In the backdrop of a struggling cryptocurrency market with outflows from Bitcoin spot ETFs continuously registering negative figures, leading to a sea of red for alternative coins (altcoins), March 21, 2024 witnessed an explosion in Real World Asset (RWA) Coins, bringing a fresh wave of green across the entire market.

This surge stemmed from an announcement by BlackRock – the world’s largest asset manager – regarding the establishment of a new investment fund named the “Digital USD Liquidity Fund,” aimed at collaborating with asset tokenization company Securitize, hinting at future products potentially linked to real-world asset tokenization.

Real World Asset (RWA) involves the digitization of tangible assets. The core idea is to convert traditional assets such as real estate, securities, and commodities into tokens that can be stored and traded on the blockchain.

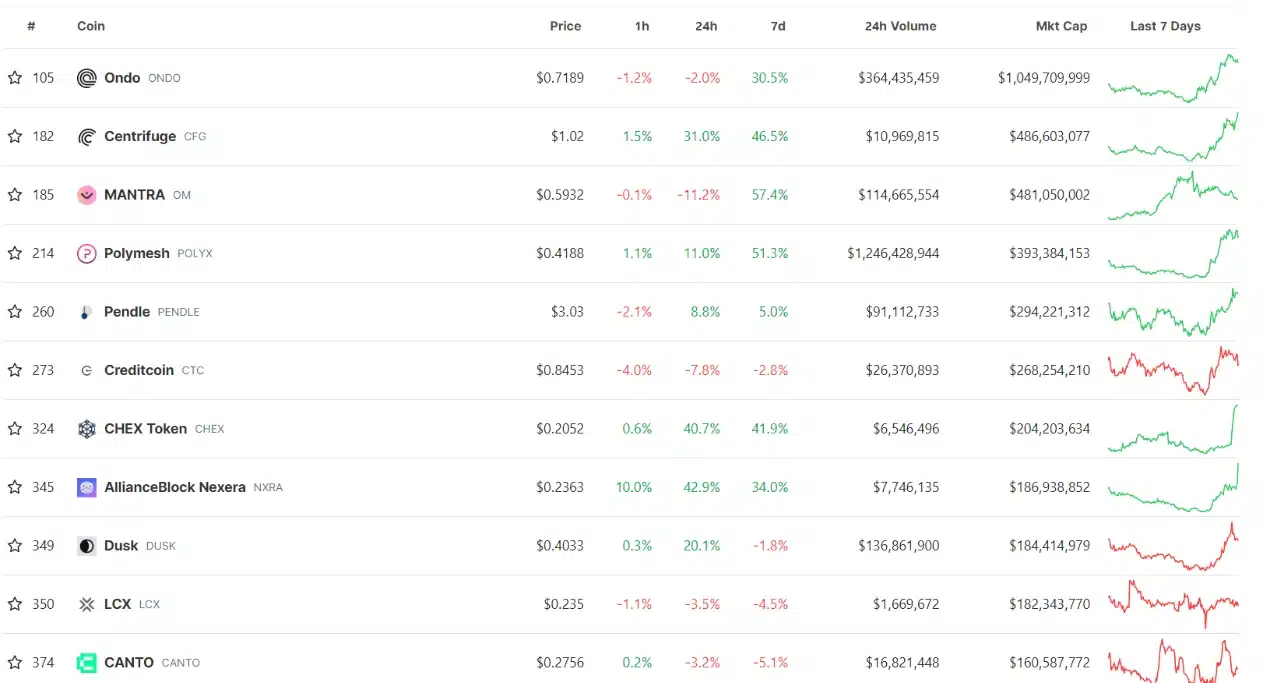

According to data from CoinGecko, the total market capitalization of RWA tokens has now reached $5.72 billion, increasing by 36% in the past 24 hours, with many tokens recording nearly 50% gains in less than a day.

In fact, the RWA Coin trend has been targeted by many major financial institutions (Fubon Bank, Standard Chartered, etc.) and countries (Singapore, Japan, UK, Switzerland) throughout 2023.

Experts from the Federal Reserve have suggested that RWAs could bring several benefits such as lowering investment thresholds, promoting standardization, improving liquidity, and asset digitization through smart contracts.

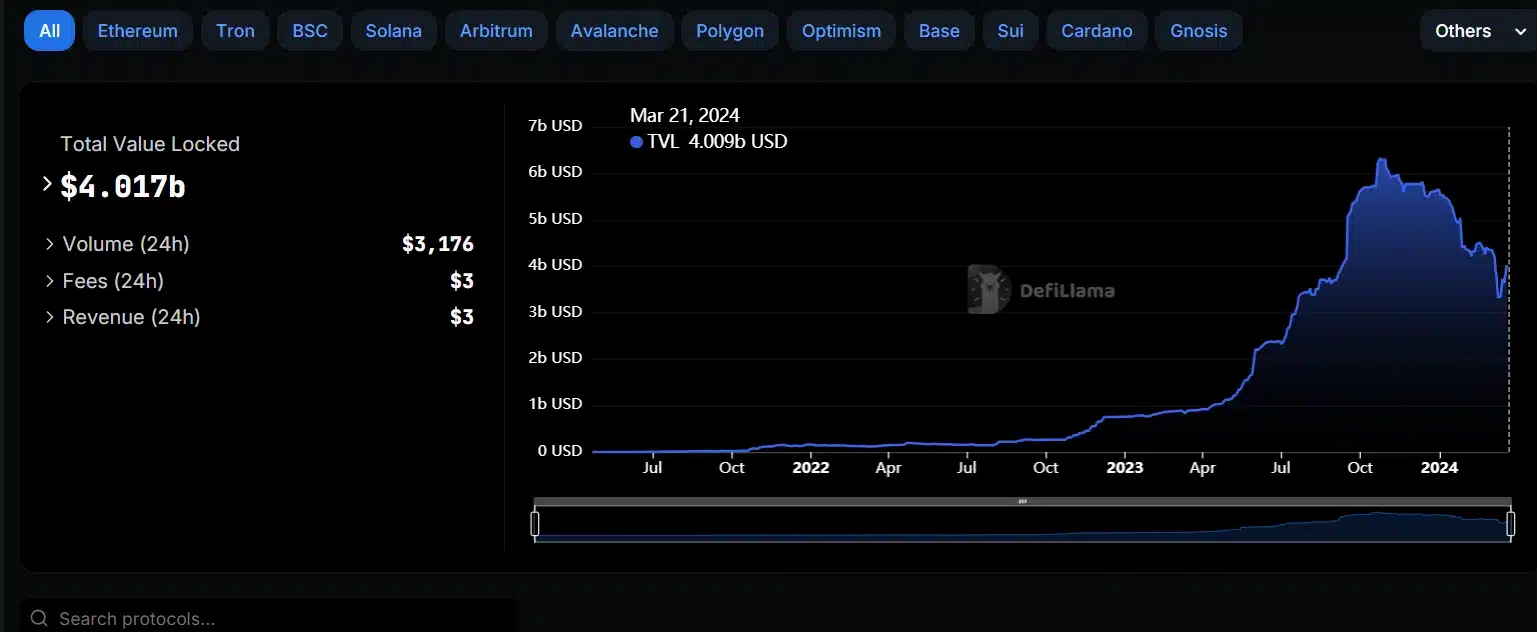

According to a study, RWA is the fastest-growing decentralized finance (DeFi) asset class. As of March 21, 2024, the Total Value Locked (TVL) in the RWA space has quadrupled from $900.63 million to nearly $4.1 billion in the past year.

Related: Exploring Real-World Assets (RWA) in Cryptocurrency

Tokens of the RWA Category

Leading the surge in RWA Coins is Polymesh – a blockchain project dedicated to tokenizing securities and one of the protocols involved in the asset tokenization process – with its POLYX token witnessing a growth of up to 46.8% in the past 24 hours, currently trading around $0.42, equivalent to a 54% increase in the past 7 days.

Following Polymesh is Centrifuge – one of the pioneering RWA projects that held an IDO on Coinlist in 2021 – with its CFG token also recording over 39% growth in the last 24 hours, with market capitalization increasing by over 60% to reach $442 million from $270 million a month ago.

Other RWA Coins experiencing approximately 20% increases in the past 24 hours include:

- Ondo Finance (ONDO) – a decentralized financial platform building RWA infrastructure for institutional clients – up by 34.9%.

- Goldfinch (GFI) – a decentralized credit protocol enabling collateral-free cryptocurrency lending – up by 14.9%.

- Maple (MPL) – a capital market for institutions with its core product being RWA backed by blockchain – up by over 11%.

- MANTRA (OM), the infrastructure platform for real-world asset tokenization, just completed an $11 million fundraising round, witnessing an 87.3% increase in the past 7 days.

(OM), the infrastructure platform for real-world asset tokenization, just completed an $11 million fundraising round, witnessing an 87.3% increase in the past 7 days.

MANTRA (OM), the infrastructure platform for real-world asset tokenization, just completed an $11 million fundraising round, witnessing an 87.3% increase in the past