What is Covalent?

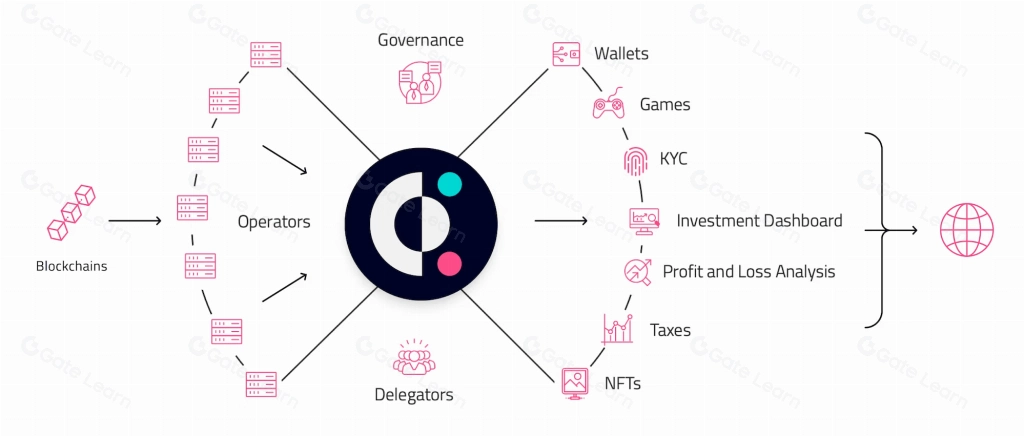

Covalent is a decentralized data infrastructure platform that offers unified APIs for developers to access data from various blockchains. Its goal is to become the go-to data provider network for Web3 projects in sectors like DeFi, NFTs, and Gaming.

Covalent extracts data from multiple blockchains, then uploads, indexes, transforms, and stores this data into a local data repository for API users to query. Throughout this process, Covalent sends proofs to Moonbeam to validate the work at each step. This approach secures and standardizes blockchain data, enabling developers to query data from any supported chain via a single unified API.

How Does Covalent Work?

Covalent’s Unified API Structure

Covalent’s unified API is a significant breakthrough, addressing the challenges of accessing blockchain data. Developers often struggle with the complexity of individual blockchains. Running public nodes or writing custom SQL queries is not only costly but also time-consuming. Moreover, indexing data can further slow down network processing. Covalent overcomes these issues by providing transparency across all blockchains through a consistent format, allowing developers to easily fetch data from any supported blockchain. For example, they only need to adjust the blockchain identifier in the API call, such as Ethereum or BNB Chain.

Unlike traditional JSON-RPC, which handles each data request individually, Covalent’s API allows querying multiple objects, eliminating the inefficiencies of previous APIs. This is crucial for diverse Web3 applications like gaming, on-chain analysis, and NFTs. Covalent also empowers developers to design custom APIs, enhancing the flexibility of Web3 applications.

A standout feature of Covalent is its compatibility with multiple blockchains through a single API, streamlining development and accelerating the launch of Web3 products. As blockchain technology penetrates industries like music, real estate, and energy, tools like Covalent’s unified API will be indispensable for realizing their full potential in Web3.

Covalent’s Operator System

Covalent involves various network components known as operators, with two primary roles currently: Block Specimen Producer (BSP) and Refiner. As of December 2023, Covalent has notable BSPs such as Chorus One, Woodstock, StakeWithUs, and Meria.

- Block Specimen Producer (BSP): Extracts raw blockchain data and creates Block Specimens. The BSP standard promises to make blockchain data aggregatable and reusable outside the on-chain execution environment. BSPs then upload Block Specimens to storage versions, create hashes, and publish proofs to Covalent’s smart contract on Moonbeam. Once the proof is on Moonbeam, other nodes can verify the BSP’s activity.

- Refiner: A processing framework designed to transform data into scalable and verifiable outputs. One possible output is a block described and returned from an RPC call to a blockchain node. Like BSPs, Refiners use cryptography to ensure that transformations are valid.

In the future, other operator roles will emerge, including Query Operators, Auditors, and Storage Operators.

- Query Operators: Load transformed data into local data repositories before responding to API queries.

- Auditors: Verify each proof for a specific stage before payment, with the network randomly selecting auditors from the total operators for data audit roles.

- Storage Operators: When BSPs upload data to storage versions, they can run those versions locally or pay Storage Operators to run them. Storage Operators are expected to enhance the availability of proof data by uploading it via IPFS and local storage.

Covalent offers a rich and robust ecosystem for accessing blockchain data, enabling developers to harness and utilize data efficiently and cost-effectively.

Features of Covalent

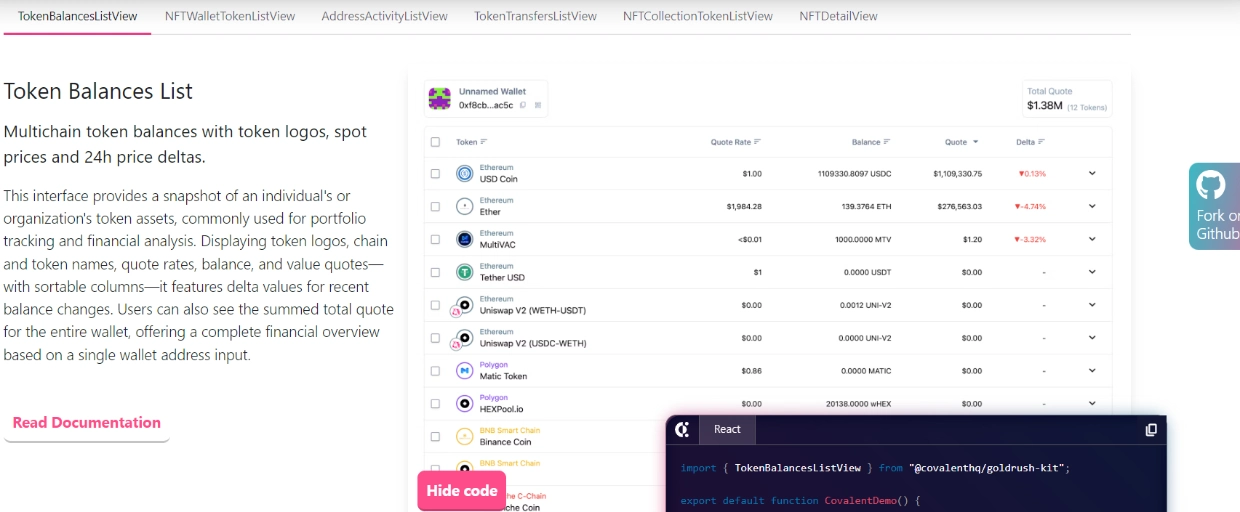

Token Balance API

The Token Balance API provides a comprehensive view of ERC-20 balances in wallets, including transactions and coin/token prices. This API supports over 100 blockchains, enhancing security by notifying approvals for high-risk assets.

NFT API

Covalent’s NFT API grants access to NFT media, metadata, and transactions, supporting over 100 blockchains. This API accelerates the integration of NFT features, reduces costs, and ensures clear transaction visibility and consistent floor prices.

Historical Transactions API

This API offers access to transaction histories across multiple blockchains, decoding complex hashes into user-friendly formats, resulting in a smoother user experience.

Crypto Taxation SDK

The SDK provides a powerful suite of APIs for crypto asset taxation solutions, standardizing data across all chains and adding user-friendly details to ensure transaction transparency.

Related: What is an NFT and how does it work?

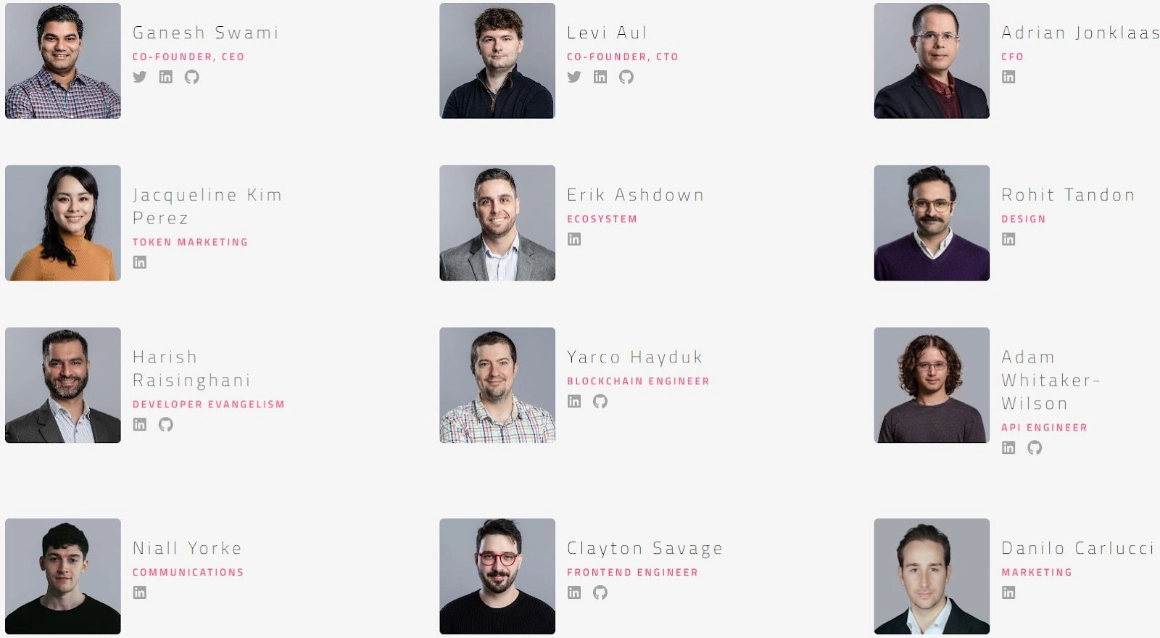

Team

Covalent is developed by a team of 30 experts in finance, blockchain, databases, and distributed systems. This team is led by two experienced technology leaders:

- Ganesh Swami – Co-Founder & CEO: Ganesh Swami is a leading blockchain data provider, entrepreneur, explorer, and prominent speaker with over 10 years of experience in database technology and bringing new products to market. His current focus with Covalent is to address major issues hindering mainstream blockchain adoption.

- Levi Aul – Co-Founder & CTO: Levi Aul built one of the first Bitcoin exchanges in Canada (Bex.io) and was part of the CouchDB development team at IBM. He has experience working on scaling solutions and other tasks at Fortune 500 companies and is the author of several open-source Erlang libraries.

Additionally, key team members include:

- Adrian Jonklaas (CFO)

- Jacqueline Kim Perez (Token Marketing)

- Erik Ashdown (Ecosystem)

Investors

Covalent has raised $5.1 million from investment funds such as Binance Labs, Coinbase Ventures, and Mechanism Capital.

What is the CQT Token?

After understanding what Covalent is, let’s explore its token, CQT.

Basic Information about CQT Token

- Token Name: Covalent

- Ticker: CQT

- Blockchain: Ethereum

- Token Standard: ERC-20

- Contract: 0xd417144312dbf50465b1c641d016962017ef6240

- Token Type: Governance

- Total Supply: 1,000,000,000 CQT

- Circulating Supply: Updating

Uses of CQT Token

- Rewards for users providing data.

- Governance voting on platform parameter changes.

- Staking for interest or becoming a validator.

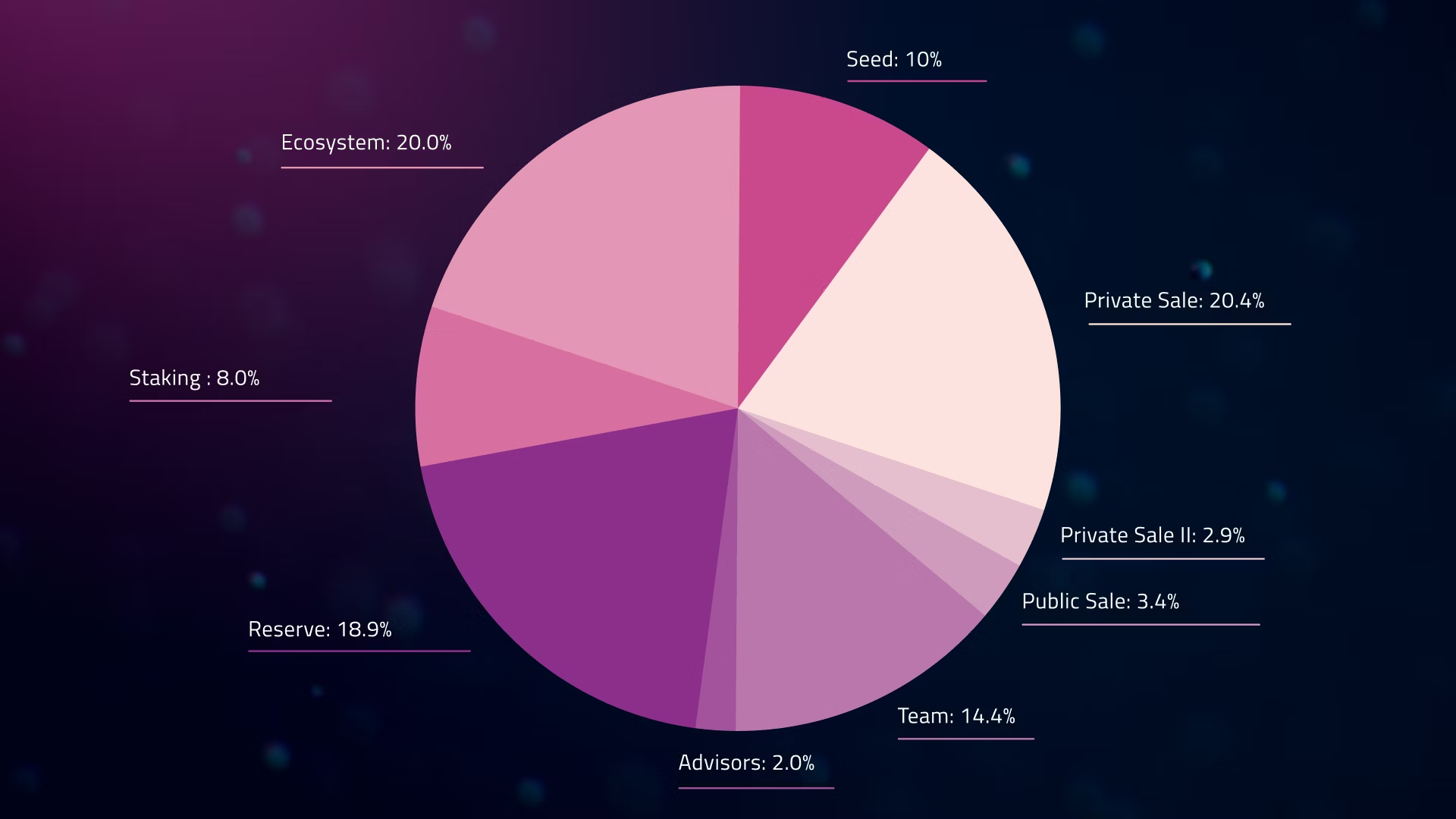

CQT Token Allocation

- Seed Sale: 10%

- Private Sale: 20%

- Private Sale 2: 3%

- Public Sale: 3%

- Team: 14%

- Advisors: 2%

- Reserve: 20%

- Staking Rewards: 8%

- Ecosystem: 20%

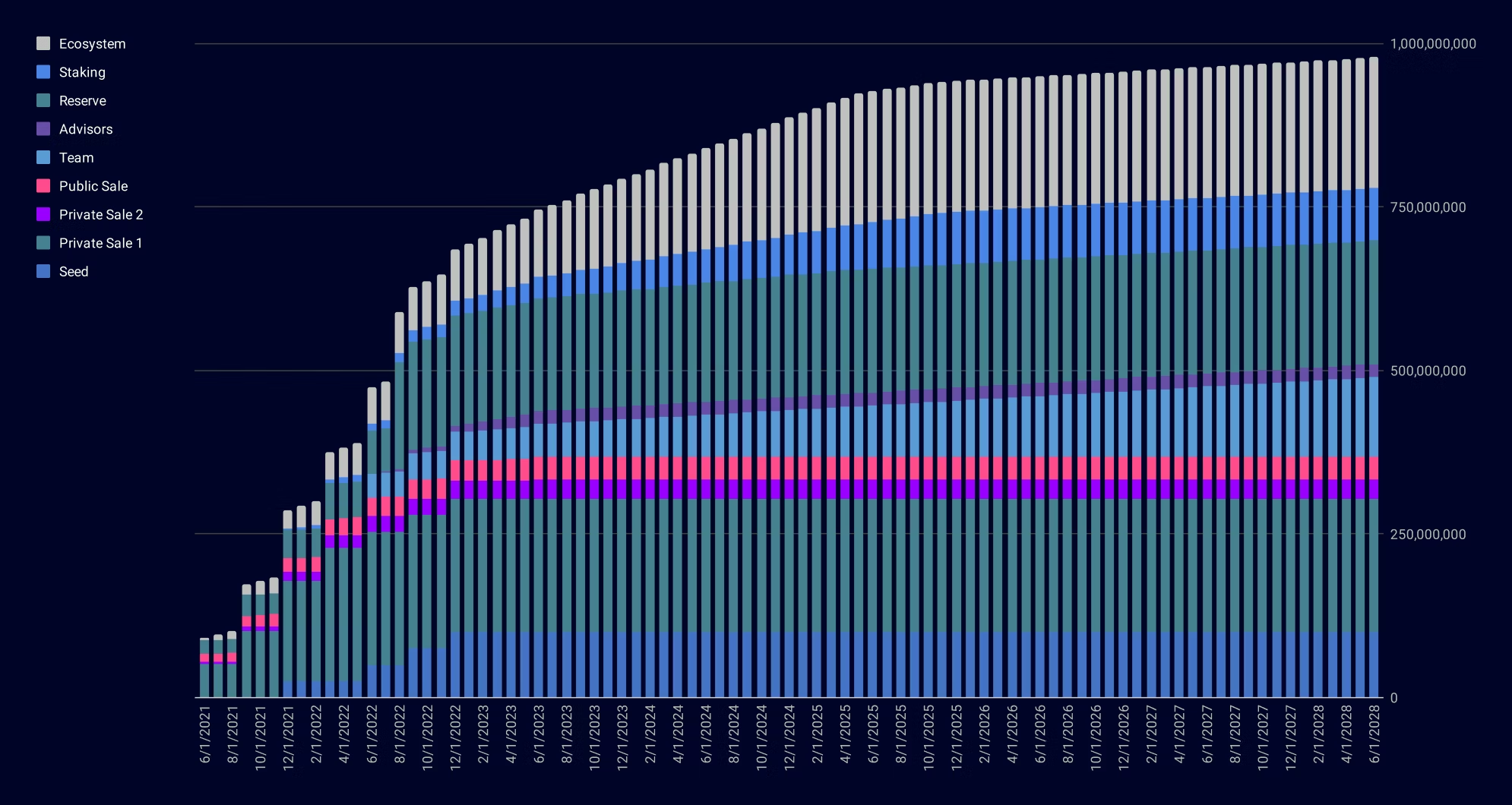

CQT Token Release Schedule

Trading CQT Token

Users can trade CQT tokens on prominent exchanges like OKX and Gate.io.

Related: What is OKX Exchange? Latest Detailed Review of OKX Platform in 2024

Roadmap

In the first quarter of 2024, Covalent has advanced AI development through the most comprehensive Web3 data set, integrated the Ethereum Wayback Machine, implemented a token buyback mechanism, supported additional chains, and organized airdrops for ecosystem projects.

Similar Projects

Covalent is part of the Blockchain Infrastructure sector, similar to projects like GRT and FIL.

Social Media Information

- Website : https://www.covalenthq.com/

- Discord : https://discord.com/invite/VHgmzB9973

- Telegram: https://x.com/covalent_hq

Conclusion

Covalent is a decentralized data infrastructure platform that provides unified APIs for developers to access data across multiple blockchains. With a vision of empowering users, Covalent leads the way in supporting Web3 solutions through its comprehensive data set.

Through this article, we hope you have a clear understanding of what Covalent and the CQT Token are. If you have any questions, please leave a comment below for prompt clarification!