What is Clearpool?

Clearpool is a decentralized lending platform launched in 2021, enabling institutional borrowers to create liquidity pools and receive unsecured loans from lenders.

Clearpool aims to build a platform that facilitates the intersection between traditional capital markets and the burgeoning DeFi ecosystem.

- Borrower: Institutions looking to secure loans. Clearpool collaborates with Credona to conduct KYC and verify these institutions before accepting them as borrowers.

- Lender: Provides capital and earns dual returns, including USDC and CPOOL tokens.

How Clearpool Works

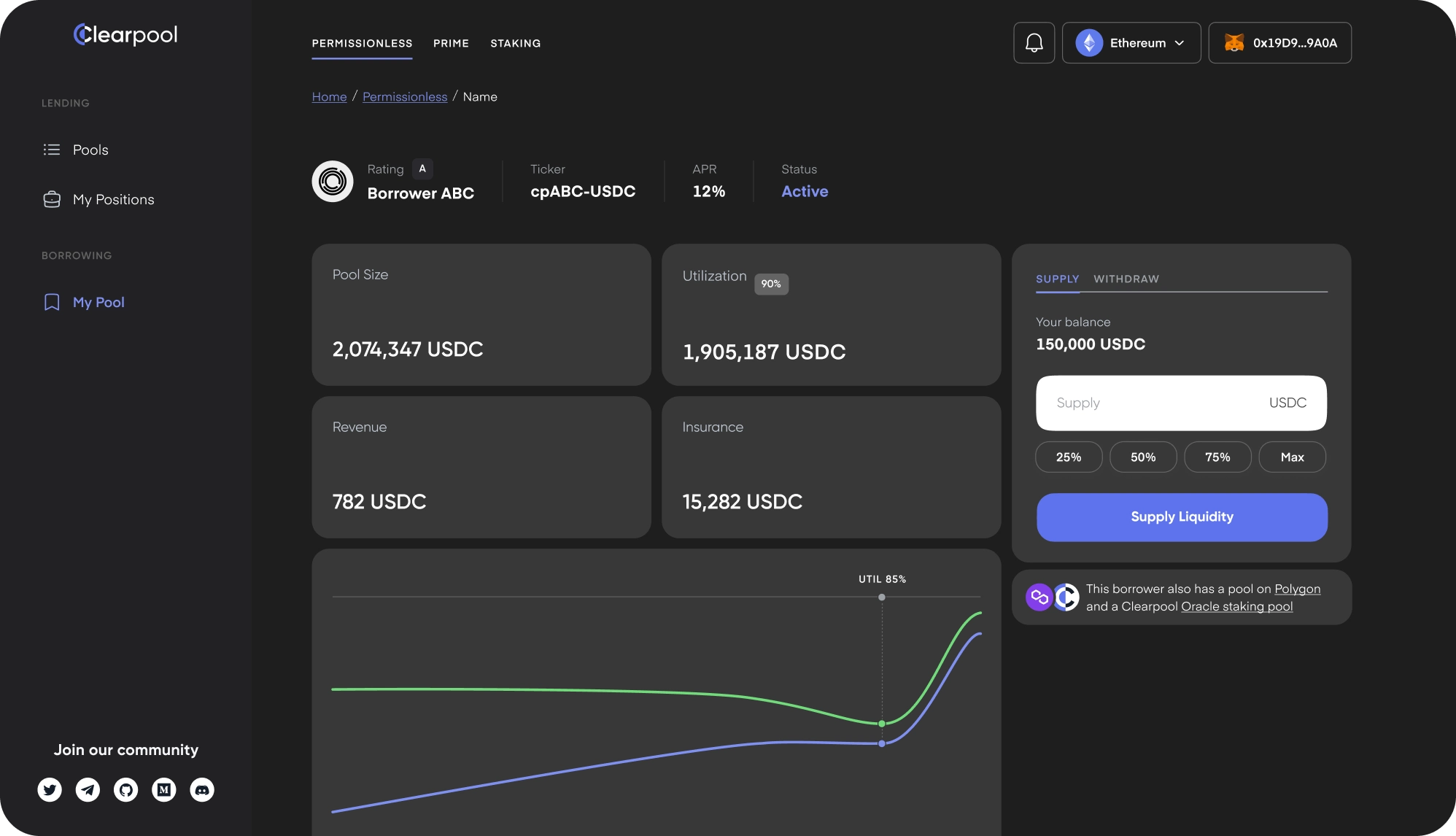

Clearpool operates similarly to other Real-World Asset projects, where both borrowers and lenders undergo thorough KYC and Anti-Money Laundering (AML) checks. Borrowers can establish liquidity pools with customized terms, while lenders gain access to high-quality institutional partners.

Whitelisted borrowers can create individual liquidity pools where interest rates vary depending on the pool’s utilization rate. The $CPOOL token is Clearpool’s native token, designed as both a utility and governance token with multiple functions. Borrowers must stake $CPOOL to open a pool, while lenders receive $CPOOL tokens as additional rewards alongside USDC interest payments.

Clearpool Oracles also need to stake $CPOOL to qualify as Oracles and can earn token rewards by participating in interest rate parameter voting. Users can delegate their $CPOOL voting power to Oracles and earn a portion of the staking rewards received by the Oracles.

Key Features of Clearpool

- Decentralized Capital Market Ecosystem: Clearpool applies decentralization principles to traditional credit market concepts, creating a decentralized capital market ecosystem.

- Capital Efficiency: Clearpool introduces liquidity pools for individual borrowers, allowing whitelisted institutions to compete for decentralized liquidity directly from the DeFi ecosystem.

- Dynamic Interest Rates: Interest rates adjust based on market supply and demand, accumulating into LP rewards through CP Token – Clearpool LP.

- Attractive Rewards: Clearpool’s liquidity providers are fairly compensated for their risk, earning additional CPOOL tokens, enhancing the overall APY to market-leading levels.

- Progressive Decentralization: As Clearpool moves towards full decentralization, CPOOL holders can propose and vote on protocol developments, fostering a bright future for the growing community.

Team

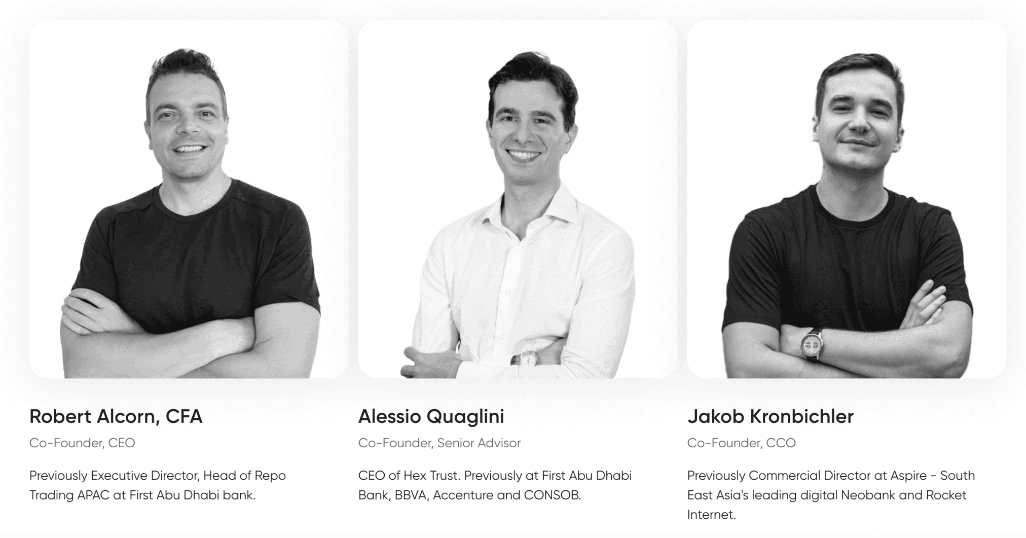

Clearpool was founded by a team of experts with experience in fintech, internet, and blockchain:

- Robert Alcorn, CFA: Former CEO and Head of Repo Trading APAC at First Abu Dhabi Bank.

- Alessio Quaglini: Co-founder and senior advisor, currently the CEO of Hex Trust, with previous roles at First Abu Dhabi Bank, BBVA, Accenture, and CONSOB.

- Jakob Kronbichler: Co-founder and COO, previously the Commercial Director at Aspire – Southeast Asia’s leading digital Neobank, and Rocket Internet.

In addition, Clearpool is supported by 12 other members from product development, marketing, and business development departments.

Investors

Clearpool successfully raised a total of $3.1 million across four funding rounds: Seed round, Private 1, Private 2, and public round on DaoMaker. Notable investors include Sequoia Capital, Arrington Capital, Sinso Global Capital, Hashkey Group, and Wintermute.

What is the CPOOL Token?

Basic Information about CPOOL Token

- Token name: Clearpool

- Ticker: CPOOL

- Token Type: Governance, Utility

- Blockchain: Ethereum

- Total Supply: 1,000,000,000

- Max Supply: 1,000,000,000

- Circulating Supply: 327,653,931

CPOOL Token Allocation

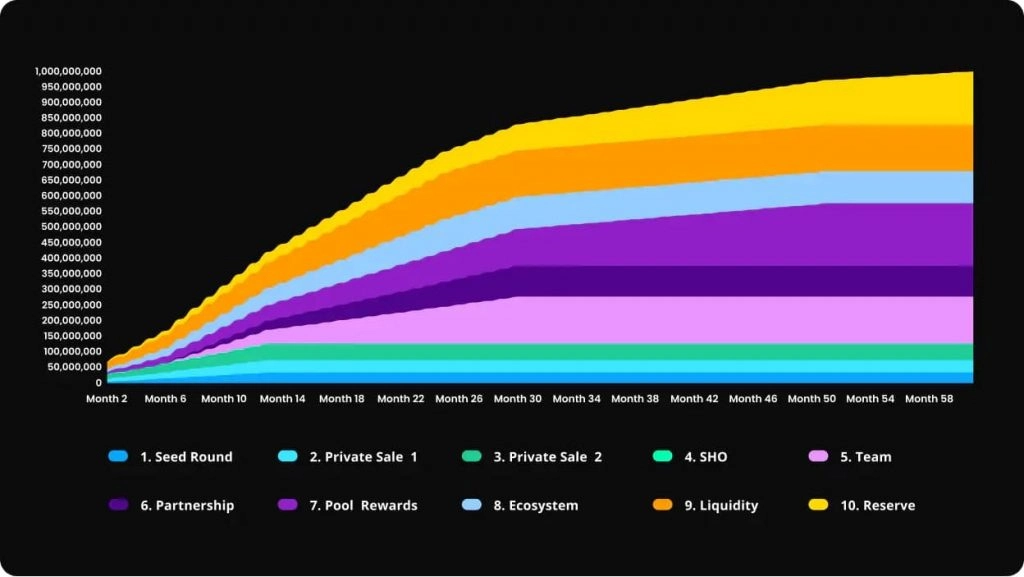

- Seed Round: 3.33%

- Private Sale 1: 4%

- Private Sale 2: 5%

- Team and Advisors: 15%

- SHO: 0.25%

- Partners: 10%

- Pool Rewards: 20%

- Ecosystem: 10.25%

- Liquidity: 15%

- Reserve: 17.17%

CPOOL Release Schedule

Functions of CPOOL Token

- Borrow Stake: New borrowers need to stake a certain amount of CPOOL to launch a liquidity pool, ensuring continuous demand for CPOOL. The staked amount remains locked for the entire duration of the pool.

- Delegated Staking: Any CPOOL holder can earn returns by staking CPOOL with Clearpool Oracles.

- LP Rewards: Liquidity providers are rewarded for supplying liquidity to borrower pools with additional CPOOL rewards, maintaining attractive lending yields on Clearpool.

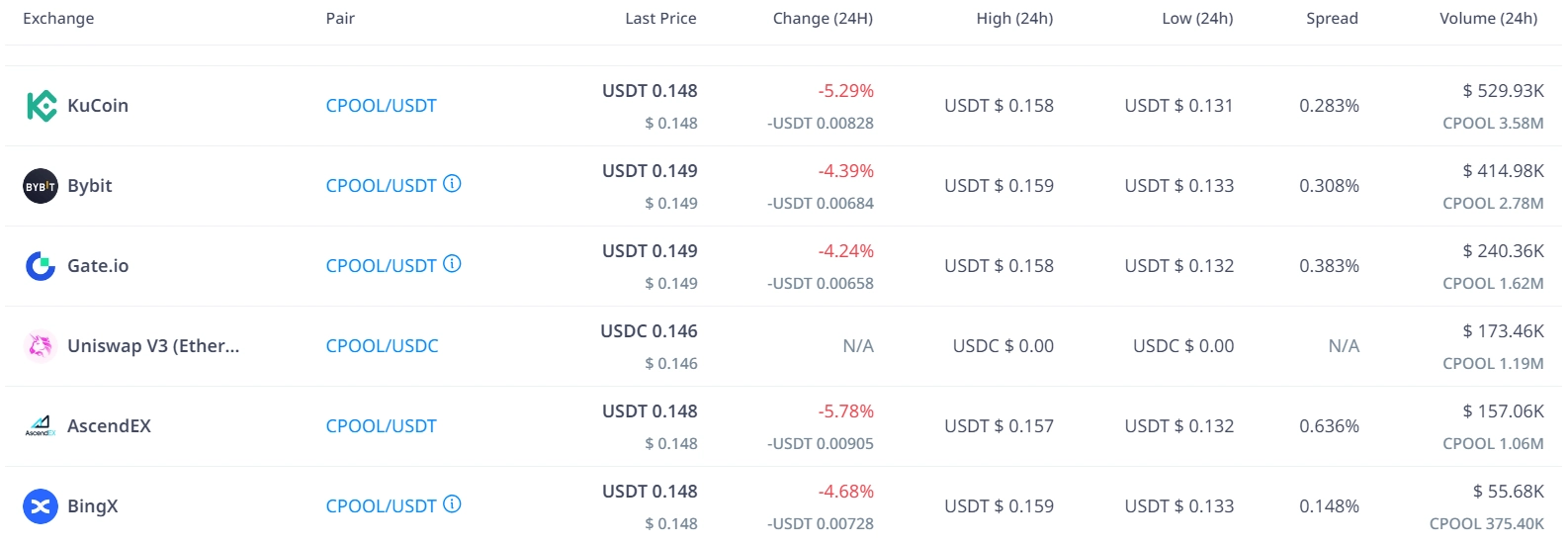

Trading CPOOL Token

Currently, CPOOL Token is traded on major exchanges such as Bybit, Kucoin, and BingX.

Roadmap

Q1 2024:

- Credit Vaults

- New Chain

- Fintech Borrowers

- New Multi-chain UI/UX

- Term Pools

Q2 2024:

- New CPOOL Staking Model & Protocol Governance

- Larger Variety of Borrowers & Credit Products

- Detailed Credit Reports

Q3 2024:

- Collateralized Lending

- Continued Multi-Chain Growth

- New Asset Support

Q4 2024:

- Clearpool Prime V2

- Exchange Traded Pools

Similar Projects

Clearpool is an RWA project similar to Chainlink and ONDO.

Related: What is Real World Assets (RWA)? Top 5 Outstanding Projects

Project Information Channels

- Website: https://clearpool.finance/

- Twitter: https://twitter.com/ClearpoolFin

- Discord: https://discord.com/invite/YYzxscA4nu

Conclusion

Clearpool is a promising blockchain project in the DeFi sector. With unique products like Clearpool Oracle and Clearpool Prime, it supports the connection between the traditional financial world and the cryptocurrency space. Built by a team of experienced professionals and backed by reputable investors, Clearpool is shaping a bright future for the decentralized capital market.

Through this article, we have introduced what Clearpool is and provided information about the CPOOL Token. If you have any questions or comments, please leave them below for immediate answers!