One of the most pressing concerns today is the escalating trade conflict between the United States and China. Last week, Chinese Foreign Ministry spokesperson Lin Jian strongly opposed the new tariffs proposed by President Donald Trump and warned that China would retaliate. The new tariffs — with some Chinese products being taxed as high as 145% — are further straining the already fragile relationship between the two economic superpowers.

At the same time, China is facing declining exports and growing concerns about capital outflows, while the United States is grappling with the enormous challenge of refinancing its $6.5 trillion national debt.

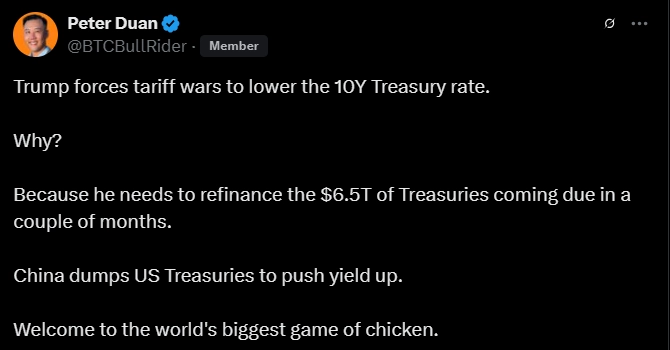

According to veteran analyst Peter Duan, Trump’s tariff strategy is essentially aimed at pushing down yields on 10-year U.S. Treasury bonds. However, China is countering by selling off its holdings of U.S. Treasuries — a move that is pushing yields even higher and driving the market into deeper turmoil.

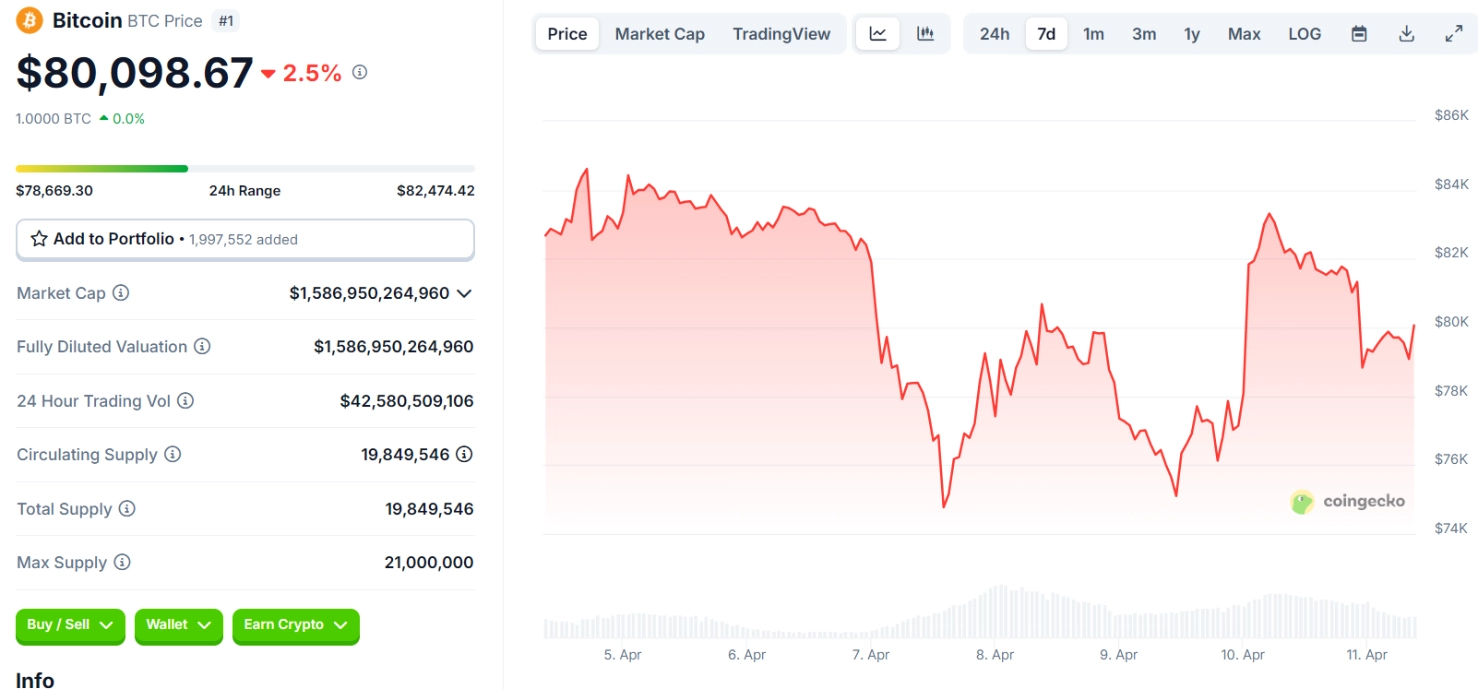

Bitcoin has taken a significant hit amid this financial uncertainty, losing over $500 billion in market capitalization since April 2. Its price briefly dipped below $75,000 before staging a modest recovery. Altcoins such as ETH, XRP, SOL, ADA, and DOGE have suffered even more severe losses due to tightening liquidity conditions.

Historically, Bitcoin tends to rally when market liquidity is abundant. Many analysts believe that if the Federal Reserve officially restarts its quantitative easing (QE) program in 2025, Bitcoin could see a strong rebound — similar to 2020, when the Fed’s stimulus measures helped drive Bitcoin to record highs.

Related: Trump Delays Tariff for 90 Days, Increases China Tariff to 125%: Crypto Market Explodes

Arthur Hayes, former co-founder of the BitMEX exchange, believes that if history repeats itself, Bitcoin could soar to $250,000. He argues that a new liquidity injection by the Fed could serve as the catalyst for the next major bull run of the leading digital currency.