According to Bloomberg, the UK government aims to introduce a comprehensive regulatory framework for managing the cryptocurrency sector by early 2026, striving to catch up with rival financial hubs such as Hong Kong and Singapore.

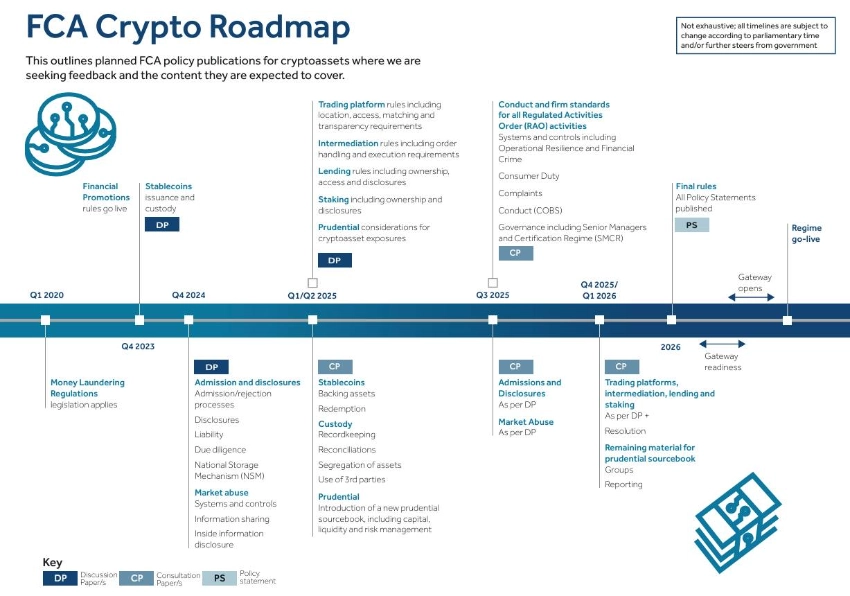

The UK’s Financial Conduct Authority (FCA) has unveiled a roadmap for finalizing the regulatory framework. From Q4 2024 to Q4 2025, a series of discussions and consultations will be held to develop regulations addressing market abuse, exchange operations, lending, staking, stablecoins, custody, and other related areas.

Once approved, the official cryptocurrency regulatory framework in the UK will be enacted in Q1 2026. This timeline aligns with the “preliminary outline of the cryptocurrency regulatory framework” presented on November 21 at the Tokenisation Summit hosted by City & Financial Global in London.

The ambition to transform the UK into a global cryptocurrency hub—strongly supported by former Prime Minister Rishi Sunak—faces significant challenges, particularly given the potential for a change in government following the upcoming general election.

Currently, the UK is making continuous efforts to catch up with financial centers like Hong Kong, Singapore, and the United Arab Emirates (UAE), which established cryptocurrency regulatory frameworks years ago.

Related: Bitfinex Stops Providing Crypto Services to Customers in the UK

Meanwhile, the European Union is preparing to implement the MiCA regulation, aimed at harmonizing cryptocurrency oversight across member states. In the United States, under President Trump, the attitude toward the industry has also become more open.

The introduction of a comprehensive cryptocurrency regulatory framework is expected to not only stimulate market growth in the UK but also help the country maintain its competitive position on the global stage. According to the latest data from the FCA, 12% of adults in the UK currently own cryptocurrency assets, highlighting the urgent need for a clear legal framework.