The federally licensed digital bank Anchorage Digital has made a noteworthy recommendation, urging institutional customers to withdraw funds from popular stablecoins like USDC, AUSD, and USD0, and instead use the Global Dollar (USDG). This decision comes amid fierce competition in the stablecoin market, which is preparing for significant legal changes.

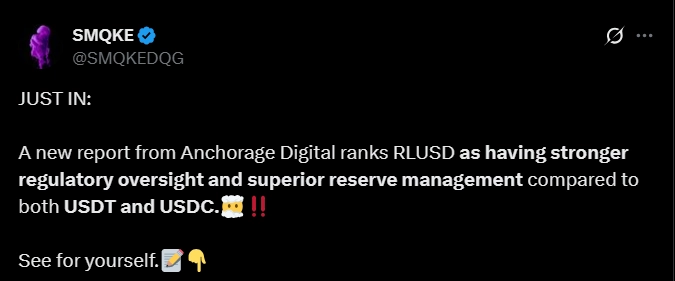

According to the “Stablecoin Security Matrix” report by Anchorage, stablecoins are evaluated based on stringent criteria concerning legal oversight and reserve asset management. The report concludes that USDC, AUSD, and USD0 do not meet the necessary standards to ensure long-term sustainability.

Ms. Rachel Anderika, Global Chief Operating Officer of Anchorage, emphasized, “Some stablecoins currently have overly centralized issuance structures, posing risks regarding transparency and long-term resilience.” Anchorage has stated that it will only support stablecoins that meet strict requirements for transparency, independence, security, and compliance with future regulations.

This recommendation comes just before the U.S. Senate passes the GENIUS Act, expected to take effect in July 2025. This legislation is anticipated to reshape the stablecoin market, setting higher standards for governance and operation. In this context, USDG— a stablecoin issued by Paxos with Anchorage’s involvement— is being promoted as a superior option.

Anchorage’s move has faced significant backlash. Mr. Nick Van Eck, a representative of the AUSD issuer, accused Anchorage of spreading misinformation and concealing direct interests in USDG. “This is a clear attempt to manipulate the market, while Anchorage has close ties with Paxos and USDG,” Mr. Van Eck asserted.

Related: Crypto Market Faces Volatility Ahead of Trump Tariff Pause Expiration

Meanwhile, an expert from Coinbase, which co-issued USDC alongside Circle since 2018, called this recommendation a “baseless smear campaign” targeting USDC—one of the leading stablecoins in the world. The contrasting opinions indicate that the competition for market share in the stablecoin space is becoming increasingly intense.

Anchorage’s public prioritization of USDG has raised questions about objectivity and conflicts of interest. While the bank emphasizes its commitment to high standards, the cryptocurrency community is awaiting more information to assess whether this move is justified.