The Federal Housing Finance Agency (FHFA) has issued a directive requiring two major financial institutions, Fannie Mae and Freddie Mac, to prepare proposals to consider cryptocurrencies as a valid asset in the risk assessment process for home mortgage loans.

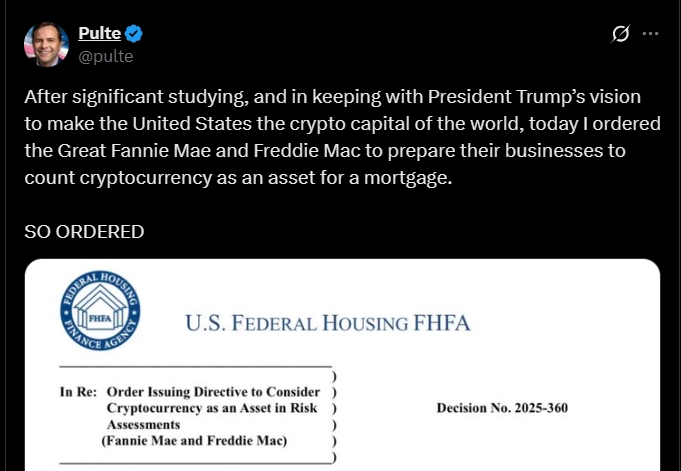

In an announcement on June 25 on platform X, FHFA Director William Pulte stated:

After thorough research and to realize President Trump’s vision of making America the global cryptocurrency hub, I have directed Fannie Mae and Freddie Mac to develop a plan to integrate cryptocurrencies into the asset assessment process when approving mortgage loans.

If the proposal is approved, this would be the first time digital assets are officially recognized in mortgage applications in the U.S., opening up opportunities to change how credit is assessed in the real estate market. Notably, Pulte, who issued the directive, revealed in a financial report in February 2025 that he holds a cryptocurrency portfolio, including Bitcoin, Solana, and shares in MARA Holdings, with a total value of up to $1 million. This further reinforces the FHFA’s commitment to promoting the integration of digital assets into the financial system.

Related: Tether Aims to Become the World’s Largest Bitcoin Mining Company

This move is part of a broader effort by the Trump administration to promote the cryptocurrency industry. Since taking office, Trump has committed to making the U.S. the “crypto capital” of the world through policies such as:

- Establishing a national Bitcoin reserve.

- Appointing cryptocurrency-friendly personnel to regulatory agencies like the SEC, CFTC, and FHFA.

- Encouraging Congress to pass key legislation, such as the GENIUS Act for stablecoins.

Fannie Mae and Freddie Mac, two companies established by the U.S. Congress, play a crucial role in ensuring liquidity in the mortgage market by purchasing loans from banks and reselling them as securities. As government-sponsored enterprises (GSEs), both are under tight FHFA oversight, especially after being taken over by the government during the 2008 financial crisis.