1. What is Berachain?

Berachain is a high-performance Layer 1 blockchain that is fully EVM-compatible, utilizing the Proof-of-Liquidity (PoL) consensus mechanism and built on BeaconKit, a modular framework focused on EVM execution environments.

The Berachain project originates from the team behind the Bong Bears NFT collection, which was previously heavily promoted by Olympus DAO. While Berachain and Bong Bears share the same founding team, they are separate and independently developed projects.

On February 6, 2025, Berachain will officially launch its mainnet and list the BERA token on major exchanges such as Binance, OKX, Bybit, and many others.

Related: Binance Announces Listing of Berachain (BERA) on February 6, 2025

2. How Does Berachain Work?

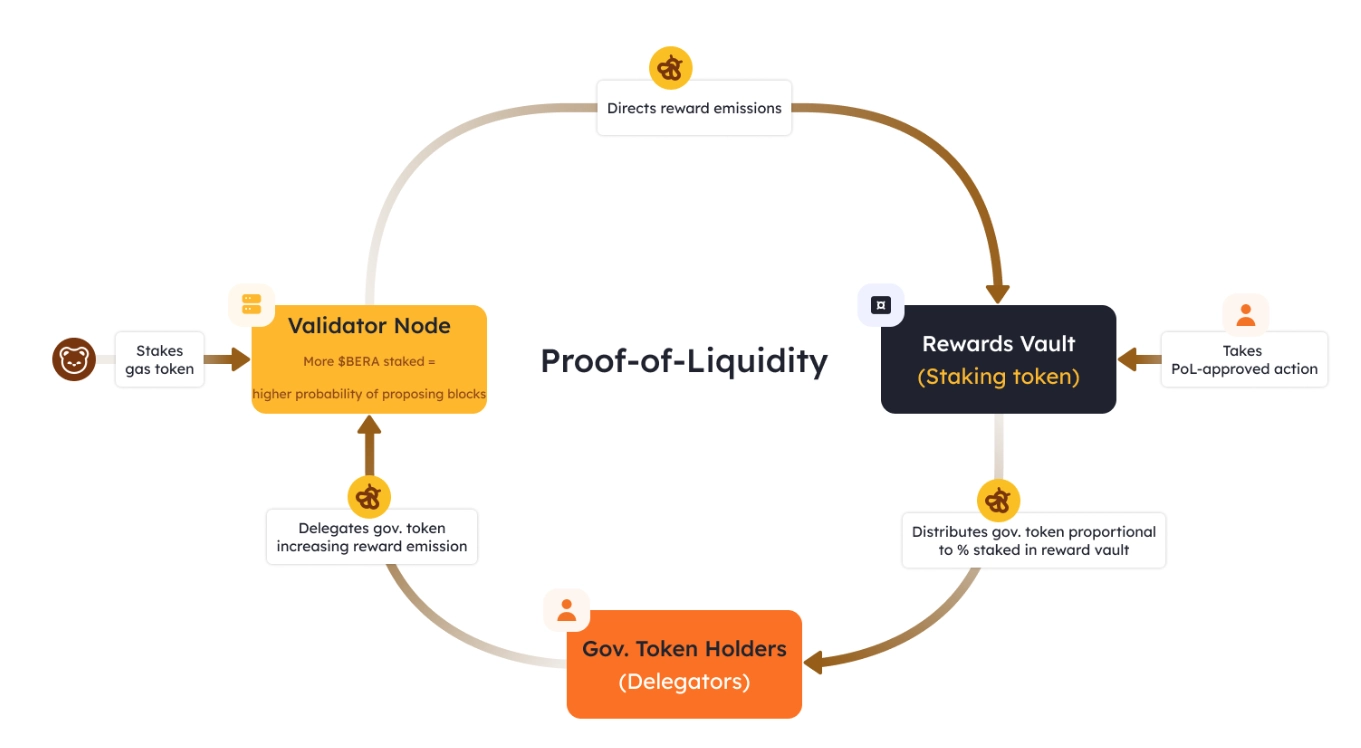

2.1. Proof of Liquidity (PoL)

Proof of Liquidity (PoL) is designed to incentivize liquidity provision on Berachain. When users participate in liquidity pools within Berachain’s DeFi protocols, Liquidity Providers (LPs) earn BGT tokens as rewards.

BGT is the only token that can be staked to delegate voting power to validators, allowing them to generate new blocks in proportion to the amount of delegated BGT. Additionally, validators can use BGT to vote on future BGT inflation rates for any liquidity pool on Berachain.

Initially, only core Berachain protocols such as BEX, Berps, and Bend will qualify for the PoL system. However, once the mechanism proves stable, Berachain will expand PoL eligibility to all smart contract liquidity pools, further strengthening its ecosystem.

2.2. BeaconKit

BeaconKit is an advanced framework that enables the CometBFT consensus algorithm to function within any EVM execution environment. In other words, BeaconKit serves as a modular consensus layer adaptable to Ethereum-based blockchains.

This system is designed with a high degree of modularity, allowing for expansion through various layers such as:

- Custom block builders

- Rollup layers

- Data availability layers

- Other specialized components

As a result, BeaconKit not only supports Layer 1 blockchain development but also serves as a robust framework for Layer 2 solutions.

A blockchain built on BeaconKit offers several advantages (assuming the default configuration with an EVM execution client):

- Near-instant finality – Transactions are confirmed in just one slot, compared to Ethereum’s ~13 minutes.

- Faster block processing – The Optimistic payload building mechanism allows block proposals to occur in parallel with voting, reducing block production time by up to 40%.

- Ethereum 2.0 modularity compliance – Aligns with the Ethereum modular roadmap.

- Full support for Ethereum Improvement Proposals (EIPs) – Ensures maximum compatibility with the Ethereum ecosystem.

3. Team

Most core team members remain anonymous, with limited publicly available information on:

- Smokey The Bera (CEO & Co-Founder)

- Homme Bera (Co-Founder)

- Dev Bear (CTO & Co-Founder)

Notably, Dev Bear previously worked at Apple, while other team members have backgrounds at Terraform Labs (Luna) and Amazon.

4. Investors

Berachain successfully raised $142 million across two funding rounds:

- Series A (April 20, 2023): Raised $42 million, led by Polychain Capital, with participation from Tribe Capital, Robot Ventures, Hack VC, Shima Capital, and others.

- Series B (April 12, 2024): Raised $100 million, led by Framework Ventures and Brevan Howard, with backing from Polychain Capital, HashKey Capital, Tribe Capital, Arrington XRP Capital, Sandeep Nailwal, Hypersphere Ventures, and SamsungNext.

5. Berachain Airdrop

At TGE (February 6, 2025), Berachain will conduct an airdrop for testnet participants, KOLs, and NFT holders.

The airdrop has received mixed reactions, particularly from early testnet participants. However, Berachain strategically airdropped tokens to KOLs, helping mitigate FUD and ensuring strong community support.

6. Berachain Ecosystem

Berachain has built a strong and diverse ecosystem spanning multiple sectors, including:

- DeFi: Beradrome, Aori, Honeypot Finance,…

- NFTs: Bera Collective, Bera Punks, Beranames,…

- Gaming: Gamblino, Wizzwoods, BOINK,…

- Infrastructure: Shogun, Infrared, Hyacinth

- DAOs: MijaniDao, Apiology DAO, notrealDAO,…

7. Berachain’s Token Model

Berachain introduces a three-token model:

- $BERA – Native token for transaction fees and staking to generate $BGT.

- $HONEY – An over-collateralized stablecoin (150%) minted using assets like BTC, ETH, and alternative Layer 1 tokens. It provides liquidity for the consensus layer and serves as collateral for derivative minting on Perp Dex.

- $BGT – Non-transferable governance token, exclusively minted by staking $BERA.

8. BERA Token Overview

8.1. Basic Information

- Token Name: Berachain

- Token Symbol: BERA

- Blockchain: Berachain

- Listing Date: February 6, 2025

- Total Supply: 500,000,000

- Max Supply: Unlimited (10% annual inflation)

- Circulating Supply: 107,480,000 BERA (21.5% of total initial supply)

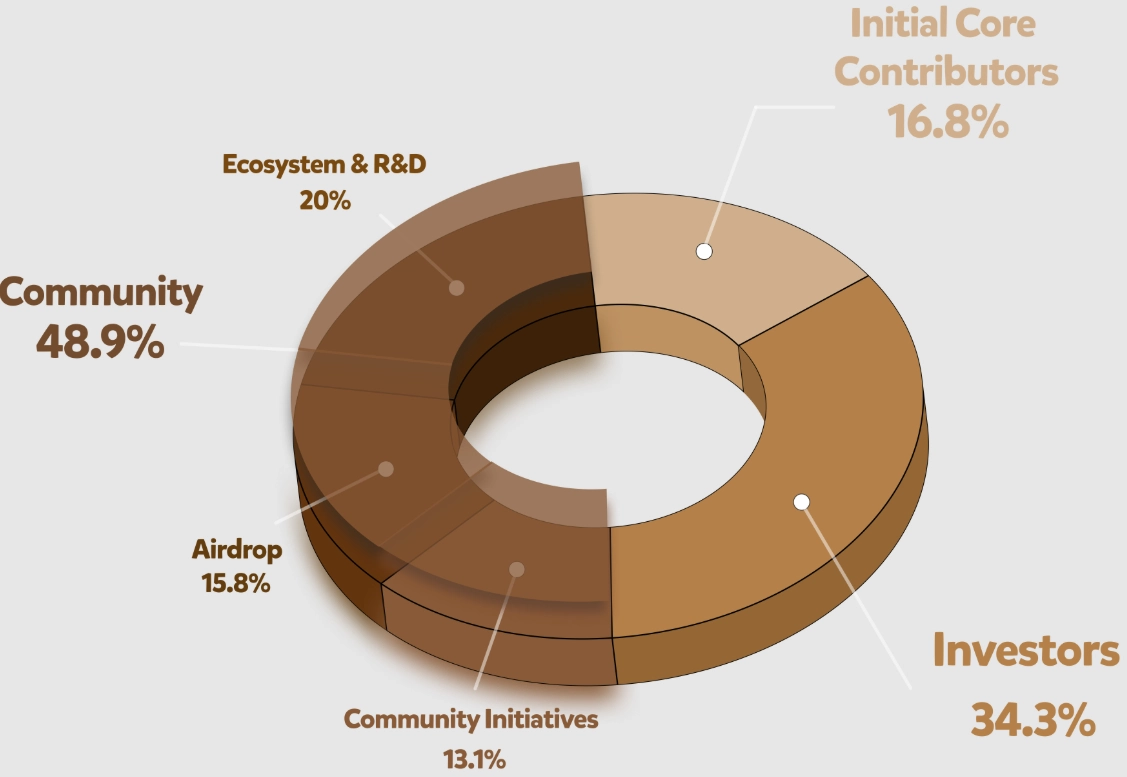

8.2. Token Allocation

- Initial Core Contributors: 84,000,000 (16.8%)

- Investors: 171,500,000 (34.3%)

- Community Allocations: 244,500,000 (48.9%)

- Airdrop: 79,000,000 (15.8%)

- Future Community Initiatives: 65,500,000 (13.1%)

- Ecosystem & R&D: 100,000,000 (20%)

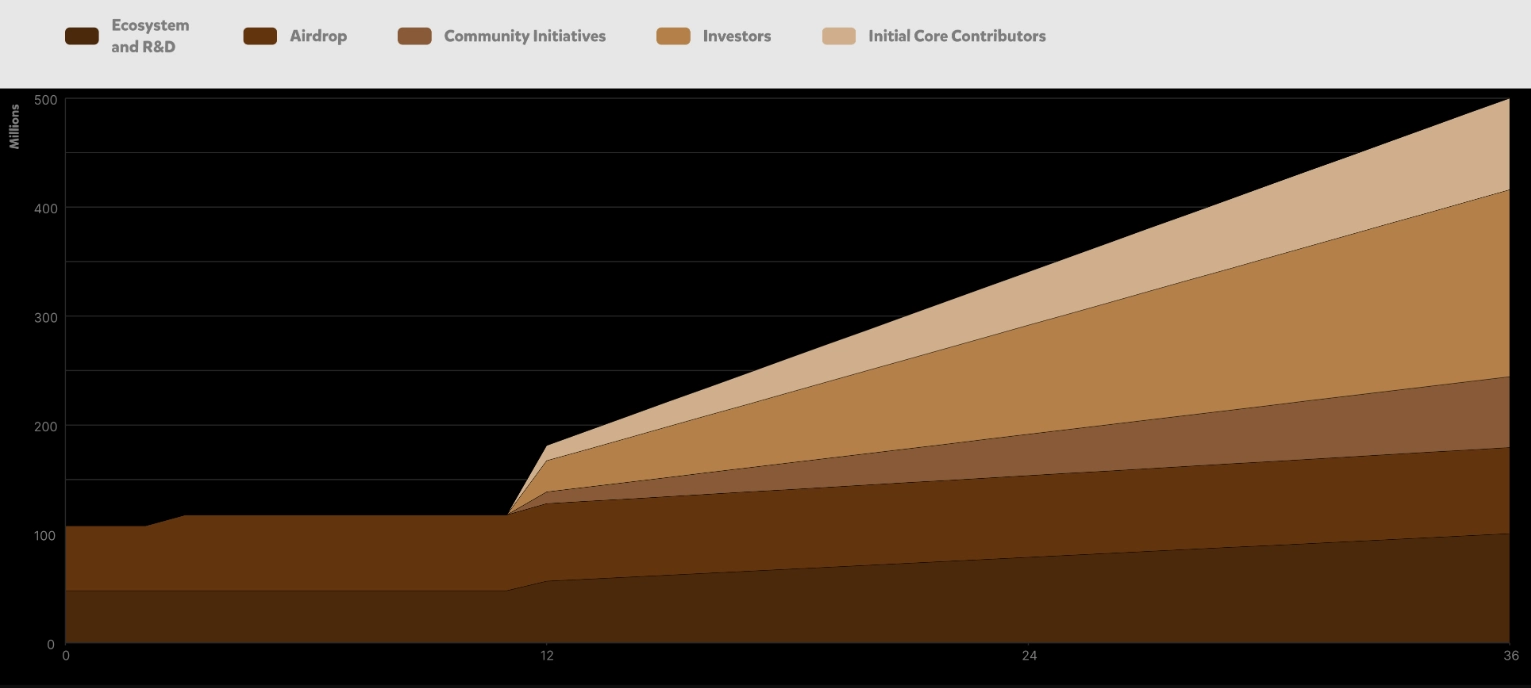

8.3. Token Release Schedule

All BERA tokens will be fully unlocked within 36 months.

8.4. Use Cases of BERA Token

- Gas fees for transactions on the Berachain ecosystem.

- Staking for network security and governance.

8.5. Where to Buy BERA Token?

Investors can trade BERA on major exchanges such as Binance, OKX, and Bybit.

9. Potential & Market Outlook

As one of the most highly anticipated Layer 1 blockchains, Berachain is seen as a competitor to projects like Sui and Aptos.

Even before launching its mainnet, Berachain has demonstrated strong adoption, with total deposits reaching $3 billion.

With its innovative technology, dedicated team, and strong investor backing, Berachain has gained trust from both developers and the crypto community. While its airdrop faced some criticism, the project remains well-supported and has not suffered from mass community backlash.

Regarding BERA Token, the initial circulating supply (21.5%) is relatively high, which could lead to selling pressure in the early stages. However, in the long run, BERA does not suffer from excessive inflation, and if the ecosystem continues to grow, it could become a major competitor to leading blockchains.

10. Conclusion

Berachain is not just another Layer 1 blockchain—it is a highly scalable, EVM-compatible ecosystem with a well-structured token model. With strong technological foundations, an expanding ecosystem, and robust investor support, Berachain is positioned as one of the most promising projects in DeFi & Web3.