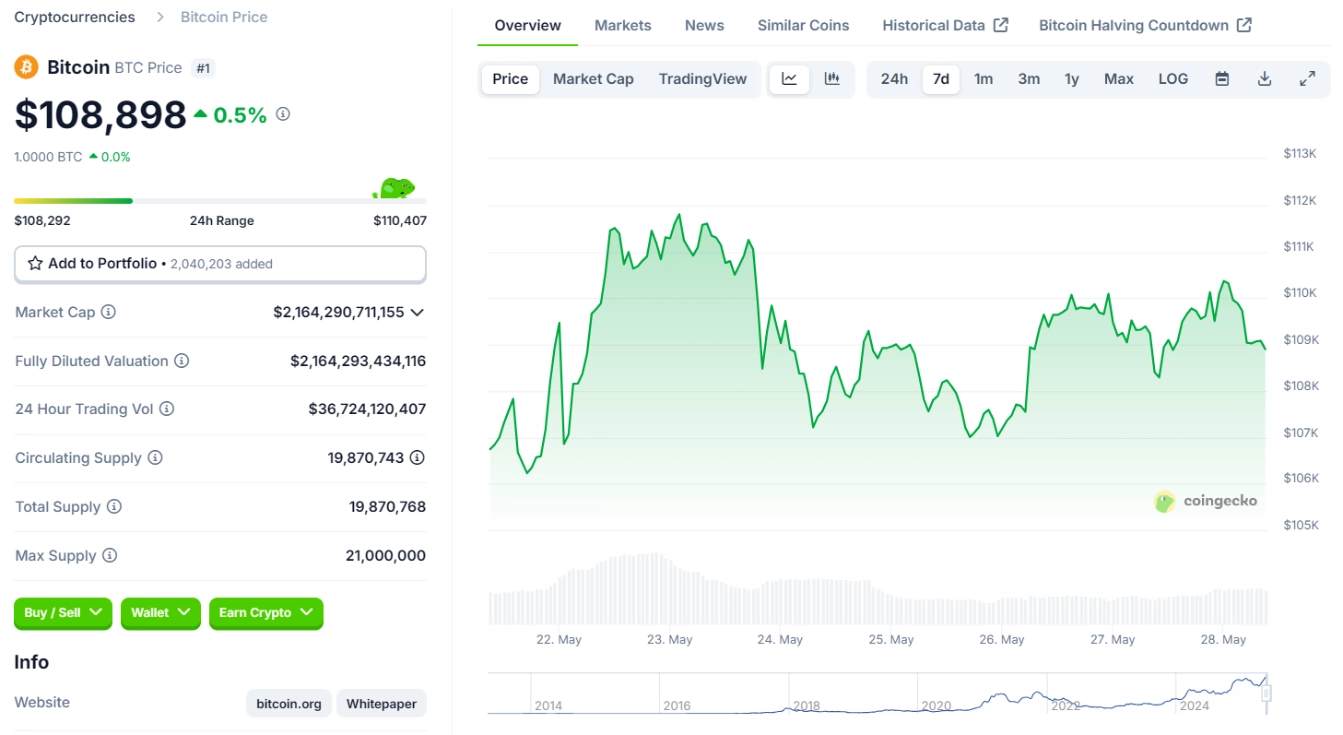

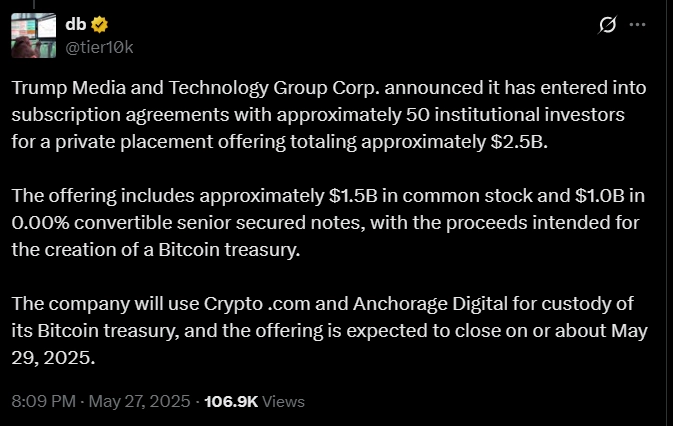

Trump Media and Technology Group (TMTG), the operator of the Truth Social social media platform and the FinTech brand Truth.Fi, has announced the completion of private placement agreements with approximately 50 institutional investors, successfully raising nearly $2.5 billion. This capital will be used to establish a corporate Bitcoin treasury, incorporating Bitcoin into TMTG’s balance sheet alongside existing assets such as cash, cash equivalents, and short-term investments.

Of the $2.5 billion raised, $1.5 billion comes from the issuance of common stock, and $1 billion from convertible bonds with a conversion price 35% higher than the current market price. According to financial reports, as of the end of Q1 2025, TMTG holds $759 million in cash and short-term assets. Adding Bitcoin to the asset portfolio is part of the company’s strategy to expand its investment in digital assets.

TMTG, which is currently listed on Nasdaq under the ticker DJT, also stated that the FinTech brand Truth.Fi, set to launch in January 2025, has been approved to allocate up to $250 million from its existing $700 million cash reserve into traditional investment channels such as SMAs, ETFs, Bitcoin, and cryptocurrency-related assets.

This announcement follows TMTG’s dismissal of rumors regarding plans to raise $3 billion for investment in Bitcoin and other cryptocurrencies, while criticizing the Financial Times for inaccurate reporting.

Related: Trump’s Crypto Dinner Guest Slams Terrible Food and “Nonsense” Speech

Devin Nunes, Chairman and CEO of TMTG, emphasized: “Bitcoin is the ultimate symbol of financial freedom, and now, TMTG will officially integrate cryptocurrency into its core asset portfolio. This is a strategic move, like a gem in the company’s asset treasury. This investment not only helps protect TMTG from discriminatory practices by financial institutions—something many individuals and businesses in America are facing—but also provides superior efficiency in subscription payment transactions, utility tokens, and other trading plans on Truth Social and Truth+.”

To ensure the security of its Bitcoin treasury, TMTG will collaborate with Crypto.com and Anchorage Digital for the custody of digital assets.

This move by TMTG echoes the pioneering strategy of Strategy (formerly MicroStrategy), a company known for accumulating 580,250 BTC in its treasury. TMTG’s journey marks a bold step in integrating digital assets into corporate financial strategy.