The crypto community has just witnessed a buzzworthy event as two “dormant” Bitcoin wallets, inactive for over 14 years, suddenly came back to life. A total of 20,000 BTC, worth more than $2 billion at current prices, was transferred, marking the surprising re-emergence of a (or a group of) “whale” from Bitcoin’s early days.

“Satoshi Era” Wallets Suddenly Move

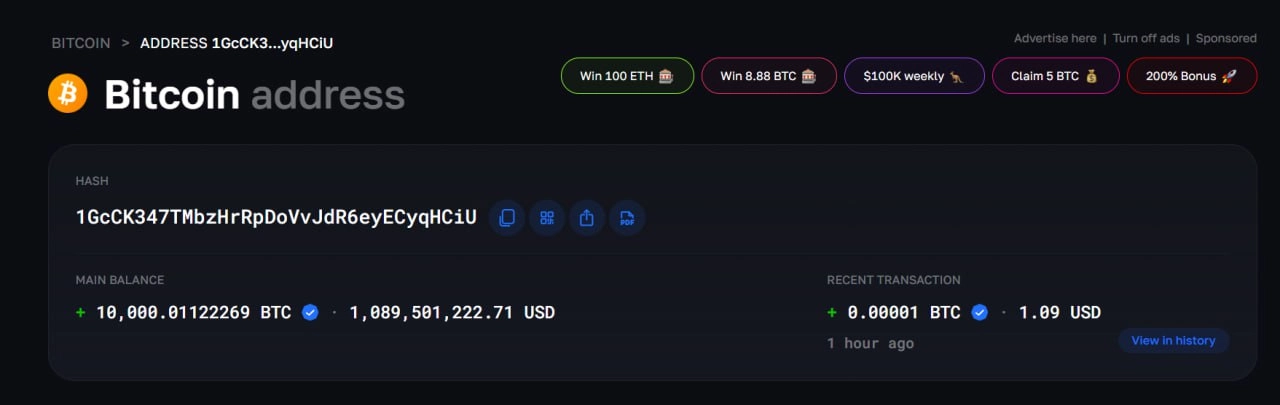

The first wallet, with the address 12tLs9c9RsALt4ockxa1hB4iTCTSmxj2me, received 10,000 BTC on April 2, 2011, when the price of Bitcoin was only $0.78/BTC, equivalent to about $7,805 at that time. After more than 14 years of silence, this wallet unexpectedly transferred the entire amount of BTC to a new address: 1GcCK347TMbzHrRpDoVvJdR6eyECyqHCiU.

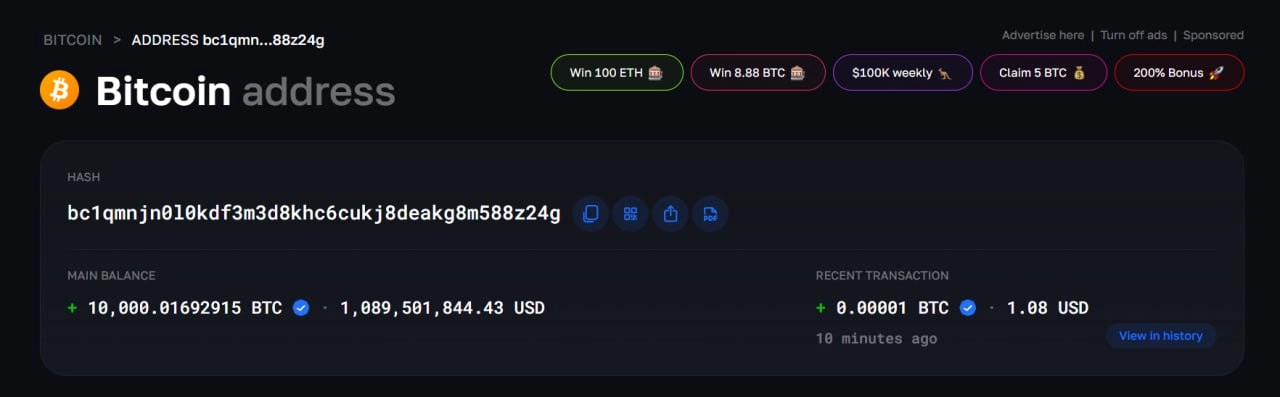

Similarly, the second wallet with the address 1KbrSKrT3GeEruTuuYYUSQ35JwKbrAWJYm also received exactly 10,000 BTC on the same day, April 2, 2011, at a price of $0.77/BTC, equivalent to $7,700. After more than a decade of inactivity, this wallet transferred the entire amount of Bitcoin to a new Bech32 address: bc1qmnjn0l0kdf3m3d8khc6cukj8deakg8m588z24g.

Related: CEX Trading Volume Hits Bottom While DEX Soars

Signs Suggesting a Common Owner

Despite having different addresses, both wallets received 10,000 BTC on the same day, retained their assets for over 14 years, and transferred them around the same time. This raises questions about whether they might belong to the same individual, organization, or at least have a close connection. This coincidence has piqued the curiosity of the crypto community.

Bitcoin wallets from the early days of the network—often referred to as the “Satoshi Era”—are always the center of attention. With their long history, these wallets are closely monitored for clues about Satoshi Nakamoto, the creator of Bitcoin, or the first miners.

Experts note that the “awakening” of these long-dormant wallets does not necessarily mean that these “whales” will sell off immediately. However, the movement of such a large volume of Bitcoin could still cause psychological market fluctuations, especially given the current context, where the market is sensitive to significant changes.