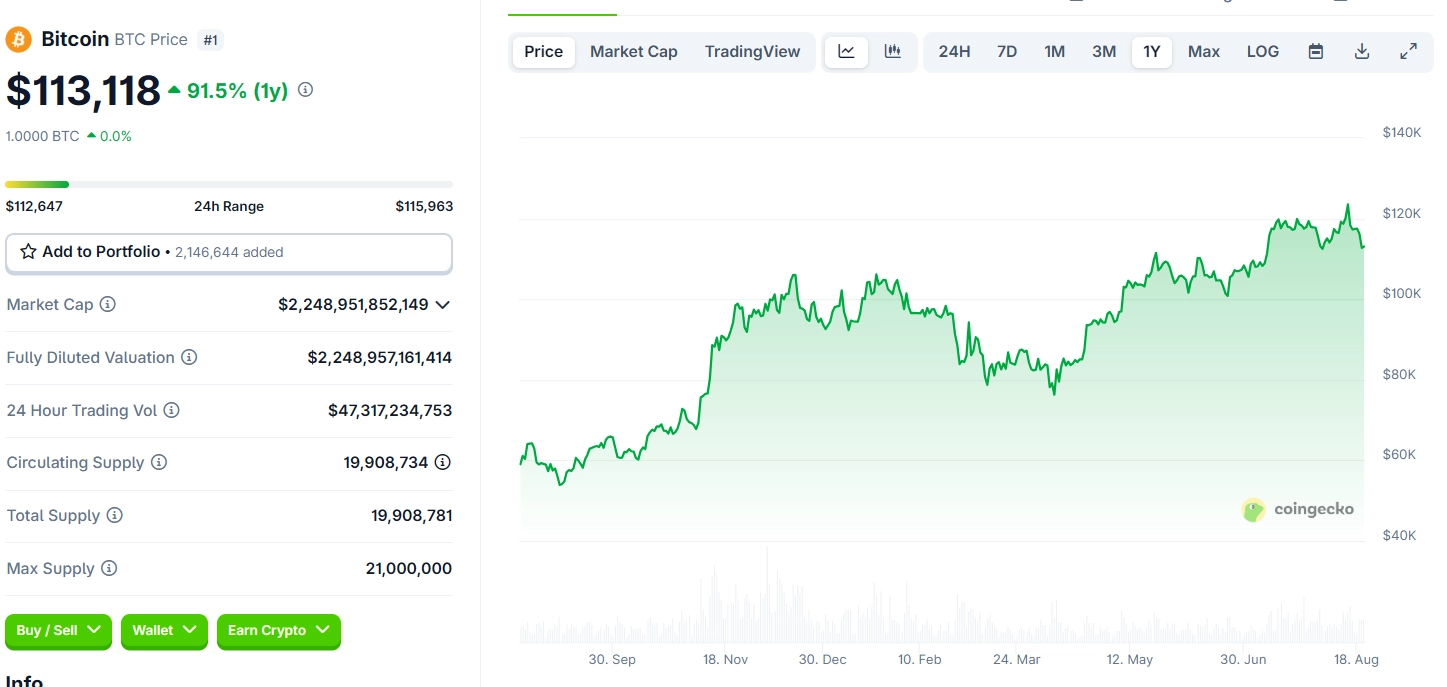

VanEck recently released its mid-August 2025 ChainCheck Bitcoin report with the bold prediction that Bitcoin will reach $180,000 by the end of the year. This forecast is based on in-depth analysis of various key market indicators and institutional investment behavior.

Long-Term Forecast with Solid Foundations

VanEck, with its extensive experience in financial market trend research, is not new to making positive predictions about Bitcoin. In its latest report, the company reaffirms its belief in BTC’s growth potential:

“As autumn approaches, several associated risks and opportunities are emerging. Macroeconomic developments and the seasonal re-engagement of investors could either extend Bitcoin’s momentum or lead to profit-taking. However, we remain steadfast in our BTC price target of $180,000 by year-end.”

Supporting Factors for the Forecast

- Favorable Timing: The ChainCheck report indicates that Bitcoin’s recent price peak occurred at a very opportune time, with 92% of on-chain assets profitable before the temporary price increase. This suggests a solid technical foundation and market readiness for a new breakout.

- Stable Corporate Inflows: The rise in investments from businesses has helped Bitcoin maintain its strength, even as Ethereum attracts significant capital from institutions. VanEck emphasizes that the stable commitment of institutional investment strategies has encouraged a new wave of interest in Bitcoin.

- Strong Mining Sector: Although Bitcoin mining difficulty reached an all-time high last month, revenue from mining activities continues to grow. Notably, the mining sector in the US is capturing a larger share of the global hashrate as the market undergoes consolidation.

Related: Short Position on ETH Reaches All-Time High

Challenges to Note

- Declining On-Chain Dominance: The report also acknowledges some clear obstacles. Bitcoin’s on-chain dominance has significantly decreased compared to Ethereum, partly due to a decline in the use of Ordinals (NFTs on Bitcoin). However, VanEck does not view this as a serious issue due to the stability from corporate capital.

- Risks from Corporate Reserves: VanEck warns that corporate Bitcoin reserves could lead to a larger downturn. If BTC volatility remains low for an extended period, this may affect fundraising capabilities for future investments.

- Shifts Among Some Mining Companies: The report notes a partial shift of TeraWulf away from Bitcoin; however, VanEck does not consider this a significant negative factor in the overall context.

VanEck’s forecast comes amid:

- Increasing institutional interest in Bitcoin

- More favorable cryptocurrency policies from the US government

- Diversification trends among large companies

- Development of the Bitcoin ETF ecosystem

Conclusion

VanEck’s $180,000 forecast reflects a strong belief in Bitcoin’s long-term potential, supported by real data and institutional investment trends. However, the company also expresses caution regarding potential risks.

As one of the leading Bitcoin ETF issuers, VanEck’s predictions not only serve as a reference but may also influence market sentiment in the latter months of 2025. Whether Bitcoin achieves this target will depend on various factors, from macroeconomic policies to the behavior of institutional investors.