VanEck is preparing to launch a private digital asset fund in June, named the VanEck PurposeBuilt Fund, focusing on investing in tokenized Web3 projects on the Avalanche blockchain. This fund, dedicated to accredited investors, will invest in liquidity tokens and Web3 projects backed by venture capital, spanning fields such as gaming, financial services, payments, and artificial intelligence.

According to VanEck, the unallocated capital will be invested in real-world assets (RWA) on the Avalanche platform, including tokenized money market funds. The fund will be managed by the team of the VanEck Digital Assets Alpha Fund (DAAF), which currently manages over $100 million in net assets as of May 21, 2025.

Mr. Pranav Kanade, Portfolio Manager of DAAF, emphasized: “A new wave of value in the cryptocurrency space will come from real businesses, not new infrastructure.”

VanEck’s Thematic Fund Strategy

The PurposeBuilt Fund is the latest move in VanEck’s series of thematic investment products, competing with rivals to tap into the potential of the rapidly growing Web3 sectors.

On May 14, 2025, VanEck launched an actively managed ETF focused on stocks and financial instruments related to the digital economy. Earlier, in April, the company introduced a passive ETF tracking companies operating in the cryptocurrency sector.

Currently, VanEck and other asset managers are awaiting SEC (U.S. Securities and Exchange Commission) approval for over 70 cryptocurrency ETF funds. This move comes as President Donald Trump eased SEC policies toward the crypto market after taking office in January 2025.

Related: Avalanche Foundation Announces Holdings of 5 Memecoins

Avalanche: A New Destination for Real-World Assets

Avalanche is emerging as a leading hub for real-world assets (RWA) and crypto projects aimed at institutions. Thanks to subnetworks, Avalanche allows organizations to deploy Ethereum-compatible smart contracts in a controlled environment.

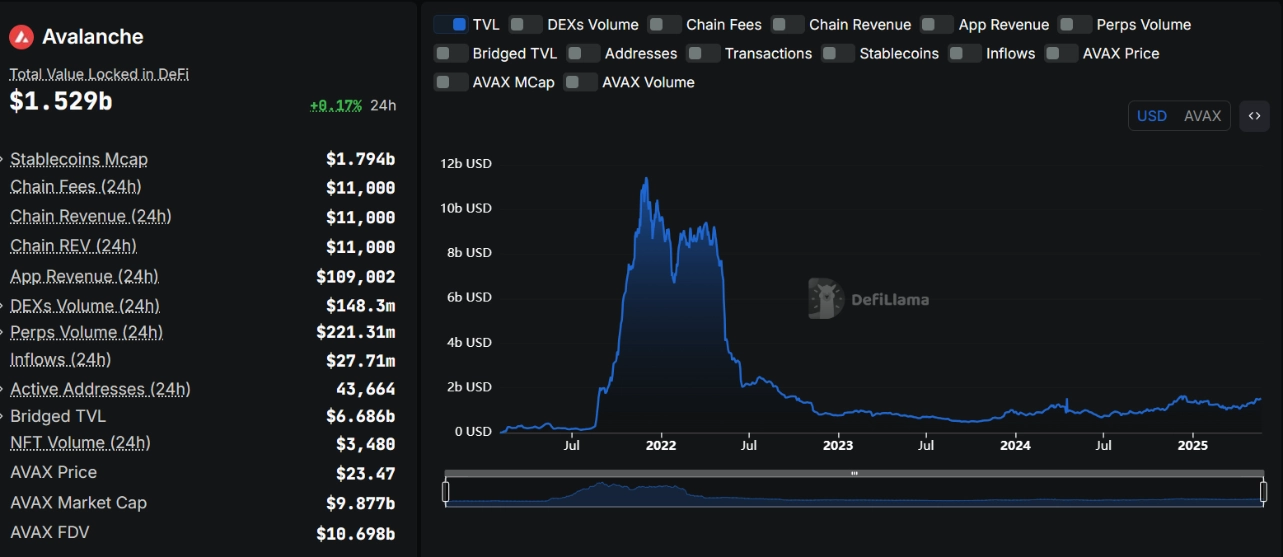

On May 16, 2025, Solv Protocol launched a yield-bearing Bitcoin token on Avalanche, targeting institutional investors. According to DefiLlama, the total value locked (TVL) on Avalanche reached approximately $1.5 billion as of May 21, 2025.

Mr. John Nahas, Business Director of Ava Labs, remarked: “We are witnessing a shift from speculative frenzy to practical applications and a sustainable token economy.”

The VanEck PurposeBuilt Fund promises to be a bridge for investors to access the potential of Web3 and real-world assets on Avalanche, marking an important step in the journey of integrating blockchain into traditional finance.