Binance is one of the largest cryptocurrency exchanges in the world, facilitating millions of trades every day, including a type of trading that can potentially double or even increase an account tenfold within seconds, but with extremely high risks. This is called Binance Futures. So, what is Binance Futures, and how do you play it? Let’s find out in this article.

What is Binance Futures?

Binance Futures is one of the most liquid derivative trading platforms in the market, supporting numerous cryptocurrency trading pairs and providing investors with countless profit-making opportunities. Futures trading involves entering into a futures contract to speculate on the future price (whether it will rise or fall) of a cryptocurrency without the need to directly own those assets, within a specified period. The appeal lies in the ability to predict and place orders based on the price fluctuations of a cryptocurrency, allowing you to profit in both rising and falling markets.

For example, if you predict that the price of ETH will rise within a week, you would place a Long/Buy order. At the end of the week, if the price of ETH increases, you will earn the price difference between your purchase price and the market price. Conversely, if the price of ETH decreases, you will incur a loss equivalent to the price difference.

Related: What is Binance? Binance Exchange Review 2024

How to Use Binance Futures

To start using Binance Futures, you need to open a Binance Futures account, which requires having a Binance account. If you don’t have one, you can follow the registration instructions here or visit Binance and click on “Register” at the top right corner of the screen. Then, follow these steps:

- Open a Binance Account: Enter your email address and create a secure password. If you have a referral ID, paste it into the referral ID box. Click “Create Account” to proceed.

- Verification: You will soon receive a verification email. Follow the instructions in the email to complete your account registration.

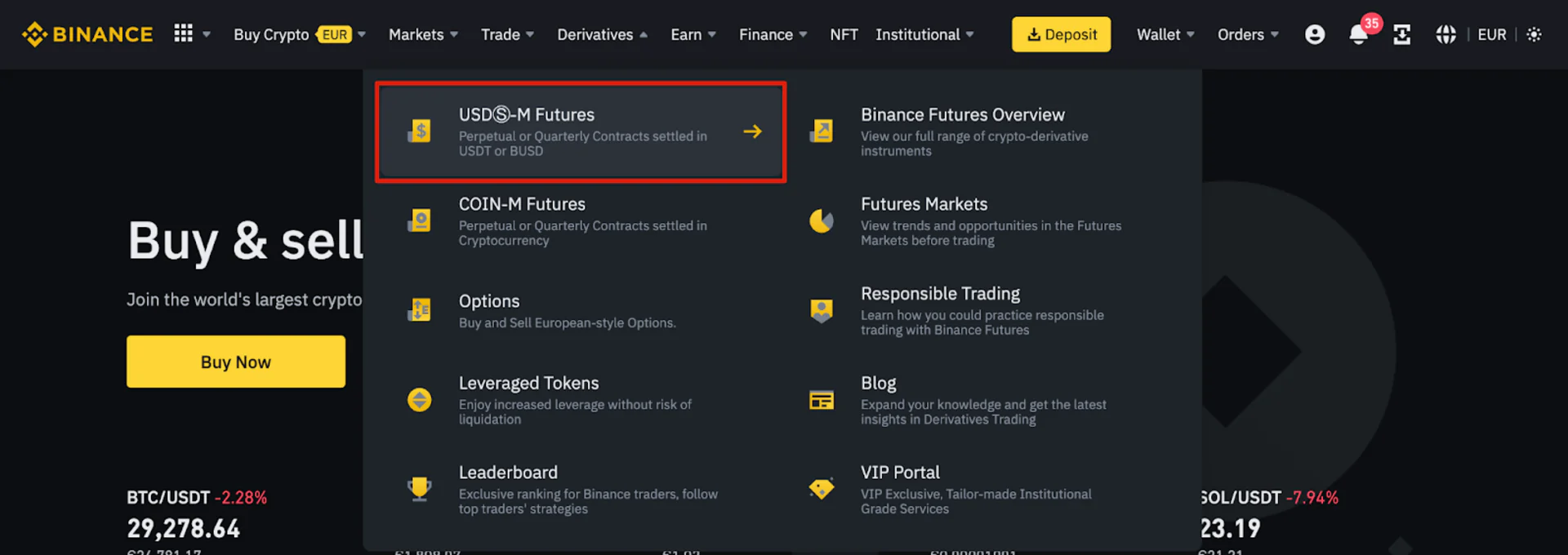

- Access Binance Futures: After logging into your Binance account, hover over the menu at the top and click on “Futures” under “Derivatives“.

- Activate Binance Futures Account: Click on the “Open” button to activate your Binance Futures account. Now you can start trading Futures contracts on Binance. However, it’s advisable to prepare and enhance your knowledge before responsibly using the product.

How to Play Binance Futures

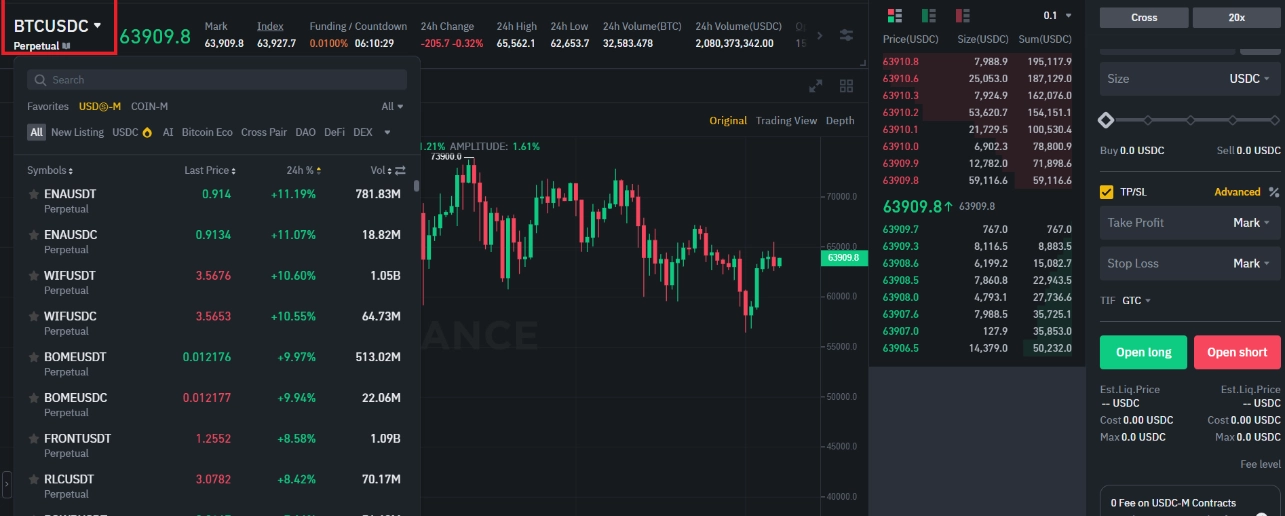

- Understanding the Interface: The Binance Futures interface provides various sections for trading and monitoring your positions.

- Menu Area: Here, you’ll find links to different Binance pages like Futures Contracts, Options, Trading Strategies, and Activity. The “Info” tab includes links to FAQs about Futures Contracts, API Access, Funding Rate, Index Price, and other market data.

- Account Overview: On the top right corner, you can access your Binance account. You can check your wallet balances and all your orders across the Binance ecosystem.

- Price Chart: In this section, you can:

- Choose a contract by hovering over the current contract name (default is BTC/USDT).

- View Mark Price, crucial for liquidation, and the countdown to the next funding round.

- Access your current chart. You can switch between the original TradingView chart or the integrated one.

- See the real-time order book depth by clicking on “Depth.”

- View live trade data directly from past transactions on the platform.

- Trading Activity Panel: This panel allows you to monitor your Futures Contract trading activity. You can switch between tabs to see your current position status, as well as your open and past orders. You can also view your entire trading history and trades within a specific time frame. This section also shows your position in the automatic deleveraging queue, particularly important during high market volatility.

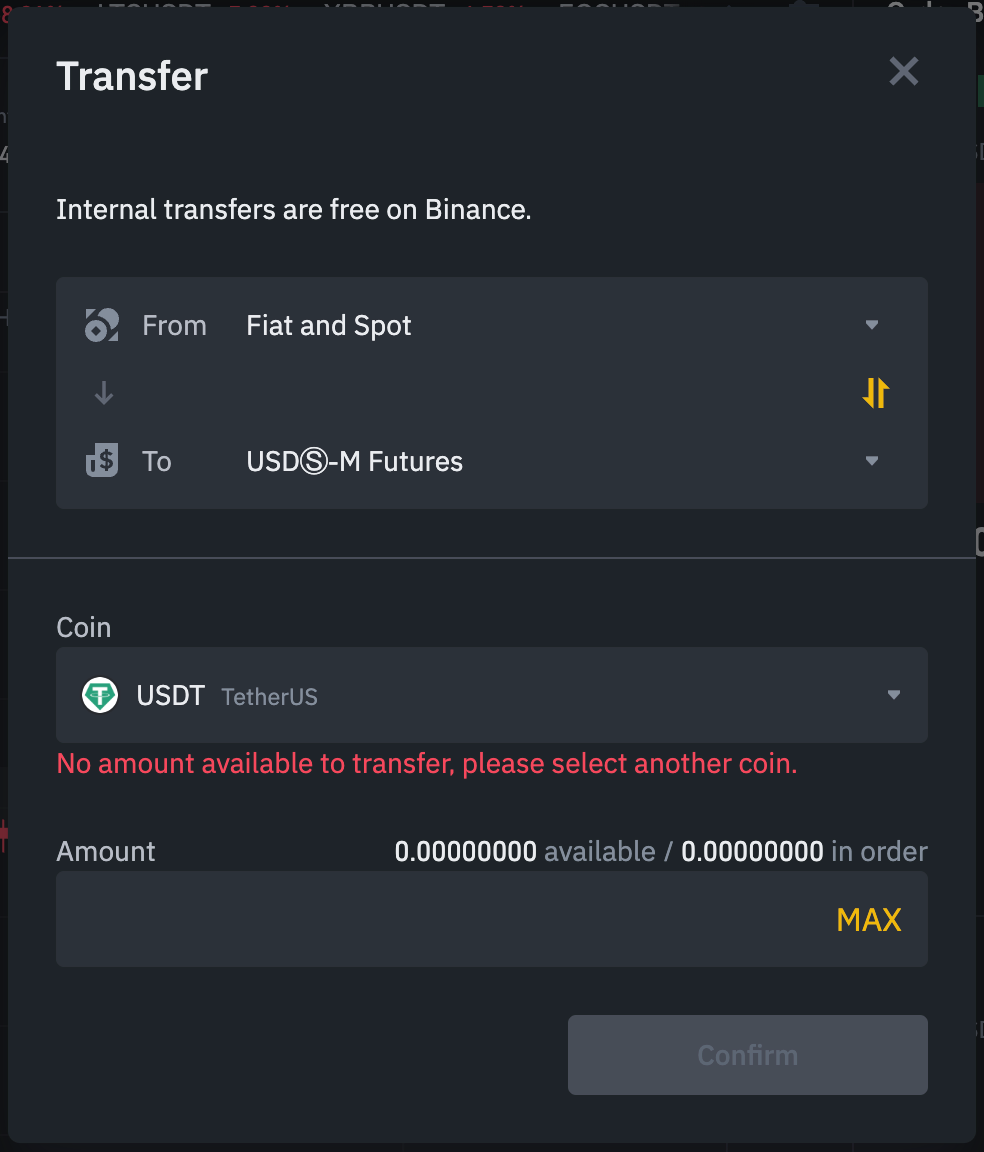

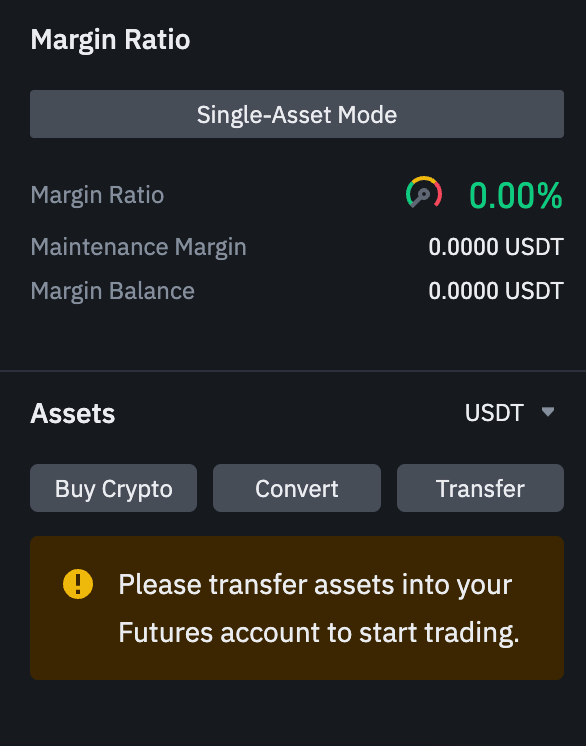

- Asset Overview and Funding: Here, you can view your current assets, transfer, and purchase additional cryptocurrencies. You can also see information related to the current contract and your positions. Always keep an eye on the margin ratio to prevent liquidation. By clicking “Transfer,” you can move funds between your Futures Wallet and the rest of the Binance ecosystem.

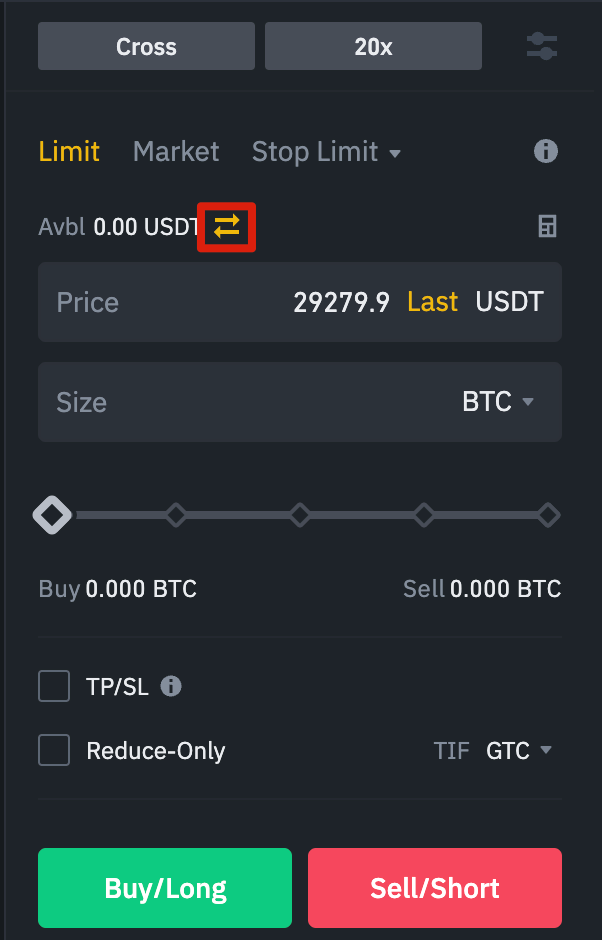

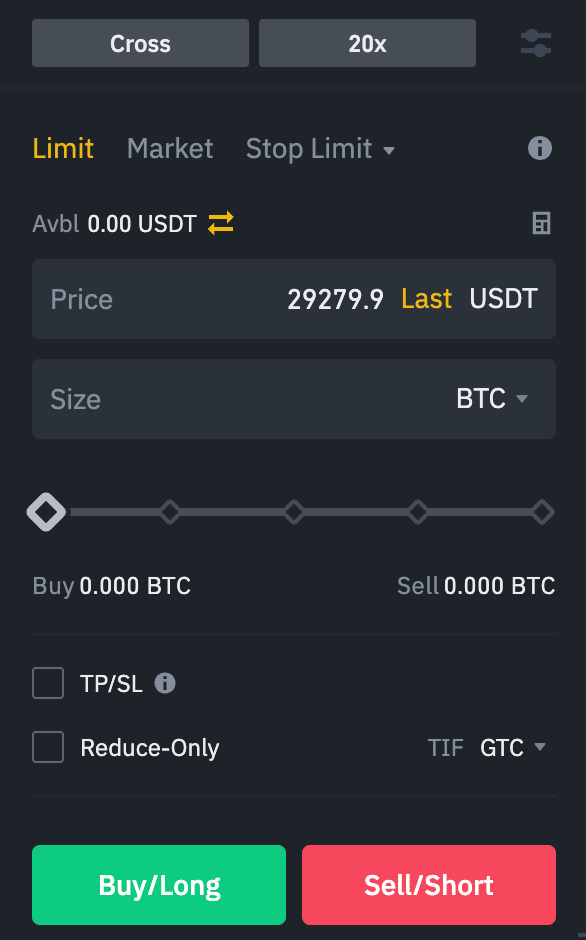

- Order Placement: The “Order Entry” field is where you enter Buy/Long and Sell/Short orders. You can find detailed explanations of the available order types in subsequent sections. You can also switch between Cross Margin and Isolated Margin at the top of the view mode. If you want to adjust leverage, click on your current leverage level (default is 20x).

How to Adjust Leverage in Binance Futures

Binance Futures allows you to manually adjust leverage for each contract. To select a specific contract, navigate to the top left of the page and hover over the current contract (default is BTC/USDT).

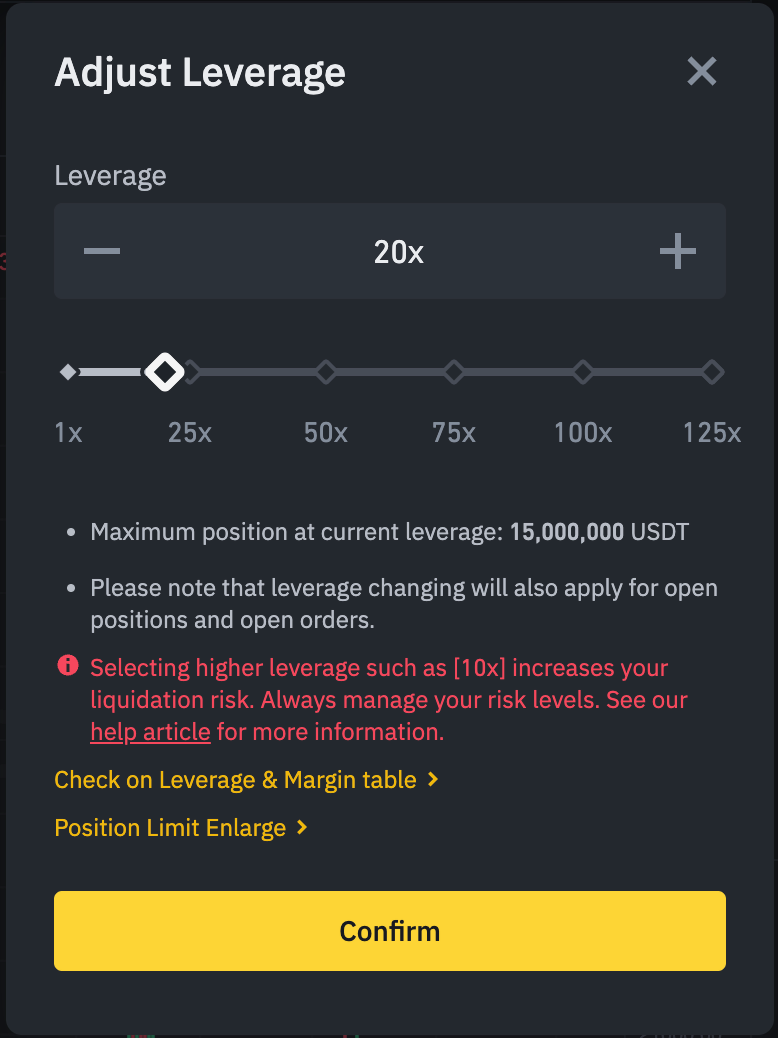

To adjust leverage:

- Go to the “Order Entry” section and click on your current leverage level (default is 20x).

- You can specify the leverage level by adjusting the slider or by entering it manually and clicking “Confirm“.

Keep in mind that the larger the position size, the smaller the leverage you can use. Similarly, the smaller the position size, the larger leverage you can use. Using higher leverage also entails higher liquidation risk.

As always, traders should carefully consider the leverage they use and the associated risks.

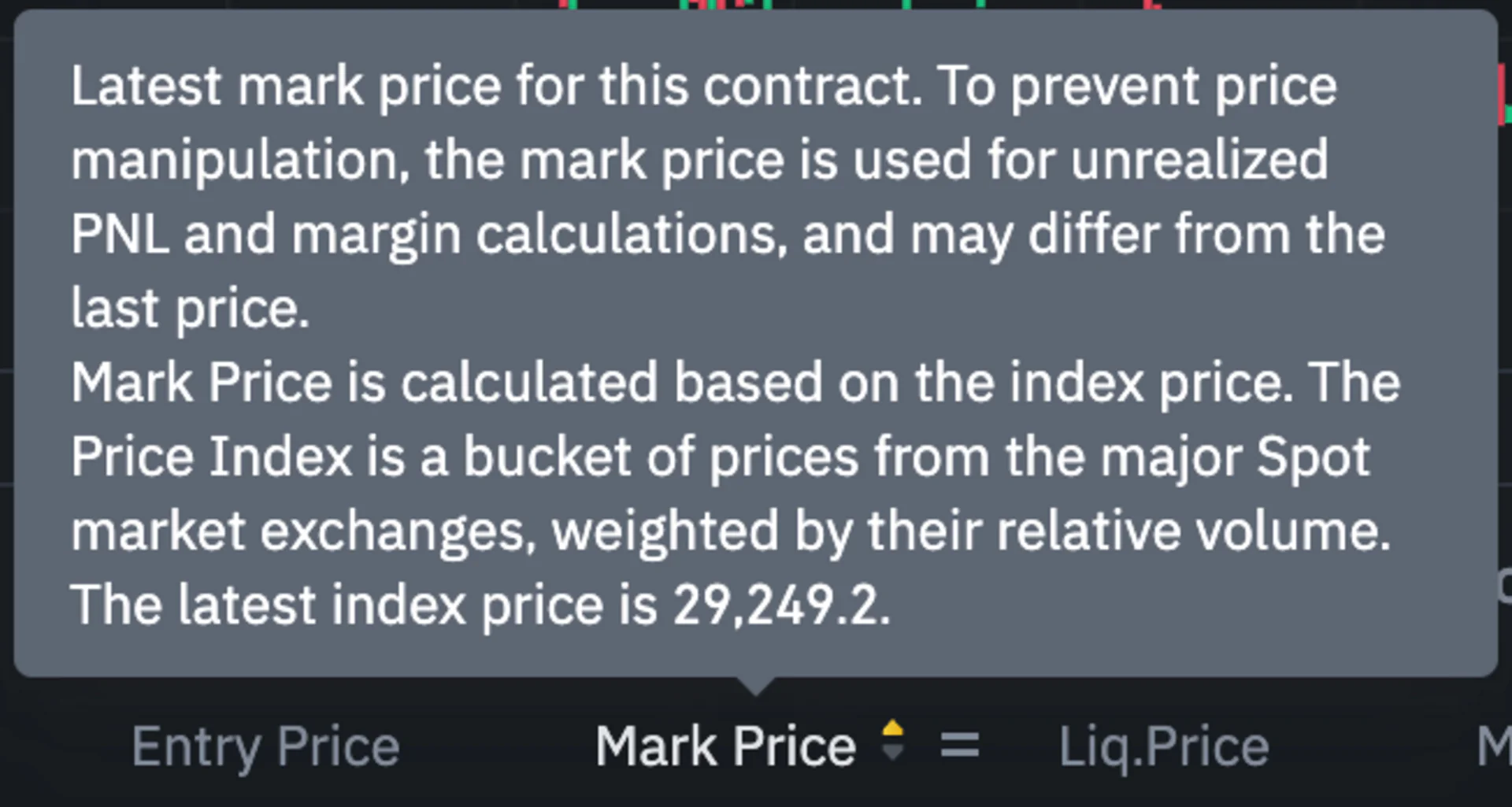

Difference between Mark Price and Last Price

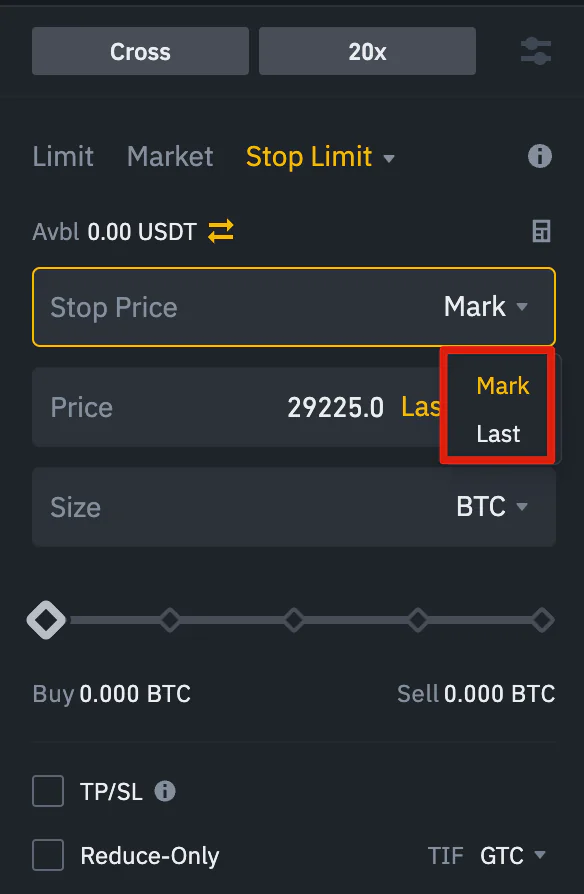

To avoid sudden spikes and unnecessary liquidations during periods of high volatility, Binance Futures uses the last price and mark price.

- Last Price: It’s straightforward. It signifies the final price at which a contract was traded. In other words, the last trade in the trading history determines the last price. It’s used to calculate your realized Profit and Loss (PnL).

- Mark Price: It’s designed to prevent price manipulation. It’s calculated using a combination of funding data and price data from multiple immediate trading platforms. Your liquidation price and unrealized PnL are calculated based on the mark price.

Note: The mark price and last price can differ.

When placing an order type using a stop price as the activation level, you can choose either the last price or the mark price as the activation level. To do this, select the price level you want to use in the “Activation” dropdown menu at the bottom of the order entry field.

When is your position at risk of liquidation?

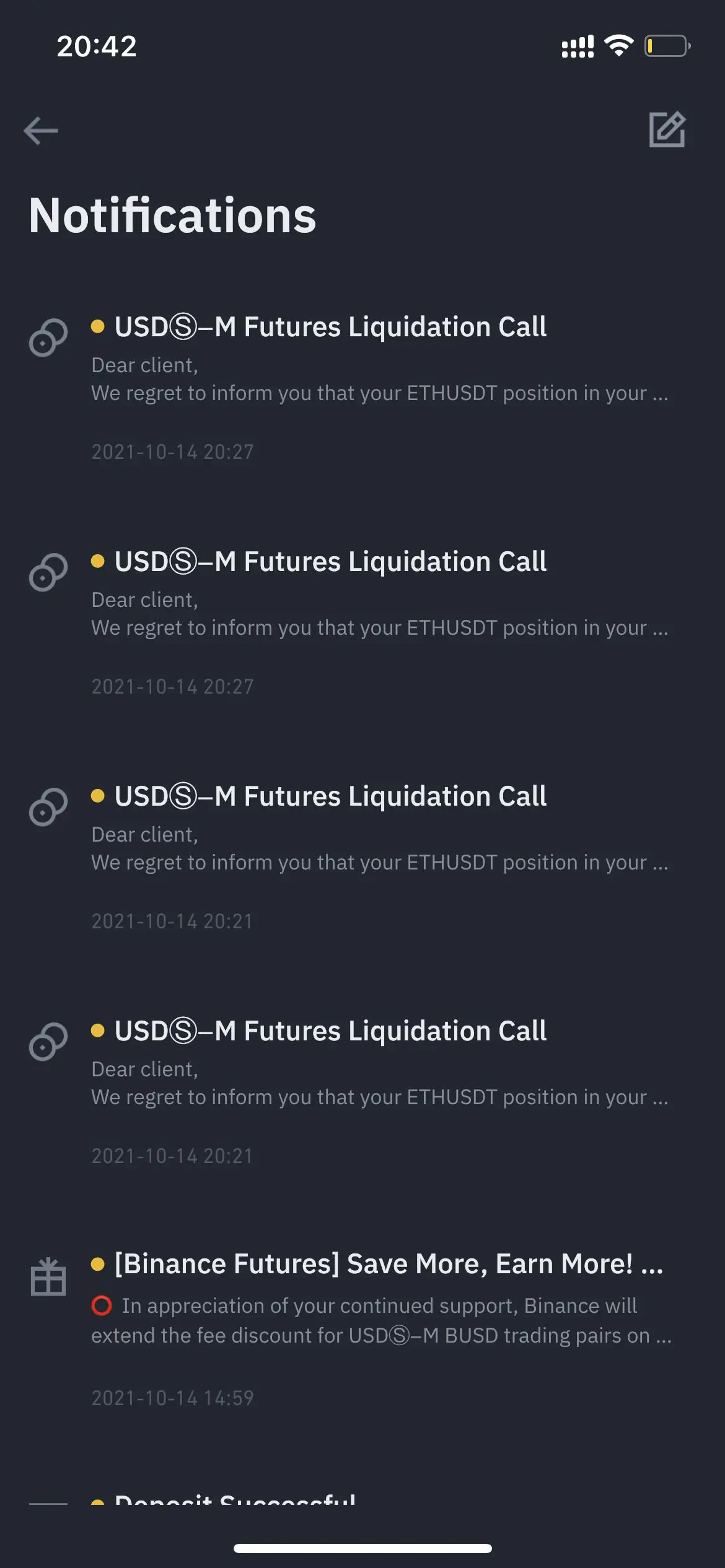

Liquidation occurs when your available balance drops below the required maintenance margin. The available balance is the balance in your Binance Futures account, including your unrealized PnL. Therefore, your profit and loss affect the value of your available balance. If you’re using Cross Margin mode, this balance is shared across all your positions. If you’re using Isolated Margin mode, this balance may be allocated to each individual position.

The maintenance margin is the minimum value you need to maintain your position. It varies depending on the size of your position. Larger positions require higher maintenance margin.

You can check your current margin ratio in the bottom right corner. If your margin ratio reaches 100%, your position will be liquidated.

When liquidation occurs, all your open orders will be canceled. It’s best to monitor your positions to avoid automatic liquidation, which comes with an additional fee. If your position is close to being liquidated, consider closing the position manually instead of waiting for automatic liquidation.

Conclusion

Above is all the information about what Binance is and how to play Binance Futures. You should note that Binance Futures is a double-edged sword, capable of quickly bringing in huge profits but also carrying considerable risks. Consider carefully before participating in Futures trading, equip yourself with sufficient knowledge, and it’s never too late to start.