According to the latest report from Finbold, the number of Bitcoin wallets holding $1 million or more has surged in the first half of 2025, with 26,758 new wallets, increasing the total from 155,569 to 182,327. This boom marks one of the strongest accumulation phases of Bitcoin since 2021, reflecting growing confidence in the cryptocurrency market.

Q1 Decline, Impressive Q2 Recovery

The report shows a contrasting trend between the two quarters of the year. In Q1, the number of Bitcoin millionaire wallets decreased significantly by 13,942, from 155,569 (on January 1) to 141,627 (on March 31). Within this, wallets holding $1 million dropped by 12,687, while wallets with $10 million decreased by 1,255. This decline reflects a period of market volatility.

However, Q2 witnessed an impressive recovery. By June 30, the number of wallets holding $1 million surged to 161,839, representing an increase of 21,589 wallets in just three months. Notably, the number of wallets valued at $10 million or more also rose sharply by 5,169, contributing to a remarkable net increase of 26,758 millionaire wallets in the first half of the year.

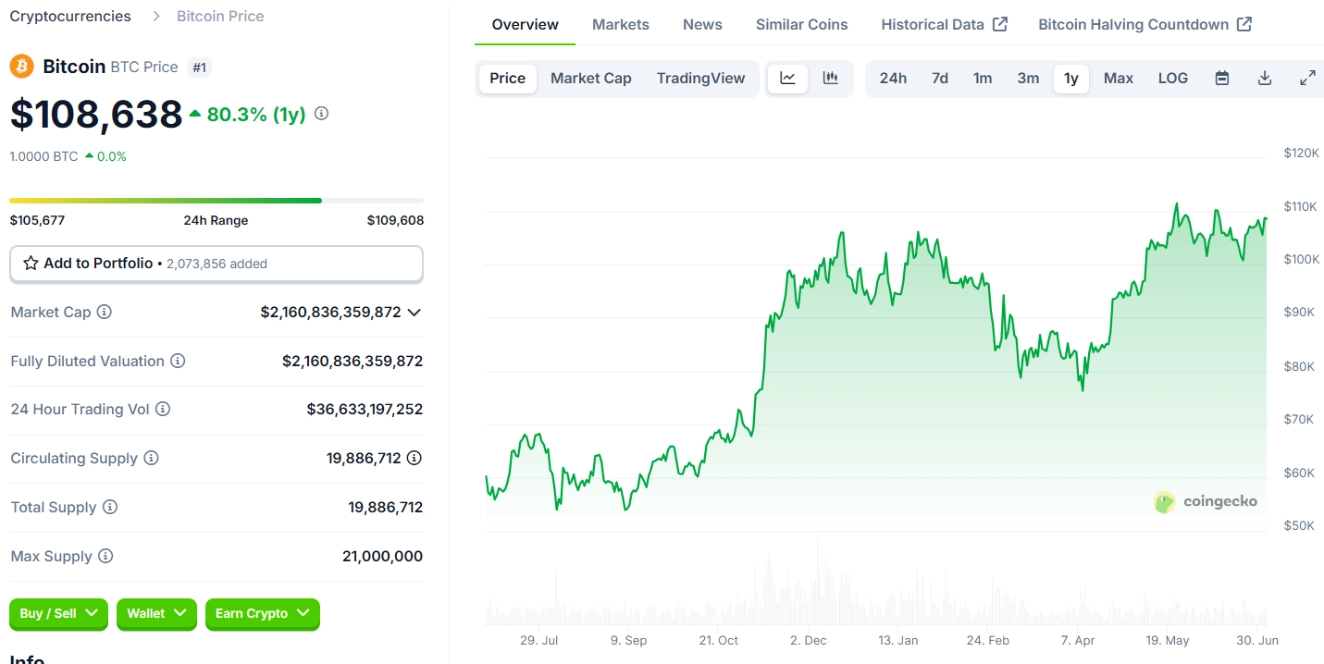

This growth is driven by several factors. Active buying occurred even during the market downturn, combined with heightened institutional demand following the approval of spot Bitcoin ETFs in the U.S. The Bitcoin halving event in April 2025 further bolstered positive sentiment, pushing Bitcoin prices to a peak of $111,970 in May.

Related: Transforming $86,000 into $1 Million through Daily Bitcoin DCA

Positive Signals for the Second Half of the Year

With over 26,000 new “Bitcoin millionaires,” the market is demonstrating significant strength. This strong accumulation trend reflects not only the confidence of individual investors but also the increasing participation of institutions. Experts suggest that this upward momentum could open up positive prospects for Bitcoin in the second half of 2025, as the market continues to embrace supportive factors from policies and investor sentiment.

Finbold’s report emphasizes that, with an impressive recovery in Q2, Bitcoin is solidifying its position as an attractive investment asset, ready to face the opportunities and challenges ahead.