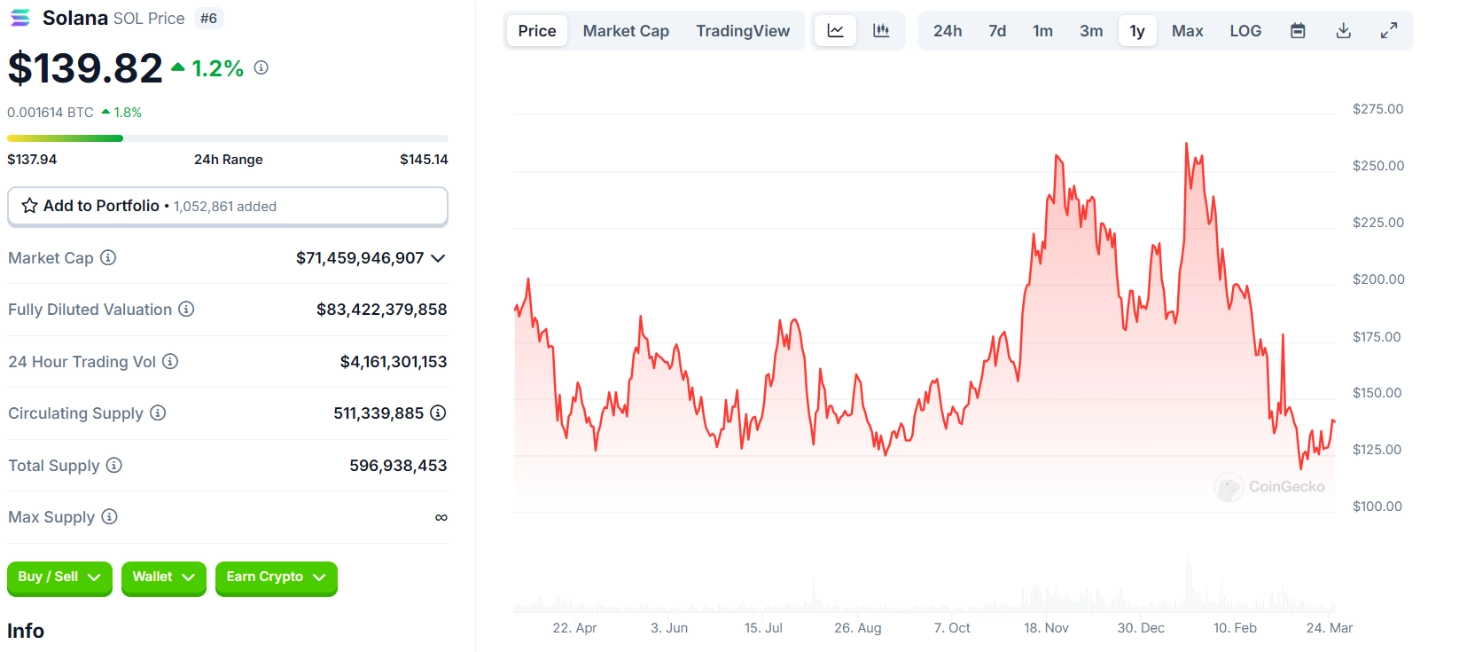

Solana (SOL) is witnessing notable developments amid the volatility of the cryptocurrency market. While its current value remains modest, positive signals are gradually emerging, bringing renewed optimism to investors.

On Binance, traders are showing increasing confidence in Solana. The Long-to-Short ratio surged to 2.40 on March 23, marking its highest level in over two months. This is seen as a key indicator that trust in SOL is gradually being restored.

One of the most significant factors at play is the potential approval of a Solana ETF in the United States. According to Matthew Sigel, Head of Digital Asset Research at VanEck, the U.S. Securities and Exchange Commission (SEC) is expected to make a final decision before the end of the year.

If approved, the ETF could provide a fresh catalyst for Solana, enhancing its legitimacy and attracting institutional investors. Although not guaranteed, this possibility is fueling positive expectations.

Related: JPMorgan’s Bold Prediction for Solana and XRP ETFs

Additionally, other supporting factors are contributing to Solana’s momentum. Former President Trump’s launch of the TRUMP memecoin has sparked significant attention within the crypto community.

On the technology front, Solana continues to maintain its competitive edge with strong Total Value Locked (TVL) and network fees compared to its rivals. Large investors (whales) are also showing optimistic signs regarding its growth potential.

Despite the inherent volatility of the crypto market, Solana is displaying promising indicators. From growing trader confidence to regulatory prospects, various factors are aligning to create a favorable environment for its future growth.