Binance Coin (BNB) has recently reclaimed the fifth position in the market capitalization rankings, surpassing Solana (SOL). According to data from CryptoQuant, this shift was driven by a memecoin frenzy that has shifted significantly from the Solana ecosystem to the BNB Chain.

The surge in BNB’s performance is believed to be attributed to the continuous “memecoin hints” from former Binance CEO Changpeng Zhao (CZ) through posts on social media platform X.

CryptoQuant noted:

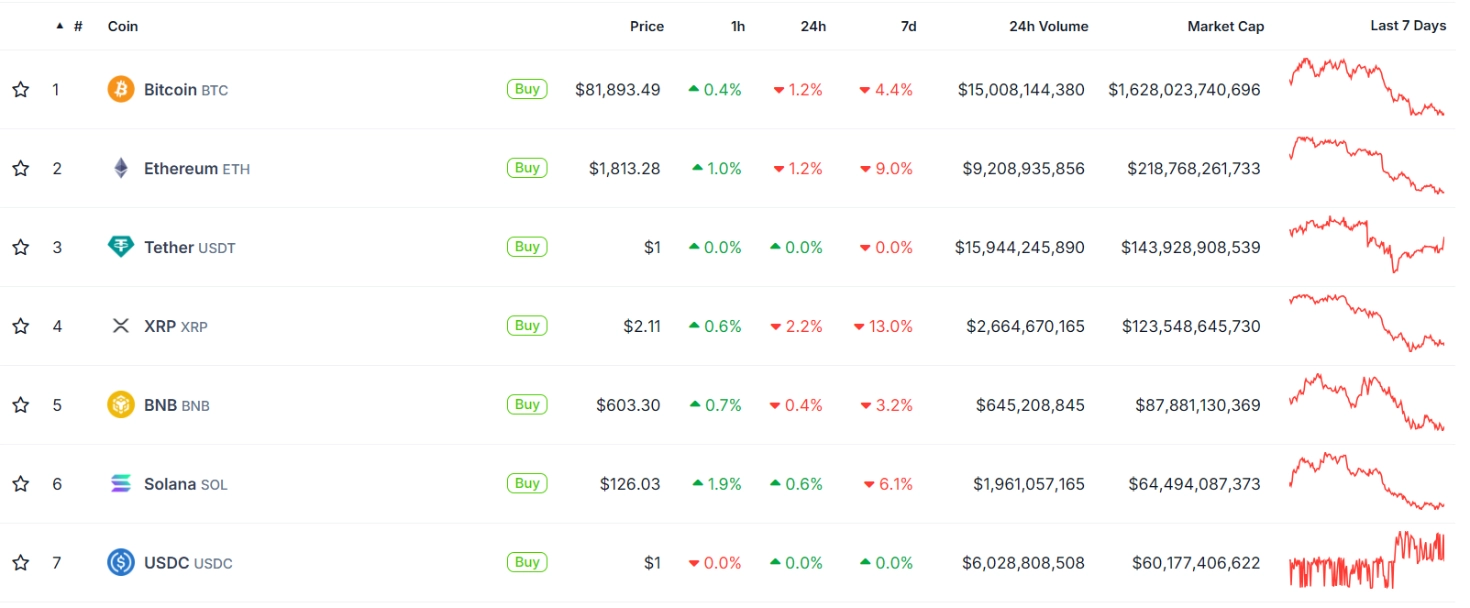

BNB has surpassed SOL due to the wave of memecoins moving towards the BNB Chain, bringing BNB’s market capitalization back into the top 5 at $86 billion. Meanwhile, SOL is lagging behind with a market cap of $64 billion.

This change began in mid-February, shortly after the controversy surrounding the memecoin LIBRA and revelations about market manipulation. As a result, the appeal of memecoins on Solana has significantly decreased, leading to a 60% drop in trading volume on DEX platforms. Major platforms within the Solana ecosystem, such as Pump.fun and Raydium, have also not escaped this decline.

Related: CZ Sparks a Memecoin Explosion in the BNB Ecosystem

In addition to the memecoin factor, the Binance exchange has played a crucial role in BNB’s growth. BNB holders often enjoy more benefits through attractive promotional programs like the Binance Holder Airdrop, Launchpool, and Binance Wallet IDO. These events not only increase the value of BNB but also attract more investors.

In terms of returns, investors holding BNB currently have a significant advantage over those holding SOL. As of 2025, the SOL/BNB price ratio has dropped by over 50%, indicating SOL’s performance lags far behind BNB. This ratio reflects the relative value of SOL compared to BNB, and a 50% decline means that SOL holders have lost nearly half the value of their assets compared to BNB holders.