The Return of the Legend – TheRoaringKitty?

Recently, a well-known figure on social media platform X (formerly Twitter) known by the nickname “TheRoaringKitty” is believed to have sparked a wave of sudden price surges in several cat-themed cryptocurrencies on the Solana blockchain, as well as in the stock of GameStop (traded under the ticker GME on the NYSE).

This user posted a simple image with the implication of “locking in” – a term suggesting a phase of high concentration and switching to “serious mode.” The community on X and Reddit largely took this as a signal that “the time is right” to re-enter the financial market.

According to sources, “TheRoaringKitty” is the personal account of Keith Gill – the legendary trader who caused the dramatic price surge of GameStop stock in 2021, defying negative assessments from leading hedge funds in the U.S. and far exceeding initial predictions by Wall Street experts.

This is the first time since mid-2021 that TheRoaringKitty has been active on social media, attracting significant attention and anticipation within the investment community.

Related: Binance Announces Listing of Notcoin (NOT) on Launchpool

GameStop Stock and “Memecoins” Explode

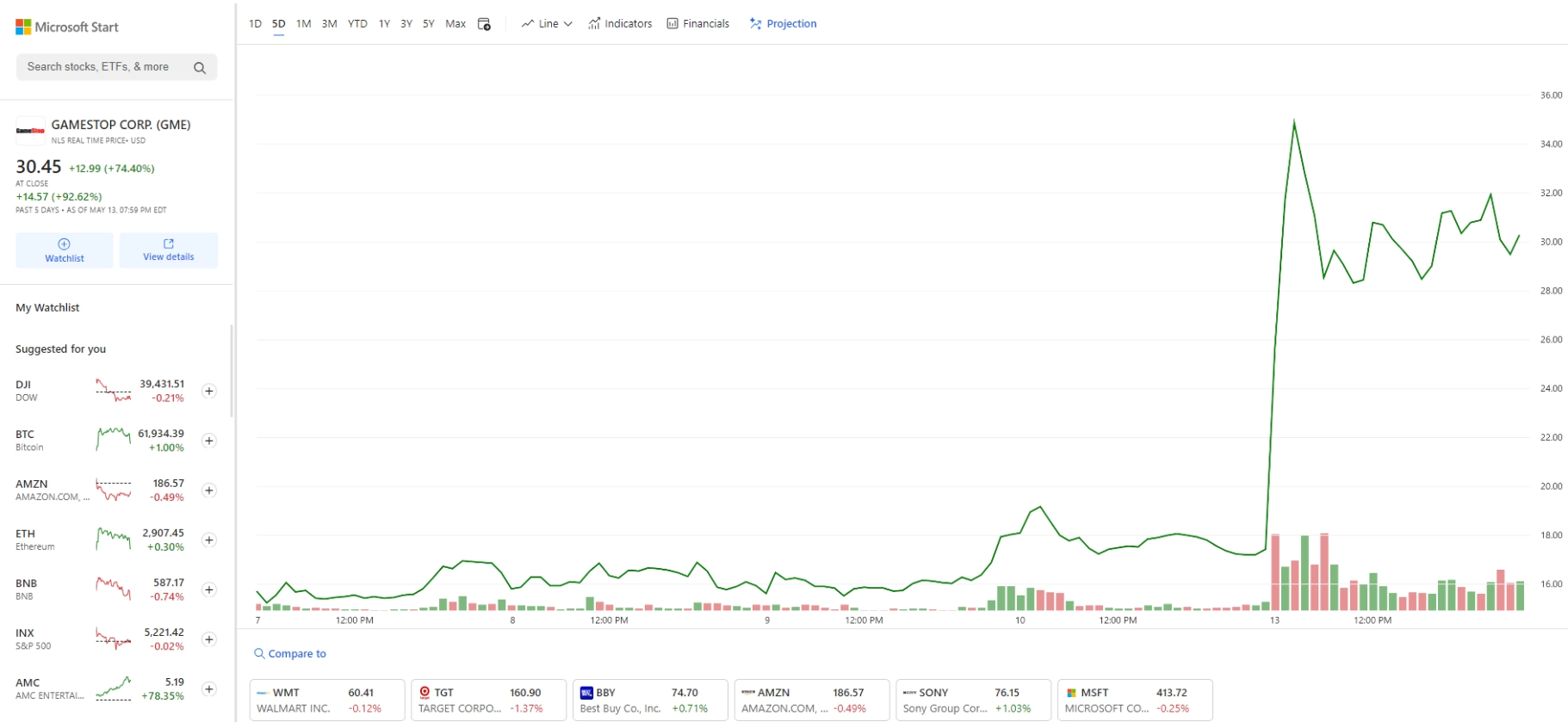

With just a simple image, stocks and meme cryptocurrencies associated with Keith Gill witnessed a surprising growth wave. GameStop’s GME stock, the company where Gill played a crucial role in driving up the price in 2021, is currently trading around $30, a staggering 74% increase from the previous period.

This event once again underscores the influence of “TheRoaringKitty” on the market. Besides GME stock, decentralized exchanges (DEX) also saw a wave of new token issuances related to Gill, GameStop, and the term “stonks” – a meme word for stocks – within the past 24 hours. A prime example is the small-cap memecoin KITTY with a cat theme, which surged by thousands of percent.

Notably, cat-themed memecoins have appeared on various blockchains, reflecting the widespread popularity of this phenomenon in the cryptocurrency community.

💪💪