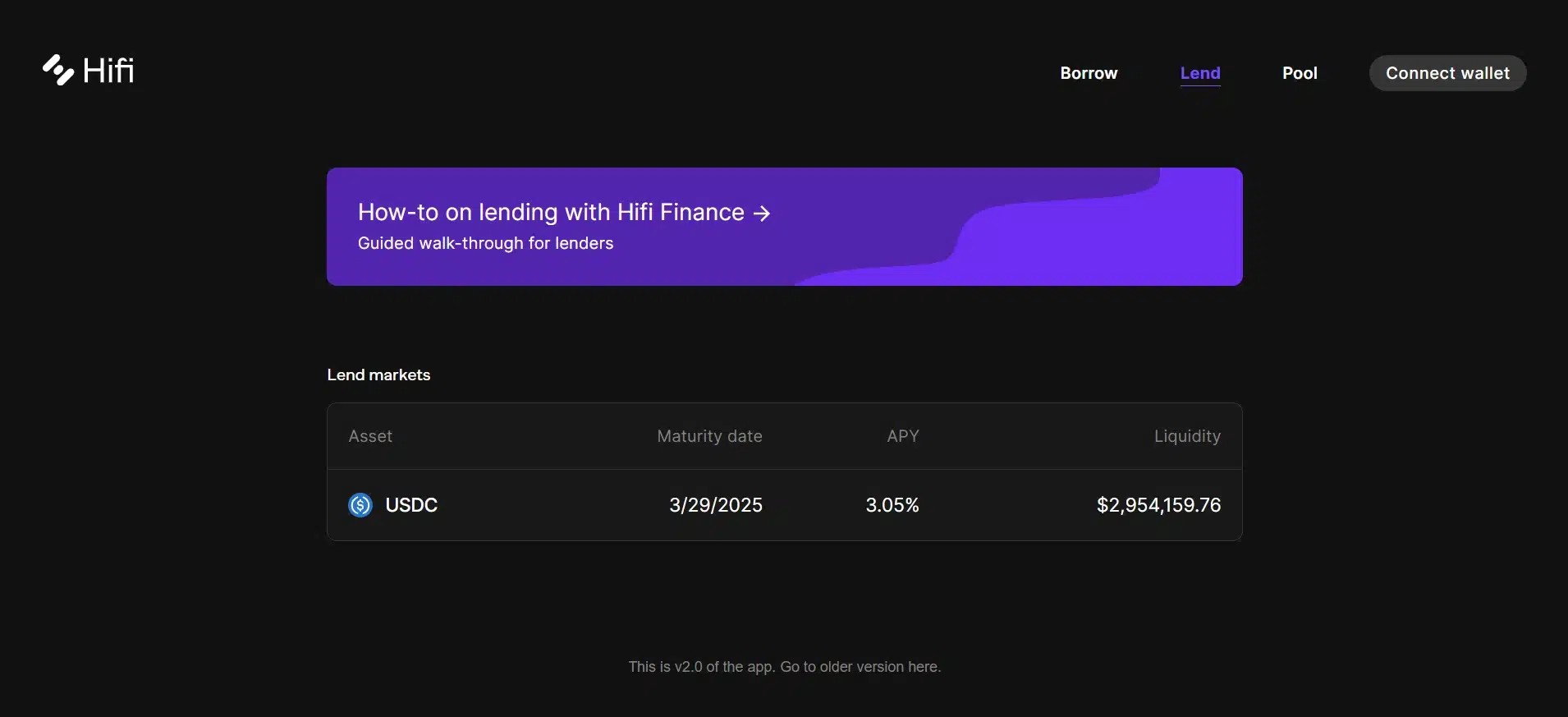

- Lending: Users can buy or mint hToken assets (e.g., hUSDC) at a discount, and the principal amount will be locked until maturity. At that time, users can exchange the assets back to the underlying tokens. They can also sell the hToken assets on the market before maturity.

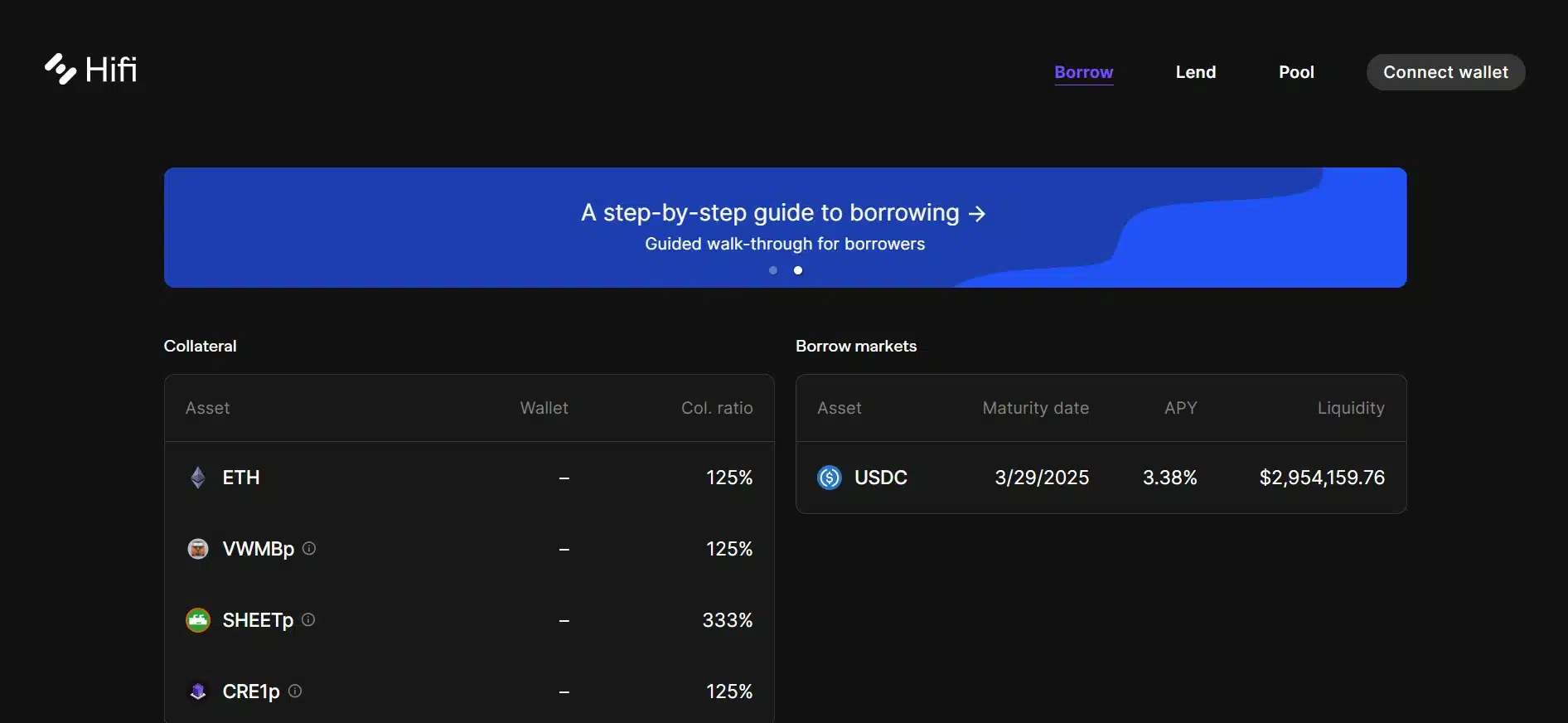

- Borrowing: Users only need to deposit collateral assets into the protocol and withdraw new hTokens based on the collateral. Then, they can sell the hTokens to receive the base tokens and lock in the borrowing rate. Hifi provides an integrated automated market maker (AMM) to facilitate efficient hToken selling. Borrowers can also repay the borrowed hTokens before maturity to exit their position.

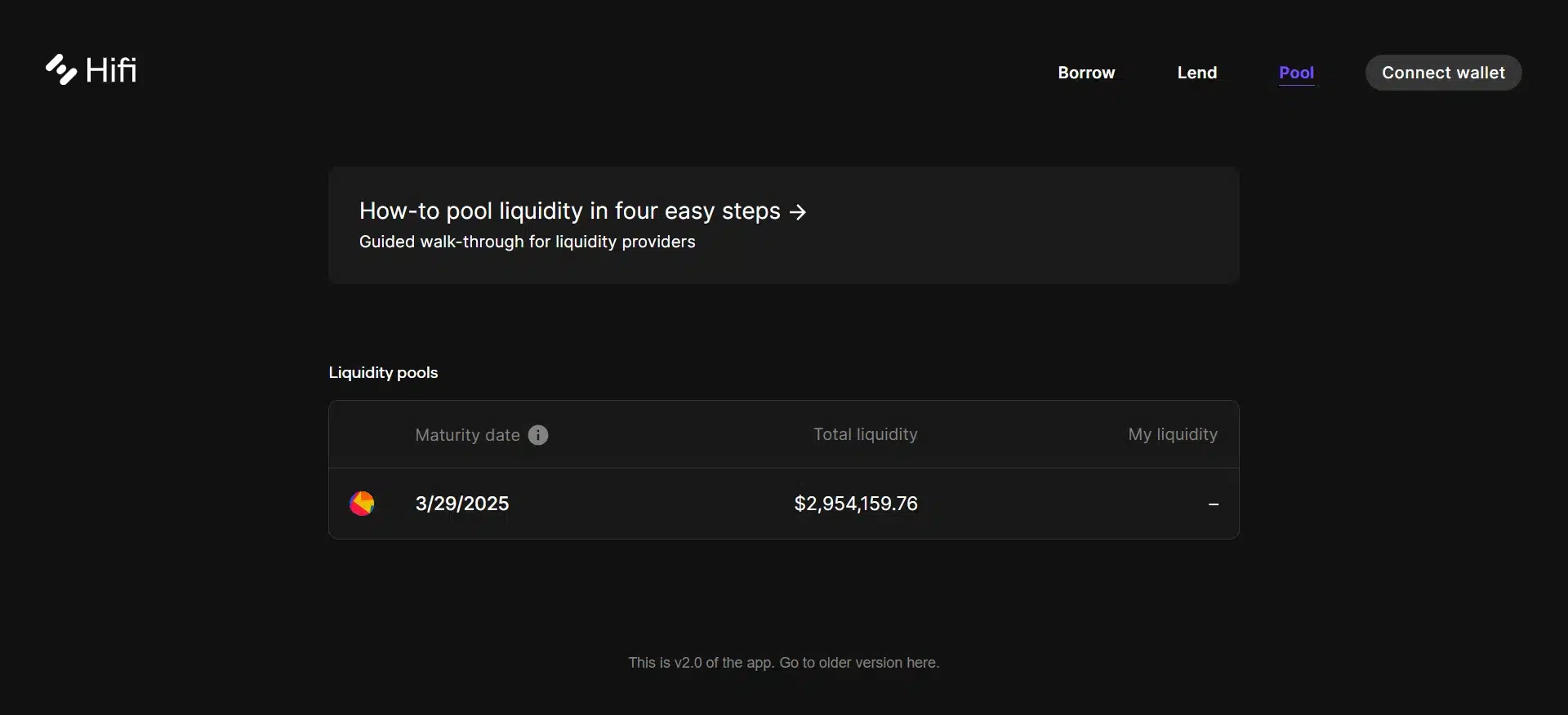

- Add liquidity: To create liquidity for lenders and borrowers to exchange between hToken assets and underlying assets, an ample liquidity source provided by users is needed. Typically, users add liquidity to the hUSDC/USDC pair in Hifi Finance’s AMM Pool.

Other Hifi Finance products

In addition to lending and borrowing services, Hifi Finance offers other products such as:

- NFT Loan: Instead of using cryptocurrencies like ETH as collateral, borrowers can use their owned NFTs to secure loans. The process is similar to collateralizing with tokens, but the difference is that if the borrower defaults, the NFT will be sold to compensate the lender’s losses. Hifi Finance is expanding and integrating several NFT projects into the protocol, such as Pawn Bots – an NFT collection on Ethereum, and Sheet Heads, an NFT project created entirely using Google Sheets.

- Real World Assets (RWAs): In addition to NFTs, Hifi Finance allows users to use Real World Assets as collateral for their loans. Currently, the value of RWA collateralization has exceeded $1 million, and the protocol’s first collateralized asset was a 1952 Volkswagen Type 2 DeLuxe Microbus owned by Kevin Bradburn, CEO of Orchard Securities, a brokerage firm and investment service provider for securities services.

Related: The Resurgence of “RWA” Token Category

What is the HIFI Token?

Basic Information

- Token Name: Hifi Finance

- Ticker: HIFI

- Blockchain: Ethereum

- Standard: ERC-20

- Contract: 0x4b9278b94a1112cad404048903b8d343a810b07e

- Total Supply: 118,730,005

Use Cases of HIFI Token

HIFI is the native token of the Hifi Finance project. In addition to being used for paying transaction fees, the token has other applications such as:

- Governance: Holders of HIFI tokens have the right to participate in DAO governance and influence the development of the protocol’s services.

- Staking: Similar to new-generation PoS protocols, HIFI owners can lock their tokens to participate in network security and receive rewards.

HIFI Token Allocation

- Airdrop: 1%

- Hifi Labs: 19.8% – Vesting over 2 years

- MFT Holder: 79.2%

Roadmap

The project’s roadmap for 2024 includes:

- Double the Real World Assets (RWAs).

- Propose and implement a plan to address the supply-side liquidity shortage (AMM Liquidity and Lenders) of Hifi.

- Upgrade the lending protocol to expand its usability.

- Address economic issues within the protocol and token.

Development Team

Doug Leonard: CEO

- Doug Leonard, the CEO of Hifi Finance, has a diverse work history before joining this project.

- In 2014, he co-founded Bettrnet, a program aimed at helping parents monitor and control their children’s phone usage and access to content. However, in 2016, Doug left his startup.

- In 2015, he worked at Weave HQ as a Senior Software Developer and Product Owner, managing a large iOS codebase and leading an Android consulting team.

- In 2017, Doug transitioned to a Software Engineer role at KiLife Tech, where he participated in building a distributed system interacting with IoT nodes, providing in-depth asset tracking and analytics information.

- Also in 2017, he co-founded Moderance, a private space similar to Instagram, allowing users to record life memories and print them into physical keepsakes.

- Currently, Doug is a Co-Founder of Married to a Startup, a podcast sharing the realities of raising a family while building a business, and serves as the Chief Executive Officer of Hifi Finance.

Josue Gomez Calderon: Software Engineer

- Josue Gomez Calderon, a Software Engineer at Hifi Finance, has had a diverse academic and professional journey.

- In 2005, he graduated with a degree in Computer Science from Universidad del Valle de México.

- Afterward, Gomez worked at Aquaclyva, starting as a Regional Sales Operations Manager and later being promoted to Chief Operating Officer.

- In 2019, he interned as a Junior Security Analyst at LDS Business College.

- Currently, Gomez is working at Hifi Finance in the role of Software Engineer II.

Investors

Updating

Project Information

- Twitter : https://twitter.com/HifiFinance

- Website : https://hifi.finance/

- Discord : https://discord.gg/uGxaCppKSH

Abubakar Rabiu shaibu from Nigeria

Weldon springs Android phone

Interested