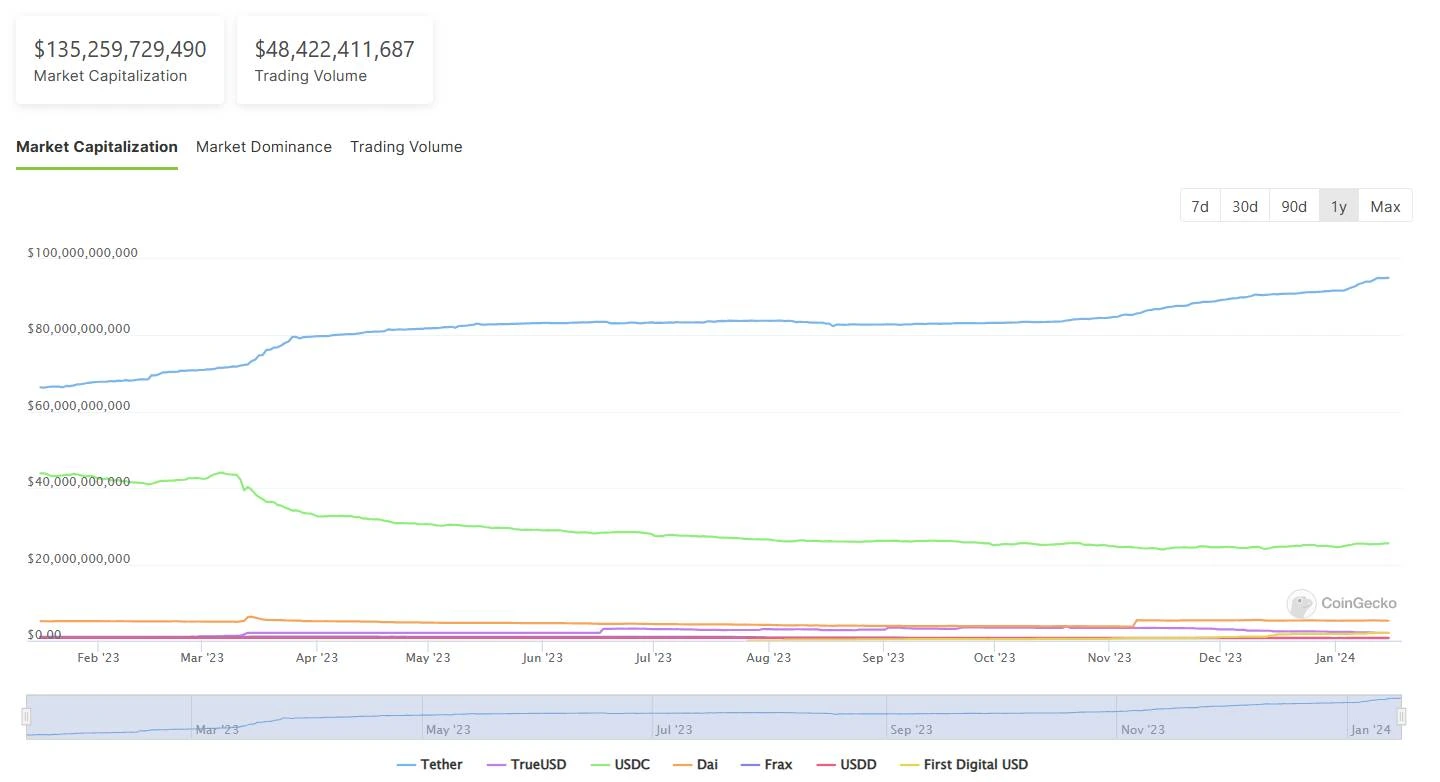

Tether (USDT) is currently “dominating” the stablecoin supply.

Tether’s market share in the stablecoin sector, as the company issuing USDT, has increased from 50% to 71% throughout the year 2023, according to statistics from CoinGecko.

Market capitalization changes of leading stablecoins over the past year. Source: CoinGecko (January 15, 2024).

The latest Tether (USDT) issuance of 1 billion USD occurred on January 12, further propelling the market capitalization of this stablecoin to a new record, approaching the 100 billion USD mark in just one year. This figure even surpasses the GDP of countries like Guatemala and Bulgaria.

Meanwhile, Tether’s primary competitor, Circle, the issuer of the USDC coin, has recently filed for an IPO with the SEC. Circle currently has 27 billion tokens in circulation and started 2023 with a total of 48 billion USDC.

Related: Tether (USDT) Capitalization is about to Hit 100 Billion USD

Additionally, leveraging a periodic profit allocation strategy, Tether’s Bitcoin investment portfolio is currently valued at around 3 billion USD as of January 4, 2024, continuing to be a significant source of income for the company.

Tether has recently undergone internal personnel changes, with longtime CTO Paolo Ardoino being promoted to the position of CEO, replacing Jean-Louis van der Velde at the end of the past year. In his new role, Ardoino is working to foster closer ties between Tether and U.S. law enforcement agencies, demonstrated by several instances of collaboration, including freezing wallets on the U.S. Office of Foreign Assets Control (OFAC) sanctions list and seizing over 435 million USD in illicit funds.