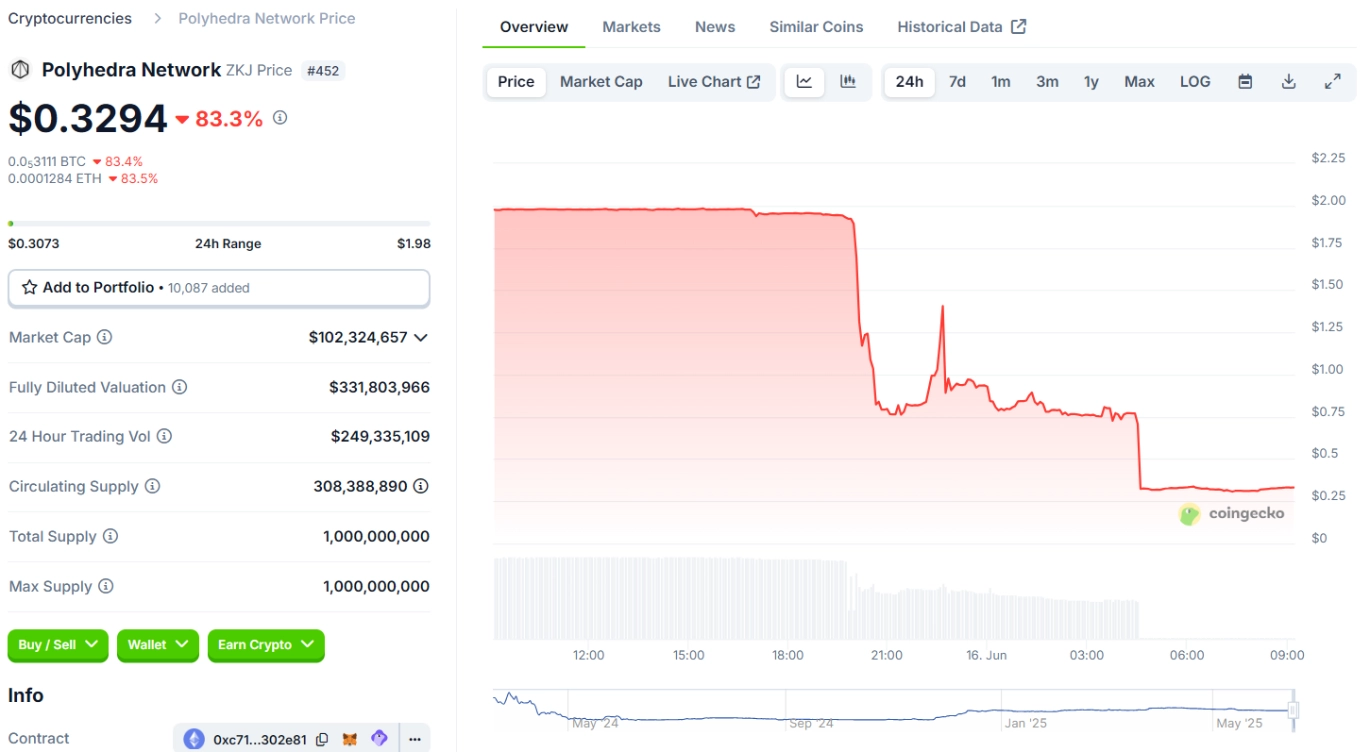

In the crypto world, stories of tokens “collapsing” within hours are not uncommon. However, the collapse of ZKJ is particularly notable, resembling a “fake stablecoin drama” meticulously staged with all the elements: ample liquidity, community enthusiasm, and attractive rewards, only to end in a catastrophic crash. In less than an hour, the price of ZKJ plummeted from $2 to $0.30, erasing over 83% of its market value. What stands out is not just the speed of the collapse, but also how it was orchestrated and then shattered.

Data and Developments

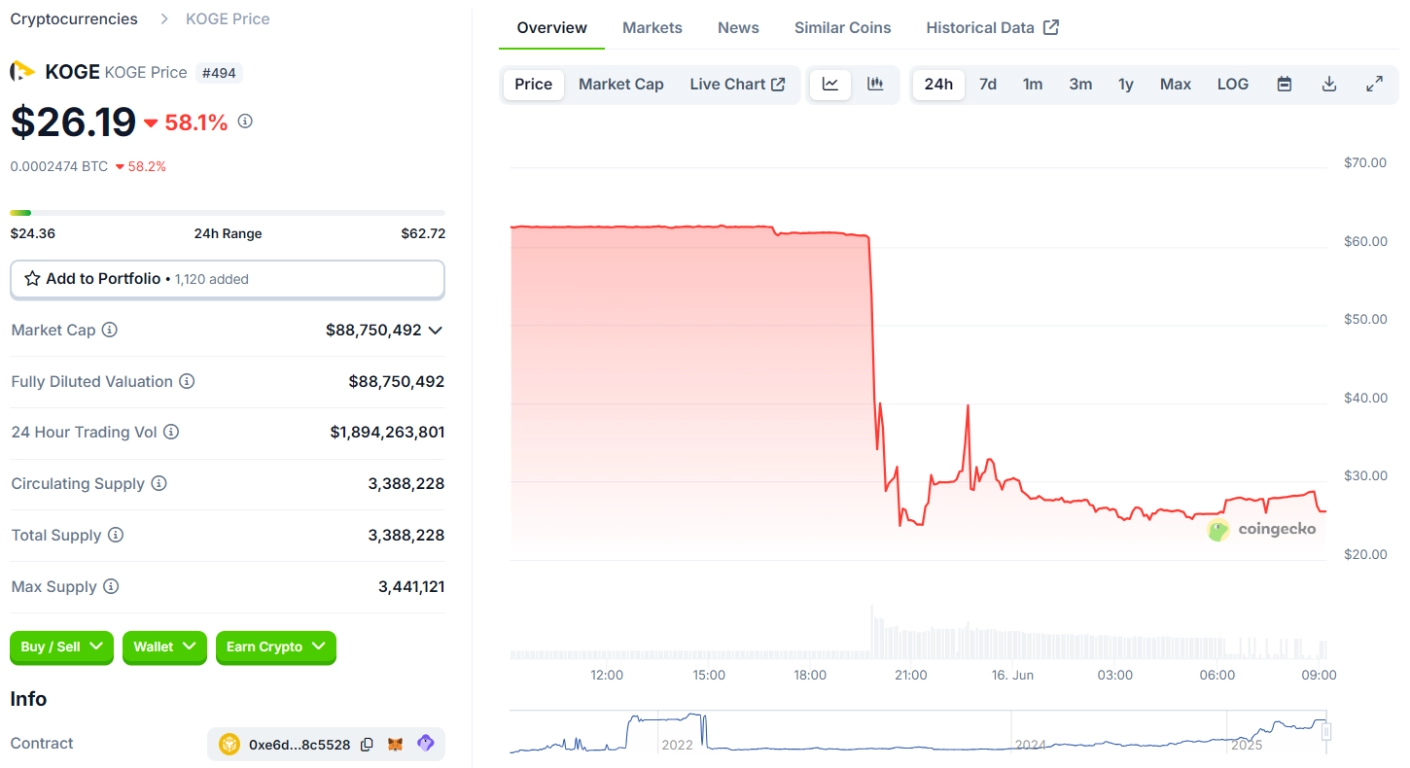

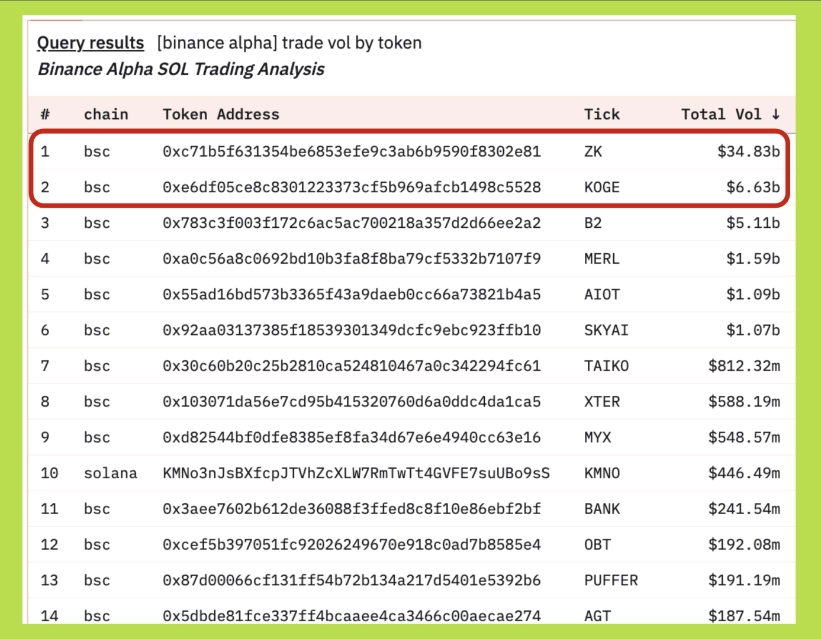

According to Binance Alpha, both ZKJ and KOGE fell over 60% in just one hour. As of the latest updates, ZKJ was trading at $0.31 (down 84% in 24 hours), while KOGE hit $27 (down 60%). Binance confirmed the detection of severe price fluctuations, stating that the cause stemmed from “whales” simultaneously withdrawing liquidity across multiple exchanges and chains, coupled with a series of liquidation orders.

The KOGE development team – 48 Club – also spoke out, asserting that this token had no lockup mechanism from the start and they had never committed to retaining the tokens in the treasury.

Phase 1: ZKJ – The Disguised “Stablecoin”

For an entire month, ZKJ became a peculiar phenomenon: trading like a stablecoin even though it wasn’t one. With liquidity reaching $2 billion – a rare figure for a new project – ZKJ experienced almost no slippage, trading smoothly like USDC.

Moreover, ZKJ was utilized to “farm points” on Binance Alpha, one of the hottest trends in the market. At one point, ZKJ’s market cap exceeded zkSync, a genuinely operational Layer 2 solution, by three times. On the surface, ZKJ appeared to be a safe asset, humorously referred to by the community as a “perfect stablecoin.”

But this stability did not stem from trust or a sustainable financial model. It was fueled by speculative cash flows and short-term rewards – a fragile and easily breakable foundation.

Phase 2: The Bubble and the Gap

ZKJ was designed to appear stable: concentrated liquidity, narrow liquidity provision (LP), attractive short-term rewards, and a speculative community ready to engage. But what lay behind this facade?

- No clear business model, no real cash flow.

- No cohesive community, just a group of point hunters.

The “stability” of ZKJ was essentially a fragile bubble. A significant capital withdrawal could trigger a collapse – and that scenario unfolded, repeating what the crypto market has witnessed countless times.

Phase 3: More Than a Price Crash, But a Liquidity Exodus

On the evening of June 13, a large wallet (0x364…f18e9) withdrew liquidity from the ZKJ-KOGE pair worth over $3.5 million and then began to dump heavily. This move not only caused the price to drop but also shattered the liquidity structure that depended on LP with extremely narrow margins.

ZKJ’s trading volume surged to over $12 million in just a few minutes, then plummeted immediately. Liquidity providers panicked and withdrew capital, leading to severe slippage, and MEV bots quickly jumped in. KOGE, tightly linked to ZKJ’s liquidity, also faced a collapse.

Within less than an hour:

- Several other large wallets (0x1A29…, 0x0781…) continued to withdraw and dump millions of ZKJ in a “relay race” style, mercilessly driving down the price.

- The system unexpectedly unlocked an additional 15.5 million ZKJ tokens amid the crisis, dramatically increasing supply like pouring oil on fire.

A Well-Planned Exit Strategy

This was not a natural correction but a meticulously orchestrated plan:

- A large wallet withdrew millions of USD worth of ZKJ-KOGE liquidity, creating fake trading volume by swapping backward.

- Next, it dumped over 1.5 million ZKJ to create initial selling pressure.

- Other wallets joined in, repeating the cycle of liquidity withdrawal – continuous token dumping.

- Just when the market was most panicked, 15 million ZKJ were unlocked and dumped further, pushing the price into a freefall.

Notably, the KOGE team (48 Club) did not appear to be the initiators but merely “caught in the crossfire” due to the liquidity being tightly bound to the ZKJ/KOGE pair – which was being used to farm Alpha points. Previously, 48 Club had warned of risks, as if they had sensed signs of instability.

Lessons Learned

ZKJ is not the first token, and certainly not the last, to collapse due to speculative frenzy, artificial liquidity, and a lack of foundational models. In crypto, what looks like a stablecoin isn’t necessarily stable. When liquidity is manipulated by a small group, “value” is merely a temporary illusion.

When the music stops, only those who truly understand the nature of the situation can pull their feet out in time. The takeaway: short-term rewards from “farming” cannot replace long-term research, and “high liquidity” does not equate to “safety.” In the crypto world, vigilance is always the key to survival.