Since returning to the White House in January 2025, President Donald Trump has not only stirred the political landscape in the U.S. with a series of bold policies but has also attracted attention due to a growing digital financial empire that is quietly rising under his and his family’s support.

According to Bloomberg, in just a few months, the Trump family has earned at least $620 million from cryptocurrency-related activities, raising his net worth to around $6.4 billion. Notably, digital assets now account for about 9% of Trump’s personal investment portfolio, marking an ambitious shift into the crypto space, making it an important financial pillar for the 47th President.

World Liberty Financial

The focus of this empire is World Liberty Financial (WLFI), a DeFi project controlled by the Trump family with a 60% stake, benefiting from 75% of revenue from token sales. Recently, the Trump family pocketed $390 million from a $550 million token sale, while also holding over $2 billion in WLFI value.

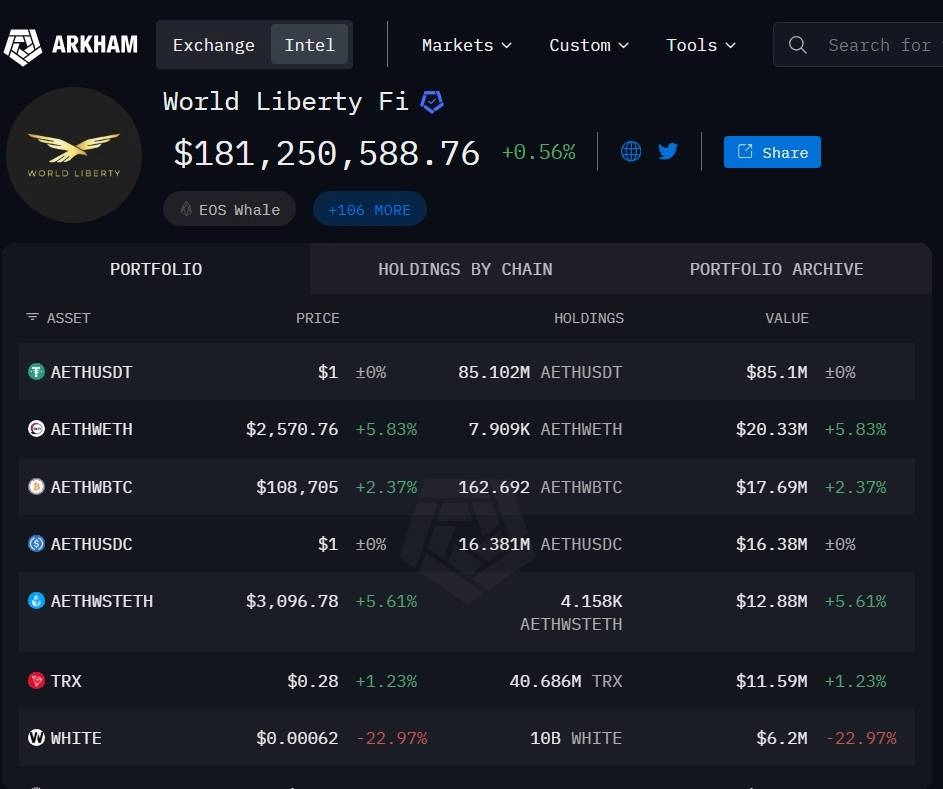

In March 2025, WLFI launched the stablecoin USD1, which was used by MGX (based in Abu Dhabi) to invest $2 billion into the Binance exchange, expected to generate at least $100 million in profit for WLFI. However, this project has faced scrutiny as reports revealed connections between WLFI and the SEC’s suspension of investigations into “tycoon” Justin Sun. Sun, the founder of TRON, spent $75 million to purchase WLFI tokens and was appointed to the project’s advisory board, raising suspicions of politically-financially motivated agreements. According to Arkham Intelligence, WLFI currently holds over $181 million in crypto assets, primarily on the Ethereum network.

Memecoin TRUMP

On January 18, 2025, Trump officially entered the memecoin world with the TRUMP coin on the Solana blockchain, with a total supply of 1 billion tokens, of which 800 million belong to companies associated with him such as CIC Digital LLC and Fight Fight Fight LLC. This project generated $350 million from token sales and transaction fees. Notably, Trump hosted a lavish party for the 220 largest investors in the TRUMP coin, accompanied by a VIP tour, a move criticized by many lawmakers as an abuse of power to promote his personal brand.

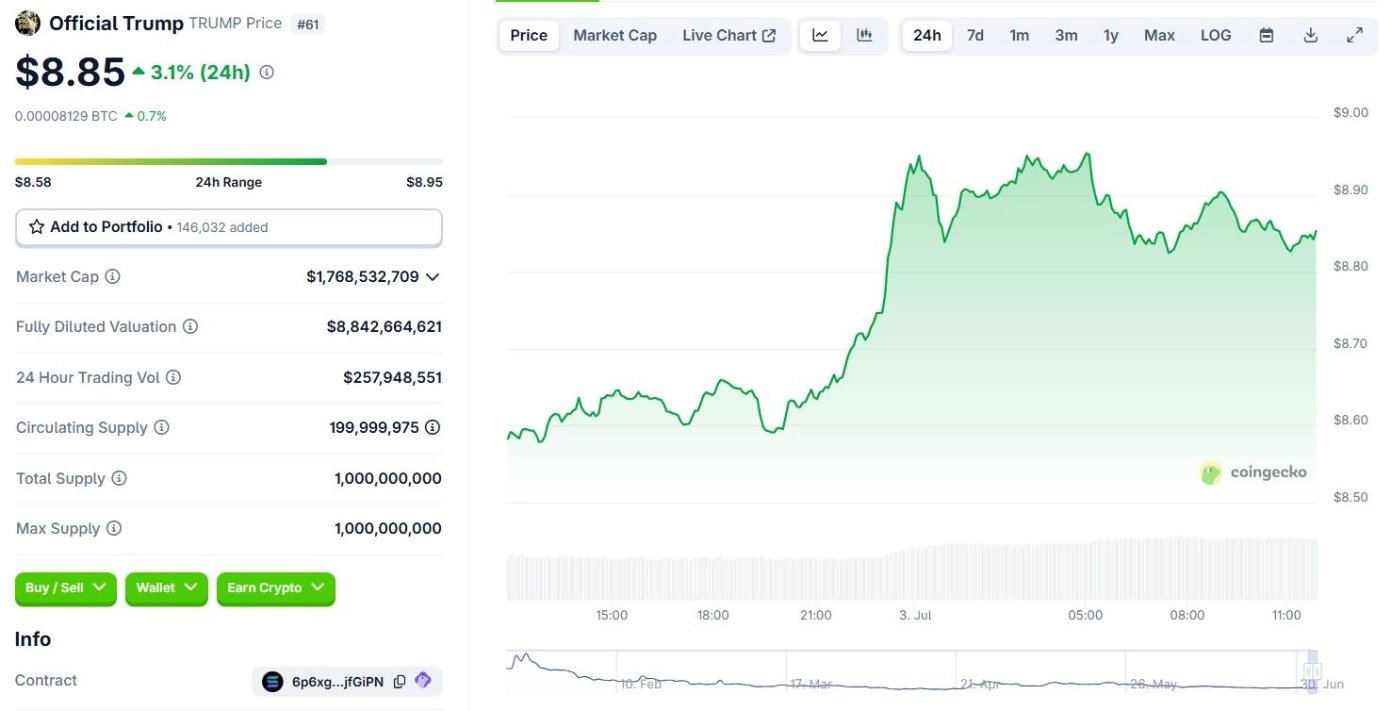

The TRUMP coin achieved a record market cap of $9 billion just three hours after launch, with a current price of $8.85 per token and a 24-hour trading volume of $258 million. Trump’s investment in this project is currently valued at around $150 million, with millions of tokens expected to be unlocked over the next three years, although the allocation mechanism remains uncertain.

Starting from NFTs

Trump’s journey in the digital asset space began in 2022 with an NFT collection of 45,000 digital cards, priced at $99 each. By August 2024, he announced earning $7 million from NFTs and holding around $5 million in ETH, laying the groundwork for future expansion. Currently, Trump Media, his social media platform, is planning to raise $2.5 billion to invest in Bitcoin and is applying to establish a Bitcoin ETF on the NYSE. Additionally, the TRUMP Wallet, which supports major coins like BTC, ETH, DOGE, and SOL, is also under development, although his two sons deny direct involvement.

Related: Can Altcoins Grow in July?

Decrees and Policies Promoting Crypto

Leveraging executive power, Trump is working to shape the crypto industry in the U.S. He has signed a decree to establish a national Bitcoin reserve fund, utilizing BTC seized from criminal activities. Trump has also urged the SEC to end lawsuits related to crypto, push for the approval of altcoin ETFs, and clarify the classification of digital assets under securities law. Notably, he is urging the House of Representatives to pass the GENIUS bill, creating a legal framework for stablecoins in the U.S. Trump emphasizes that if the U.S. does not lead in this field, rivals like China will gain the upper hand.

Congressional Response

The rapid expansion of the Trump family’s crypto empire has sparked controversy in the U.S. Congress. Many Democratic lawmakers have proposed bills prohibiting the President, Vice President, members of Congress, and their family members from owning or promoting digital assets. Although these bills have not passed due to the Democrats being in the minority, political pressure is increasingly mounting.