What is Cross-chain?

When Blockchain was first developed, many envisioned it as a comprehensive solution for everything, with all transactions, smart contracts, and other features executed on a single Blockchain. However, that’s no longer feasible due to the increasing number of Blockchain platforms created with different structures, scalability limitations, and innovation constraints.

To address these issues, cross-chain technology has been developed.

Cross-chain, also known as interoperability, is a solution that enables interaction between independent blockchains, making them more interconnected. This technology allows users to transfer and exchange assets between blockchains, optimizing their connectivity and increasing the value of these assets.

How Does Cross-chain Work?

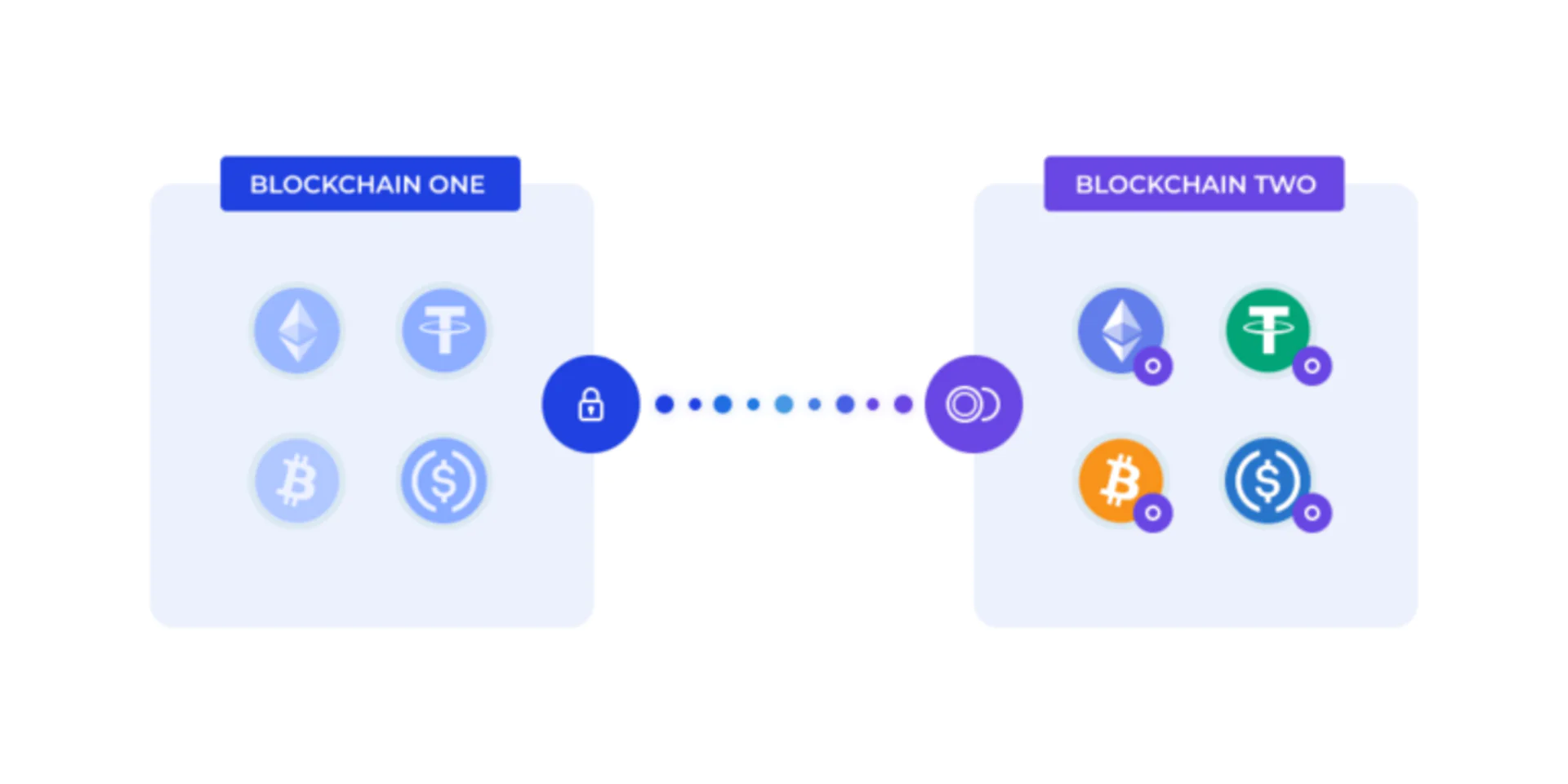

To solve the isolation problem between blockchains and allow seamless digital asset conversion, cross-chain bridge solutions have been developed. This enables connecting different blockchains and transmitting information as well as digital assets between them efficiently.

For example, when Bob wants to exchange some Bitcoin for Ethereum, he can use a cross-chain protocol to facilitate this transaction conveniently.

First, Bob’s Bitcoin is locked in a smart contract on the Bitcoin blockchain. This smart contract creates a unique hash representing the locked Bitcoin. Then, this hash is sent to a cross-chain bridge, acting as an intermediary between the Bitcoin and Ethereum blockchains.

The bridge then creates a corresponding hash on the Ethereum blockchain, representing Bob’s locked Bitcoin. Subsequently, Bob can use this hash to unlock an equivalent amount of Ethereum on the Ethereum blockchain.

Once the transaction is completed, the bridge releases the locked Bitcoin on the Bitcoin blockchain and transfers the unlocked Ethereum to Bob’s Ethereum wallet.

In this example, data and value are exchanged between two different blockchains via the cross-chain protocol, allowing Bob to convert between two cryptocurrencies without using intermediary exchanges and without worrying about the compatibility between blockchain standards and network fees.

Technologies and Basic Mechanisms

Blockchain Bridge:

These are protocols that facilitate movement between different blockchains. Bridge locks assets on one blockchain and issues corresponding tokens on another blockchain, maintaining value consistency.

Wrapped Tokens:

To make assets from one blockchain compatible with another, they are often “wrapped.” This involves creating new tokens on the target blockchain representing the original assets. Example: Wrapped Bitcoin (WBTC) is an Ethereum token representing Bitcoin.

Cross-chain Liquidity Pools:

These pools allow users to access assets from different blockchains. Liquidity providers deposit assets into these pools, and traders can exchange between them.

Oracles:

Cross-chain DeFi platforms often rely on oracles to provide real-world data and asset prices from multiple chains, ensuring accurate information for smart contracts across different chains.

Types of Cross-chain Interactions

Isomorphic Cross-chain:

Features include simple security mechanisms, consensus algorithms, network linking structures, and block validation logic, making interaction relatively straightforward and not overly complex.

Heterogeneous Cross-chain:

Interactions of this type are relatively complex, involving technologies like PoW algorithm used for Bitcoin or PBFT consensus algorithm used by Tendermint. Block components and verification mechanisms differ, making direct cross-chain interaction mechanisms not straightforward and often requiring third-party auxiliary services.

Advantages and Disadvantages of Cross-chain Technology

Advantages

- Enhanced Interoperability: Cross-chain technology facilitates communication and interaction between various Blockchain platforms, allowing platforms to leverage their unique advantages to provide a comprehensive and diverse Blockchain solution.

- Efficiency: Thanks to cross-chain technology, asset conversion between Blockchain platforms becomes more accessible. Users can experience and engage in projects and services that were previously inaccessible on their current Blockchain platform.

Disadvantages

While holding significant potential, cross-chain technology is still relatively new and not yet mature. Current cross-chain solutions often only support token swaps between Blockchain platforms and may not guarantee complete integrity and flexibility.

Individual Blockchain platforms are still in development and not yet complete. Therefore, the capabilities and performance of current cross-chain solutions are still limited. We may need to wait until Blockchain platforms become more mature and develop further to see the full potential of cross-chain technology.

Why is Cross-chain DeFi Important?

Enhanced Interactivity:

Cross-chain DeFi aims to address the significant challenge of interoperability in the cryptocurrency space. Different blockchains have unique architectures, protocols, and ecosystems. Cross-chain DeFi enables seamless asset movement between these chains, enabling efficient and diversified operations.

Risk Mitigation:

By allocating their assets across multiple blockchains, users can mitigate risks associated with relying solely on a single blockchain. This diversification can protect against network congestion, security vulnerabilities, and other issues that may arise on a specific blockchain.

Improved Scalability:

Scalability is a persistent challenge for many blockchains. Cross-chain DeFi can help alleviate this issue by distributing transactions and smart contracts across multiple chains, potentially increasing overall capacity and speed of DeFi applications.

Related: What is DeFi? Explore Decentralized Finance 2024

Forms of Blockchain Platform Interaction

Centralized Exchange Interaction:

This method utilizes centralized cryptocurrency exchanges like Binance or Coinbase. Users deposit funds onto the exchange for trading and buying/selling various cryptocurrencies. They can then withdraw funds to personal wallets after transactions. While prevalent, this method is cumbersome and not the optimal solution for blockchain interaction.

Wrapped Tokens:

Wrapped tokens are cryptocurrencies wrapped in a layer to make them operational on blockchains other than their native one. While considered a form of blockchain interaction, this solution is temporary because wrapped tokens may lack many features and application capabilities compared to their original format on the native blockchain. Projects following this interaction method are often called Bridges.

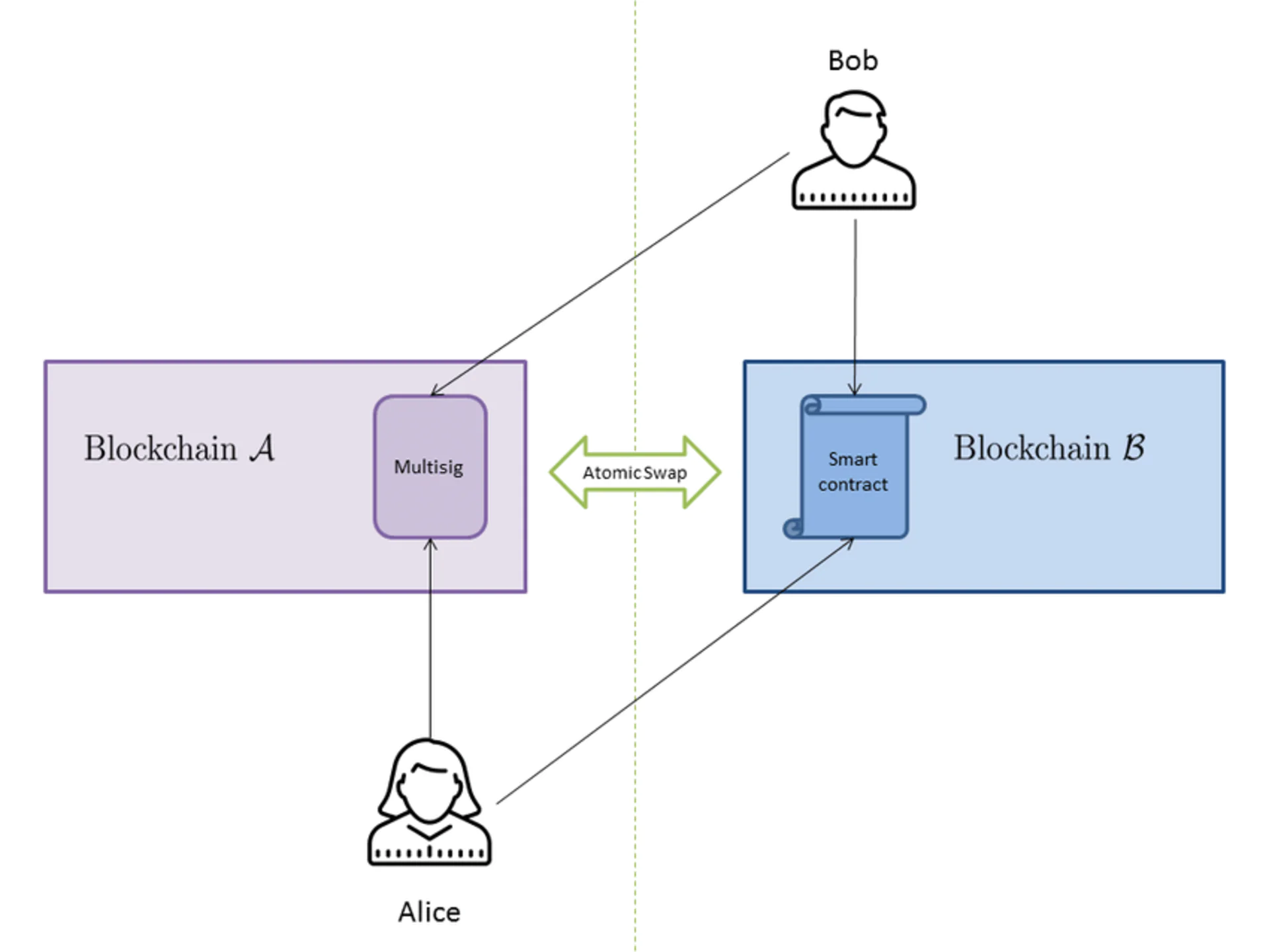

Atomic Swaps:

Atomic swaps are not considered a mainstream form of blockchain interaction because two blockchains do not directly communicate with each other. Instead, they require the use of a smart contract called Hashed TimeLock Contracts (HTLC), acting as an intermediary. This enables users to coordinate transactions across blockchains to directly exchange one cryptocurrency for another in a P2P transaction.

Prominent Cross-chain Projects

- Polkadot (DOT): Blockchain developers or decentralized applications (DApps) can create custom chains known as parachains on Polkadot. The relay chain in the network provides security and allows asset conversion between different parachains on the Polkadot network.

- Cosmos (ATOM): Cosmos’ Gravity bridge allows all Cosmos-based tokens to be represented on popular Ethereum wallets and automated market makers (AMMs), opening up a world of DeFi possibilities for the Cosmos ecosystem. Additionally, the cross-chain platform enables the conversion of ERC20 tokens to the Cosmos blockchain.

- Polygon (MATIC): Polygon’s cross-chain bridge connects Polygon’s sidechains with the Ethereum mainnet and supports the conversion of not only cryptocurrencies but also NFTs. It provides low gas fees and advanced security, as its decentralized bridge mechanism prevents easy hacks.

- Avalanche (AVAX): Users can convert tokens between AVAX and Ethereum using Avalanche’s cross-chain bridge. AVAX is considered one of the fastest smart contract platforms and one of the earliest innovators in cross-chain technology.

Conclusion

Like most things in blockchain, cross-chain bridges are still in development. While they help create a robust, flexible, and scalable blockchain ecosystem, there are still many technical and security challenges.

In the future, cross-chain technology will enhance token use cases and accelerate blockchain adoption. Besides token exchange, this technology is expected to make sharing information, payments, and resources easier. Moreover, the user experience will become smoother, such as users only needing to rely on a single wallet system. In a business environment, customers will be able to transact with companies efficiently and in real-time across different blockchains without incurring high costs.