What is Altcoin Season?

Altcoin Season is a term referring to the period when a large number of altcoins experience significant price surges simultaneously. During this time, traders anticipate a strong “bull run” of altcoins after Bitcoin has experienced a dramatic pump from $30k to $70k in just a few months.

Notably, the growth rate of altcoins during Altcoin Season often surpasses that of Bitcoin, with the potential for gains of x5, x10, or even x50. Investing in altcoins becomes very attractive during this period because almost any altcoin can easily bring profits to investors.

In the Crypto financial world, the term “Altcoin Season” or “Altseason” is used to define a period of strong growth for altcoins. This term emerged around 2016 – 2017 when altcoins began to appear more prominently in the Crypto market, and traders made significant profits from investing in altcoins.

When Bitcoin experiences a significant price drop, investors typically shift to the altcoin market. During Altcoin Season, altcoins tend to surge in price one after another, regardless of Bitcoin’s volatility.

Altcoin is short for Alternative Cryptocurrency, meaning cryptocurrencies other than Bitcoin. In fact, any coin created after Bitcoin, whether intended to replace Bitcoin or not, is referred to as an Altcoin, including platform tokens like Ethereum or Polkadot.

Relationship Between Bitcoin and Altcoin

Essentially, altcoins are often paired with Bitcoin on cryptocurrency exchanges for trading. Bitcoin can be exchanged for most altcoins. That’s why the price relationship between Bitcoin and altcoins is quite unique. When Bitcoin declines, many altcoins also decrease. However, when Bitcoin rises, some other cryptocurrencies may also increase, but most altcoins may decline as Bitcoin attracts capital from the entire market.

Currently, Bitcoin no longer plays an exclusive role in trading with altcoins, as many other coins such as ETH, BNB, EOS, along with stablecoins like USDT, USDC, have emerged and are widely used.

Related: Strong Signals Indicate the Approaching Altcoin Season

Indicators of Altcoin Season

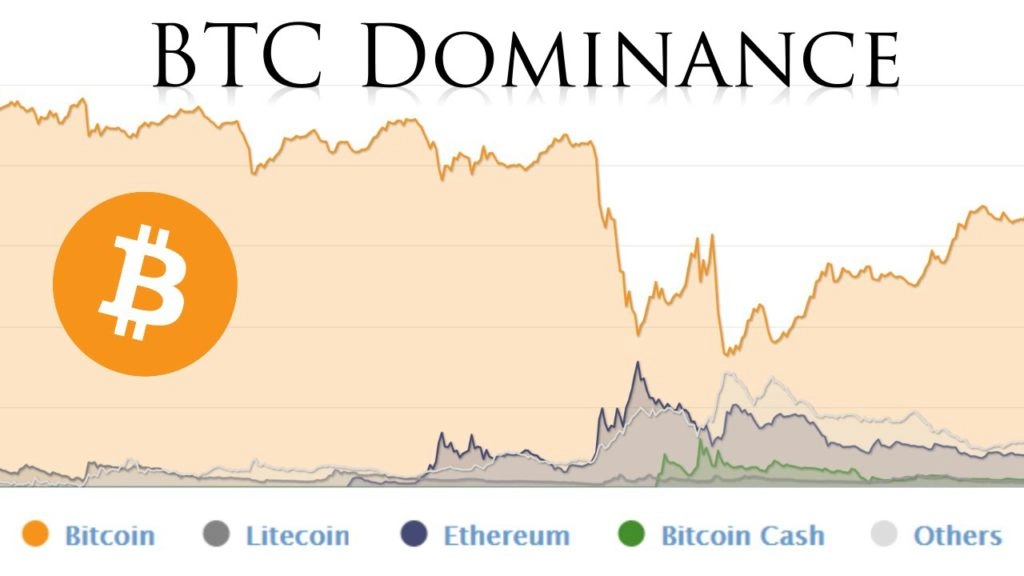

Bitcoin Dominance Index is Decreasing

Bitcoin Dominance (the dominance index of Bitcoin) represents the market capitalization of Bitcoin compared to the total cryptocurrency market capitalization. For example, if the market capitalization of Bitcoin is $1 trillion and the total market capitalization of altcoins is $500 billion, we would have a Bitcoin Dominance index of (1 trillion USD / 1.5 trillion USD) x 100 = 66.66%. When this index starts to decrease, it indicates that capital from Bitcoin is shifting to buy altcoins, or new investors are buying more altcoins than Bitcoin.

The Altcoin Season in 2017 saw Bitcoin Dominance drop to 37.84%.

Total Market Cap of Cryptocurrencies is Increasing

If Bitcoin Dominance decreases but the total market capitalization does not increase, this could be a “fake signal” for Altcoin Season. Conversely, if the Market Cap is increasing but Bitcoin Dominance is not decreasing, it may not be considered an Altcoin Season.

These two factors must occur together to be considered signs of an Altcoin Season. However, this is just a relative division method, and the market does not necessarily have to follow this rule.

Money Flow Gradually Shifts from Bitcoin to Altcoins

In the history of the cryptocurrency market, most Altcoin Seasons have appeared after strong price increases in Bitcoin. Particularly, after the 4th Halving event, Bitcoin underwent a significant price surge and is currently in a sideways phase.

This is a golden time for altcoins when a large amount of capital is poured into the cryptocurrency market but Bitcoin no longer yields significant profits. At this point, investors tend to use Bitcoin or stablecoins to invest in altcoins.

You can check if it’s Altcoin season here. https://www.blockchaincenter.net/en/altcoin-season-index/

Risks and Benefits of Altcoin Season

Risks

- No guarantee of profit without Altcoin Season: Many people think that during Altcoin Season, there will definitely be profits, but this is a misconception. The cryptocurrency market is prone to manipulation by “whales.” Statistics show that during the period when Bitcoin increased from $3,000 to $12,000, most profits went to investors with tens of millions of dollars in capital, while small retail investors lost money because they bought at the top and sold at the bottom.

- Overflow of “junk” Altcoins: Altcoin Season is an opportunity for low-cap altcoins to rise, but not all Altcoins are valuable. Many experts believe that up to 90% of Altcoins are “junk” and not worth investing in. The price increase of these Altcoins is often the result of pump-and-dump schemes, and investing in such projects carries very high risks. You should thoroughly research the quality of the project, the development team, investors, and other information to evaluate whether it is worth investing in.

- Altcoin Season may end earlier than expected: We cannot know for sure how long Altcoin Season will last. When Altcoin Season ends, investors may withdraw their capital too late. Therefore, know when to stop when you have achieved the expected profit. Remember that taking profit is never wrong.

Benefits

- High likelihood of winning: Unless it’s a project with extremely low quality, there is a high chance that the Altcoins you invest in will increase significantly due to the market’s enthusiasm.

- Very large growth potential: Large-cap coins or Bitcoin take a lot of time to increase in price. Meanwhile, small-cap Altcoins can easily increase by x5, x10, or even more. Many investors have been able to increase their assets by hundreds of times after an Altcoin Season.

What to Do When Altcoin Season Comes?

- Identify the Stage of Capital Flow: To maximize profits, it’s best to invest when new capital flows into Altcoins that haven’t experienced significant growth yet. This helps you anticipate trends and take advantage of market growth when capital begins to pour in.

- Identify Valuable Altcoins and Capital Flows: Analyzing coins doesn’t necessarily have to be completely accurate; just identifying the market’s capital flow into which type of coin can significantly increase the likelihood of profitable investment. Examples include ICO trends, DeFi, exchange tokens, etc. The latest trends are projects running on DOT or Binance Smart Chain. Monitoring these trends can help you identify potential investment opportunities.

- Make an Investment Plan: Clearly define the amount of money you will invest, the expected profit margin, your entry and exit points. Establishing a clear plan and adhering to it with discipline is the key difference between professional and amateur investors. A detailed investment plan will help you maintain discipline and maximize profits.

- Determine Whether Altcoin Season is Real: This is extremely important because temporary price trends in the market can make us think that Altcoin Season is approaching. Don’t rush to invest when the market shows temporary growth signs. Analyze carefully to determine whether Altcoin Season is really coming to avoid investing at the wrong time and losing money.

To trade Altcoins successfully, you need to understand the dynamics of the Crypto market. Trading Altcoins, in particular, or cryptocurrencies, in general, is similar to trading forex, but with the cryptocurrency market, all transactions are not supervised by any third party. This requires you to have knowledge and a solid investment strategy to protect yourself and maximize profits.

How Long Does Altcoin Season Last?

There isn’t a set duration for an Altcoin Season, but historically, it typically lasts around 2 to 3 months. A recent example was in early 2021, from March to May.

During this period, the Bitcoin Dominance index (BTC.D) dropped from 60% to as low as about 39%. All Altcoins surged, often doubling or tripling in value compared to the beginning of the year. Some promising Altcoins even surged by tenfold before March.

Trading Strategies During Altcoin Season

Short-Term Strategy

Short-term trading applies when investors hold Altcoins for a few months or less, then quickly sell the tokens to make a profit. Altcoins often experience rapid fluctuations, sometimes doubling in value overnight. Therefore, the advantage of this strategy is the increased opportunity for higher profits for investors.

However, the challenge of short-term strategies lies in the rapid price changes. To trade successfully, you need to stay alert and accurately analyze market trends in the near future. Another disadvantage is that short-term trading requires an investment proportionate to the expected profit. However, not every trader has the resources and quick calculations to confidently allocate funds for trading.

Long-Term Strategy

For a long-term strategy, Altcoins are held for at least one year after purchase. In contrast to short-term strategies, long-term trading allows for observing price fluctuations over time. Additionally, investors do not need to invest too much money at once but can gradually acquire Altcoins in small amounts over time.

The downside of a long-term strategy is that you may miss out on unexpected profit opportunities when prices rise or fall in the short term. However, holding Altcoins for an extended period also helps reduce the pressure to make quick decisions and allows you to benefit from the long-term growth of the cryptocurrency market.

Conclusion

Altcoin Season simply refers to the period when traders’ sentiment indicates that investing in Altcoins will yield greater value than Bitcoin. Experts predict that the price of Bitcoin will rise, making Altcoins the best choice for small investors, helping them maximize profits.

However, it’s essential to remember not to overinvest and lack understanding of the market, as it could be a form of gambling. Be cautious, and I wish you a successful Altcoin season!

Nice one