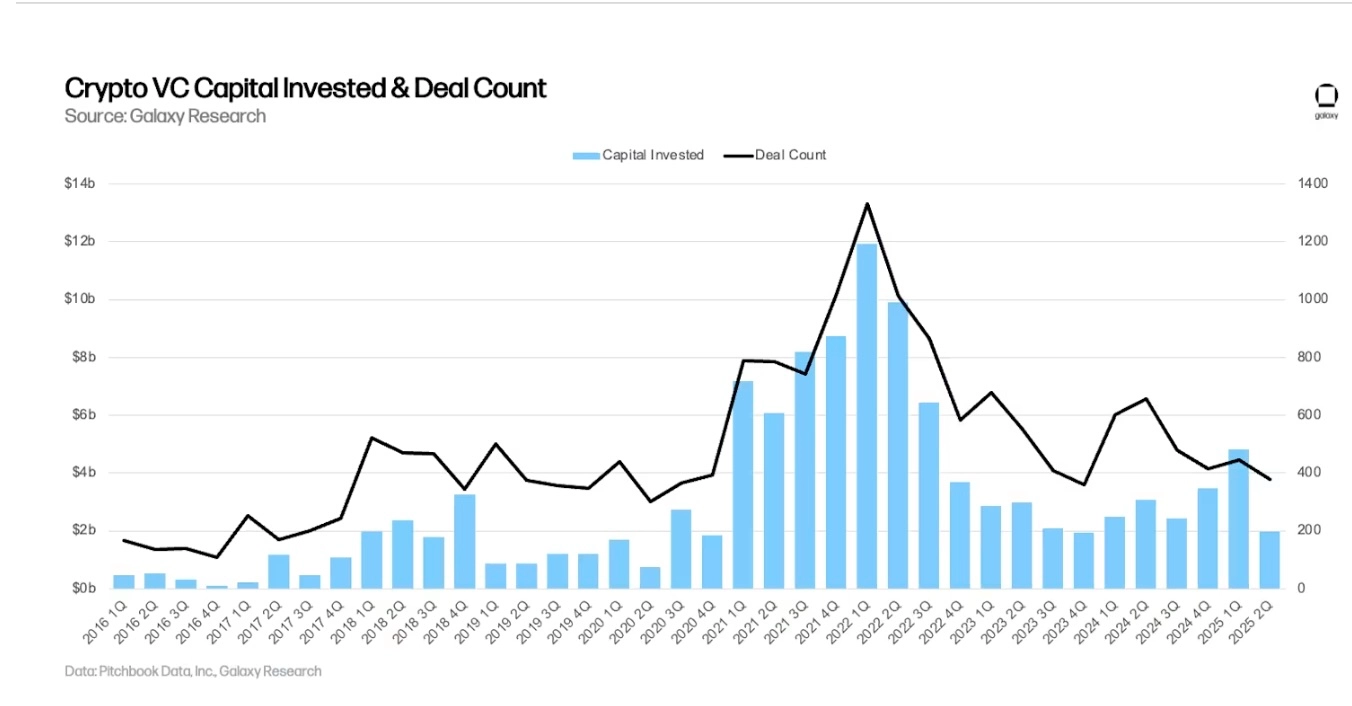

According to the latest report from Galaxy Digital, venture capital (VC) investment in the cryptocurrency sector has decreased by 59% compared to the previous quarter, totaling $1.976 billion across 378 deals in Q2 2025. This marks the second-lowest investment quarter since the end of 2020.

Key Findings

- Late-Stage Deals: Late-stage deals accounted for 52% of the total capital, marking the second time since Q1 2021 that mature companies received more funding than early-stage startups.

- Impact of Previous Investments: While the decline from the previous quarter is significant, it is somewhat “inflated” by the unusual $2 billion investment from MGX into Binance in Q1. Excluding this deal, Q2 investment only decreased by about 29%.

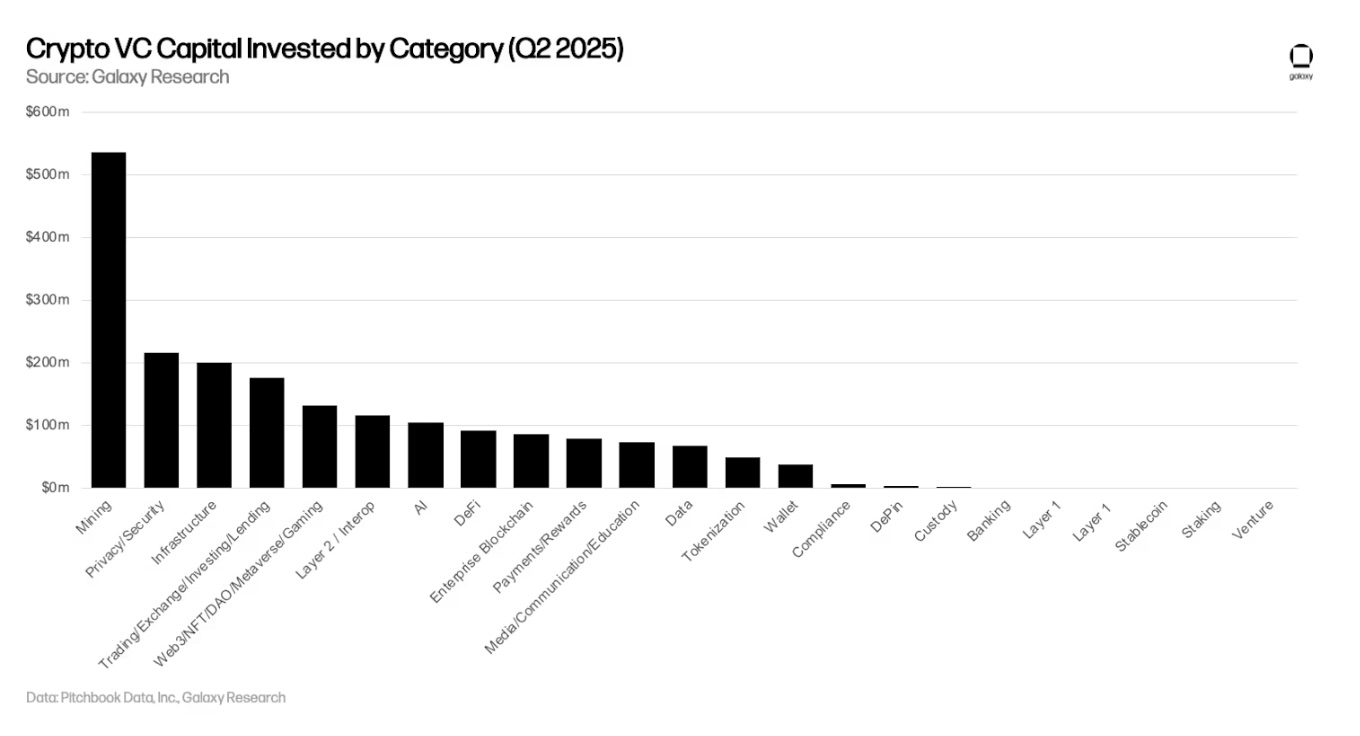

- Mining Sector Surge: For the first time in years, the mining sector has taken the lead, accounting for over 20% of total capital disbursed, equivalent to around $500 million. Notably, Sequoia invested $300 million in XY Miners, a cloud-based mining company. This trend reflects the increasing demand for computational power, particularly driven by the strong development of AI.

- US Dominance: The US continues to hold the central position in the crypto startup ecosystem, accounting for 47.8% of total capital and 41.2% of the deals. The UK ranks second with 22.9%, followed by Japan (4.3%) and Singapore (3.6%).

Market Maturity Indicators

The shift towards late-stage deals indicates the market’s increasing maturity, as many companies have achieved product-market fit and begun attracting interest from traditional corporations. Meanwhile, the percentage of pre-seed deals continues to decline, reflecting that the industry has moved past the experimental phase.

Companies founded in 2018 raised the most capital, while startups established in 2024 led in the number of deals.

Related: XRP Poised to Outperform Ethereum? Consolidation Signals a New Bull Run

Fundraising Challenges

Fundraising remains difficult, with only $1.7 billion raised across 21 funds in Q2. High interest rates, along with competition from spot Bitcoin ETFs and digital asset management firms, are diminishing the appeal of traditional venture capital investment.

Additionally, the historical correlation between Bitcoin prices and VC funding has weakened over the past two years. Despite Bitcoin’s strong rise since early 2023, venture capital no longer follows the familiar cyclical pattern. The cooling down of previously “hot” sectors like blockchain gaming, NFTs, and Web3 applications has also contributed to this decrease in attractiveness.